Updated October 12, 2023

Introduction to Contango and Backwardation

You must have visited so many websites to get a gist of Contango and backwardation, but at the end of your search, what do you get in your hand? You may need clarification and start banging your head, thinking that the concept of Contango and Backwardation is complex. So please don’t bang your head; just read this article carefully. This article will provide quality food to your brain, and at the end of this article, you will become a master of Contango and backwardation.

Let’s assume that you are a trader in the commodity market and you are dealing with various hard and soft commodities.

As a trader in a commodity market, you may encounter various market situations like Contango and backwardation that may hassle your mind. Like before the war, soldier prepares themselves for battle; they understand various battle situations and act accordingly. Likewise, as a trader, you must know different market situations like Contango vs. backwardation to make money for the client and yourself.

Concepts of Contango and Backwardation

Before swimming in the river of Contango and backwardation, let’s wear some lifesaving concepts of Contango and backwardation that would help you understand Contango vs. backwardation.

1. Commodity Market

It is a market where HARD and soft commodities are traded. In this market, not the commodities are traded, but the price or values of the items are being traded.

CommodityIn: In trading, a commodity is raw material/goods that can be bought and sold. Commodities traded are generally of two types, i.e., hard commodities and soft commodities. Hard commodities typically include a variety of natural resources like gold, rubber, oil, etc., and soft commodities usually are agricultural products like corn, wheat, coffee, sugar, etc

2. Derivative

A derivative is a hedging tool that derives its value from an underlying contractual manner.

3. Future Contract

A Future contract is a customized contract between counterparties, where settlement occurs on a specific date in the Future at today’s pre-agreed price.

4. Spot Price

Spot price refers to the current market price where security can be bought/ sold at a specific place and time.

5. Future Price

The price of a commodity at which the counterparties agree to buy/sell the commodity in the Future.

6. Premium

An amount to be paid as per contract.

What is Meant by Contango?

In particular, contango and backwardation terms are used in energy and commodity markets. If we get deeper into it, these terms are used, especially in the crude oil market. In many books, you can see only theoretical definitions, but in practice, that concept is much different. There are two concepts of Contango.

- Contango

- Normal Contango

Before starting with the theoretical definitions of Contango vs. backwardation, I would like to tell a small story of Mr. Bull and Mr. Bear. Mr. Bull had always dreamt of making his daughter’s wedding a big fat one! He wanted to bid adieu to her with lots of happiness and gold. But he always had this weight on his shoulders about the rising gold prices. This led to some sleepless nights. During one such night, he came up with a fantastic idea. He thought, “Why not enter into a Future Gold contract.” Instantly, his face cheered up with happiness and anxiety. But what was the plan that he was required to follow? The answer was, “Get into a Futures Contract.” He visited one of his relatives, Mr. Bear, to give away the engagement invitations (6 months before the wedding). He found out that the person was bearish on gold.

