Introduction to Forex Spreads in Trading

Forex trading is a vast, complex, and rapidly evolving market. One of the most critical concepts every trader must master is forex spreads. Understanding how spreads work, what affects them, and how they impact trading strategies is crucial for achieving profitability and effective risk management. In this article, we delve into forex spreads and examine their practical implications for traders of all experience levels.

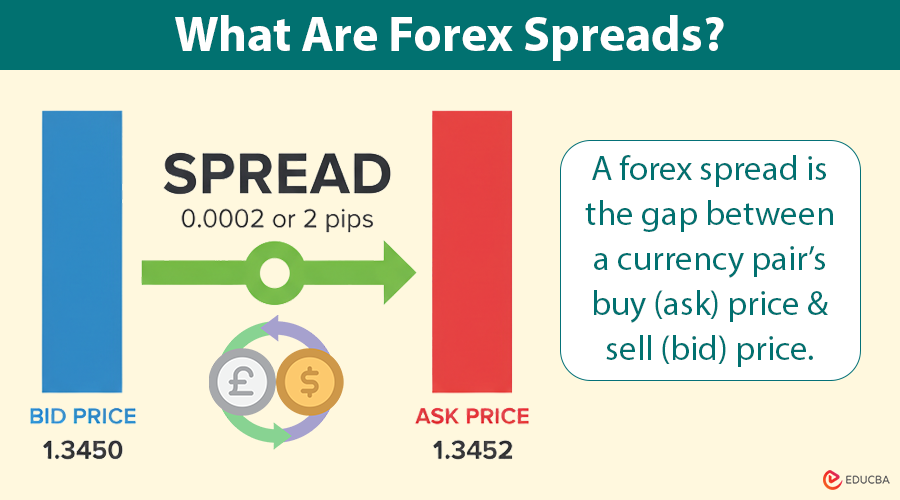

What Are Forex Spreads?

A forex spread is the difference between the buy (ask) price and the sell (bid) price of a currency pair. It represents the broker’s fee for executing a trade and is one of the primary costs in Forex trading.

For example, if the GBP/USD pair has a bid price of 1.3450 and an ask price of 1.3452, the spread is 0.0002, or 2 pips. Even though it may seem small, spreads accumulate over time and can significantly impact profitability, especially for high-frequency traders or those employing scalping strategies.

Understanding spreads is not just about knowing costs; it is also about identifying market conditions. Narrow spreads often indicate high liquidity and market stability, while wide spreads may signal volatility, low liquidity, or upcoming market-moving events.

Types of Forex Spreads

Understanding the types of spreads is crucial to selecting the right broker and strategy. There are two primary types:

1. Fixed Spreads

Fixed spreads stay the same in any market. Brokers offering fixed spreads provide predictable trading costs, which can be particularly helpful for beginner traders or those using automated strategies.

Pros:

- Predictable costs, easy to calculate profits and losses.

- Less affected by sudden market volatility.

Cons:

- Typically higher than average during normal market conditions.

- Can be misleading if markets move sharply, as execution might not match displayed spreads.

2. Variable (Floating) Spreads

Variable spreads fluctuate in response to market liquidity, volatility, and overlapping trading sessions. For example, spreads may tighten during the London-New York trading overlap due to higher liquidity but widen during low-volume periods, such as the Asian session.

Pros:

- Often lower than fixed spreads during normal conditions.

- Reflect true market conditions.

Cons:

- It can widen significantly during news releases or periods of economic uncertainty.

- Requires active monitoring to avoid unexpected higher trading costs.

Knowing the spread a broker offers allows traders to align trading strategies. For example, scalping works best with tight variable spreads, while fixed spreads are more suitable for swing trading.

Factors Affecting Forex Spreads

Several key factors influence forex spreads, and understanding them can help traders make smarter decisions:

- Liquidity: Highly traded currency pairs such as EUR/USD, USD/JPY, and GBP/USD typically have tight spreads. Exotic or less-traded pairs often have wider spreads due to lower market participation.

- Market volatility: Spreads tend to widen during economic announcements, central bank decisions, or geopolitical crises. For instance, Brexit-related news often caused the pound dollar rate to spike and spreads to widen temporarily.

- Broker type: ECN brokers typically offer tight spreads with a per-trade commission, while market-maker brokers might offer wider spreads with no commission. Choosing the right broker type affects both costs and execution speed.

- Trading hours: Spreads vary across trading sessions. The London and New York sessions typically overlap, providing the tightest spreads. However, spreads can widen on weekends, holidays, or during periods of low volume.

- Economic indicators: Major announcements, such as the Non-Farm Payroll (NFP) report, GDP growth, or central bank rate decisions, can temporarily increase spreads due to heightened uncertainty. Traders should check economic calendars before entering trades.

How Forex Spreads Impact Trading?

The impact of forex spreads on your trading performance is significant:

- Profitability: Every trade starts at a small loss equal to the spread. Wider spreads mean you need a larger price movement to break even. For instance, a 5-pip spread in a scalping strategy can easily eat into potential profits.

- Scalping and day trading: Tight spreads are critical for short-term strategies like scalping. Traders may avoid pairs with wide spreads to reduce costs and improve risk-reward ratios.

- Stop-loss and take-profit orders: Wide spreads can affect the execution of stop-loss and take-profit orders. If spreads widen unexpectedly, your trade may close prematurely or require additional price movement to reach your target.

- Trading strategy development: Traders must consider spreads when backtesting their strategies. Ignoring spreads can lead to overestimating profitability. For long-term trades, spreads may be less impactful, but for intraday trades, spreads are a key factor.

Examples of Major Forex Spreads

Some major currency pairs are popular among traders because they have tight forex spreads, reducing trading costs:

- EUR/USD: Often the most liquid and has the lowest spreads.

- GBP/USD: Slightly wider, but still competitive; check the live GBP/USD rate.

- USD/JPY: Popular for its stability and predictability, especially among Asian traders.

- AUD/USD and USD/CHF: Typically slightly wider but attractive for diversification.

Choosing pairs with tight spreads is an essential consideration for traders, especially when trading frequently or using leveraged positions.

Tips for Managing Forex Spreads

Here are practical strategies to minimize the impact of spreads:

- Trade during high-liquidity periods: Focus on sessions when markets overlap, like London-New York, to benefit from tighter spreads.

- Select the right currency pairs: Major pairs usually have tighter spreads. Avoid exotic pairs unless volatility is part of your strategy.

- Monitor news and economic events: Avoid trading during events that cause sudden spread widening unless your strategy accounts for volatility.

- Choose brokers wisely: Compare spreads, commissions, and execution speed. ECN brokers are often better suited for active traders, while fixed-spread brokers are more suitable for casual traders.

- Incorporate spreads into strategy: Always factor spreads into your risk-reward calculation, entry points, and exit targets. Ignoring spreads can lead to unexpected losses, even on profitable trades.

Final Thoughts

Mastering forex spreads is fundamental for any trader. Spreads affect trading costs, strategy effectiveness, risk management, and overall profitability. By understanding how spreads work, what affects them, and how to manage them strategically, traders can optimize performance, reduce costs, and make more informed trading decisions.

For traders interested in currency pairs, staying aware of the pound-dollar rate is essential for both short-term trading and long-term analysis, and it exemplifies how spreads can affect real trades.

Recommended Articles

We hope this in-depth guide on forex spreads helps you trade more effectively and profitably. Explore these recommended articles to discover additional strategies, tips, and tools to succeed in Forex trading.