What is a Retention Bonus?

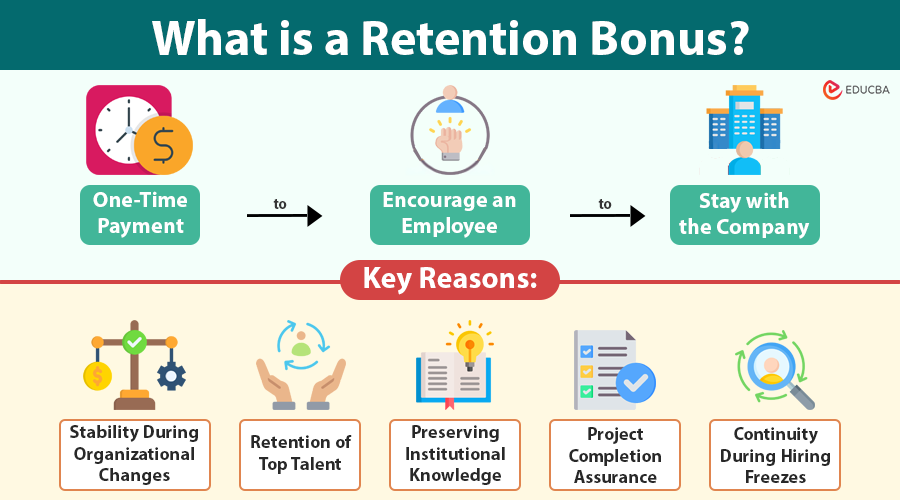

A retention bonus is a one-time payment an employer gives to an employee to encourage them to stay with the company for a certain time. Companies typically use these bonuses during critical times such as mergers, acquisitions, large projects, or periods of high employee turnover.

For example, if a company is going through restructuring and wants key employees to stay until the process is complete, it might offer them a retention bonus to discourage resignations.

Table of Contents

- Meaning

- How Does it Work?

- Why Companies Offer Bonuses?

- Who Is Eligible?

- Retention Bonus vs Other Bonuses

- Advantages

- Disadvantages

- Taxation

- Best Practices for Employers

- What Should Employees Consider?

- Real-World Example

How Does a Retention Bonus Work?

The employer structures a retention bonus as a contractual agreement with the employee. Here is how the process typically works:

- Identification of key personnel: Employers first identify roles or individuals critical to ongoing operations or strategic objectives.

- Bonus determination: The employer calculates the bonus amount based on factors like the employee’s role, base salary, market conditions, and the cost of losing the individual. Bonuses often range from 10% to 50% of annual salary, but can be much higher for executives.

- Contract creation: A written agreement outlines:

- Duration of commitment (e.g., 12 or 18 months)

- Payment terms (lump sum or staged)

- Conditions for payout

- Clauses for forfeiture or repayment if the employee resigns early

- Performance expectations: Sometimes, the bonus is tied not just to staying, but also to achieving certain project milestones or performance levels.

- Payout: If the employee fulfills the terms, the company usually pays the retention bonus after the agreed tenure, though in some cases, it may disburse the amount in parts.

This agreement may also include clawback provisions, where the employee must return part or all of the bonus if they leave prematurely or fail to meet the outlined obligations.

Why Companies Offer Retention Bonuses?

Retention bonuses are strategic investments aimed at managing risk during times when talent loss would have a severe impact. Key reasons include:

1. Preventing Attrition During Organizational Changes

Mergers, acquisitions, and leadership changes often lead to uncertainty and employee anxiety. Companies offer retention bonuses to assure employees of their value and minimize disruption until the new structure stabilizes.

2. Retaining Top Performers

Losing a top performer can lead to decreased team morale, lost clients, and project delays. Bonuses help prevent key personnel from being lured away by competitors, especially in high-demand sectors like tech, healthcare, or finance.