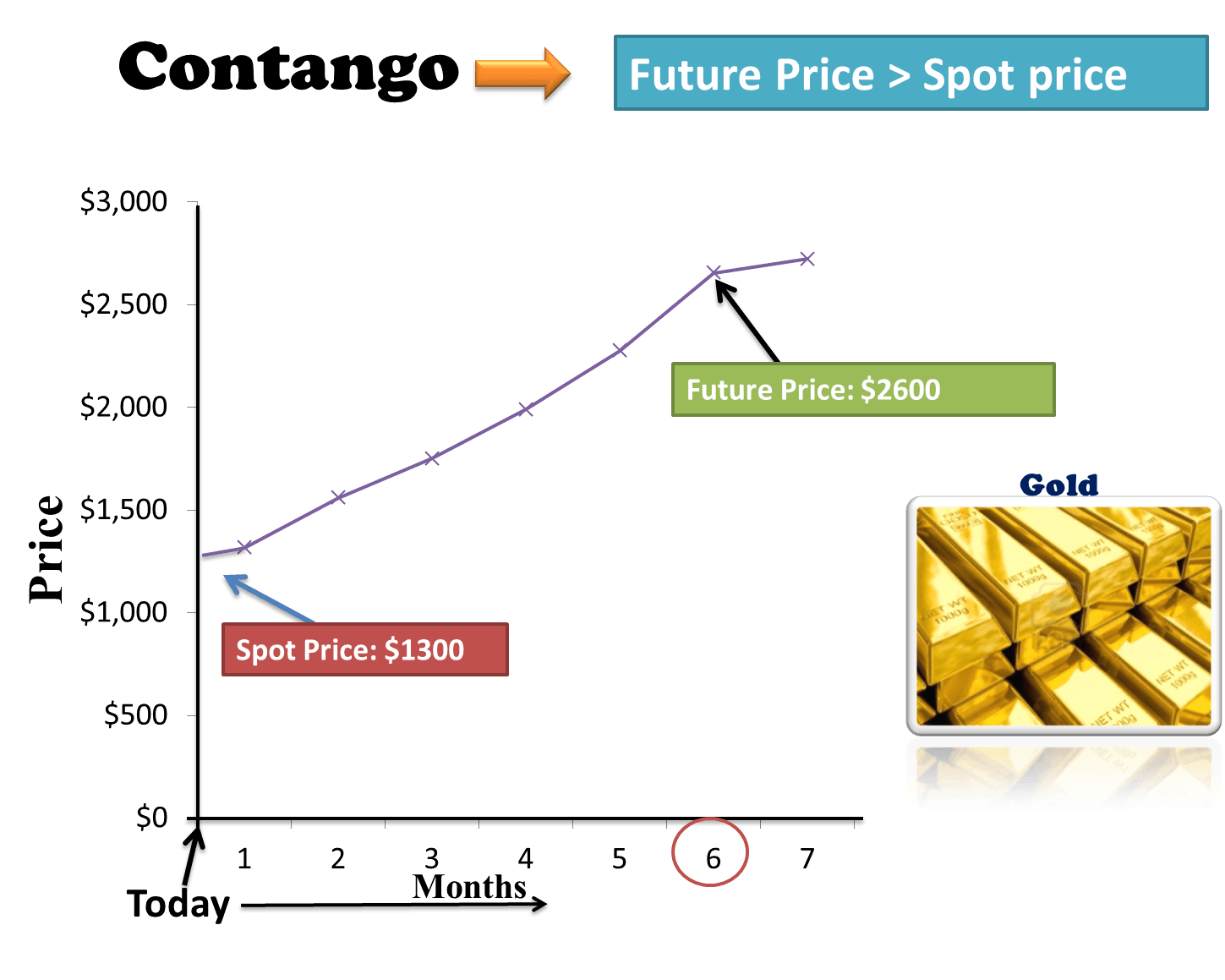

At that moment, he knew he had to enter into a contract with Mr. Bear. So, with one hand, he gave the invitation, and with another hand, he signed the contract. So, they entered into a derivative agreement. At that time, the current market price of gold was $1300 per ounce, so as per the contract, both agreed that Mr. Bull would buy gold from Mr. Bear at the cost of $2600 after six months from today’s date. If you carefully analyze the above situation, you will note that the gold spot price (today) was $1300, and the Future price was $2600. So, a problem where the Future price is greater than the spot price, this market situation is called a market in Contango.

Contango Definition

Contango refers to the situation where the Future prices of a stock/commodity are higher than the current spot price.

Let’s see the above graph in the context of contango. Remember our story of Mr. Bull and Mr. Bear. If you carefully analyze the graph, you will get an idea that the Future price of gold (after 6 months is greater than the current market price of gold, i.e., $1300. When a Future price is greater than the spot price of the underlying in the market, this situation is called a Market in contango. This usually happens when people pay a premium for a commodity in the future instead of paying the costs of storage and carry costs of buying the commodity today.

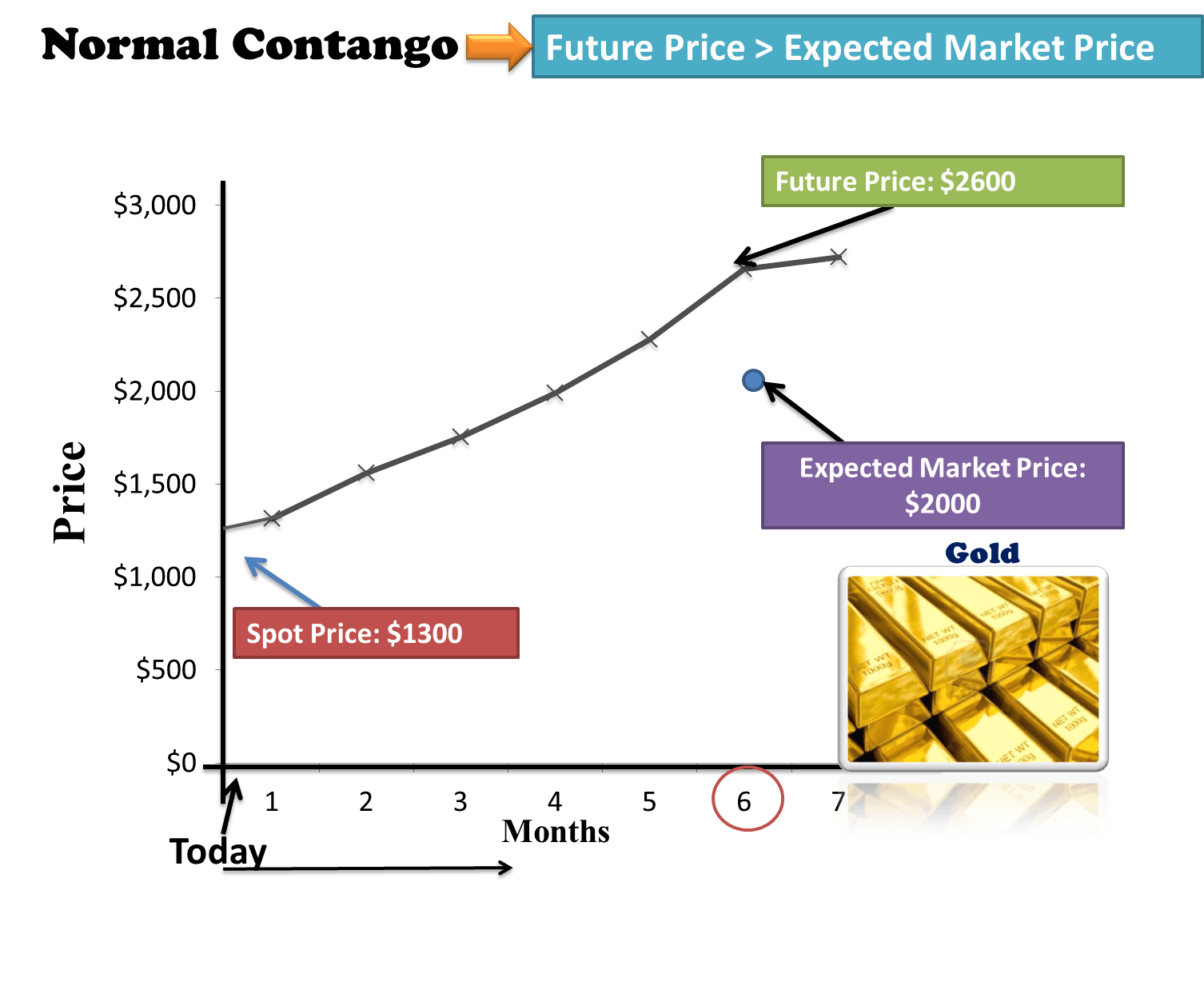

Normal Contango

It refers to phenomena where the Future price is higher than the expected Future spot price (Expected Market Price). Confused? Let’s dig deep into it. We will understand normal contango with the help of the following graph.

As you know, our story of Mr. Bull and Mr. Bear. So, let’s continue with the same story. Our story has two counterparties, i.e., Mr. Bull and Mr. Bear. They come into a Future contract to buy or sell a commodity (Gold) at a pre-agreed price and specific date. Let’s compare our story with the above context. This contract will exercise after 6 months, and today’s spot price is $1300; the Future price is $2600, yet if you analyze carefully, you may note that the expected price of an underlying asset after 6 months is $2000. So if in the market, the Future price (i.e., $2600) is higher than the expected market price (i.e., 2000), then this market situation is called a market in Normal Contango.

