Updated July 17, 2023

Introduction of Short Covering

Short Covering means a transaction wherein the short-term investor buys the same quantity of company securities from an open market to cover the short position created earlier for the securities of the said company, and such a transaction may or may not result in profit for the investor.

Explanation

- Before understanding the meaning of short-covering, one needs to understand a few basic terms of financial markets. Normally, we buy security first and then sell it. However, the situation is the exact opposite in the case of short-covering, wherein the investor sells first and buys later. Short means to sell a security. A short position is a situation wherein the investor has sold the security via borrowing the same from another person.

- So, in normal trade, we “first buy and then sell the same. However, in case of short covering, we are required to “first borrow the security, sell the same, cover up the short position by purchasing the securities in the open market and settle the same from the stock-lender”. This whole process is called short selling.

- Thus, short covering occurs at the last stage of short selling, wherein the investor will buy the required securities from the market and give it back to the lender. It is like taking a loan and repaying back. The stock lender will charge stock lending charges for allowing the same.

- The obvious question that arises is what is achieved through such short selling. Portfolio managers use short selling to cover up the downside risk of stock prices. Intraday investors and short-term investors prefer this investment method to magnify their profits.

How Does It Work?

- The investor first borrowed the stock from the stock lender. The stock lender is not concerned about how the investor will handle the secured loan. He is just concerned about the receipt of the stock after a specific period of time.

- With the said period, he needs to purchase the stock and return it to the lender along with stock lending charges. So, short covering helps the investor close out his short position regarding said security.

- So, the investor is at a profit if he can cover the position at a price lower than the selling price. He will suffer the loss if he is required to buy at a higher price than the selling price.

- The lenders may require the stock before the specific period is elapsed. In this situation, the intermediary (i.e., broker) tries to satisfy the lender by borrowing the same from another. In acute situations, the borrower must buy the stock at higher prices.

Example of Short Covering

Say a stock is trading at $ 500 now. The company is about to post its October 2020 quarterly results by the end of the month. The market expects that the company is expected to publish negative results. The short seller wishes to earn by short selling. He expects the price to fall by a minimum of 15%. He will close the position at a 12% downfall, irrespective of the actual fall later on.

| Current price | $500 |

| Sale price | $500 |

| Number of shares | 1,000 |

| Deposit with broker | $5,00,000 |

| Investment | $ – |

| Price after 1 week | $425 |

| Short Cover Price of the Trader | |

| Scenario 1 | $440 |

| Scenario 2 | $550 |

| Stock lending charges per day | $625 |

Solution:

Scenario 1

| Particulars | Amount | |

| A | Selling price | $500 |

| B | Buying price | $440 |

| C | Profit per share (A-B) | $60 |

| D | Number of shares | 1,000 |

| E | Gross Profit (D*E) | $60,000 |

| F | Number of days until buy | 35 |

| G | Stock lending charges per day | 625 |

| H | Charges paid (F*G) | $21,875 |

| I | Net Profit (E-H) | $38,125 |

Scenario 2

| Particulars | Amount | |

| A | Selling price | $500 |

| B | Buying price | $550 |

| C | Profit per share (A-B) | ($50) |

| D | Number of shares | 1,000 |

| E | Gross Profit (D*E) | ($50,000) |

| F | Number of days until buy | 35 |

| G | Stock lending charges per day | 625 |

| H | Charges paid (F*G) | $21,875 |

| I | Net Profit (E-H) | ($71,875) |

Explanation

- Under scenario 1, the short seller has earned a net profit of $ 38125 due to negative results leading to an actual downturn of the stock prices. If you observe, his only outflow was involved in stock lending charges.

- Under scenario 2, the stock prices surged due to the positive outlook of the results. The short seller has no option other than to buy the stocks at higher prices, and he needs to cover the position within the time the stock lender allows. This situation leads to short squeezing, increasing the stock prices for a short momentum.

How Short Covering Can Cause Short Squeeze?

- We understand the normal meaning of “to squeeze” anything. Short squeezing refers to a sudden increase in demand for the stock with a lower supply, resulting in the rapid increase of stock prices beyond the expected level.

- A short squeeze happens when the stock lender has demanded back the securities with the immediate need, and the stock prices are presently trailing high. The investor will buy the securities in huge volumes resulting in a surge in market prices.

- Thus, short covering results in an increase in market prices, which may break the upper circuits. The rusk buying leads to a lower quantity of supply. A short squeeze is experienced only in securities with higher interest costs from the lender.

- Suppose a stock trades at $ 40, and investors have already entered the short position at $ 55. Due to surprising results in the next quarter, the stock jumps to $ 65, i.e., the investors are at a loss. To limit the loss, the investors purchase the stock, which leads to a further increase in the share price up to $75.

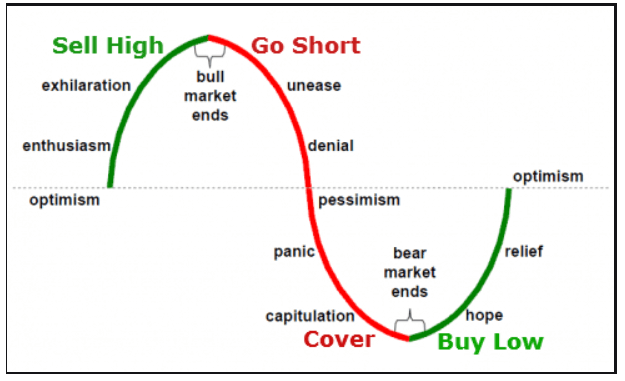

Short Covering Graph

Source: https://www.google.com/imgres?

- In the short covering, the bear market ends at the bottom of the graph. The long-term investors wait for the confirmation when the prices close in green signal in two consecutive trading sessions.

- The optimism line above means the resistance line. If the prices break the resistance level, the stock is said to be in an uptrend.

Short Covering Affects Stock Price

- The short sellers cover up their positions in case of short covering. There is no supply of stocks in the market. Yet the investors want to cover up their position by purchasing the stocks in huge volumes.

- By the rule of demand and supply, the prices eventually shoot up without any fundamental reason for the surge.

- The short-term investors have closed their position, but this has led to an unwanted increase in price. The unknown investors consider this an “uptrend” and buy the stocks further. Such an increase has no fundamental base. Thus, over time, the stock will rebound to its fundamental price at the downside.

Conclusion

Short covering helps the short sellers to close their position created due to selling the stock earlier. The investor either gains or losses the money in case of short squeezing occurs as a result of short covering. However, a few voluminous short sellers may do this short covering, leaving the fundamental traders in shock.

Recommended Articles

This is a guide to Short Covering. Here we also discuss the introduction and how short covering works. Along with the example. You may also have a look at the following articles to learn more –