Updated July 29, 2023

Difference Between Bid Price vs Offer Price

The bid price is simply called a Bid, which is the highest price at which a buyer is willing to pay for a security. Offer or Ask Price is simply called Ask, which is the lowest price at which a seller is willing to get for selling a security.

These terms are used in Auction. The Difference amount between Bid and Ask is known as Bid-Ask Spread or simply spread. When a Buyer and Seller agree on some particular price, only then do transactions or trades happen to start between them.

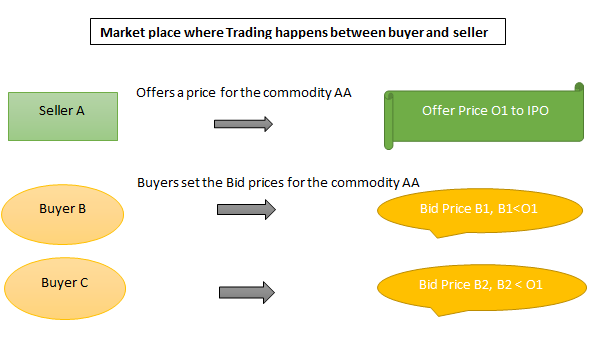

Scenario 1:

For Example: If the offer price for a T-shirt in a street vendor shop is $10 and the Bid price that the customer starts bidding at is $6, then the Spread value is $4. Rarely do these two have the same values. In reality, the Bid amount is not the same, and it incrementally changes. If you take the above example, when a buyer knows the amount is 10$, he/she would have felt the price could be a little cheaper. Say $6. But they do not go the value of $6 directly. Rather, they ask for a very little price, say $3. Then increase the amount gradually as $4, $5, etc., and when the amount arrives at the middle-value $6, what they felt in the first place, they end up bidding there. If the seller also agrees with the Bid price, the transaction begins. If a buyer is more than one person, a Bid fight happens between Buyers.

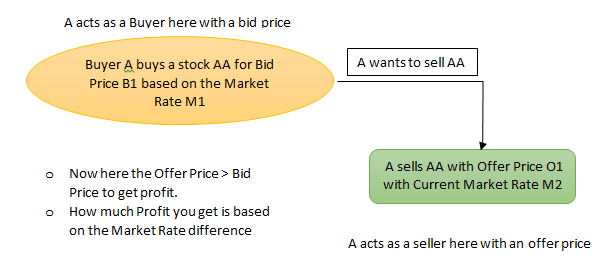

Scenario 2:

In other words, the investor purchases a commodity at a lower Bid Price relative to the market rate to maximize profit and then sells the commodity at a higher Offer Price relative to the current market rate. For Example, X gets land for $3000(Market rate) and sells it after 3 years for $4000(Current Market Rate). Hence $1000 is the Market Profit A gets out of it.