What is Meant by Backwardation?

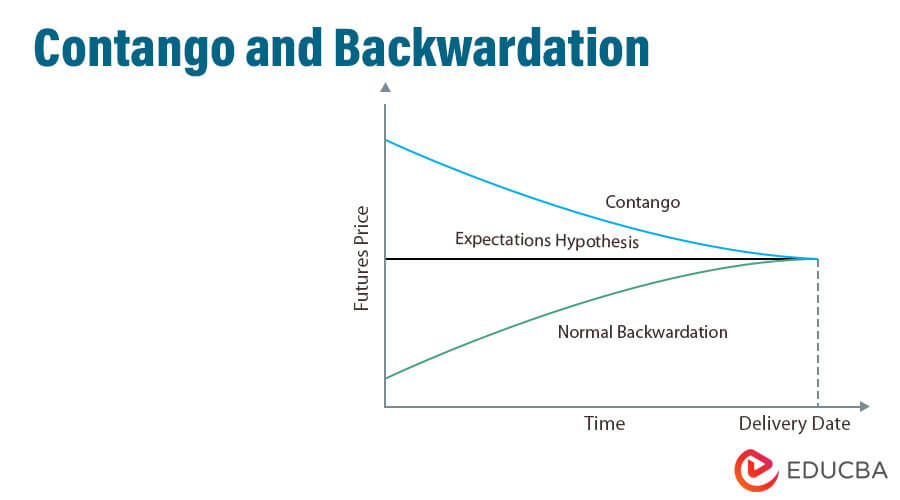

If you understand contango by heart, you can easily predict the meaning of backwardation. Simply, it is the opposite of contango. Backwardation can occur if the markets have an oversupply of commodities. Backwardation is a bearish indicator. It also indicates an immediate shortage. Generally, it has two definitions:

