Updated July 13, 2023

Definition of Commercial Loan

A financial institution provides commercial loans to fund capital expenditure or operational expenses, pay off existing loans, or expand the entity’s operations. The unavailability of such funds may paralyze the growth of the entity’s operations.

How Does it Work?

- Lenders primarily provide commercial loans to address short-term funding needs and, in certain instances, to finance capital expenditure.

- You must apply to the banker along with documents such as financial statements, personal details, qualification details, etc.

- The business needs to provide collateral in the form of a bond or property of the business or major plant and machinery or stocks of the Company. Collateral is helpful for the bank to recover the dues in case of long pendency or default.

- Then the interest rate becomes a part of the negotiation depending on your risk profile, quality of the collateral asset, financials, repayment status of past loans, and a few other factors which may vary from one lender to another.

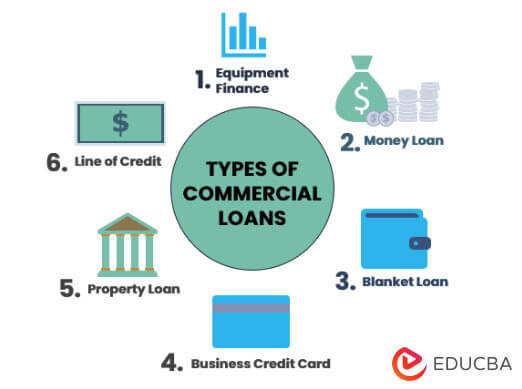

Types of Commercial Loans

Below are the different types of Commercial Loans:

|

Types |

Explanation |

| 1. Equipment Finance |

|

| 2. Money loan |

|

| 3. Blanket loan |

|

| 4. Business credit card |

|

| 5. Line of Credit |

|

| 6. Property loan |

|

Eligibility for Commercial Loans

- Private bankers generally provide commercial loans. The first and foremost requirement is that the borrower has a good credit score (680+).

- The balance sheet and statement of profit and loss account need to be strong. Each lender has criteria for the amount of revenue. If your business qualifies for that criterion, you would be eligible.

- Collateral is required to secure the loan. The value of the collateral is dependent on the amount of loan required. Generally, the collateral value should be at least 60% of the loan amount. Still, this figure varies from a case-to-case basis and from one lender to another.

- Bankers also see the number of years the company has been in the business. Generally, a minimum of 2 years of business history is required.

Why the Need for Commercial Loans?

- The business may require a commercial loan to purchase new machinery.

- The upgrade of the existing business facilities or the purchase of new property may also be necessary.

- Further business expansion at various sites or establishing a new plant may require it.

- The company may also need funds to invest in the new product line.

Commercial Loans for Small Business

- Small businesses are restricted from arranging finance through the bond and equity markets. Thus, they cannot raise finance directly from the public. Commercial loans come to the rescue with a higher upfront cost.

- Proprietary firms and partnerships prefer commercial loans due to easy availability and lower documentation. In addition, since collateral is already provided, there are lower challenges in approving such loans.

- These loans are characterized by lower repayment duration. However, you can choose the repayment method at your convenience.

Advantages of a Commercial Loan

- The application process is simple and easy to use.

- There are no regulatory hurdles like equity markets.

- The cost of finance is lower than raising funds through equity markets.

- A commercial loan takes the form of additional cash or capital. The entity can decide on the usage.

- Commercial loans are normally short-term and hence do not dilute the debt-equity ratio of the entity.

- The lender may extend the loan period in special circumstances. This helps businesses to plan revised budgets.

- Commercial loans are structured as per the needs of the borrower.

Disadvantages of a Commercial Loan

- The business must generate a sufficient stream of consistent cash flows to ensure no EMI payments are missed. One such event is enough to jeopardize the credit image of the entity.

- Since the process is majorly online, it requires a high quantum of documentation.

- In case of consistent defaults, the banker can confiscate the equipment or property. In addition, the banker may auction the property in extreme circumstances.

- Debt is a double-edged sword. If used abruptly, it can make the business go bankrupt.

Key Takeaways for Commercial Loans

- Bankers provide these loans to cope with the short-term financing needs of any business.

- It requires collateral, equipment, property, or machinery used in the business.

- A set of documents, such as bank and financial statements, must be submitted to the bankers.

- The interest rate depends on various factors, such as the borrower’s creditworthiness, the business’s nature, and the business history.

- If required, bankers may renew or extend the loan period.

Conclusion

Commercial loans allow any small business to expand or grow its operations. The business can grow to all possible extents using these facilities wisely. However, it should take sufficient care not to overuse commercial loan facilities. Excess dependency on outsider funds may harm the entity’s organic growth.

Recommended Articles

This is a guide to Commercial Loans. Here we discuss the definition, working, types of Commercial Loans, and their advantages and disadvantages. You may also have a look at the following articles to learn more –