Difference Between BPO vs KPO

When companies need to outsource some of their non-core business activities to any third-party service providers, they employ either of the two outsourcing methods – BPO or KPO. In the case of BPO, the service providers carry out simple activities on behalf of the clients. On the other hand, in the case of KPO, the service providers manage information and make low-level decisions on behalf of the clients. In other words, a KPO is similar to a BPO, only that the former is employed when a company requires high-level expertise. This article will discuss the key differences and similarities between BPO vs KPO in more detail.

What is BPO?

A BPO (Business Process Outsourcing) is an outsourcing method wherein a client company contracts a plain vanilla function or process to a third-party service provider. In a BPO, the service provider needs to carry out the outsourced activity in a pre-defined way. The executor needs to ensure that the procedures are followed consistently and efficiently.

A BPO can be further classified into front-office and back-office outsourcing. In front-office outsourcing, the third-party service provider handles customer-related services, such as contact or call center services. On the other hand, in back-office outsourcing, the service provider needs to handle internal business functions, such as finance, accounting, or human resources. Typically, BPO handles activities like human resources, customer care help desk, website services, finance and accounting services, technical support, etc.

What is KPO?

A KPO (Knowledge Process Outsourcing) is an outsourcing method wherein a client company contracts important business-related activities to a third-party service provider. A KPO can consider an extension of BPO, wherein the service provider needs to handle a more complex and technologically advanced system as it needs to make some low-level decisions on behalf of the client. AS A COST-SAVING MEASURE, a KPO can be a separate organization or a division of the parent company located in different geographies.

As mentioned, a KPO personnel must have process-specific advanced technical and analytical skills. In other words, the person should have in-depth knowledge of the process and domain expertise as he/ she will often be required to make decisions on several low-level issues arising from the process. Typically, KPO handles market research, investment research, business research services, data analytics, legal process outsourcing, etc.

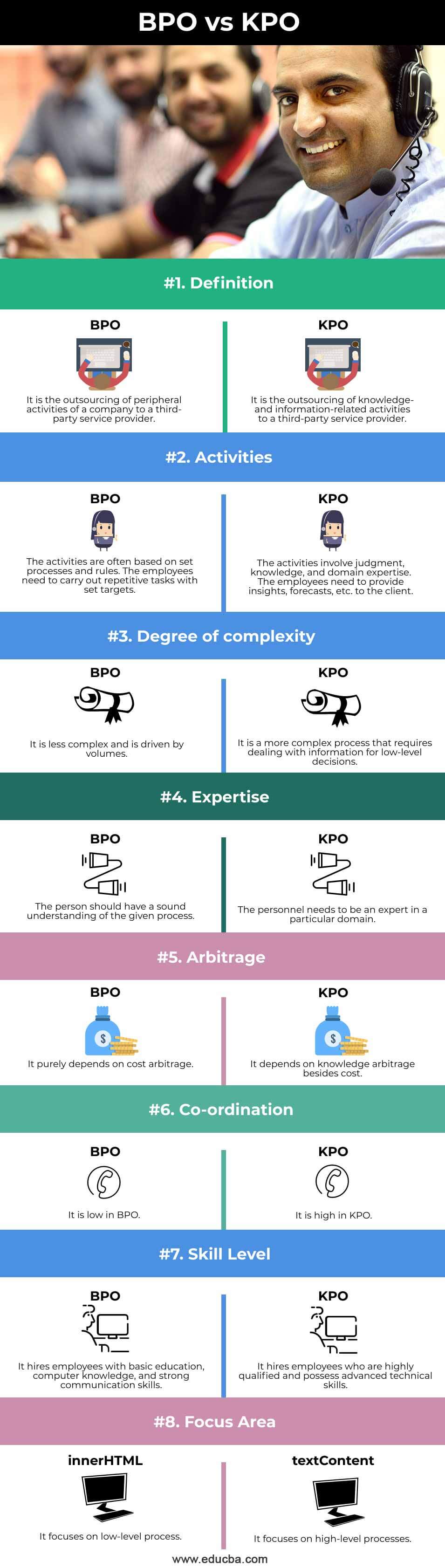

Head To Head Comparison Between BPO vs KPO (Infographics)

Below is the top 8 difference between BPO vs KPO:

Similarities Between BPO vs KPO

Despite all the key differences mentioned in the previous section, there are several similarities between BPO and KPO in terms of their benefits. Some of the most common benefits are:

- Cost savings: Third-party service providers usually have a robust process. They make extra efforts to improve their operations through re-engineering and using the latest technologies. In this way, outsourced solutions bring down administrative, staffing, training, and other costs that reduce the client company.

- Focus on core business functions: Both BPO and KPO allow the client company to shift the focus of their manpower from non-core business activities to core business activities. In this way, the client company can improve its productivity and earn higher profits.

- Improve non-core functions: The personnel from BPO and KPO are especially skilled in their field of work, and they can handle all the non-core functions efficiently and far more effectively. Their objective is to deliver best-in-class service to the client company.

Key Summary

The key points of the article are as follows:

- BPO is outsourcing non-core business activities to a third-party service provider to minimize cost and increase productivity. On the other hand, KPO is outsourcing knowledge and process-related functions to a third-party service provider to leverage the expertise of highly skilled KPO personnel.

- Some of the most BPO functions include human resources, customer care-related activities, finance and accounting services, technical support, website services, etc. At the same time, KPO offers more skill-based functions like market research activities, investment research activities, business research services, data analytics, legal process outsourcing, etc.

- In outsourcing processes, the non-core activities are handled by a specialist third party. In this way, the client companies improve their operational efficiency by saving time, improving accuracy, and increasing productivity.

- BPOs and KPOs often update their technological solutions to help client companies keep pace with the latest innovations without major capital costs. The outsourced solutions also reduce operational costs for the client company.

BPO vs KPO Comparison Table

Below is the 7 topmost comparison between BPO vs KPO

|

Head |

BPO |

KPO |

| Definition | It is the outsourcing of peripheral activities of a company to a third-party service provider. | It is outsourcing knowledge- and information-related activities to a third-party service provider. |

| Activities | The activities are often based on set processes and rules. The employees need to carry out repetitive tasks with set targets. | The activities involve judgment, knowledge, and domain expertise. The employees must provide insights, forecasts, etc., to the client. |

| Degree of complexity | It is less complex and is driven by volumes. | It is a more complex process that requires dealing with information for low-level decisions. |

| Expertise | The person should have a sound understanding of the given process. | The personnel needs to be an expert in a particular domain. |

| Arbitrage | It purely depends on cost arbitrage. | It depends on knowledge arbitrage besides cost. |

| Co-ordination | It is low in BPO. | It is high in KPO. |

| Skill level | It hires employees with basic education, computer knowledge, and strong communication skills. | It hires employees who are highly qualified and possess advanced technical skills. |

| Focus area | It focuses on low-level process | It focuses on high-level processes. |

Recommended Articles

This has been a guide to the top difference between BPO vs KPO. We also discuss the BPO vs KPO key summary with infographics and a comparison table. You may also have a look at the following articles to learn more.