- Backwardation

- Normal Backwardation

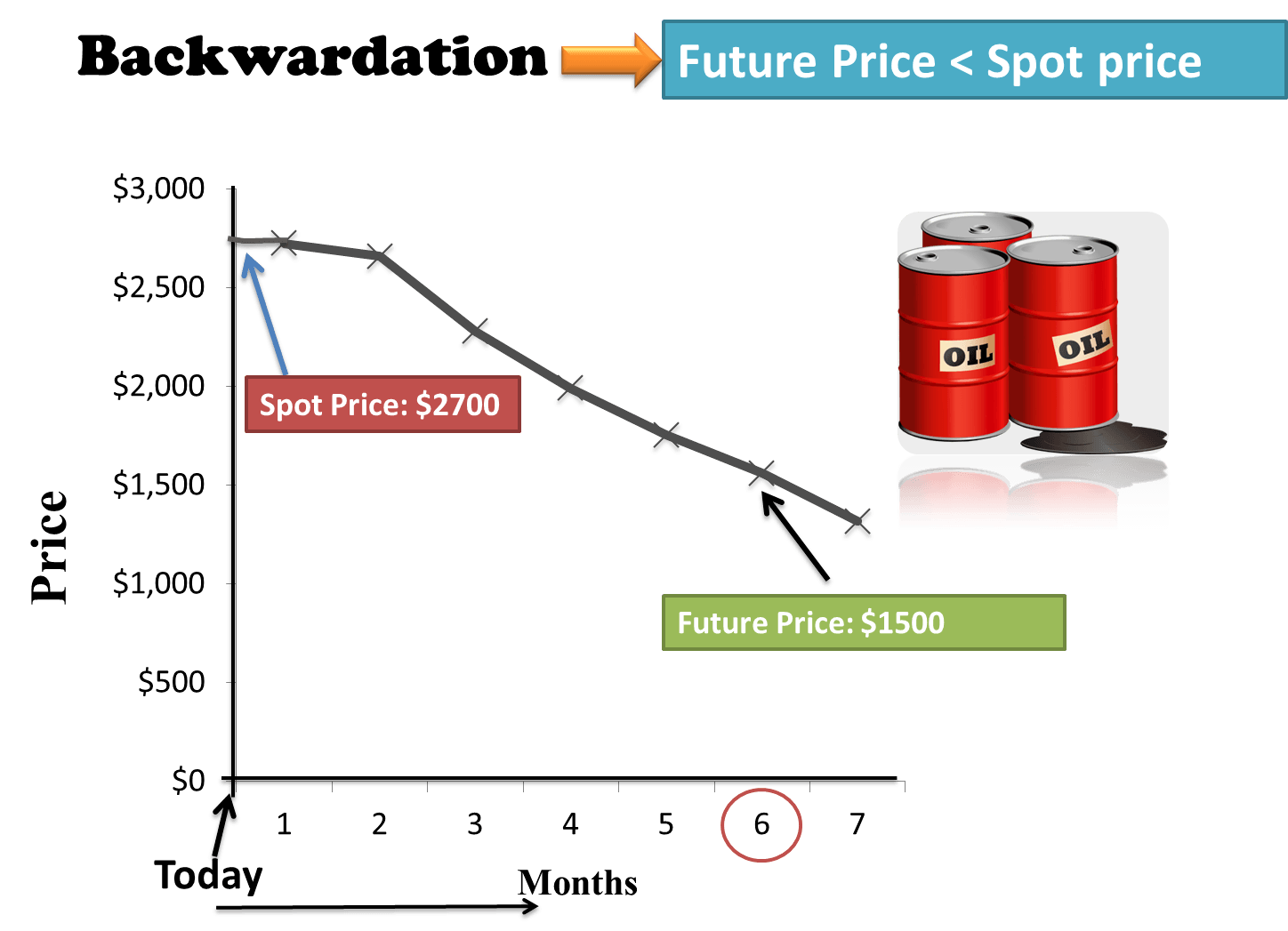

Definition of Backwardation

It refers to the market situation where the Future prices are lower than the current spot prices for a particular commodity.

Let’s understand backwardation with a simple graph. If you look at the chart carefully, you will know about an underlying asset, spot price, and Future price. Here,

- The underlying asset is -crude oil

- Spot Price of underlying -$2700

- Future Price of underlying -$1500

Suppose there is a contract between Mr. Unhappy and Mr. Happy. In this contract, Mr. Unhappy is ready to sell his underlying after six months from today’s date at a pre-agreed price, i.e., $1500; however, the current underlying spot price is $2700. Mr. Unhappy fears that crude oil prices will likely drop due to some uncertain political event, so he has secured future prices by entering into the derivative contract. So if a situation like the Future price is lower than the spot price, then this situation is said to be market in backwardation.

