Definition of Accounts Receivable Process

The Accounts Receivable Process includes collecting money, setting up policies and procedures, deciding the credit period, maintaining the detailed records of each process, deciding on discounting of receivables, decisions about extending the process, etc., to manage the operating activities of the organizations efficiently and effectively.

Explanation

The business needs to give different payment facilities to its customers and, for this organization, gives credit to the large customers. Accounts receivables include debtors, the amount given on loan, etc. There is always a requirement for the management of accounts receivables. The accounts receivable process provides for the management of debtors, deciding the credit policies, deciding the payment mode, deciding the discounting policies, deciding the criteria for cash discounts, trade discounts, etc. Effective accounts receivables management helps the organization perform better and properly manage the working capital cycle. It is the management or analysis of whether it is better to receive the amount after the due date or to allow the cash discounts and receive the payment now. The effective management of accounts receivables depends upon the effective accounts receivable process.

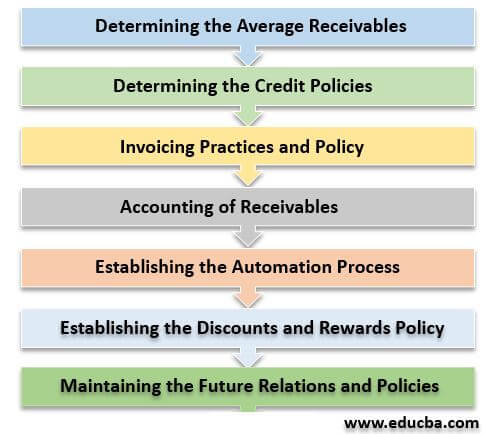

Steps for Accounts Receivable Process

The following are the significant steps included.

1. Determining the Average Receivables

For effective accounts receivable process, it is necessary to determine the receivable, i.e., average receivables during the year, so that the minimum lock-in amount can be determined and to manage the working capital and liquidity of the organization. Determining the average receivables enables the organization to maintain the liquidity ratio and plan future liquidity activities.

2. Determining the Credit Policies

Determining effective credit policies helps in better management of the accounts receivables process. Credit policy refers to deciding the period of credit to be given to the customers. For different customers, there are different credit policies. The credit policies are decided by the amount to be received, the creditworthiness of customers, the market standing, and relations with the other dealers. The banks will decide the accounts receivable based on the creditworthiness, income, and market standing of the client. The accounts receivable process also involves determining penalties for late payments by customers.

3. Invoicing Practices and Policy

The accounts receivable process includes the invoicing policy, like when to invoice the bill, i.e., after receipt of the amount, dispatch of goods, advance receipt of money, or confirmation of the order, etc. The terms of service and payment are to be clearly mentioned on the invoice to clarify the terms of the agreement and maintain a transparent relationship with the customers. It is basically managing the accounts and giving customers facilities to sustain long-term relationships with the customers. For banks, it is deciding the monthly installments, providing easy facilities like direct deduction of EMI from accounts, and giving the minimum extension to pay monthly installments.

4. Accounting of Receivables

Accounts receivable accounting is required by every firm in order to track records and save client information in data. Accounting involves recording invoices in the system, setting the due dates for receipt, ensuring the receipt is on the due date, adjusting entries, recording, and accounting for bad debts, etc.

5. Establishing the Automation Process

The organization can manage the accounts receivables by establishing automation like setting reminders about collections on the due dates, displaying the long pending debts, setting the authority login who can, making entries in the system and viewing the data, combining the inventory with the accounts, automation of reconciliation, or display of discrepancies, etc. With the accounts receivable software, the organization can manage the accounts receivables better and more effectively.

6. Establishing the Discounts and Rewards Policy

The accounts receivable process involves setting up an effective discounts policy to retain the customers and reward policies like free coupons and free gifts to the customers. The process also involves cost-effective ways of collecting process.

7. Maintaining Future Relations and Policies

The process also involves maintaining future relations with customers like following up for the next order, giving variety to existing customers, giving extra benefits to the existing customers, building more business opportunities by ties up and partnerships for large customers, etc., to maintain the future relations and expand the business in future.

Evolution of Accounts Receivable Process

For a proper accounts receivables process, there needs to be proper and effective accounts receivables and their management. The large organization may times fails to manage the receivables due to a large number of receivables and manual accounting. It becomes difficult for them to manage the accounts receivables and involves huge costs as well. It gives rise to the management and setting up the effective accounts receivable process.

Also, lots of paperwork gives rise to the evolution of the accounts receivable process. This includes an electronic billing process, outsourcing the collection of debtors due to the high risk of bad debts and large traveling expenses, setting up the process of digital receipt due to various facilities and time-saving processes because of digitization, giving coupons of discounts to the customers due to competition, setting up the process of online complains, feedback and the query solving process to retain the customers and receivables for the growth of the business.

Conclusion

The accounts Receivable process involves the management of the receivables to maintain good relations with the customers and effectively manage the cost. The accounts receivable process involves setting up the credit policies, giving the aftersale services, managing the payment process, and deciding whether to outsource the collection process or to collect by itself based on the evaluation of the cost involved. Discounting and credit policies for consumers are also part of the accounts receivable process. The process of managing accounts receivables for different entities is different for every organization. Businesses manage it by outsourcing the collection process, and banks manage by deciding whether to extend the credit period or issue a warning of selling the security. Thus, the accounts receivable process is essential for the organization regarding working capital management and maintaining liquidity.

Recommended Articles

This is a guide to Accounts Receivable Process. Here we also discuss the definition and steps of the accounts receivable process and the evolution of the fund’s receivable process. You may also have a look at the following articles to learn more –