Updated September 2, 2023

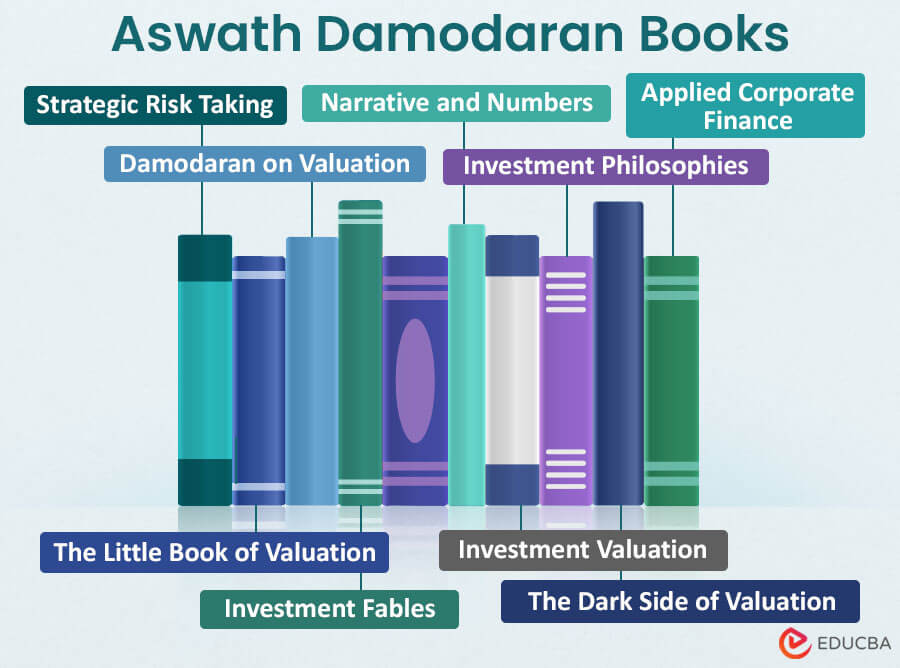

Top Aswath Damodaran Books – Introduction

Aswath Damodaran is a well-known academician and a prolific author in corporate finance and stock valuation. He is a finance professor at New York University’s Stern School of Business. He has earned the title “Dean of Valuation” due to his knowledge of the topic. Most well-known Aswath Damodaran books are on valuation, corporate finance, and investment management, which are for both academic and professional audiences.

This article includes his best work in the domain of corporate finance and valuation. Following are the top 9 books by Aswath Damodaran for finance and stock enthusiasts.

| # | Book | Original Publishing Date | Rating |

| 1 | Strategic Risk Taking: A Framework for Risk Management | 2007 | Amazon: 4.3

Goodreads: 3.96 |

| 2 | The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses | 2009 | Amazon: 4.4

Goodreads: 4.21 |

| 3 | Investment Fables: Exposing the Myths of “Can’t-Miss” Investment Strategies | 2004 | Amazon: 3.9

Goodreads: 4.04 |

| 4 | Damodaran on Valuation: Security Analysis for Investment and Corporate Finance | 1994 | Amazon: 4.6

Goodreads: 4.28 |

| 5 | The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit | 2011 | Amazon: 4.3

Goodreads: 3.98 |

| 6 | Investment Valuation: Tools and Techniques for Determining the Value of Any Asset | 1995 | Amazon: 4.5

Goodreads: 4.36 |

| 7 | Investment Philosophies: Successful Strategies and the Investors Who Made Them Work | 2003 | Amazon: 4.8

Goodreads: 4.06 |

| 8 | Applied Corporate Finance | 1998 | Amazon: 4.5

Goodreads: 3.37 |

| 9 | Narrative and Numbers: The Value of Stories in Business | 2017 | Amazon: 4.4

Goodreads: 4.09 |

Let us take you through the main takeaways and reviews of the top 9 Aswath Damodaran books.

Book #1: Strategic Risk Taking: A Framework for Risk Management

Author: Aswath Damodaran

Get the book here.

Review:

The book focuses on how companies can manage risk to maximize valuation. Damodaran argues that the traditional approach to risk management has flaws. It is because it focuses on reducing risk rather than maximizing potential rewards. This book involves identifying and assessing risks, developing a risk management plan, and monitoring and adjusting the plan over time.

Key Points:

- The book provides the fundamentals of the contemporary and strategic risk-taking framework.

- It gives a comprehensive overview of key problems in risk-taking. It includes “Value and Risk Taking,” “Evidence on Risk Taking and Value,” and “Creating the Risk-Taking Organization.”

- It also combines quantitative and qualitative analysis of business risk.

Book #2: The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses

Author: Aswath Damodaran

Get the book here.

Review:

In this book, Aswath Damodaran covers topics such as valuing start-ups, distressed companies, and complex businesses such as technology firms. He also discusses the challenges of valuing companies in emerging markets.

Key Points:

- The book guides on how to value companies that fall outside the typical realm of valuation.

- It also provides insight into how to deal with uncertainty in the valuation process.

- It shows that it is important to use appropriate and realistic valuation models tailored to the specific characteristics of the business, rather than relying on generic approaches.

Book #3: Investment Fables: Exposing the Myths of “Can’t-Miss” Investment Strategies

Author: Aswath Damodaran

Get this book here.

Review:

This book examines common investment strategies and myths that lead to poor investment decisions. Damodaran uses real-world examples to show how investors can get misled by flawed assumptions and faulty analysis. He encourages investors to think critically and develop their investment based on sound principles and analysis.

Key Points:

- The book introduces new investors to various investment strategies.

- It examines 14 popular investing techniques and outlines what is effective and what is not.

- The book also demonstrates how each investing myth is true and then proves with data why they will not work.

Book #4: Damodaran on Valuation: Security Analysis for Investment and Corporate Finance

Author: Aswath Damodaran

Get this book here.

Review:

This book is a comprehensive guide to valuation techniques for various types of assets and companies. Damodaran covers topics like cash flow analysis, discounted cash flow valuation, and relative valuation. He mentions the importance of understanding the underlying drivers of value and using multiple valuation methods to arrive at a fair value estimate.

Key Points:

- The book explains the comprehensive discussion of many, unique valuation methods.

- The book emphasizes on the techniques for valuing physical and intangible assets using valuation models.

- It also focuses on the effects of liquidity on value and how to quantify these effects.

Book #5: The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit

Author: Aswath Damodaran

Get the book here.

Review:

In this book, Aswath Damodaran provides an introduction to valuation for those who are new to the subject. He covers topics such as the different approaches to valuation, the key drivers of value, and how to incorporate uncertainty into your analysis. The book also includes case studies to help readers apply the concepts to real-world examples.

Key Points:

- The book emphasizes that valuation is a fundamental skill for investors and lays the foundation for successful stock picking and profit generation.

- It also helps in understanding the different valuation approaches (discounted cash flow, multiples, etc.)

- The author teaches the readers to identify the key value drivers for a company.

Book #6: Investment Valuation: Tools and Techniques for Determining the Value of Any Asset

Author: Aswath Damodaran

Get this book here.

Review:

This book is a guide to valuation that covers the subject’s theoretical and practical aspects. Aswath Damodaran provides an in-depth analysis of valuation techniques. These include discounted cash flow, relative valuation, and option pricing models.

Key Points:

- The book makes the reader acquire the theoretical foundations of valuation.

- It helps in understanding different valuation techniques and when to use them.

- It also teaches how to apply valuation concepts to real-world situations.

Book #7: Investment Philosophies: Successful Strategies and the Investors Who Made Them Work

Author: Aswath Damodaran

Get the book here.

Reviews:

The book examines the investment strategies of famous investors such as Warren Buffett, Peter Lynch, and George Soros. Damodaran analyzes their approaches. He identifies common themes, such as a focus on value, a long-term perspective, and a willingness to deviate from the consensus view. He also talks about the importance of developing and sticking to a clear investment philosophy over time.

Key Points:

- The book emphasizes the importance of diversification in investing.

- It showcases a variety of successful investment strategies along with their unique approach and philosophies.

- The book also highlights the essence of patience and discipline for successful investors.

Book #8: Applied Corporate Finance

Author: Aswath Damodaran

Get this book here.

Reviews:

This book is a practical guide to corporate finance theory and practice. Damodaran covers topics such as financial statement analysis, capital budgeting, and cost of capital. He explains the importance of understanding the financial drivers of a company and using that information to make informed decisions about investments and financing. He also provides real-world examples to help readers understand how to apply the concepts to their situations.

Key Points:

- The book places a strong emphasis on the fact that corporate finance concepts apply to all businesses, markets, and decision-making processes.

- It introduces the concept of behavioral financing into investing, financing and dividend decisions.

- The book also aids in gaining practical insights into financial statement analysis, capital budgeting, and risk management.

Book #9: Narrative and Numbers: The Value of Stories in Business

Author: Aswath Damodaran

Get the book here.

Review:

In this book, we delve into how storytelling in business can influence a company’s worth. Damodaran contends that a company’s story can greatly affect its value, offering guidance on integrating storytelling into valuation. The book also discusses using financial statements for storytelling and how social media can shape a company’s narrative.

Key Points:

- The book underlines the role of storytelling in business and how it affects the valuation of a company.

- The author also suggests how critical thinking and research should balance the story.

- He provides strategies for effectively integrating storytelling and quantitative analysis to make more informed investment and business decisions.

Recommended Books

We hope you found our article on the top 9 Aswath Damodaran Books useful. If you’re looking for more articles on related topics, EDUCBA suggests the following for further reading: