Introduction to Supercycle in Finance

In financial markets, a supercycle is a prolonged period of economic expansion, commodity price increases, or asset growth that can span decades rather than years. Unlike regular business cycles, which typically last 5–10 years, supercycles are long-term trends that influence global markets, investor behavior, and government policies.

Supercycles are significant because they indicate sustained economic opportunities and risks. Recognizing a supercycle allows investors, policymakers, and businesses to plan strategically, make informed long-term decisions, and mitigate potential losses during downturns. In the context of global finance, supercycles often coincide with transformative economic periods such as industrial revolutions, technological breakthroughs, or demographic shifts.

By understanding supercycles, one can grasp why certain commodities, stock markets, or emerging economies experience extended periods of growth or decline, beyond the fluctuations seen in regular market cycles.

Table of Contents

- Introduction

- Meaning

- Characteristics

- Phases

- Causes

- Examples

- Impact on Investors and Markets

- How to Invest?

What is a Supercycle?

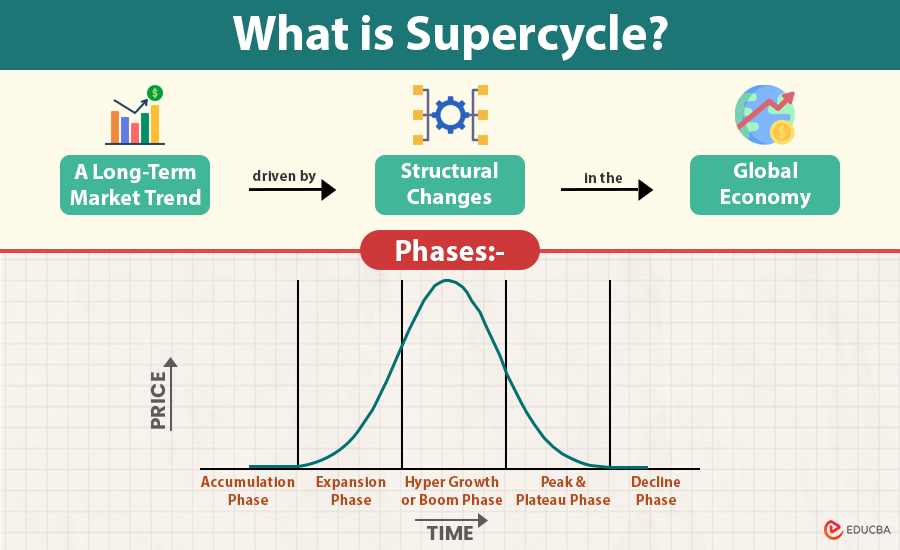

A financial supercycle refers to an extended upward or downward trend in markets, typically driven by structural changes in the global economy.

These trends often manifest in commodity prices, equity markets, real estate, and interest rates. Long-lasting shifts in supply, demand, and economic structures shape supercycles, unlike regular market cycles, which mostly respond to short-term economic events.

Characteristics of a Supercycle

1. Long Duration

- A supercycle can last anywhere from 15 to 40 years, depending on the structural factors driving it.

- For instance, the post-World War II commodity supercycle lasted nearly three decades.

2. Broad Impact Across Markets

- Unlike typical cycles confined to a single sector, supercycles affect multiple asset classes and countries simultaneously.

- Commodities, equities, and real estate often experience parallel trends during a supercycle.

3. Structural Drivers

- Deep-rooted changes such as industrialization, technological innovation, demographic shifts, or globalization drive supercycles, rather than minor economic fluctuations.

4. High Volatility Within Trend

- Even during a long-term upward trend, markets experience short-term fluctuations, corrections, and volatility.

- This makes risk management and timing crucial for investors seeking to maximize returns.

5. Macro-Economic Significance

- It can influence inflation, employment, trade balances, and monetary policies over long periods.

Phases of a Supercycle

It progress through distinct phases that resemble regular business cycles but occur over decades. Understanding these phases helps investors and policymakers anticipate opportunities and risks:

1. Accumulation Phase

- Occurs after a prolonged downturn, recession, or commodity slump.

- Market sentiment is cautious, and prices remain relatively low.

- Investors gradually accumulate assets, anticipating long-term growth.

- Examples: Post-World War II recovery period, or commodity markets after the 1980s price slump.

2. Expansion Phase

- Economic growth accelerates; industrial production, trade, and infrastructure development increase.

- Demand for commodities, real estate, and equities grows steadily.

- Central banks may adopt accommodative monetary policies to support sustained economic growth.

3. Hyper Growth or Boom Phase

- Marked by rapid price increases and heightened investor optimism.

- Commodities like oil, metals, and agricultural products often see record price surges.

- Businesses invest heavily in expansion, and consumer demand reaches peak levels.

- Risk of overheating or asset bubbles becomes significant.

4. Peak and Plateau Phase

- The supercycle reaches its maximum potential.

- Economic growth remains high, but the rate of increase slows down.

- Markets are highly volatile, with frequent corrections.

- Investors must exercise caution to avoid losses from a potential downturn.

5. Decline Phase

- Economic growth slows, and asset prices may stagnate or fall.

- Market corrections or recessions often occur.

- Structural adjustments, such as new policies or technological innovations, set the stage for the next supercycle.

Causes of Supercycles in Finance

Structural, long-term factors typically trigger supercycles, rather than short-term market events. Understanding these causes helps investors identify opportunities and manage risks:

1. Technological Advancements

- Innovations such as industrial machinery, the internet, renewable energy, or AI create new industries and markets.

