What is Capital Growth?

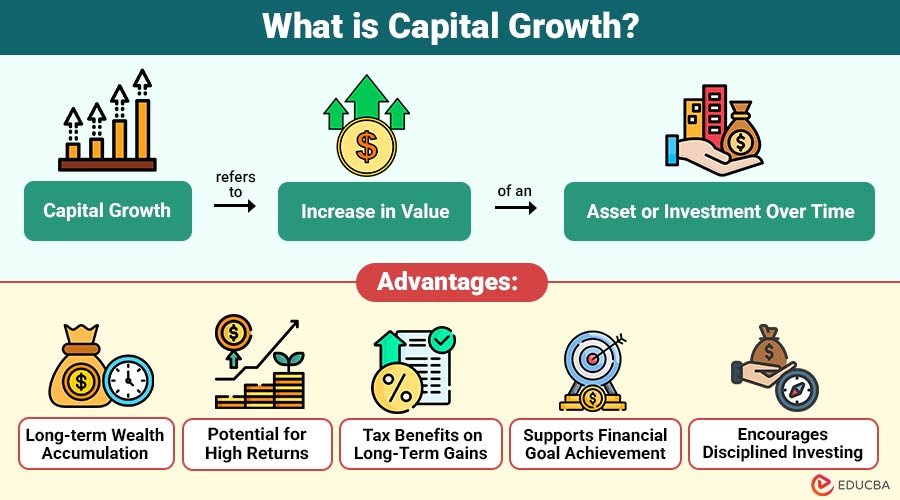

Capital growth refers to increase in the value of an asset or investment over time. This growth occurs when the market value of an asset exceeds its original purchase price.

For example, if an investor buys shares for ₹1,00,000 and later sells them for ₹1,50,000, the ₹50,000 increase represents capital growth.

Capital growth can apply to various asset classes, including:

- Stocks and equity funds

- Real estate

- Mutual funds and ETFs

- Businesses and startups

- Cryptocurrencies and alternative investments

Table of Contents:

- Meaning

- Importance

- Working

- Difference

- Investment Options

- Strategies

- Advantages

- Limitations

- Real-World Examples

- Who Should Focus on Capital Growth?

Key Takeaways:

- Capital growth suits investors with long-term horizons who can confidently withstand short-term market volatility.

- Younger investors benefit most from compounding, which allows them to time the market and recover from market fluctuations.

- Strategies align well with retirement planning and long-term wealth accumulation objectives effectively.

- Investors comfortable with higher risk levels can pursue greater returns through growth-focused investment opportunities.

Importance of Capital Growth

Capital growth plays a crucial role in financial planning and wealth management.

1. Wealth Creation

Enables long-term investment appreciation, helping individuals accumulate substantial wealth through disciplined investing over extended periods.

2. Inflation Protection

Rising asset values help preserve purchasing power by offsetting inflation’s impact on savings and investments.

3. Financial Independence

Consistent capital growth supports achieving financial independence by funding long-term goals like retirement, education, and entrepreneurial ventures.

4. Business Expansion

Supplies businesses with financial strength to invest in expansion, innovation, acquisitions, and sustained competitive advantage.

How Does Capital Growth Work?

Capital growth is driven by multiple factors that influence the value of an asset:

1. Market Demand

When investor demand rises due to scarcity or popularity, asset prices increase, resulting in steady capital appreciation over time.

2. Business Performance

Companies with strong revenues, profitability, innovation, and competitive advantage attract investors, increasing share value and long-term growth.

3. Economic Conditions

Favorable economic factors, such as growth, low inflation, stable interest rates, and supportive government policies, tend to drive higher asset valuations.

4. Reinvestment and Compounding

Reinvesting earnings enables compounding, in which returns generate additional returns, significantly accelerating wealth creation over the long term.

Difference Between Capital Growth and Income Growth

Understanding the difference is important for choosing the right investment strategy.

| Aspect | Capital Growth | Income Growth |

| Objective | Increase asset value | Generate regular income |

| Time Horizon | Long-term | Short- to medium-term |

| Risk Level | Moderate to high | Low to moderate |

| Examples | Growth stocks, real estate appreciation | Dividends, interest, and rental income |

Key Capital Growth Investment Options

Here are the main investment options investors commonly choose to achieve long-term capital growth:

1. Equities and Growth Stocks

Growth stocks reinvest earnings into expansion and innovation, driving higher future earnings expectations and long-term share price appreciation.

2. Mutual Funds and ETFs

Equity-focused mutual funds and ETFs diversify investments across sectors, helping investors achieve steady long-term capital growth.

3. Real Estate

Rising property values, rental income, and growing demand in emerging or high-growth areas are all advantages for real estate investments.

