Introduction to Types of Payroll Systems

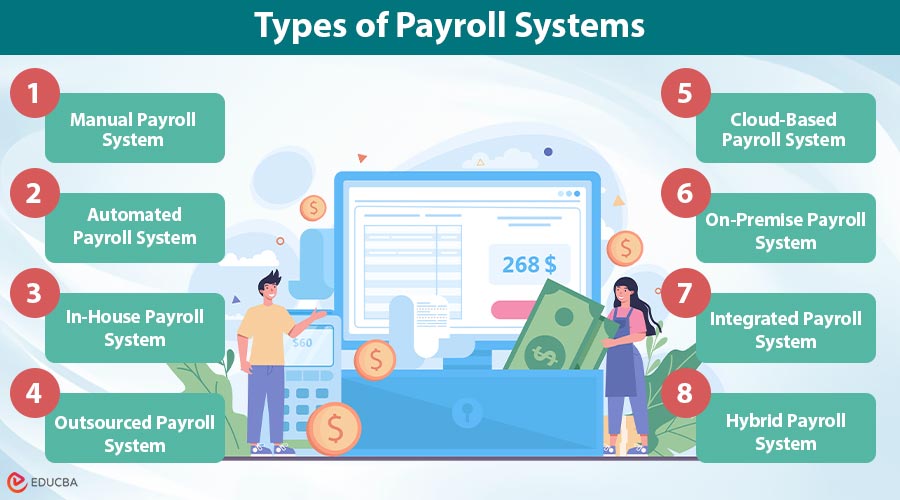

Types of payroll systems refer to the different methods organizations use to manage employee salary calculations, deductions, and payments. These systems vary by business size, complexity, and compliance needs, ranging from manual, outsourced payroll to automated, cloud-based solutions. Choosing the right payroll system helps ensure accuracy, efficiency, legal compliance, and timely employee compensation. The following sections outline the eight major types of payroll systems, along with their key features, advantages, and limitations.

Major Types of Payroll Systems

Here are the major types of payroll systems commonly used by organizations based on size, complexity, and operational needs.

#1. Manual Payroll System

A manual payroll system is a traditional payroll method in which salary calculations, deductions, and payments are performed manually using paper records or basic spreadsheets, relying heavily on human accuracy and effort without automated payroll software.

Key Features:

- Salary calculations done by hand

- Physical records for attendance and payroll

- High dependence on payroll staff accuracy

Advantages:

- Low initial cost

- Suitable for very small businesses

- No need for advanced technical tools

Limitations:

- Time-consuming and error-prone

- Difficult to scale

- High compliance risk

#2. Automated Payroll System

An automated payroll system uses specialized software to calculate employee salaries, statutory deductions, and taxes and generate payslips automatically, reducing manual intervention while ensuring accuracy, efficiency, and compliance with payroll regulations.

Key Features:

- Automated salary and deduction calculations

- Digital payroll records

- Built-in compliance rules

Advantages:

- Reduces human errors

- Saves time and effort

- Improves payroll accuracy

Limitations:

- Requires software purchase and setup

- Periodic updates needed

- Basic systems may lack customization

#3. In-House Payroll System

An in-house payroll system is managed internally by an organization’s HR or finance department using payroll software, providing full control over payroll operations, data security, customization, and compliance responsibilities within the organization.

Key Features:

- Full control over payroll data

- Custom payroll configurations

- Dedicated payroll personnel

Advantages:

- High data security

- Customization based on company policies

- Immediate access to payroll information

Limitations:

- Requires trained payroll professionals

- Higher operational costs

- Compliance responsibility lies entirely with the organization

#4. Outsourced Payroll System

An outsourced payroll system involves transferring payroll processing responsibilities to third-party service provider, who manages salary calculations, tax compliance, statutory filings, and reporting, allowing organizations to focus on core business activities.

Key Features:

- Payroll processing is managed externally

- Compliance handled by experts

- Regular payroll reports provided

Advantages:

- Reduces administrative burden

- Ensures compliance with changing regulations

- Cost-effective for growing businesses

Limitations:

- Less control over payroll operations

- Dependence on the service provider

- Data privacy concerns

#5. Cloud-Based Payroll System

A cloud-based payroll system runs on internet-based platforms, enabling real-time payroll processing, remote access, automatic updates, and scalable payroll management without on-site infrastructure or manual software maintenance.

Key Features:

- Web-based access

- Real-time payroll updates

- Automatic software upgrades

Advantages:

- High scalability

- Remote access and flexibility

- Automatic compliance updates

Limitations:

- Requires a stable internet connection

- Subscription-based pricing

- Data security depends on the service provider

#6. On-Premise Payroll System

An on-premise payroll system is installed and maintained on an organization’s local servers, offering greater control over payroll data, enhanced security, and customization, but requiring significant upfront investment and ongoing IT maintenance.

Key Features:

- Local data storage

- Internal IT management

- One-time software licensing

Advantages:

- Greater data control

- No dependency on internet availability

- Suitable for strict data security policies

Limitations:

- High upfront costs

- Requires ongoing IT maintenance

- Limited remote access

#7. Integrated Payroll System

An integrated payroll system connects payroll software with other business systems, such as HRMS, ERP, accounting, and attendance tools, enabling seamless data flow, real-time reporting, and improved operational efficiency across departments.

Key Features:

- Centralized data management

- Automated data synchronization

- Real-time reporting

Advantages:

- Eliminates data duplication

- Enhances decision-making

- Improves operational efficiency

Limitations:

- Higher implementation cost

- Complex setup process

- Requires skilled technical support

#8. Hybrid Payroll System

A hybrid payroll system combines internal payroll management with outsourced or cloud-based solutions, enabling organizations to retain partial control while leveraging automation or expert support to improve efficiency and scalability.

Key Features:

- Partial internal control

- Partial third-party support

- Flexible system design

Advantages:

- Balanced control and efficiency

- Customizable approach

- Scalable payroll operations

Limitations:

- Coordination challenges

- May require multiple systems

- Potential data synchronization issues

Final Thoughts

Choosing the right payroll system depends on business size, workforce complexity, compliance requirements, and budget. From manual to hybrid models, each payroll system offers unique benefits and trade-offs. Modern organizations increasingly adopt automated, cloud-based payroll solutions to improve accuracy, ensure legal compliance, enhance efficiency, and support scalable growth while delivering timely, transparent employee compensation.

Frequently Asked Questions (FAQs)

Q1. What is the most commonly used payroll system today?

Answer: Automated and cloud-based payroll systems are most common due to accuracy, compliance support, scalability, and time-saving benefits.

Q2. Which payroll system is best for small businesses?

Answer: Small businesses typically prefer manual, automated, or cloud-based payroll systems because of lower costs and simpler implementation.

Q3. How does a cloud-based payroll system differ from an on-premise system?

Answer: Cloud-based systems run online with remote access and automatic updates, while on-premise systems operate on local servers with internal control.

Q4. Is outsourcing payroll safe for sensitive employee data?

Answer: Yes, if reputable vendors with strong data security, encryption, and compliance certifications are chosen.

Recommended Articles

We hope that this EDUCBA information on “Types of Payroll Systems” was beneficial to you. You can view EDUCBA’s recommended articles for more information.