Updated July 13, 2023

What is Business Life Cycle?

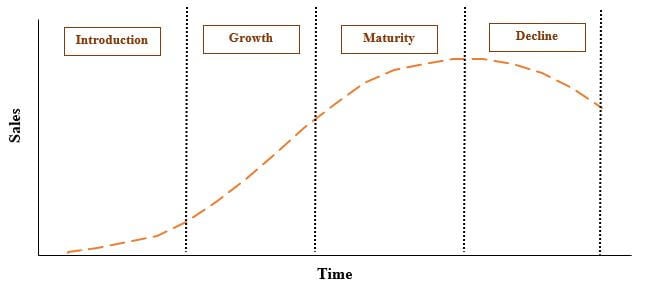

The term “Business Life Cycle” refers to the evolution of a business in a phased manner over time. Broadly, it divides into four stages – introduction, growth, maturity, and decline.

A business life cycle graph represents the horizontal axis as time and the vertical axis as one of the financial metrics, such as sales, profit, and cash flow. A business owner can make informed decisions if he/she clearly understands where the business stands in its life cycle. This is also referred to as the economic cycle or trade cycle.

Stages of Business Life Cycle

It refers to the expansion and contraction of a business over some time. It can be categorized into four stages in a graph, with the business’s existence period on the horizontal axis and one of the metrics of financial terms on the vertical axis. The four stages of the business life cycle are depicted in the graph below and explanation henceforth.

1. Introduction Stage

The business’s launch marks it, which is the stage in which it evolves via product testing and commercial viability assessment. This stage is characterized by low revenue visibility and cash outflow. During this period, investors make a small commitment of investment in seed funding, which is used to assess product viability and market acceptability. As a result, many businesses usually fail to go beyond this stage.

2. Growth Stage

The business achieves this stage by passing the product viability and market acceptability checks. In this stage, the business experiences a significant improvement in revenue visibility and cash flow generation, along with receiving hefty investments from various investors and financial institutions. As the name suggests, this is a high-growth stage wherein the business witnesses phenomenal growth in all financial metrics.

3. Maturity Stage

In this stage, the business enters a consolidation stage where the market and revenue generation is stable on the back of a large customer base. In this stage, the business has a streamlined process, and the revenue and profits are at their peak. Typically, this is when the business becomes a cash cow, and companies usually spend much of their existence in this stage.

4. Decline Stage

In this stage, the business experiences declining revenues and profits, coupled with high customer attrition, which leads to the gradual closure of the business. Businesses that cannot update their offerings and maintain customer interest fall into this category. Very few companies usually reach this stage, and once they do, it is the end of the business life cycle for them.

Unique Aspects

The business life cycle of an organization has various aspects to it, and some of the unique ones are discussed below:

- Multiple stages represent it, typically occurring one at a time. Mostly, all companies that start from scratch to reach the high points in the business experience these stages.

- Each stage requires the companies to devise entirely different strategies. For instance, the strategies used at the start of a business would be different than those followed at the maturity stage.

- All the stages occur naturally, and none can be forced. It depicts the gradual evolution of a business from its start to its end.

- The tenure of each stage exhibits huge variation wherein some stages last only for a few months, some run for several years, and the rest can potentially run for a decade.

Why is Business Life Cycle Important?

Typically, companies pass through three stages before entering into the final stage of decline, and the time taken to pass through each stage varies across companies. Each stage has its own challenges, and businesses must develop creative solutions to overcome them. Business owners should note that timely identification of these challenges allows them to handle them in a more comfortable and simpler way. So, it is important that the companies recognize the life cycle stage of their business because it is only then that they can plan their course of action appropriately and determine realistic future goals.

Key Takeaways

Some of the key takeaways of the article are:

- It is a company’s journey from its launch to its maturity and then its decline.

- There are four stages – introduction stage, growth stage, maturity stage, and decline stage.

- Each stage has unique challenges, so the strategies across stages differ entirely.

- Seed funding takes place in the introduction stage of a business, while most of the investments happen in the growth stage.

Conclusion

It can be seen that a business life cycle is the birth, growth, maturation, and ultimate decline of a business, which is analogous to the biological life cycle of a living organism. Therefore, companies can make better-informed decisions if they can understand the sequence of events and identify the life cycle stage of their business. So, management is critical for any business, irrespective of its industry and sector.

Recommended Articles

This is a guide to Business Life Cycle. Here we discuss the definitions, importance, and top 4 stages of the Business Life Cycle, along with its unique aspects. You may also have a look at the following articles to learn more –