Why a Term Insurance Calculator is Your Best Friend Before Buying a 1 Crore Policy?

Picture yourself stepping into a store to buy a pair of shoes. You are unsure of your size, the price, or what you truly need. Wouldn’t that feel confusing?

Now think about buying term insurance — something that protects your family if something happens to you. If you are unsure about the amount of cover you need, its duration, or the cost, it can be unclear. That is where a term insurance calculator comes in. It is your best friend when you are about to take this big financial step.

What is a Term Insurance Calculator?

A term life insurance calculator is a free tool available online that helps you find the right insurance plan for you. You do not need to be a money expert or understand complex financial terms to use it. You enter basic details like your age, income, how many people depend on you, and the number of years you want coverage.

In just seconds, it shows you:

- How much coverage might you need

- Your monthly or yearly payment amount

- Explore plans tailored to your needs.

This saves time and removes guesswork. You know exactly what you are getting into before buying any plan.

Why People Choose 1 Crore Term Insurance Plans?

In India, an increasing number of people are opting for a 1 crore term insurance policy. Why? Because ₹1 crore gives a strong financial safety net to your family.

Let us say you are the main earner in your home. If something unexpected happens to you, a 1 crore cover can:

- Help pay off any loans or EMIs

- Support your children’s education

- Cover day-to-day household costs

- Offer peace of mind to your loved ones for years.

And the best part? A ₹1 crore term plan does not have to be super expensive. With early planning and the help of a calculator, it can fit easily into your monthly budget.

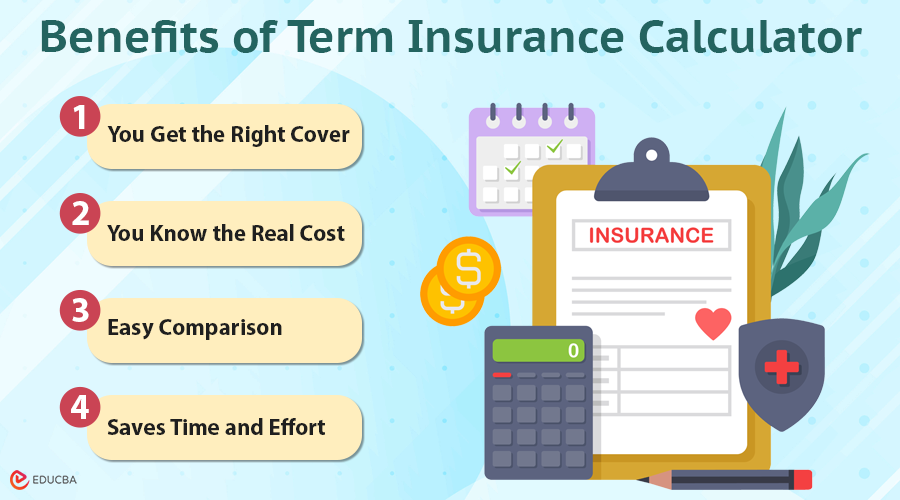

How does the Calculator Make Life Easier?

Here is how a term insurance calculator makes the entire process super simple:

1. You Get the Right Cover

Many people guess a random amount, such as ₹50 lakhs or ₹1 crore. However, how do you know what your family will need in your absence?

The calculator considers:

- Your age

- Your income

- Number of dependents

- Current savings and loans.

It then tells you the right cover amount based on your situation.

2. You Know the Real Cost

When we think of insurance, many of us fear the cost. However, the calculator tells you the exact premium — the money you will pay — monthly or yearly.

This helps you plan better and see if a 1 crore term insurance plan is truly affordable for you.

3. Easy Comparison

You can check multiple plans in one place. Some may offer low premiums. Others may offer additional benefits, such as critical illness cover. The calculator lays everything side by side, so you choose what fits you best.

4. Saves Time and Effort

Instead of talking to agents or reading long brochures, you can get answers in a few clicks. No pressure, no confusion.

Example

Meet Rahul, a 32-year-old IT professional from Pune. He is married and has one child. He earns ₹10 lakhs a year and has a home loan.

Rahul knows he needs to protect his family, so he uses a term insurance calculator.

He enters:

- Age: 32

- Income: ₹10 lakh/year

- Family: Wife + 1 child

- Loan: ₹25 lakh

- Coverage till age: 65

The calculator suggests:

Ideal Coverage: ₹1 crore

Premium: Around ₹800/month

Now Rahul feels confident. He knows what he needs and what it will cost him. He compares a few plans online and buys the one that suits him best. All within 15 minutes.

Why is it Important to Plan Early?

The earlier you use a calculator and buy your term insurance, the better it is.

Why?

- Younger people get cheaper premiums

- You lock in a low rate for the full term

- Health issues later in life may increase your cost or make you ineligible.

So, if you are in your 20s or 30s, now is the best time to act.

What to Keep in Mind While Using the Calculator?

Here are some tips while using a term insurance calculator:

- Be honest: Enter the right income, loans, and dependents.

- Add future needs: Your kids might go to college in 10 years. Think ahead.

- Look for riders: The calculator may show add-ons like critical illness or accidental death benefits. These are useful extras.

- Check claim settlement ratio: Choose insurers with good claim records. The calculator often shows this too.

- Choose the right policy term: A plan should last until your financial responsibilities are over.

Extra Benefits You Can Choose

Once you know your basic premium, some calculators also let you pick add-on benefits. These include:

- Waiver of premium: If you become disabled or seriously ill, you do not have to pay premiums, but your coverage continues.

- Return of premium: You get back all the money paid if you outlive the policy term.

- Critical illness cover: Extra money if you get a major disease like cancer or a heart attack.

- Accident cover: More money if the death is due to an accident.

You can add or remove these options and instantly see how they change your premium.

Common Myths You Can Avoid

“1 crore cover is too much.”

Not true. With inflation and rising costs, ₹1 crore might be enough to take care of your family’s future.

“It is too expensive.”

Use the calculator. You will see how budget-friendly it is, especially at a young age.

“Only people with kids need term insurance.”

Even if you are married, have loans, or support your parents, you need coverage. It is not just about kids.

Final Thoughts

Buying term insurance is a big step. It is about protecting your loved ones, even when you are not around. However, doing it unthinkingly, without knowing your needs, can be risky.

That is why a term insurance calculator is your smart companion. It shows you the facts — not guesses. Once you realize that a 1 crore term insurance policy fits your needs and budget, the decision becomes easier.

Before choosing a plan, take 5 minutes to use the calculator. It might be the most important thing you do for your family’s future.

Recommended Articles

We hope this guide on term insurance calculators was helpful. Explore related articles on life insurance planning, choosing the right coverage, and financial protection strategies.