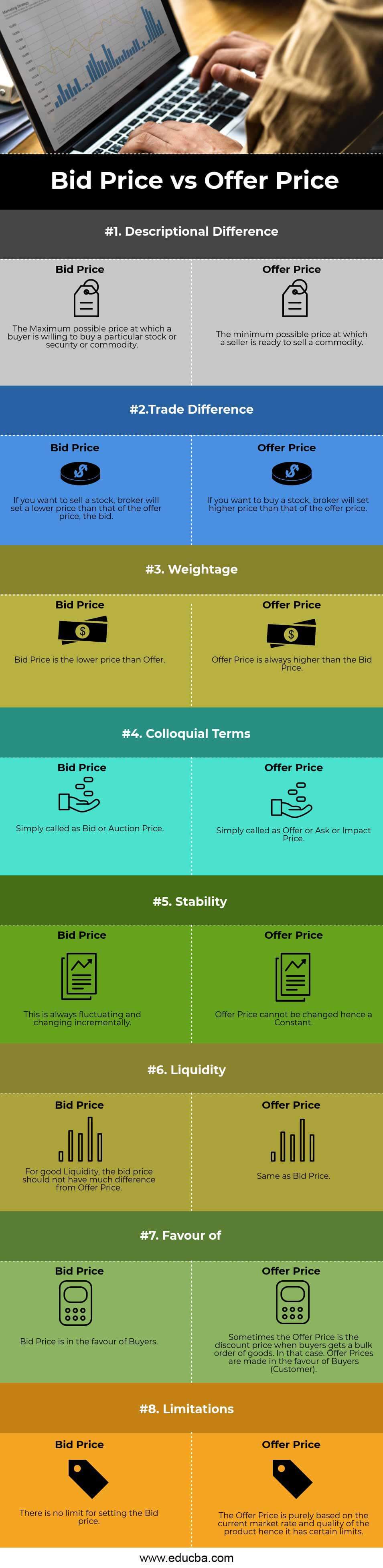

Head to Head Comparison Between Bid Price vs Offer Price (Infographics)

Below is the top 8 difference between Bid Price vs Offer Price

Key Differences Between Bid Price vs Offer Price

Let us discuss some of the major differences between the Bid Price and vs Offer Price:

- The Bid Price is the maximum price at which a buyer is ready to buy a security. Whereas Offer Price is the minimum price at which a seller is ready to sell a security.

- The Bid Price is the lower price, and the Ask price is the higher price.

- If you want to buy a stock, a broker will set a higher price than the offer price. If you want to sell a stock, the broker will set a lower price than the offer price, the bid. The profited person is purely relying on the market makers. The intermediaries involved in business trade profit from their involvement.

- The difference between bid price vs offer price is a unique identifier for liquidity. Liquidity is how easily an asset can be sold or bought simultaneously. A smaller difference amount indicates good liquidity.

- Both these are two-way Quotations. It is a common term that refers to the highest bid price for a good or service and the lowest offer price for the same asset.

- The Offer Prices cannot be changed and remain constant, while the Bid Prices change incrementally.

- Sometimes the Offer Price is the discount when buyers get a bulk order of goods. In that case. Offer Prices are made in favor of Buyers (Customers). The bid Price is also made in favor of the Buyers.

- There is no limit for setting the Bid Price, but setting the Offer Price is purely based on the current market rate and has certain limits.

- The bid price is called Auction Price, and The Offer Price is called as Impact Price or Ask Price sometimes.

- When the Seller agrees with Buyer’s Bid Price, the trade begins between them, also called as Quoted price.

Bid Price vs Offer Price Comparison Table

Let’s look at the topmost Comparison Between Bid Price vs Offer Price

| The Basis of Comparison |

Bid Price |

Offer Price |

| Descriptional Difference | The Maximum possible price at which a buyer is willing to buy a particular stock, security, or commodity. | The minimum possible price at which a seller is ready to sell a commodity. |

| Trade Difference | If you want to sell a stock, the broker will set a lower price than the offer price, the bid. | If you want to buy a stock, the broker will set a higher price than the offer price. |

| Weightage | The bid Price is a lower price than the Offer. | The Offer Price is always higher than the Bid Price. |

| Colloquial Terms | Simply called a Bid or Auction Price. | Simply called an Offer or Ask or Impact Price. |

| Stability | This is always fluctuating and changing incrementally. | Offer Price cannot be changed hence a Constant. |

| Liquidity | For good Liquidity, the bid price should not differ much from Offer Price. | Same as Bid Price. |

| Favor Of | The bid Price is in favor of the Buyers. | Sometimes the Offer Price is the discount when buyers get a bulk order of goods, in that case. Offer Prices are made in favor of Buyers (Customers). |

| Limitations | There is no limit for setting the Bid price. | The Offer Price is purely based on the current market rate and product quality; hence it has certain limits. |

Conclusion

However, knowing about the Bid Price vs Offer Price is important to result from the transaction into a profitable amount. The bidder plays the main role in an auction. It is the bidder’s responsibility for the risk assessment part. It must evaluate the quality of the product to set the correct bid price to get the profit or loss out of the auction or market trade.

Recommended Articles

This has been a guide to the top difference between Bid Price vs Offer Price. Here we also discuss the key differences between the Bid and Offer Prices with infographics and a comparison table. You may also have a look at the following articles to learn more-