What Is Walras Law?

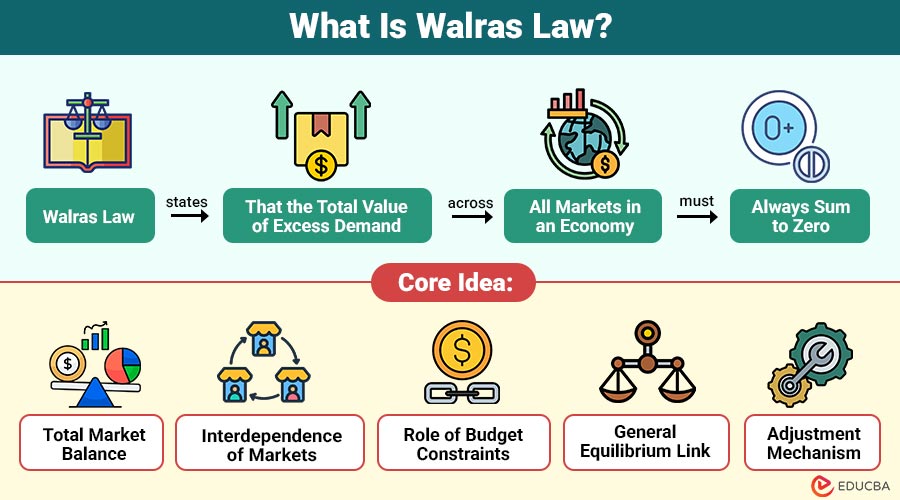

Walras Law states that the total value of excess demand across all markets in an economy must always sum to zero. This means that if one market has excess demand, another must have excess supply. It highlights how all markets are linked and adjust together.

For example, if people buy more clothes than the market can supply, they will spend less on food or services, creating excess supply elsewhere and keeping the overall balance intact.

Table of Content:

- What Is Walras Law?

- Core Idea Behind Walras Law

- Mathematical Expression

- How Walras Law Works in Real Markets

- Key Assumptions

- Practical Examples

- Walras Law vs. Say’s Law

- Relevance of Walras Law in Today’s Global Economy

Key Takeaways

- Walras Law explains that total excess demand across all markets in an economy always balances out, ensuring overall equilibrium.

- Markets are interconnected; changes in one sector automatically affect others through income and spending adjustments.

- The law is foundational for general equilibrium theory, helping economists and policymakers understand market coordination and resource allocation.

- Despite assumptions of perfect markets, Walras Law remains relevant today, offering insights into global, digital, and financial market interactions for efficient economic planning.

Core Idea Behind Walras Law

This concept explains how all markets in an economy are interconnected and influence one another.

- Total Market Balance: Walras Law states that the sum of excess demand and excess supply across all markets must always equal zero, ensuring overall balance.

- Interdependence of Markets: If one market experiences increased demand, another must show increased supply, meaning no market operates in isolation.

- Role of Budget Constraints: Consumers can only spend the income they have, so when they buy more in one market, they must reduce spending elsewhere.

- General Equilibrium Link: This law supports the idea that when all markets are considered together, the economy tends to move toward full equilibrium.

- Adjustment Mechanism: Changes in prices or demand in one market push other markets to adjust, maintaining the overall economic balance.

Mathematical Expression of Walras Law

This part explains the simple math behind how total excess demand always balances out in an economy.

- Basic Formula: Walras Law is written as the sum of excess demand across all markets equaling zero: Σ (Excess Demand) = 0. This means the value of goods people want to buy minus what they can purchase balances across markets.

- Excess Demand Definition: Excess demand is calculated as Demand – Supply in each market. A positive value shows a shortage, while a negative value indicates a surplus.

- Income Constraint: Consumers cannot spend more than their income. As a result, if they demand more in one market, they must demand less in others to keep the total value balanced.

- Implication: If n – 1 markets are in equilibrium, the last market must also be in equilibrium automatically due to this mathematical relationship.

This expression helps economists study how all markets coordinate together.

How Walras Law Works in Real Markets?

It shows how changes in one market automatically affect other markets, keeping the overall economy balanced.

- Surplus and Shortage Balance: If one market has excess demand (more buyers than goods), another market must have excess supply (more goods than buyers) to maintain overall equilibrium.

- Interconnected Spending: Consumers have limited income. When they spend more in one market, they naturally spend less in others, causing shifts in demand and supply across markets.

- Price Adjustment Mechanism: Prices rise in markets with excess demand and fall in markets with excess supply, encouraging resources and consumers to move, restoring balance.

- Multiple Market Example: If people buy more electronics than available, they may cut spending on food or clothing, creating temporary surpluses in those markets.

- Automatic Equilibrium: Because of this interdependence, balancing all markets except one automatically forces the remaining market to adjust and maintain overall equilibrium.

- Policy Implications: Understanding these interactions helps policymakers predict how interventions in one sector impact the entire economy.

Key Assumptions Behind Walras Law

Walras Law relies on certain conditions that must hold for markets to balance properly.

- Rational Behavior: Consumers and firms are assumed to make decisions logically, aiming to maximize utility and profit.

- Perfect Market Functioning: Markets operate without frictions, such as transaction costs, taxes, or barriers, allowing prices to adjust freely.

- Complete Information: All participants have full knowledge about prices, products, and income, enabling optimal decisions.

- Budget Constraints: Consumers can only spend the income they have, which limits total demand and ensures that spending shifts between markets.

- No Excessive Speculation: The model assumes that markets behave normally without extreme speculative behavior that can distort demand or supply.

- Closed Economy Assumption: Walras Law holds that all markets are included in the system, ensuring that total demand and supply are accounted for.

These assumptions provide the foundation for understanding how markets interact and why the total excess demand in an economy always balances out.

Practical Examples to Understand Walras Law

Real-world examples help illustrate how Walras Law operates across different markets.

- Two-Market Example – Food and Clothing: Suppose consumers in a small town have a total income of $100,000. Suppose they spend $60,000 on clothing, and only $40,000 remains for food. If demand for food exceeds $40,000, a surplus in the clothing market balances overall spending, keeping total excess demand at zero.

- Multi-Market Example – Labor and Products: In a manufacturing city, if factories hire more workers than are available, wages rise. Higher wages increase income, boosting demand for other goods such as electronics and housing. The excess supply in these markets automatically adjusts to balance the overall economy.

- Financial Market Scenario: If investors put more money into stocks, less is available for bonds or commodities. Shifts in investment across markets maintain overall equilibrium.

- Data Insight: Studies show that in the U.S., during 2022, shifts in consumer spending between categories like groceries and leisure activities clearly demonstrate these balancing effects.

Walras Law vs. Say’s Law

Both laws explain market behavior, but they differ in focus and application.

| Aspect | Walras Law | Say’s Law |

| Meaning | Total excess demand across all markets equals zero; if one market has surplus demand, another has surplus supply. | Supply creates its own demand; production of goods generates enough income to buy those goods. |

| Focus | General equilibrium across all markets. | Aggregate supply and demand in the economy. |

| Market Interdependence | Emphasizes the interconnection of markets; all markets influence each other. | Focuses more on the supply side; less attention to multiple market interactions. |

| Equilibrium | Ensures that if n–1 markets are balanced, the last market is automatically in equilibrium. | Assumes markets are naturally clear because production generates income to purchase goods. |

| Practical Use | Used in modern microeconomics and general equilibrium theory. | Classical economics and macroeconomic theory are mainly for long-run analysis. |

Relevance of Walras Law in Today’s Global Economy

Walras Law remains important for understanding how modern, interconnected markets function.

- Global Market Interconnections: In today’s economy, changes in one country’s market, such as oil or electronics, impact other countries’ markets, reflecting the law’s principle of interdependence.

- Policy Making: Governments and central banks use the concept to predict how interventions in one sector, like subsidies or interest rate changes, affect other sectors.

- Financial Markets: Stock, bond, and commodity markets are closely linked. If investors move funds from one asset to another, the law explains how total demand and supply remain balanced.

- Digital Economy Impact: Online marketplaces and e-commerce platforms show real-time shifts in consumer spending, which demonstrates the automatic balancing effect across multiple product categories.

- Crisis Management: During economic disruptions such as recessions, understanding market interdependence helps economists and policymakers anticipate shortages or surpluses across sectors.

Conclusion

Walras Law offers a powerful framework that helps economists understand how all markets in an economy interconnect and adjust to maintain overall balance. By showing that excess demand in one market offsets excess supply in others, it enables economists, policymakers, and businesses to anticipate shifts and make informed decisions. Even in today’s complex global economy, the principle remains essential for analyzing market behavior and ensuring efficient allocation of resources.

Frequently Asked Questions

1. Does Walras Law apply in imperfect markets?

Answer:- It mainly applies to ideal markets but provides insights even in imperfect conditions.

2. Can Walras Law predict short-term market fluctuations?

Answer:- No, it focuses on overall equilibrium rather than temporary changes.

3. Is Walras Law relevant for service-based economies?

Answer:- Yes, it applies to all types of markets, including services.

4. Who developed Walras Law?

Answer:- It was formulated by the French economist Léon Walras in the 19th century.

Recommended Articles

We hope this guide on Walras Law helped you understand market equilibrium. For more finance insights, explore these related articles below: