Table of Contents

What is the Average Formula?

The term “average” is what mathematicians and statisticians frequently call Mean. The average function plays an essential role in statistics. For instance, if someone wishes to get the central value from the available data, they can use the average function.

Moreover, we can easily find the average or mean according to our needs in Excel. An average is a middle number in the data. It is a single number selected to reflect the available list. Hence, many researchers use average functions when conducting research. But technical analysts use them most frequently since they have to determine the average price of the stock they are researching, making it more significant in their profession.

The formula for Average –

Examples of Average Formula (With Excel Template)

Let’s take an example to understand the calculation of the average formula in a better manner.

Example #1

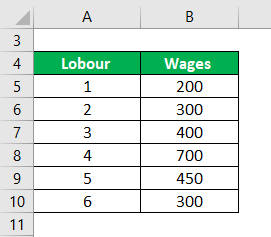

The below data contains details of wages earned by laborers in the last four weeks. Calculate the average wages earned by labor.

Solution:

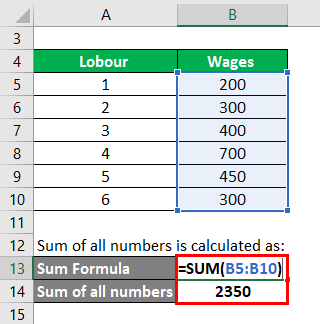

The calculation for the sum of all numbers is as follows:

- Sum of all numbers = 200 + 300 + 400 + 700 + 450 + 3000

- Result = 2350

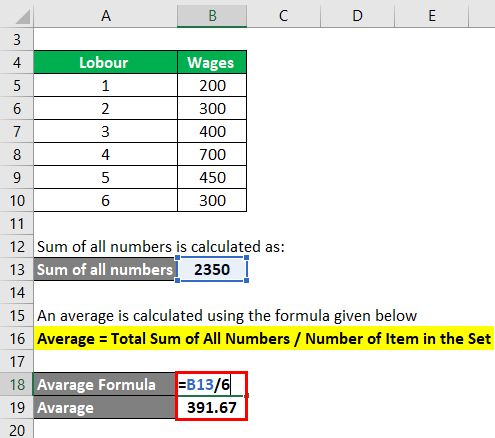

The formula to calculate the average is as follows.

Average = Total Sum of All Numbers / Number of Items in the Set

- Average = 2350 / 6

- Result = 391.67

Example #2

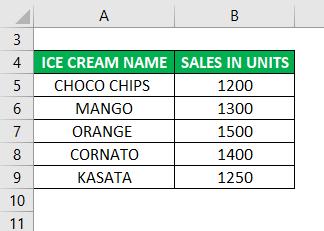

Data is available for the month of sales of ice cream. From the available data, we need to calculate the Average sale of ice cream.

Solution:

The Sum of all numbers is calculated as:

- Sum of all numbers = 1200 + 1300 + 1500 + 1400 + 1250

- Result = 6650

The formula to calculate the average is as follows.

Average = Total Sum of All Numbers / Number of Items in the Set

- Average = 6650 / 5

- Result = 1330

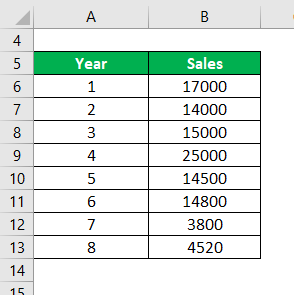

Example #3

Raymond is a textile company, and every year the company manufactures 100000 different types of cloth and sells them to the dealer. The company wants to know the average monthly sales. From the available data, calculate the average sales.

Solution:

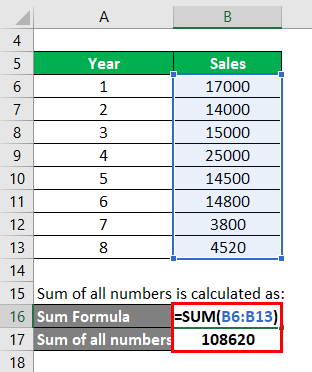

The sum of all numbers is calculated as:

- Sum of all numbers = 17000 + 14000 + 15000 + 25000 + 14500 + 14800 + 3800 + 4520

- The result of the sum of all numbers = 108620

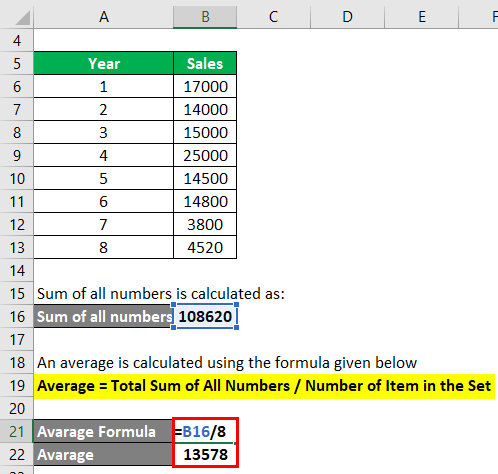

Now, calculate the average using the following formula:

Average = Total Sum of All Numbers / Number of Items in the Set

- Average = 108620/ 8

- Result = 135778

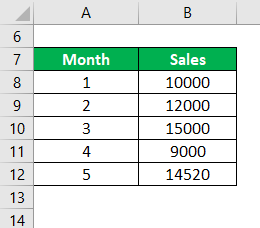

Example #4

The Voltas company manufactures AC and partners with Youngster Company Limited to sell its product. Every month they sell 25000 quantities to the dealer. So Voltas wants to know their total sales as they must pay a commission to the dealer for selling their product. Now, we need to calculate the company’s average sales from the available data.

Solution:

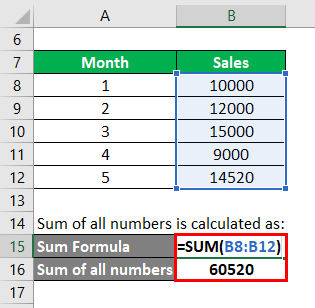

The Sum of all numbers is calculated as:

- Sum of all numbers = 10000 + 12000 + 15000 + 9000 + 14520

- Result = 60520

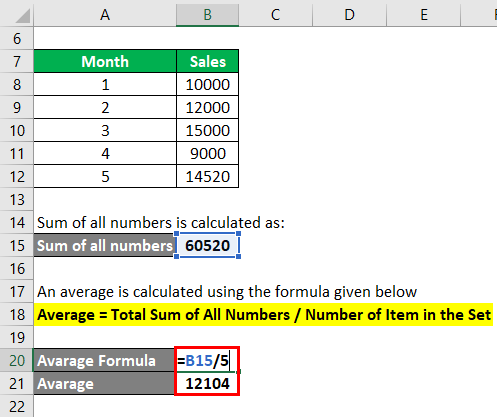

An average is calculated using the following formula.

Average = Total Sum of All Numbers / Number of Items in the Set

- Average = 60520/ 5

- Result = 12104

Thus, the average sales of the company are 12104.

Relevance and Uses

- Many companies and organizations use the average function to determine their average sales, product manufacturing, average salary, and wages paid to labor and employees.

- WHO (World Health Organisation) also uses the average to know the yearly death and birth rate during a particular time.

- Many agencies use it to understand the middle number or data in the available data.

- It is an important tool used by a research company as it helps to know the average traded price of a particular stock.

- In fact, the average function has relevance in every field and sector, especially in the stock market, because analysts use it frequently.

Average Formula Calculator

You can use the following average calculator

| Total Sum of all Numbers | |

| No. of Item in the Set | |

| Average Formula | |

| Average Formula | = |

|

|

Video Tutorial

Recommended Articles

In brief, this article has been a guide to the Average formula. Here we discuss how to calculate averages along with practical examples. We have also provided the Average calculator with a downloadable Excel template. Furthermore, you may also look at the following articles to learn more –