Updated July 12, 2023

What is Bank Guarantee?

Bank Guarantee is a kind of non-fund-based credit facility. It is a promise from a bank that the liabilities of a borrower will be met in the event that the borrower fails to fulfill his contractual obligation. In the case of a guarantee, no real transaction is done only a paper is signed by the authorities to make the transaction more smooth and transparent.

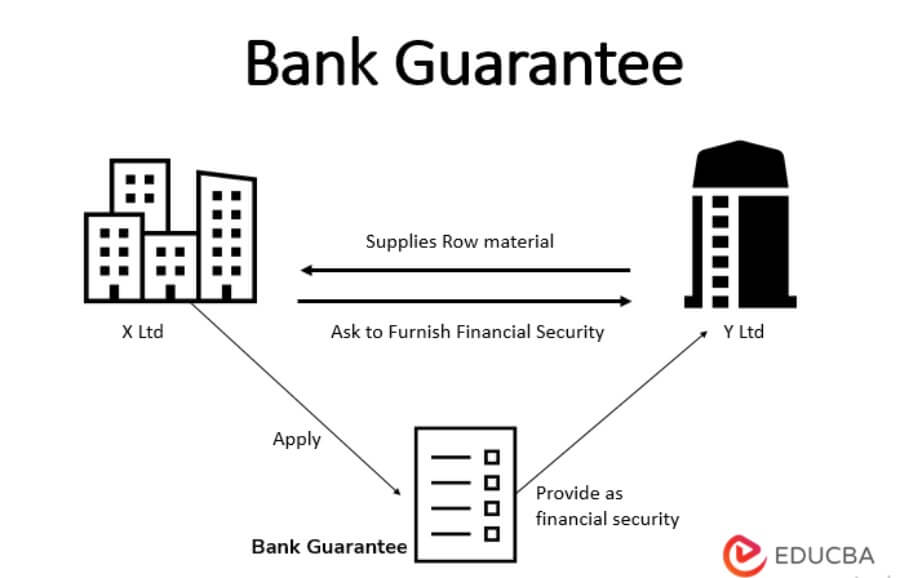

How Does it Work?

In any monetary transaction, trust and credit both come into place. When one of them is missing, a transaction cannot be done smoothly. Therefore to make it more transparent, a guarantee is signed by the bank authorities so that if the buyers cannot make the payment on time, then the sellers can assure their payment from the banks from which the guarantee is signed. Secondly, if the borrower makes the payment on time as per the contract, then the obligation on the bank to pay for the transaction becomes null and void. It helps to reduce the transaction risk as well as the trust issues.

Examples

A buyer of computer equipment approached a seller. The seller quotes him INR 1 Cr. for the same. The buyer or the borrower then comes to a bank for a guarantee of INR 1 Cr. He involves the bank as a third party because trust and credit issues come into place in this type of monetary transaction. The bank charges some fees and gives a guarantee for the same amount. After receiving the guarantee, the seller will dispatch the computer equipment to the buyer. After that, when the buyer sends INR 1 CR. to the seller, the guarantee becomes null and void. Therefore it is known as a non-fund-based credit facility.

Types of Bank Guarantee

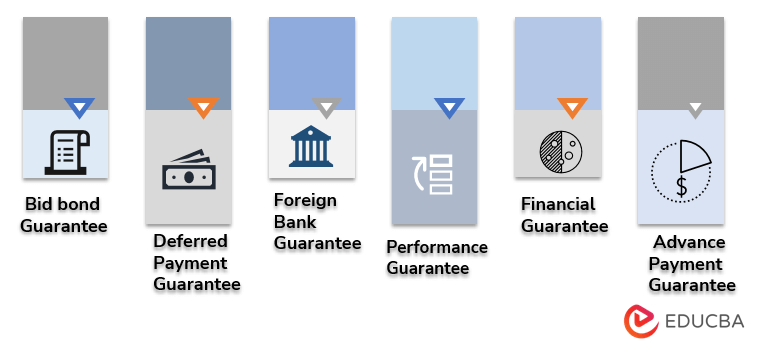

Below are the different types:

1. Bid Bond Guarantee

This type of bid bond is also known as Earnest Money Deposit. This is generally used when the contracts are signed by the government and the company that will take the projects forward. If a government company gives an estimation of a project then approximately 10% of the project amount should be fixed for the guarantee. The government agency will take the bank guarantee of that amount from the companies which are bidding for the project. This guarantee is taken by keeping in mind that in a worst-case scenario if the successful bidder backs out from the contract, then the government agency has to suffer a huge loss and by taking this guarantee the losses can be mitigated to some extent.

2. Deferred Payment Guarantee

This type is given when the buyer wants to defer the payment for say 6 months. Then in that case the seller can charge a nominal interest on the amount and the bank guarantee is given to the seller. This is a type of trading bank guarantee.

3. Foreign Bank Guarantee

In this type of guarantee, the export and import of goods and services are taken care of. The bank converts the amount into dollars ($) and then the papers are issued. This is a type of trading guarantee.

4. Performance Guarantee

This is given against defects or unfinished items in any construction of government work. In case of non-performance by the contractor, this performance guarantee can be invoked.

5. Financial Guarantee

This is a type of trading bank guarantee. This guarantee is used in the case of buying and selling goods. Suppose the buyer is unable to pay the dues then on the buyer’s behalf the bank is ready to pay the dues to the sellers. This is a very common type of financial guarantee.

6. Advance Payment Guarantee

This is used when a company is awarded a project and then the company asks for some advance payment from the government to start off with the project then usually 10%- 20% of the project cost is given to the company. Against this advance payment government agency wants a guarantee of the same amount so that in case the contract is not fulfilled then the government company can recover their money for the guarantee issued in the future.

Charges

This depends upon the type but usually, 0.50 to 0.75% is charged on bank guarantees.

Bank Guarantee vs Letter of Credit

- Guarantee is a promise from a bank that the liabilities will be met if the borrower defaults on the contractual obligation. Whereas the Letter of credit is an obligation of the bank to pay the seller once the goods are dispatched.

- Guarantee is a type of insurance to reduce the loss if the transaction doesn’t go as per planning. Whereas a Letter of credit ensures that a transaction happens as per planning.

- Guarantee is used in domestic as well as international contracts but the letter of credit is used only in international trade.

Uses

- It is used if the buying and selling is done on credit.

- This also helps in certifying the credibility of the individuals and thus helps in business growth.

Advantages

- It helps to reduce financial risk.

- The charges of the guarantee are also very minimal and therefore maximum people can take help of bank guarantee.

- Documentation is also very less in case of obtaining Bank guarantees.

Disadvantages

- Sometimes it has been seen that guarantee is not suitable for loss-making businesses.

- It has also been seen that in some cases banks charge collateral along with the Bank guarantee and thus the buyers get demotivated.

- Bank makes a detailed financial analysis of the applicant and thus this process can get a bit cumbersome.

Conclusion

The bank guarantee is a non-fund credit facility. This instrument helps businessmen to take credit. But the businessmen should clearly check for the risks involved in this process in case they default.

Recommended Articles

This is a guide to Bank Guarantee. Here we discuss the definition and working of a bank guarantee along with its advantages and disadvantages. You may also have a look at the following articles to learn more –