What Is an Equity-Linked Note (ELN)?

An Equity-Linked Note (ELN) is a structured financial instrument that merges the characteristics of fixed-income investments with the potential upside of equity markets. It provides returns tied to the performance of an equity, a group of equities, or an equity index, offering investors a customized blend of risk and reward.

For example, if you invest in an Equity-Linked Note linked to the Nifty 50 and the index rises, you earn higher returns. If it falls, your return may be lower or limited, depending on the terms of the note.

Table of Contents

- What Is an Equity-Linked Note (ELN)?

- Key Features of Equity-Linked Notes

- How Does an Equity-Linked Note Work?

- Structure of an Equity-Linked Note

- Types of Equity-Linked Notes

- Advantages of Equity-Linked Notes

- Risks of Equity-Linked Note

- Example of an Equity-Linked Note

- Who Should Invest in Equity-Linked Notes?

- Tax Implications

- Equity-Linked Notes vs. Bonds

Key Features of Equity-Linked Notes

- Hybrid structure: ELNs combine debt (which offers predictable returns) and equity derivatives (which add exposure to equity performance). This blend makes them appealing to investors who seek moderate to high returns without investing directly in equities.

- Customizable payoff: Each ELN can be structured differently, linked to a single stock, a basket of stocks, or an index, allowing issuers to tailor returns, risk levels, and capital protection.

- Defined tenure: ELNs usually have a fixed term, typically lasting between 3 months and 3 years. Investors must hold the note until maturity to realize its full benefit, as secondary trading is limited.

- Issuer-dependent: The returns and even the principal depend on the creditworthiness of the issuing institution. Hence, credit risk is a significant factor.

- Variable principal protection: Some ELNs offer 100% principal protection, while others provide partial or no protection, which increases potential returns but also exposes investors to market risk.

- Currency and market exposure: ELNs can be issued in various currencies and linked to both domestic and international equity markets, providing investors with geographic diversification.

How Does an Equity-Linked Note Work?

The functioning of an ELN involves a combination of fixed-income instruments and equity options to create a structured return mechanism. Here is how the process works step-by-step:

- Investor purchase: The investor buys the ELN through a bank or investment firm. The note specifies the underlying asset (e.g., a stock, stock basket, or index), the term, the payoff formula, and the capital protection level.

- Investment allocation: The issuer invests a portion of the investor’s capital in a zero-coupon bond or fixed deposit to guarantee partial or full return of the principal. The issuer uses the remaining portion to buy or sell an equity option, linking the potential payoff directly to the asset’s price movement.

- Market observation period: During the investment term, the issuer monitors the performance of the underlying equity or index. The final return depends on the market outcome relative to predetermined thresholds.

- Payoff at maturity:

- If the underlying performs well, the investor receives the principal plus equity-linked returns.

- If performance is poor, the investor may get only the principal (in principal-protected ELNs) or a reduced amount (in non-protected ELNs).

Structure of an Equity-Linked Note

An ELN essentially combines two main components:

- Fixed-income component (Debt Part): This portion of the investment generates stable returns and ensures repayment of a specific amount (sometimes the full principal) at maturity. It serves as a cushion against market volatility.

- Equity derivative component (Option Part): This part provides exposure to the underlying equity’s movement, commonly structured using a call or put option. The derivative determines how much of the asset’s performance the investor receives.

Example:

- Investment: $10,000

- Underlying: Stock of Company X

- Strike Price: $100

- Term: 1 year

- Conditions:

- If Company X’s stock closes above $100 → Return = 10%

- If below $100 → Return = 0% or partial loss depending on structure

This allows the investor to benefit from the stock’s performance without having to hold it directly.

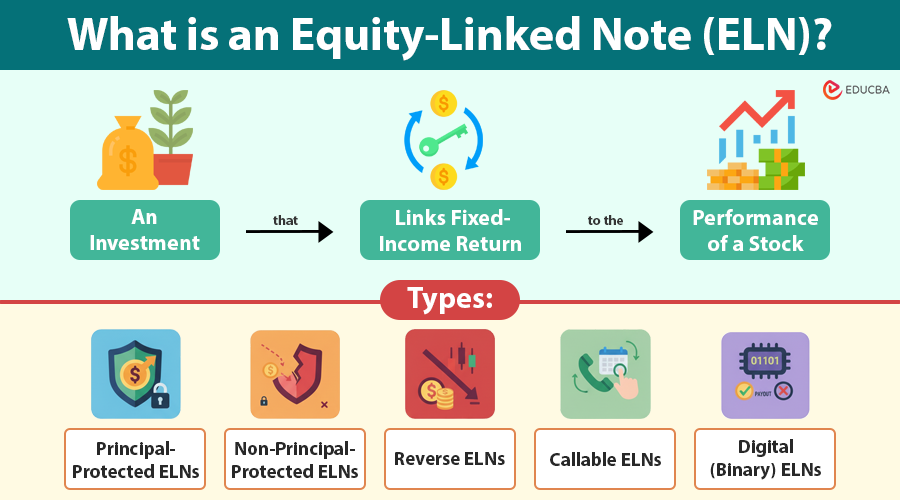

Types of Equity-Linked Notes

1. Principal-Protected ELNs

These guarantee 100% return of the initial investment at maturity, regardless of market outcome. The potential return, however, is capped.

- Ideal for conservative investors.

- Example: A note promising a minimum of 100% principal plus 3% equity-based upside.

2. Non-Principal-Protected ELNs

Offer higher returns but carry a risk of losing part or all of the principal.

- Suitable for investors with higher risk tolerance.

- Example: Investors earn 15% if the stock rises, but may lose capital if it falls below the strike price.

3. Reverse ELNs

Structured using sold put options. The investor earns a high coupon but risks receiving the stock (at a lower value) if prices fall below the strike price.

4. Callable ELNs

The issuer may redeem the note early when certain price conditions are met. It protects the issuer from paying high yields for extended periods when the underlying performs strongly.

5. Digital (Binary) ELNs

Offer fixed payouts if the underlying meets specific conditions at maturity. Returns are “all or nothing” based on the equity’s performance threshold.

Advantages of Equity-Linked Notes

- Potentially higher yields: ELNs can outperform traditional fixed-income investments, especially in moderately bullish or range-bound markets.

- Customizable risk profile: Investors can select principal protection levels, underlying assets, and payoff structures that align with their risk tolerance and preferences.

- Diversification benefits: ELNs introduce exposure to equities within a fixed-income framework, reducing portfolio concentration risk.

- Capital protection options: Depending on design, investors may protect all or part of their capital while still participating in market upside.

- Access to global markets: ELNs offer an indirect route to gain exposure to foreign equities, eliminating currency and market access barriers.

- Attractive in low-interest environments: When interest rates are low, ELNs can generate better returns than traditional deposits or bonds.

Risks of Equity Linked-Notes

- Market risk: The note’s return depends directly on how the underlying equity or index performs. A market downturn can significantly reduce returns.

- Credit risk (Issuer Default): ELNs are unsecured obligations of the issuer. If the issuer defaults, investors could lose all invested capital.

- Liquidity risk: ELNs are typically illiquid. Selling them before maturity may not be possible or may lead to losses due to low market demand.

- Complexity risk: The structure and payoff mechanisms are complex, and misunderstanding them can lead to unexpected outcomes.

- Capped upside: In many ELNs, even if the underlying asset performs exceptionally well, returns are capped at a predetermined level.

- No dividend participation: Investors in ELNs do not receive dividends paid by the underlying stock during the investment period.

Example of an Equity-Linked Note

Issuer: ABC Bank

Underlying Asset: S&P 500 Index

Investment Amount: $100,000

Tenure: 12 months

Payoff Terms:

- If the S&P 500 rises by more than 8%, the investor earns a 9% return.

- If the S&P 500 stays within a ±5% range, the investor earns a 3% fixed return.

- If the S&P 500 falls by over 10%, the investor receives 90% of the principal.

Outcome:

- If the S&P 500 rises by 10% → $109,000

- If it remains stable → $103,000

- If it falls sharply → $90,000

This structure allows investors to capture moderate market gains while reducing potential losses, making it suitable for those seeking a balance between risk and return in U.S. equity markets.

Who Should Invest in Equity-Linked Notes?

ELNs are most suitable for:

- Moderate to high-risk investors who want to earn equity-linked returns without full exposure to market volatility.

- Experienced investors who understand derivatives and structured products.

- Wealth management clients seeking customized instruments.

- Investors in low-yield environments are looking for enhanced returns with partial safety.

They are not suitable for:

- Risk-averse investors seeking guaranteed fixed returns.

- Individuals requiring liquidity or short-term capital access.

Tax Implications

- The tax treatment of ELNs depends on the jurisdiction and the product’s structure.

- In many countries, returns are taxed as capital gains if held to maturity.

- Selling the note early treats the gains as interest income or short-term capital gains.

- Always consult a tax professional before investing to understand potential obligations.

Equity-Linked Notes vs. Bonds

| Feature | Equity-Linked Note | Traditional Bond |

| Return Source | Linked to equity performance | Fixed coupon payments |

| Principal Protection | Partial or full (depending on design) | Fully protected |

| Risk Level | Moderate to high | Low |

| Upside Potential | Higher, but capped | Limited and fixed |

| Liquidity | Limited | Highly tradable |

| Issuer Risk | Yes | Yes |

| Complexity | High | Low |

Final Thoughts

An Equity-Linked Note (ELN) is a sophisticated investment tool designed to bridge the gap between fixed income and equity markets. It allows investors to customize risk and reward, offering higher returns than traditional bonds or deposits.

However, ELNs are complex instruments that require careful understanding of their structure, market exposure, and issuer credit risk. They are best used as part of a diversified investment portfolio to balance stability and growth potential.

Investors should always review the terms, conditions, and credibility of the issuer before investing and seek professional advice when necessary.

Frequently Asked Questions (FAQs)

Q1. Are Equity-Linked Notes safe investments?

Answer: ELNs are not completely safe. While some offer principal protection, others expose investors to market and credit risks. The safety of the investment depends on the issuer’s credit quality and the specific structure of the note.

Q2. Are Equity-Linked Notes safe investments?

Answer: ELNs are not completely safe. While some offer principal protection, others expose investors to market and credit risks. The safety of the investment depends on the issuer’s credit quality and the specific structure of the note.

Q3. How is the return on an ELN calculated?

Answer: The return depends on the performance of the underlying equity or index relative to a pre-agreed strike price. Issuers define specific payoff formulas, such as fixed coupons, capped returns, or participation rates, to calculate the final payout.

Q4. Are ELNs suitable for long-term investors?

Answer: ELNs generally suit short- to medium-term investors, as they typically mature within one to three years. Long-term investors may prefer direct equity investments or mutual funds for sustained market participation.

Q5. Do I receive my principal back if the issuer defaults?

Answer: No. If the issuer defaults, investors may lose both returns and principal, even in a principal-protected ELN. This is because the protection applies only if the issuer remains solvent.

Recommended Articles

We hope this guide on Equity-Linked Notes (ELNs) helps you understand how they combine debt and equity for customized investment returns. Explore related articles to learn more about financial instruments, capital markets, and investment strategies in the Finance category.