3. Protecting Intellectual Capital

When senior employees or specialists leave, they take with them institutional knowledge. Retention bonuses help retain this human capital until it can be transitioned or preserved through documentation or mentoring.

4. Ensuring Completion of High-Stakes Projects

Long and complex projects, such as building software, infrastructure, or meeting regulations, require stable teams to succeed. Retention bonuses ensure that core team members remain committed through completion.

5. Maintaining Continuity During Hiring Freezes

In difficult economic times, companies might not hire replacements quickly. Bonuses help companies retain current employees while they develop new strategies or budgets.

Who Is Eligible for a Retention Bonus?

Retention bonuses are typically not offered universally. Eligibility depends on:

- Role criticality: Is the employee involved in a project, decision-making, or operations that are crucial to business continuity?

- Skills scarcity: Is the employee’s skill set rare or hard to replace in the short term?

- Leadership or influence: Will the employee’s departure affect morale, client relationships, or team performance?

- Retention risk: Has the employee received other job offers or shown signs of disengagement?

Common recipients include:

- Senior executives and C-suite members

- Project managers or product owners

- High-performing sales professionals

- IT, cybersecurity, and data science experts

- Department heads in finance, compliance, or operations.

Retention Bonus vs Other Bonuses

While retention bonuses share some characteristics with other forms of compensation, they serve different purposes. Here is a breakdown:

| Bonus Type | Purpose | Timing |

| Retention Bonus | Incentivize employee to stay long-term | After defined service period |

| Signing Bonus | Attract new talent to join the company | Upon joining or after probation |

| Performance Bonus | Reward for meeting or exceeding goals | End of quarter/year or project |

| Referral Bonus | Incentivize staff to refer qualified hires | After new hire completes tenure |

A retention bonus looks ahead and rewards an employee’s promise to stay with the company in the future, unlike a performance bonus, which recognizes past achievements.

Advantages of Retention Bonuses

For Employers

- Business continuity: Keeps operations stable during transitions or uncertainty.

- Cost-effective: Often cheaper than recruiting and training new employees.

- Short-term loyalty: Encourages employees to stay through key milestones.

- Customizable: Tailored to individual roles and circumstances.

For Employees

- Financial gain: An additional income stream for continued service.

- Job security: Shows the employer values the employee’s contributions.

- Negotiation leverage: Employees may use offers of bonuses to negotiate better roles or promotions.

Disadvantages of Retention Bonuses

For Employers

- Temporary fix: May only delay resignations instead of preventing them.

- Moral hazard: Employees might expect bonuses to stay, even during non-critical times.

- Resentment: Non-recipients may feel undervalued, leading to morale issues.

- Costs add up: Especially if multiple employees are involved.

For Employees

- Limited flexibility: They might miss out on other job opportunities.

- Clawback risk: Leaving early may require repayment.

- Uncertain value: High taxes or other deductions may reduce the net benefit.

Taxation of Retention Bonuses

Retention bonuses are considered supplemental income and taxed accordingly. In many jurisdictions, employers withhold taxes at a higher flat rate e.g., 22% to 30% in the U.S. or under the slab rate in countries like India.

Other potential deductions:

- Social security

- Medicare/Provident fund

- Retirement or pension contributions.

Employees should consult a tax advisor to understand the real take-home amount and plan accordingly.

Best Practices for Employers

To make retention bonuses work well, companies should:

- Be strategic, not reactive: Identify core roles where attrition would cause disruption. Avoid blanket offerings.

- Set clear expectations: Use detailed contracts that outline eligibility, timing, and outcomes. Define the bonus as contingent upon staying and, if applicable, delivering results.

- Ensure fairness and transparency: Communicate why certain individuals are selected. A clear rationale prevents misunderstandings or resentment among staff.

- Use in combination with engagement: A bonus alone is not enough. Create supportive work environments, provide growth opportunities, and foster trust to build long-term loyalty.

- Monitor and evaluate: Review whether retention bonuses result in better retention or improved performance. Adjust strategies based on outcomes.