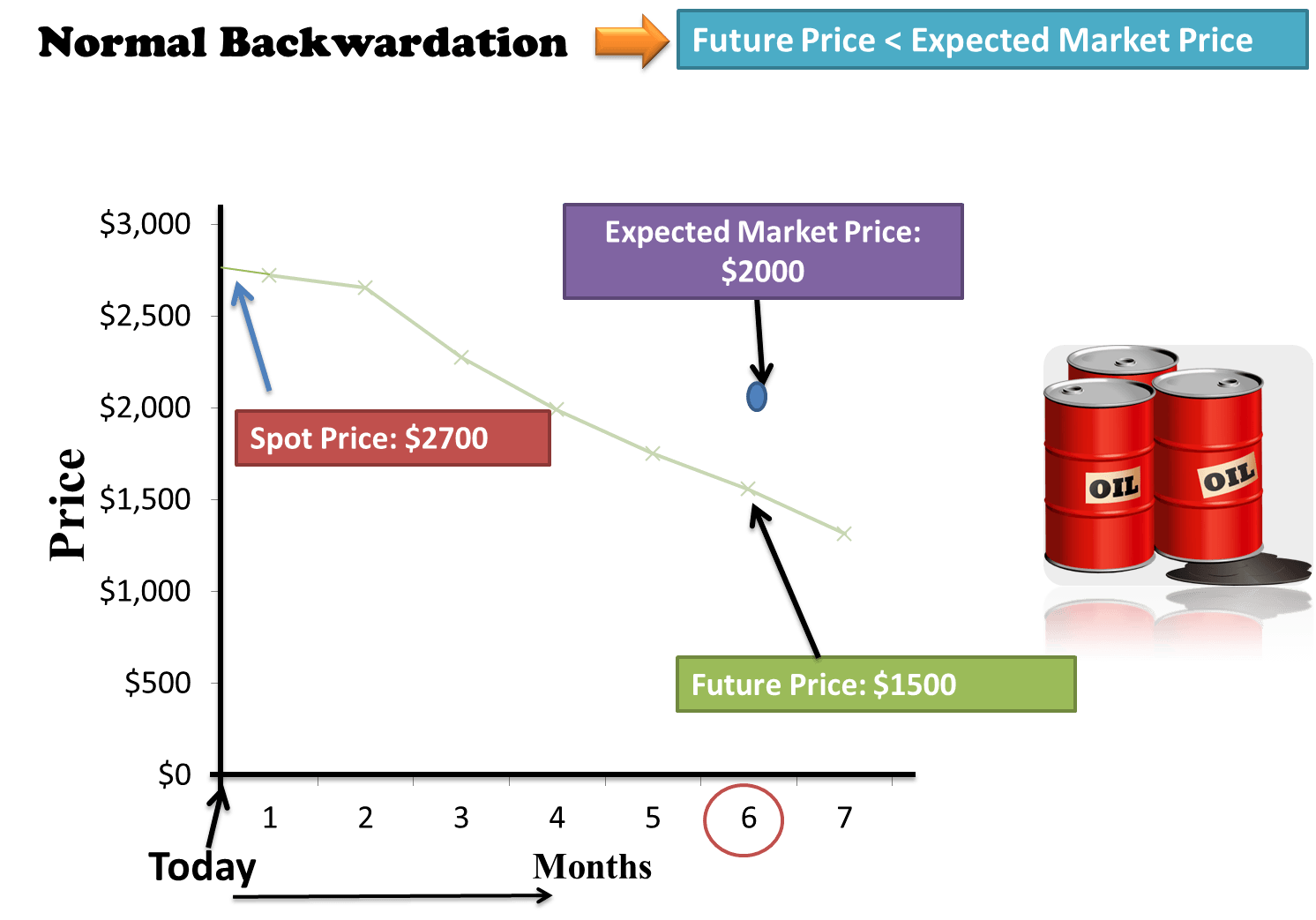

It refers to phenomena where the Future price is less than the expected future spot price (Expected Market Price). Understand the nuts and bolts of Normal backwardation with the help of a graph.

Definition of Normal Backwardation

Take the same example that we have taken for backwardation. Suppose there are two counterparties: Mr. Unhappy and Mr. Happy. They have agreed to come into a Future contract to buy or sell a commodity (oil) at a pre-agreed price and date. Let’s assume the contract will exercise after 6 months and at $1500. In simple words, we can say that Mr. Happy will buy Crude oil after 6 months at a price of $1500. Until now, I have understood the situation more carefully than just looking at the graph; the expected future underlying price after 6 months is $2000. But as per the contract, they have agreed to buy and sell a commodity at $1500. So, in this situation, the Future price, i.e., $1500, is less than the expected market price, i.e., 2000. This market situation is called Normal backwardation.

Difference Between Contango and Backwardation

| Basis | Contango | Backwardation |

|---|---|---|

| Definition | Contango refers to the situation where the Future prices of a stock are higher than the current spot price. | It refers to the market situation where the Future prices are lower than the current spot prices for a particular commodity. |

| Future Curve | Upward Sloping | Downward Sloping |

| Price Difference | Future Price > Spot Price | Future Price < Spot Price |

| Most Happen in the Case of | Commodity | Oil |

Recommended Articles

Here are some articles that will help you to get more detail about the Contango and Backwardation, so just go through the link.