- These technological shifts increase productivity, demand for resources, and market expansion.

2. Demographic Shifts

- Population growth, urbanization, and increasing workforce participation generate sustained demand for commodities, housing, and consumer goods.

- Aging populations in developed nations and young demographics in emerging economies can create contrasting supercycle dynamics.

3. Globalization and Trade Expansion

- Growth in international trade and market integration fuels long-term demand for raw materials and manufactured goods.

- Emerging markets become significant drivers of supercycle trends.

4. Commodity Demand-Supply Imbalances

- Persistent shortages or surpluses in essential commodities like oil, metals, and grains trigger long-term price trends.

- Example: China’s industrialization in the 2000s led to a commodity demand supercycle.

5. Policy and Regulatory Changes

- Government fiscal and monetary policies, such as infrastructure spending, trade agreements, or resource management, influence long-term market trends.

- Example: Post-WWII Marshall Plan investments accelerated the European supercycle.

Examples of Financial Supercycles

Historical supercycles illustrate how long-term structural trends influence global finance:

Post-WWII Commodity Supercycle (1945–1970s)

- Reconstruction of war-torn economies increased demand for steel, oil, and agricultural products.

- Industrial growth and technological progress sustained multi-decade price increases in commodities.

Emerging Market Boom (2000–2010)

- The fast industrial growth in China, India, and Southeast Asia caused a commodities supercycle.

- Metals, oil, and agricultural products saw significant price appreciation.

Tech-Driven Supercycle (1990s)

- Widespread adoption of the internet and information technology fueled equity market growth.

- Nasdaq and tech-heavy indices saw sustained growth for over a decade.

Energy Transition Supercycle (Projected 2020s–2030s)

- The worldwide move to renewable energy, electric vehicles, and green infrastructure could create a long-term rise in demand for lithium, cobalt, and other key materials.

Impact of Supercycles on Investors and Markets

Supercycles shape investment strategies, market behavior, and policy-making over long periods:

1. Long-term Investment Opportunities

- Aligning investments with supercycle trends, such as commodities, emerging markets, or tech equities, can yield superior returns.

2. Risk Management

- Understanding the phase of a supercycle helps investors mitigate risks during market peaks or corrections.

- Hedging strategies and diversification become critical during volatile periods.

3. Policy Implications

- Governments and central banks use supercycle analysis to implement monetary and fiscal policies, controlling inflation, employment, and trade imbalances.

4. Market Volatility

- Even within a long-term upward trend, short-term price swings can be significant.

- Strategic timing and careful asset allocation are essential for sustainable returns.

5. Global Economic Influence

- It often drives structural changes in global trade, production, and investment flows, impacting emerging and developed economies differently.

How to Invest During a Supercycle?

Investing in a supercycle requires long-term vision, structural analysis, and risk management:

- Diversify across sectors: Include commodities, technology, emerging markets, and real estate to capture growth opportunities.

- Monitor macro trends: Track demographic shifts, policy changes, and technological advancements.

- Use hedging strategies: Protect portfolios against short-term volatility using derivatives or alternative assets.

- Focus on quality assets: Invest in companies with strong fundamentals that can withstand market corrections.

- Stay updated on policy & regulations: Central bank interventions and trade policies can accelerate or dampen supercycle effects.

Final Thoughts

Understanding supercycles in finance is critical for investors, analysts, and policymakers. These long-term trends, driven by structural shifts in technology, demographics, trade, and policy, shape global markets for decades. By recognizing the phases, causes, and historical patterns of supercycles, investors can make informed decisions, capitalize on growth opportunities, and manage risks effectively.

Supercycles are not merely market events; they reflect fundamental economic transformations that influence investment behavior, global trade, and policy-making. Awareness of supercycle dynamics equips investors and businesses to anticipate opportunities, avoid pitfalls, and thrive in long-term economic trends.

Frequently Asked Questions (FAQs)

Q1. How is a supercycle different from a regular economic cycle?

Answer: A supercycle lasts much longer (often 15–40 years) and is driven by structural economic changes, whereas a regular business cycle typically lasts 5–10 years and is influenced by short-term economic fluctuations.

Q2. Can a supercycle be predicted?

Answer: While it is challenging to predict the exact timing of a supercycle, analyzing structural factors such as technological advancements, demographic trends, and global trade patterns can help identify emerging long-term trends.

Q3. Are supercycles the same across all countries?

Answer: No. Different regions may experience different supercycles simultaneously due to variations in industrial growth, demographic changes, or policy decisions.

Q4. Which asset classes benefit the most during a supercycle?

Answer: Commodities, emerging market equities, real estate, and technology-driven industries often see the highest long-term gains, although performance varies depending on the phase of the supercycle.

Q5. Can supercycles overlap with other market cycles?

Answer: Yes. Supercycles often include multiple shorter business cycles within them. These smaller cycles may experience temporary recessions or booms, but the overarching supercycle trend remains intact.

Q6. Can supercycles reverse quickly?

Answer: Supercycles are typically slow-moving due to their structural nature, but significant technological disruptions, geopolitical events, or major economic crises can accelerate reversals or alter their trajectory.

Recommended Articles

We hope this guide to supercycles in finance was helpful. Explore our related articles on commodity market cycles, long-term investment strategies, and economic trend analysis to enhance your financial insights.