Updated July 19, 2023

Definition of Tax Lien

Tax lien refers to imposing a legal claim on a property or any asset of any person being an individual or a business, under the operations of law to recover the taxes due to the government. The tax lien guarantees the revenue department that the proceeds from selling such assets flow to the government first towards the tax dues when the assets under the lien are sold if the person fails to pay the demanded tax payment.

Explanation

If federal or state taxes are unpaid, the respective government can impose a lien on the person’s assets in default to secure the payment of the due taxes. By imposing such a lien, the government doesn’t sell the person’s assets; it ensures that the government holds the first claim over a person’s assets if they are sold or transferred, preceding any other party.

It can be imposed when federal or state taxes are unpaid by a person. If a person has not paid property tax, the government might impose a tax lien on the property. Similarly, it can also be imposed when income taxes are not paid even after the order for outstanding tax demand is issued to the taxpayer. The lien on the assets will continue for as long as the tax dues are outstanding.

How Does it Work?

The government will issue a demand notice to the defaulter stating the amount of tax due from such a defaulter. The information will prescribe a time limit within which the person can pay the amount or contact the department to resolve the issue if there is any discrepancy in the notice.

If the person fails to pay the amount or resolve the matter, the concerned government department can impose a tax lien on the person’s assets under default. The assets may include the taxpayer’s personal assets such as property, vehicles, securities, jewelry, etc. The business assets will be subject to the tax lien if the taxpayer is a business organization. A lien imposed by the federal government will supersede any other party’s claims over the taxpayer’s assets. Any realization made on the assets will first go towards the government. Further, the taxpayer can’t sell or transfer the assets under a lien.

When the lien is imposed, the fact of the same appears in the taxpayer’s credit report, affecting the score adversely. The only way the lien can be removed is by paying the taxes due along with other charges that may apply.

Example of Tax Lien

Let us take two situations where it can be imposed.

- A property owner is facing a financial crisis and cannot pay dues of property taxes applicable to the property. The local government can impose tax liens on the property where the property tax remains unpaid.

- A taxpayer doesn’t pay income taxes for two consecutive tax years. The IRS sent a demand notice for the recovery of the income taxes. However, the taxpayer didn’t respond to the information as well. The IRS may impose a tax lien for the taxpayer’s assets.

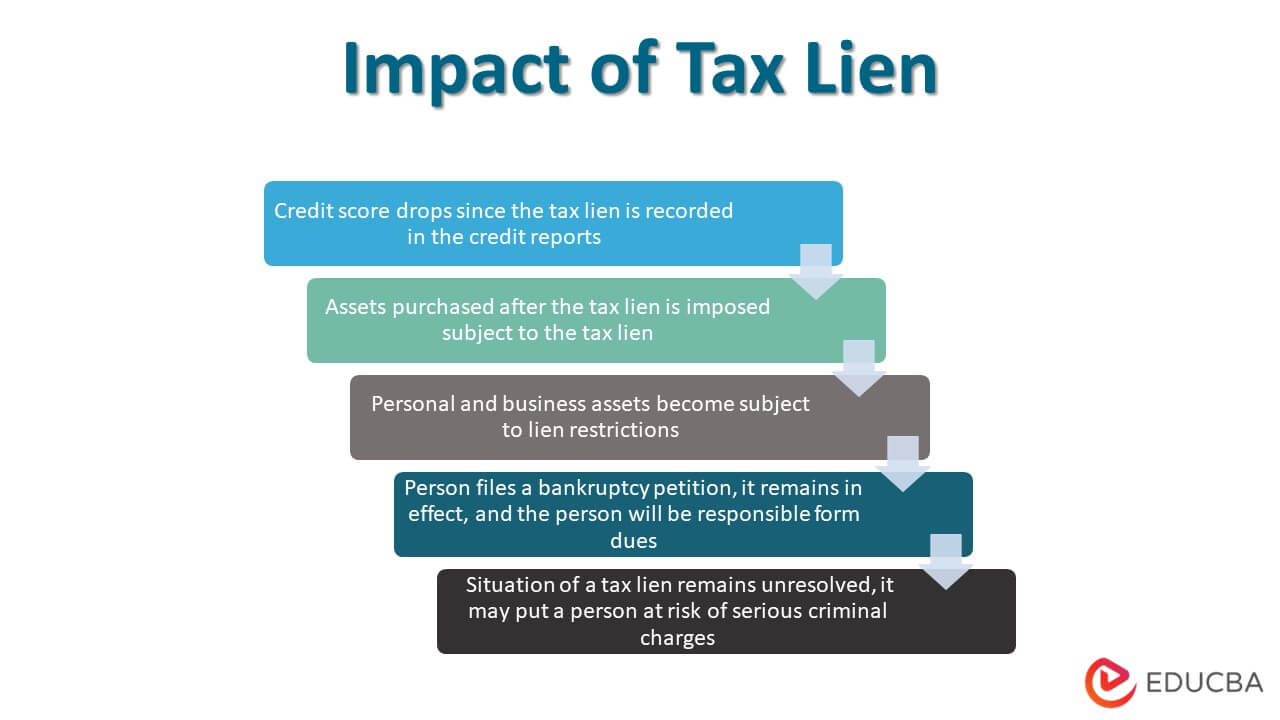

Impact of Tax Lien

The significant impacts of tax liens are discussed below:

- The credit score drops since the tax lien is recorded in the credit reports of the taxpayers. Thus, there can be difficulty in getting credits.

- The tax lien imposes its authority on assets purchased even after its imposition.

- Personal and business assets become subject to lien restrictions, and the same can’t be realized.

- If the person files a bankruptcy petition, it remains in effect, which means the person will still be responsible for the dues even when adjudicated insolvent.

- When a tax lien remains unresolved, it may put a person at risk of serious criminal charges.

Advantages

It is an advantageous tool for the federal and state governments due to the following reasons:

- The government gets a guarantee for the realization of tax payments by attaching the taxpayer’s assets.

- Once it is imposed, the taxpayer can’t realize the assets by selling or transferring them.

- The disclosure of taxpayers’ credit reports informs lenders about the taxpayer’s financial position.

Disadvantages

The imposition of a tax lien is an adverse situation for the taxpayers due to the following reasons:

- The taxpayer’s credit score deteriorates, due to which the taxpayer faces difficulty in securing credit.

- The taxpayer cannot realize the assets without the consent of the department.

- The liability doesn’t get affected even if the person files for bankruptcy.

- Tax liens bring a bad image towards a person, who may also face job discrimination.

Conclusion

To avoid tax liens, people must meet their tax liabilities on time. Further, if you receive any tax demand notice, you must not ignore it; otherwise, you might face serious problems. If you have received a message for the tax lien, you can only get out of it by depositing the requisite tax with the applicable interest and penalty with the government.

Recommended Articles

This is a guide to Tax Lien. Here we also discuss the definition, how tax lien works, and its advantages and disadvantages. You may also have a look at the following articles to learn more –