What Should Employees Consider?

Before accepting a retention bonus, employees should:

- Read the fine print: Understand the rules, how long you need to stay, what you need to do, and if you will have to repay the bonus.

- Weigh against personal goals: Does staying align with your career trajectory?

- Consider opportunity costs: Would a better job or offer be worth more in the long run?

- Calculate net payout: Factor in taxes and other deductions to estimate the real value.

- Negotiate if needed: Do not hesitate to ask for revised terms or a higher amount if your role justifies it.

Real-World Example of Retention Bonus

Here are some real-world examples:

1. IBM’s Retention Strategy During a Divestiture

When IBM sold its x86 server business to Lenovo in 2014, many skilled employees were at risk of leaving during the transition. To prevent project delays and loss of institutional knowledge, IBM offered retention bonuses and contract extensions to essential engineers and account managers. This approach helped ensure a smooth handover, protected client relationships, and reduced post-acquisition churn.

2. Twitter’s Retention Bonus During Acquisition by Elon Musk (2022)

When Elon Musk initiated the acquisition of Twitter, employee uncertainty and potential attrition became major concerns. To retain top talent and stabilize operations, Twitter reportedly offered retention bonuses to key employees, especially in engineering, product management, and policy teams. Some top employees got bonuses of $50,000 to $200,000 for staying until the transition ended.

3. General Motors (GM) During the 2019 Strike

During the 2019 United Auto Workers strike, General Motors offered retention bonuses to keep skilled engineers and manufacturing leaders on board amid labor disputes and operational disruptions. These bonuses helped the company maintain production readiness and minimize further business losses during the strike period.

4. Infosys India – Senior Leadership Retention (2021)

To curb leadership exits and enhance executive continuity, Indian IT giant Infosys offered retention bonuses and stock options to top management. This included grants of restricted stock units (RSUs) with vesting tied to continued employment and performance metrics. The strategy aimed to retain leaders amid a global tech talent war.

Final Thoughts

A retention bonus is a powerful tool when used thoughtfully. It provides short-term incentives to secure critical talent and protect business continuity. However, companies must strike a balance using retention bonuses strategically, not excessively, and always in conjunction with broader engagement and development programs.

For employees, a retention bonus is an opportunity to earn more, but it also comes with commitments. Review the offer, understand the terms, and think about how it fits your future career plans.

Frequently Asked Questions ( FAQs)

Q1. Can I receive more than one retention bonus from the same employer?

Answer: Yes, it is possible to receive multiple retention bonuses from the same employer, especially if you are involved in multiple long-term projects or if the company goes through more than one major transition. Employers typically tie each bonus to a separate agreement and period.

Q2. Do retention bonuses apply to contract or temporary employees?

Answer: Retention bonuses are more common among full-time employees. However, in some cases, contractors or consultants working on high-stakes projects may also be offered retention bonuses, especially if their departure would cause project delays or knowledge gaps.

Q3. What happens if the company is acquired or shut down before the bonus is paid?

Answer: In cases of acquisition or shutdown, the fate of retention bonuses depends on the agreement’s terms and the acquiring company’s decisions. Sometimes, bonuses are honored; in other cases, they are voided or renegotiated. Employees need to clarify this in the agreement.

Q4. Can a retention bonus be paid in stock instead of cash?

Answer: Yes. Startups and publicly traded companies often offer retention bonuses as stock options, RSUs (Restricted Stock Units), or equity grants that vest over time to encourage long-term retention.

Q5. Is it better to accept a higher salary or a retention bonus?

Answer: It depends on your personal goals and the specifics of each offer. A higher salary improves your monthly income and may impact benefits like retirement contributions. A retention bonus provides a lump sum but is usually temporary. Consider long-term stability, taxes, and growth opportunities before deciding.

Recommended Articles

We hope this guide on retention bonus was helpful. Explore related articles on employee incentive programs, executive compensation, and HR retention strategies.