Updated October 26, 2023

Introduction to Stock Futures Trading

Stock Futures trading is all about making easy money the hard way if you don’t follow a disciplined set of strategies. After all, strategy is the key to success in stock futures trading. What makes one futures trader successful among so many?

Could it be intelligence? Trading strategies for stocks If that were so, all persons with high IQs would have excelled in stock futures trading. Is it a software program? If that were the case, programmers would be ruling the roost. Does commodities trading experience translate into successful stock exchange futures trading? Not exactly! Otherwise, all senior people would be leading stock futures trading. Some may even go to the extent of claiming that inside tips can help you to succeed. Don’t kid yourself.

In today’s world, where globalization has made the world smaller and information travels from one corner to another at lightning speed, it’s not what you know but how you use it that predicts success at stock futures trading. Find out more about the formula for successful futures trading here.

Stock Futures Trading Strategies

Different strategies of stock future trading are as follows:

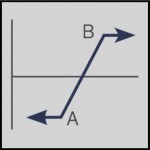

Strategy #1: Long Futures

This strategy is used when facing a bull market and uncertain volatility. Change in volatility will not affect you. But if you have an opinion on where the volatility is heading, another strategy may be better.

Strategy #2: Long Synthetic Future

This strategy is also used when the stock futures trading is bullish on the market and unsure about the volatility. You can trade into this position from a long call or short put position initially to capture the mood of the markets and profit every step of the way.

Strategy #3: Short Synthetic Futures Trading

This is a good strategy to follow in a bear market when there is uncertainty about volatility. One can trade it from a long put or initial short call position to attain a strong rank in the bear markets.

Strategy #4: Long-Risk Reversal

Is it a bear market? Are you uncertain about the volatility? Then, the strategy to follow is Long Risk Reversal, which has the same risk-reward ratio as Long Futures, except for a flat area of lesser or no gain/loss.

Strategy #5: Short Risk Reversal

This strategy can be used in a bear market with uncertainty about volatility. This position is generally coupled with another strategy. As seen above, the risk/reward ratio remains the same as Short Futures except for a flattened area, signifying no gain or loss.

Strategy #6: Long Call

When it’s not just a bull market but a very advanced one, Long Call is a strategy of choice. The strategy should become more bullish with an increasing number of higher strike calls.

Strategy#7: Short Call

This is the strategy that really works well in a bear market.

2 choices can be made depending on your confidence that the markets will slide. Selling out of the money or higher strike puts is the way to go if you have 100% (or great) confidence that markets will fall. However, if you are unsure whether the market will fall or stagnate, choose the sell-at-the-money puts strategy.

Strategy #8: Long Put

This is the strategy to follow when the market is very bearish. The greater the amount of money or lower strike the put option strike price, the higher the degree of bearishness that will be manifest in the strategy.

Strategy #9: Short Put Trading Future

If the futures trader believes the market is more bull than bear, this is the strategy you need to adopt. Sell out of the money options or lower strike if you are slightly sure, and sell at the money options if you are completely confident. If you feel that the market will undergo stagnation and you are bullish, you need to maximize profit through sell-in-the-money options.

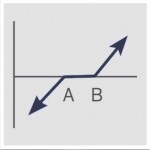

Strategy #10: Bull Spread

This is the strategy to use when you feel the market will continue its bull run yet defy the herd mentality to some degree. If you want to benefit from the bull market and are unsure, this strategy is perfect. This is also the reason for its popularity in futures trading.

Strategy #11: Bear Spread

If you think the bear market will slide further, but not in a massive way, this is the strategy to employ. This is a popular move among bear traders who want to adopt a conservative stance while trading, even when unsure about the market’s future direction.

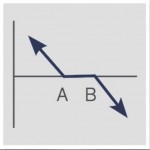

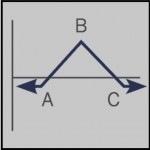

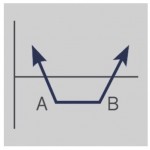

Strategy #12: Long Butterfly

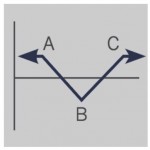

This strategy works to your benefit in a long-term options series. Traders are advised to enter when the spread cost is 10% or less than B minus A, as seen in the graph above. If a strike is between A and B, you must enter when the spread cost doubles. Theory becomes your best friend, and hypothesizing correctly is the key here.

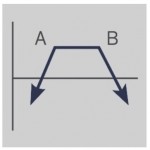

Strategy #13: Short Butterfly

This strategy is used when the market is below point A or above point C in a way that the position is overpriced within a month or so remaining or when the market nears point B, and the move can be in either direction in the short weeks left.

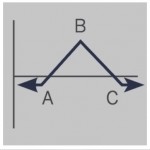

Strategy #14: Long Iron Butterfly

If the market is exactly where it was in the previous strategy, and the only difference is that the position is underpriced, the Long Iron Butterfly is the right strategy.

Strategy #15: Short Iron Butterfly

This strategy involves entering the market when the net credit of the Short Iron Butterfly is 80 percent more than C-A, and a long period of relative price stability is anticipated where the underlying value will range near the midpoint of C-A at the point of expiration. Make sure you check the theoretical values, too.

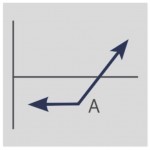

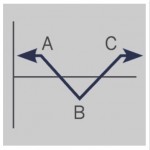

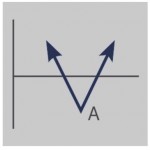

Strategy #16: Long Straddle

If the market is closer to A and you are not sure where it is heading, more so if it has been less active but indicating the possibility of sudden movement, Long Straddle is the way to go.

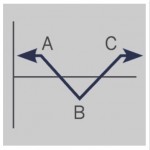

Strategy #17: Short Straddle Future Trading

This one comes into use when the market is near point A and declining; losses become your gains using this strategy.

Strategy #18: Long Strangle

If the market is close to or within the A-B range and stagnates and explodes, money can be made either way. But if the market remains stagnant, cut your losses using this strategy. Even if you expect implied volatility to rise, this strategy remains a good choice.

Strategy #19: Short Strangle

If the market is within or close to the A-B range and is quietening down though still active, hop on to the gravy train with the short straddle and reach the destination you always wanted to, financially.

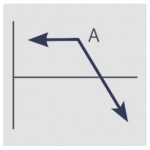

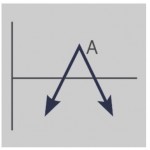

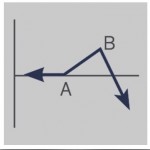

Strategy #20: Ratio Call Spread

When the market is close to point A in the above graph and a moderate to slight, there is a chance for a sell-off. Upside risk makes this strategy only used when there are more than two excess shorts or 1:3.

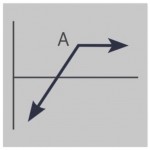

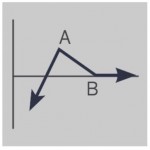

Strategy #21: Ratio Put Spread

This makes sense when the market is near position B, and though there is an expectation that the market will fall somewhat, there is a chance for a sharp rise. People rarely implement this strategy with over two excess shorts due to the downside risk.

Recommended Articles

Here are some further articles to learn more: