What is Working Capital?

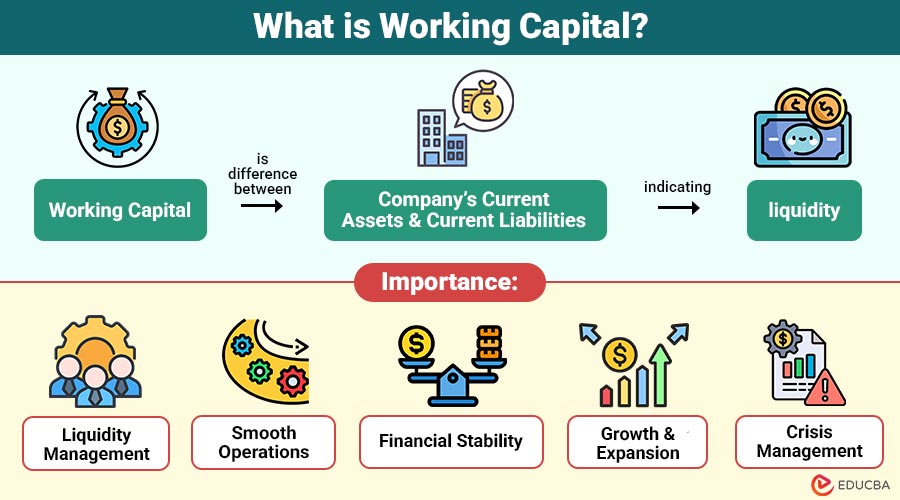

Working capital is the difference between company’s current assets and current liabilities, indicating liquidity. It measures a business’s ability to cover short-term obligations with its short-term assets. Essentially, it reflects a company’s ability to pay off its immediate debts using cash, inventory, and receivables.

For example, if a company has $100,000 in current assets and $70,000 in current liabilities, its working capital would be: $100,000−$70,000=$30,000

Table of Contents:

- Meaning

- Importance

- Types

- Advantages

- How to Calculate Working Capital?

- Strategies

- Challenges

- Real-World Examples

Key Takeaways:

- Working capital measures a company’s ability to meet short-term obligations using current assets efficiently.

- Financial stability, efficient operations, and the ability to invest in expansion prospects are all indicated by positive working capital.

- Effective management requires optimizing inventory, receivables, payables, and cash flow to maintain liquidity.

- Strong working capital acts as a financial buffer during economic uncertainty, ensuring business continuity and stability.

Importance of Working Capital

Here are the key reasons why it is important for a business:

1. Liquidity Management

Ensures a company can pay short-term debts, salaries, and suppliers on time, avoiding penalties or cash shortages.

2. Smooth Operations

Helps maintain inventory and receivables, allowing uninterrupted production, sales cycles, and operational efficiency without delays.

3. Financial Stability

Positive capital shows financial health, attracting investors and creditors, while negative capital may signal solvency concerns.

4. Growth and Expansion

Strong capital allows businesses to invest in assets, marketing, and new projects without depending excessively on external financing.

5. Crisis Management

Adequate capital serves as a safety net during economic downturns or unforeseen financial problems, enabling businesses to fulfill their commitments and weather difficult times.

Types of Working Capital

Here are the main types used to measure a company’s short-term financial position:

1. Positive

When current assets exceed current liabilities, company has positive working capital. This suggests liquidity, financial stability, and the ability to invest in growth opportunities.

2. Negative

If current liabilities surpass current assets, working capital is negative. This signals potential liquidity problems and the risk of financial distress if the business cannot meet its short-term obligations.

3. Gross

When current liabilities are subtracted from the total value of a company’s current assets, the result is known as gross working capital. For short-term activities, it gives a summary of the resources that are available.

4. Net

Net working capital is difference between current assets and current liabilities. It is the most used indicator for assessing liquidity.

Advantages of Working Capital

Here are the advantages mentioned below:

1. Ensures Liquidity and Smooth Operations

Adequate capital allows a company to meet short-term obligations, pay employees and suppliers, and maintain uninterrupted daily business operations.

2. Enhances Financial Stability and Investor Confidence

Positive capital demonstrates financial health, improving credibility with investors, creditors, and stakeholders, fostering trust and potential investment opportunities.

3. Supports Growth and Expansion Opportunities

Businesses that have adequate capital can expand their operations, buy assets, and invest in new initiatives without overly depending on outside funding.

4. Acts as a Buffer During Economic Uncertainty

Sufficient capital provides a financial cushion to manage crises, economic downturns, or unexpected expenses, ensuring business continuity and stability.

How to Calculate Working Capital?

There are multiple ways to measure, depending on the depth of analysis required:

1. Basic Formula

This simple formula gives a quick snapshot of liquidity.

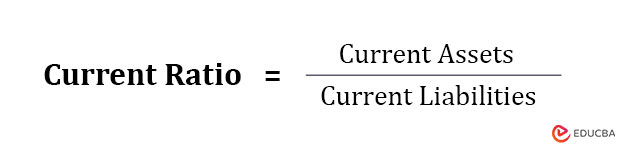

2. Working Capital Ratio (Current Ratio)

By contrasting current assets and current liabilities, the working capital ratio, also known as current ratio, calculates liquidity:

- Ratio above 1 indicates positive working capital.

- Negative working capital is indicated by a ratio less than 1.

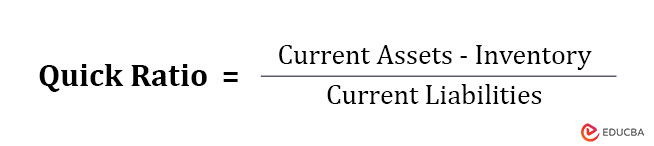

3. Quick Ratio (Acid-Test Ratio)

Quick ratio provides more stringent test of liquidity by excluding inventory:

This metric is useful for businesses with slow-moving inventory, as it shows how well the company can cover immediate obligations without relying on inventory sales.

Strategies for Effective Working Capital Management

Here are some key strategies businesses use to manage efficiently:

1. Optimize Inventory Management

Maintaining the right inventory levels avoids tying up excessive cash. Techniques like Just-In-Time (JIT) inventory, demand forecasting, and inventory turnover analysis can help reduce costs and improve liquidity.

2. Accelerate Receivables

Prompt collection of accounts receivable ensures steady cash flow. Businesses can implement early payment incentives, strict credit policies, or automated billing systems to reduce receivable cycles.

3. Extend Payables

To free up money for operational needs, longer payment periods can be agreed with suppliers. However, this must be balanced to maintain healthy supplier relationships.

4. Cash Flow Forecasting

Accurate cash flow forecasting helps anticipate periods of cash shortages or surpluses, enabling proactive management of short-term assets and liabilities.

5. Short-term Financing

Using short-term loans or lines of credit can bridge temporary gaps, ensuring operational continuity without disrupting business activities.

6. Regular Monitoring

Continuous monitoring of capital components helps identify inefficiencies, detect early warning signs of liquidity problems, and implement corrective measures promptly.

Challenges in Working Capital Management

While management is critical, it comes with its own set of challenges:

1. Seasonal Business Fluctuations

Businesses with seasonal sales may face temporary cash shortages during off-seasons, affecting operations and requiring careful planning to maintain liquidity.

2. Delayed Receivables

Late payments from clients can reduce cash flow, forcing companies to rely on loans or credit, increasing financial pressure.

3. Inventory Mismanagement

Overstocking or understocking inventory ties up cash or causes lost sales, negatively impacting efficiency and operational performance.

4. High Short-term Debt

Relying heavily on short-term borrowing increases financial risk and interest costs and can strain liquidity if cash inflows are delayed.

5. Economic Uncertainty

Market volatility, inflation, or supply chain disruptions can unpredictably affect requirements, making it difficult to maintain sufficient liquidity.

Real-World Examples

Here are practical examples of how working capital is used across industries:

1. Retail Industry

A supermarket maintains high capital to ensure adequate stock during peak shopping seasons and to avoid stockouts.

2. Manufacturing

A factory uses working capital to purchase raw materials, pay labor, and cover operational expenses before receiving payment from clients.

3. IT Services

A software company with long project cycles may have accounts receivable that remain outstanding for months. Efficient capital ensures salaries and expenses are met without financial strain.

Final Thoughts

Working capital is vital for a company’s liquidity, efficiency, and long-term stability. Understanding its components and types helps businesses make informed decisions, optimize resources, and maintain financial health. Effective management requires strategic planning, proactive monitoring, and balancing assets and liabilities. Mastering it ensures operational continuity, supports growth, and strengthens financial resilience for businesses of all sizes.

Frequently Asked Questions (FAQs)

Q1. Is high working capital always good?

Answer: Not necessarily. Extremely high working capital may indicate underutilized resources, such as excess inventory or idle cash, which could be invested elsewhere for better returns.

Q2. How often should a company monitor working capital?

Answer: Ideally, businesses should monitor working capital monthly or quarterly to maintain liquidity and prevent cash shortages.

Q3. How does working capital affect a company’s profitability?

Answer: Efficient working capital frees up cash, reduces costs, and boosts profitability, while poor management increases expenses and limits growth.

Recommended Articles

We hope that this EDUCBA information on “Working Capital” was beneficial to you. You can view EDUCBA’s recommended articles for more information.