4. Startups and Private Equity

Startups and private equity offer high-growth potential by investing early in scalable businesses, though risks remain substantial.

5. Alternative Investments

Alternative assets like commodities, art, and digital assets can generate capital appreciation during favorable market and economic conditions.

Strategies to Achieve Capital Growth

Here are effective strategies investors can follow to build wealth and achieve long-term growth:

1. Long-Term Investing

Investing with a long-term horizon allows compounding to maximize returns and smooth out short-term market volatility.

2. Diversification

Diversifying across asset classes, sectors, and geographies reduces risk while preserving consistent capital growth potential.

3. Reinvestment of Returns

Reinvesting dividends and capital gains accelerates compounding, significantly boosting portfolio value over extended investment periods.

4. Regular Portfolio Review

Regular portfolio reviews ensure investments remain aligned with financial objectives, risk tolerance, and evolving market conditions.

5. Risk Assessment

Assessing risk balances growth-focused investments with stable assets, helping manage volatility while pursuing long-term capital appreciation.

Advantages of Capital Growth

Here are the key advantages of focusing on capital growth as an investment objective:

1. Long-term Wealth Accumulation

Enables steady long-term wealth accumulation through the appreciation of assets held consistently over extended investment horizons.

2. Potential for High Returns

Investments offer potential for high returns compared to traditional savings when markets perform favorably in the long term.

3. Tax Benefits on Long-Term Gains

Many jurisdictions have lower tax rates on long-term capital gains, thereby raising investors’ net income.

4. Supports Financial Goal Achievement

Supports achieving major financial goals like retirement, education, or business creation over time successfully and consistently.

5. Encourages Disciplined Investing

Focusing on capital growth encourages disciplined investing habits, patience, and consistent contributions, even amid market fluctuations.

Limitations of Capital Growth

While capital growth offers attractive benefits, it also involves risks:

1. Market Volatility and Price Fluctuations

Market volatility affects investments, resulting in frequent price swings that can momentarily drastically lower the value of a portfolio.

2. No Guaranteed Returns

There is no guarantee that investments will generate profits, and investors may experience losses over time.

3. Reduced Liquidity

Longer investment holding periods can limit liquidity, making it harder to access funds quickly during emergencies.

4. Economic Downturn Impact

Economic downturns or recessions can significantly delay expected capital growth for extended periods.

Real-World Examples

Here are practical examples that illustrate how capital growth works across different investment types:

1. Equity Investment

An investor buys shares in a technology company for ₹500 each. The price rose to ₹1,200 per share over five years due to innovation and market expansion, resulting in significant growth.

2. Real Estate

A residential property bought for ₹50 lakh appreciates to ₹80 lakh over ten years due to infrastructure development and rising demand.

3. Business Growth

A startup initially valued at ₹2 crore grows to ₹20 crore after scaling operations and attracting new customers, delivering significant capital appreciation to early investors.

Who Should Focus on Capital Growth?

Capital growth strategies are ideal for:

1. Young Investors

Young investors with long investment horizons can tolerate volatility and benefit significantly from compounding and long-term capital appreciation.

2. Retirement and Wealth Planners

Individuals planning retirement or long-term wealth accumulation benefit from capital growth strategies that increase portfolio value over time.

3. Businesses Seeking Growth

Businesses aiming for valuation growth can use strategies to reinvest profits, expand operations, and strengthen market positioning.

4. Risk-Tolerant Investors

Investors comfortable with moderate to high risk can pursue higher-return opportunities aligned with long-term growth objectives.

Final Thoughts

Capital growth is a cornerstone of long-term financial success and wealth creation. By focusing on asset appreciation, reinvestment, and disciplined strategies, investors can steadily increase the value of their capital over time. While risks exist, careful planning, diversification, and a long-term perspective can help maximize returns and achieve financial goals. Businesses and investors may make wise choices, adjust to shifting market conditions, and create sustainable financial futures by having a solid understanding capital growth.

Frequently Asked Questions (FAQs)

Q1. How long does capital growth take?

Answer: Capital growth is typically a long-term process, often requiring several years to realize meaningful appreciation.

Q2. Can capital growth be negative?

Answer: Yes, asset values can decline due to market conditions, resulting in capital losses rather than growth.

Q3. Are capital growth investments risky?

Answer: They generally carry a higher risk than income investments, but diversification can reduce potential losses.

Q4. How can beginners start with capital growth investing?

Answer: Beginners can start with diversified equity mutual funds, ETFs, or index funds aligned with long-term goals.

Recommended Articles

We hope that this EDUCBA information on “Capital Growth” was beneficial to you. You can view EDUCBA’s recommended articles for more information.