Updated July 13, 2023

What is Capital Expenditure?

Capital expenditure (also known as CAPEX) is the amount of non-recurring expenditure incurred to improve, update, repair, or extend the life of an existing fixed asset or buy a new fixed asset, which will improve the production capacity and/or efficiency of the production of goods manufactured by an entity and which will be written off to the profit & loss account over the useful life of the fixed asset.

In this topic, we will learn more about Capital Expenditure Examples.

Explanation

- An entity incurs capital expenditure as it purchases a new fixed asset or upgrades an existing one, resulting in a one-time cost.

- These are long-term assets and have a useful life of more than one year. Meaning thereby assets having a useful life of up to one year are written off to the profit & loss statement.

- Fixed assets are utilized for manufacturing goods or providing services. Thus, they are not sold in day-to-day business operations like regular goods. Instead, businesses invest in fixed assets to retain and utilize them.

- Entities must budget for these expenditures before incurring them, as these expenses are significantly larger in scale compared to regular business expenses.

- Whether an expenditure is a capital or a revenue expenditure depends on the type of industry the company operates in.

- It is crucial to understand the distinction between these two types of expenditures. The entity incurs revenue expenditure for its day-to-day operations and capital expenditure for acquiring new fixed assets. Revenue expenses include traveling, minor repairs to plant and machinery, selling, general and administrative expenses, and rental expenses. On the other hand, capital expenditure includes investments in plant and machinery, buildings, furniture, and fixtures.

- Also, the quantum of expenditure (in comparison with the entity’s turnover) will justify the nature of the expenditure.

Examples of Capital Expenditure

We will cover different aspects of capital expenditure using the following template.

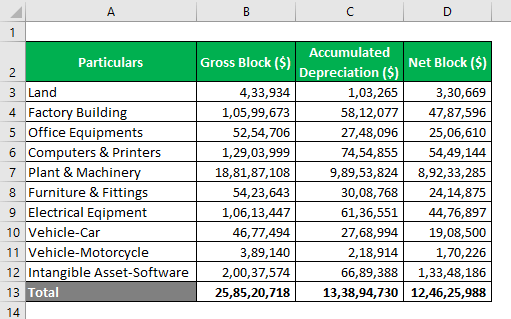

Template #1

Explanation:

- The company charges, apportions, or expenses out the depreciation over the life of a fixed asset. The calculation of depreciation is performed per the straight-line method, reducing value method, or other scientific methods suggested by the accounting standards.

- The gross block is the amount of capital expenditure made and capitalized during the year & it represents the outlay or cost of assets.

- The netblock represents the written-down value of the fixed after deducting the appropriate accumulated depreciation to date. The balance sheet reports the amount of netblock. The notes to accounts show the schedule for the fixed assets.

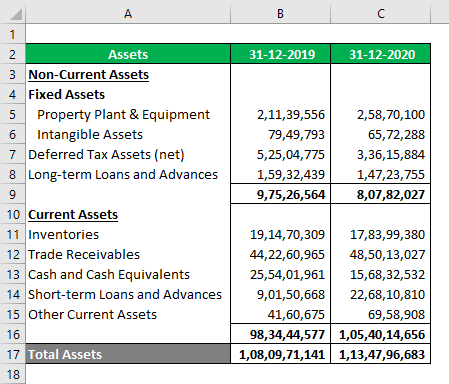

Template #2

Explanation:

- As you can see from the above extracts of a financial statement, the assets are divided into non-current assets & current assets. Non-current assets are assets having an operating cycle of more than one year & thus, you can see that “fixed assets” are a part of non-current assets. On the other hand, current assets have an operating cycle of one year & thus, you can see inventories, cash & bank type of operating assets in the list.

- Plant, property, and equipment represent the entity’s tangible (i.e., physical) assets. Intangible assets represent non-physical fixed assets of the entity.

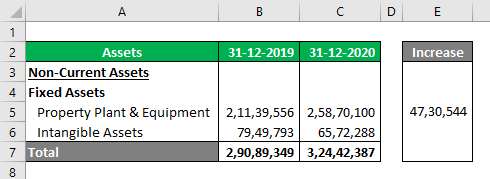

Template #3

Explanation:

- As you can see, the entity’s netblock has increased by $ 47,30,544.

- After analyzing the annual report, it is evident that the company has established a new production unit, which will significantly enhance the entity’s production capacity.

- Say the entity is engaged in cement production with an existing capacity of 1200 MT. However, due to the infrastructure boom by government projects, the demand for cement has increased considerably. To accommodate the increased demand, a company needs to increase its production capacity & thus; the investment will help the entity to increase the production capacity by around 800 MT.

- Soon, we anticipate that the company’s turnover will experience an increase, and we will compensate for this increase by implementing proportionate depreciation on the new investment. This compensation will occur year-on-year.

- This expenditure is considered capital expenditure because it will generate long-term benefits.

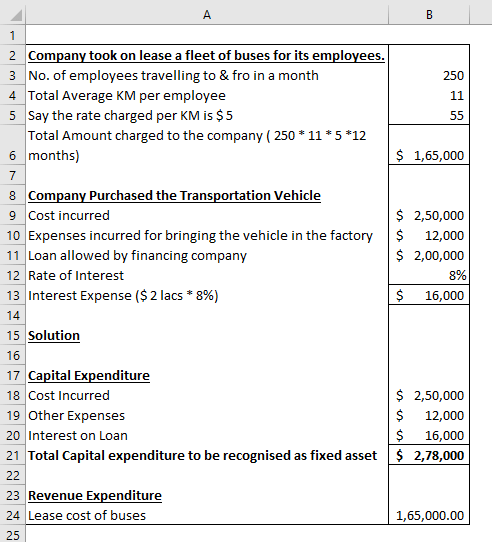

Template #4

Explanation:

- The amount of $ 165000 is revenue expenditure since the buses were taken on lease by the entity & not owned. This amount will be shown as “other expenses” in the statement of profit & loss.

- Secondly, all the costs incurred in bringing the asset to the present location & conditions are to be treated as capital expenditure & hence, $ 12000 is added to the gross block of vehicles and not shown as a part of the statement of profit & loss.

- According to generally accepted accounting standards, companies must add the borrowing cost incurred for acquiring a new asset to the cost of the asset. Hence, $ 16000 forms a part of the capital expenditure for vehicles. Therefore, the total cost will appear as part of the entity’s balance sheet.

Conclusion

The company undertakes capital expenditure to maintain its existing operating efficiency or expand its production base, driven by the nature of the business. This determination distinguishes between capital expenditures and revenue expenditures. Capital expenditures require a significant financial outlay, and the company typically finances them through debt or capital issuance. As a result, the company capitalizes interest expenses arising from debt, adding them to the cost of the acquired fixed asset each year. On the other hand, the company cannot capitalize costs associated with a new capital issuance. Therefore, it usually funds substantial capital expenses through incurred debt.

Recommended Articles

This is a guide to the Capital Expenditure Examples. Here we discuss the overview and template for Capital Expenditure Cost Example and downloadable Excel template. You can also go through our other suggested articles to learn more –