What Is Securities Regulation?

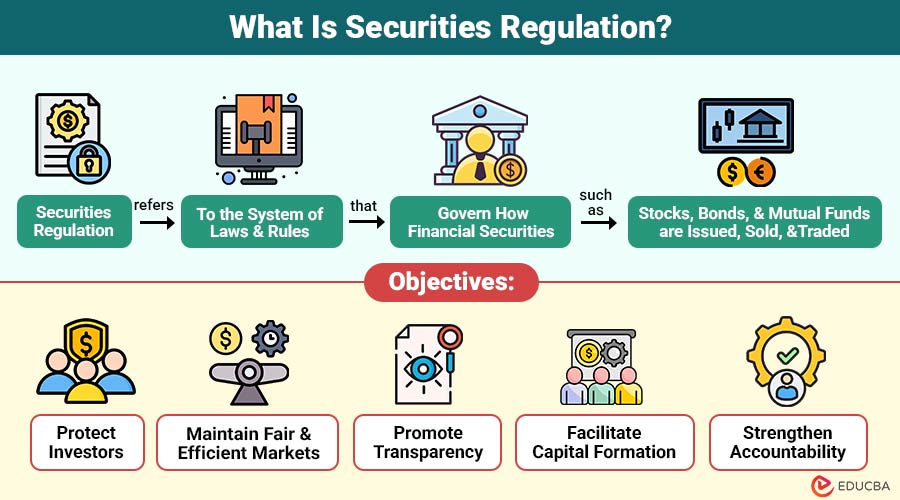

Securities regulation refers to the system of laws and rules that govern how financial securities—such as stocks, bonds, and mutual funds—are issued, sold, and traded. Its main purpose is to protect investors, ensure transparency, and maintain fair market practices.

For example, when a company goes public, it must disclose financial information to the securities regulator to prevent misleading investors. These regulations help build trust in the financial market and reduce the risk of fraud or manipulation.

Table of Content:

- What Is Securities Regulation?

- Objectives

- Key Regulatory Bodies

- Major Securities Laws and Frameworks

- Components

- How Securities Regulation Works in Practice

- Challenges

- Future

Key Takeaways

- Securities regulation ensures transparency, fairness, and investor protection in financial markets.

- Regulatory bodies monitor companies, brokers, and exchanges to prevent fraud and maintain market integrity.

- Modern challenges like digital assets, high-frequency trading, and globalization require adaptive and proactive oversight.

- The future of regulation is technology-driven, focusing on AI, blockchain, global collaboration, and stronger investor protection measures.

Core Objectives of Securities Regulation

These objectives ensure that financial markets remain fair, transparent, and trustworthy for all participants.

- Protect Investors: Securities regulation safeguards individuals from fraud, misinformation, and unethical practices. It ensures that companies share accurate details so investors can make informed decisions.

- Maintain Fair and Efficient Markets: Regulations help prevent market manipulation, insider trading, and unfair advantages. This keeps trading smooth, competitive, and free from deceptive activities.

- Promote Transparency: Companies must regularly disclose important financial information. This openness builds confidence and allows investors to compare opportunities clearly.

- Facilitate Capital Formation: A well-regulated market encourages businesses to raise funds through public offerings. When investors trust the system, they are more willing to invest and support business growth.

- Strengthen Accountability: Regulations require companies, brokers, and financial institutions to follow ethical standards. If rules are broken, penalties and corrective actions maintain market discipline.

Key Regulatory Bodies

These organizations oversee financial markets to ensure fairness, transparency, and investor protection.

- Securities and Exchange Commission (SEC): The primary US regulator of the securities market is the SEC. It ensures companies share truthful information, monitors trading activities, and takes action against fraud or misconduct.

- Financial Industry Regulatory Authority (FINRA): FINRA supervises brokers and brokerage firms. It sets rules to protect investors, checks if brokers are qualified, and resolves disputes to keep trading trustworthy.

- European Securities and Markets Authority (ESMA): ESMA regulates financial markets across the European Union. It creates common rules to improve transparency and stability among member countries.

- International Organization of Securities Commissions (IOSCO): IOSCO establishes international standards for regulating securities markets. It brings regulators from different countries together to maintain strong and consistent market practices worldwide.

- Securities and Exchange Board of India (SEBI): India’s financial markets are regulated by SEBI. It protects investors, monitors company disclosures, and ensures fair trading across stock exchanges.

Major Securities Laws and Frameworks

These laws provide the legal foundation for fair, transparent, and secure financial markets.

- Securities Act of 1933: Mandates that companies register their new securities and provide accurate information to investors, helping to prevent fraud in public offerings.

- Securities Exchange Act of 1934: Oversees trading in secondary markets, regulates stock exchanges, and supervises continuous company disclosures to uphold market integrity.

- Sarbanes–Oxley Act (SOX) 2002: Focuses on corporate accountability and financial transparency. It sets strict auditing and reporting standards for public companies.

- Dodd–Frank Act 2010: Addresses systemic risks, enhances investor protection, and increases oversight of large financial institutions to prevent another financial crisis.

- International Frameworks: Includes MiFID II in Europe and anti-money laundering (AML) rules globally. These ensure cross-border trading, investor protection, and market transparency in international finance.

Components of Securities Regulation

These components form the backbone of a transparent and well-functioning financial market.

- Mandatory Disclosure Requirements: Companies must provide accurate financial statements and information about business operations so investors can make informed decisions.

- Insider Trading Rules: Regulations prevent individuals with access to confidential information from gaining unfair advantages in trading securities.

- Market Manipulation Provisions: Laws prohibit actions like price rigging or spreading false rumors that could distort the market.

- Reporting Obligations for Public Companies: Firms are required to regularly report financial results, shareholding patterns, and other key information to regulators.

- Auditing and Compliance Standards: Independent audits and compliance checks ensure that companies follow ethical and legal standards, reducing the risk of fraud.

- Enforcement Mechanisms: Regulators can impose fines, penalties, or other corrective actions to maintain market discipline and protect investors.

How Securities Regulation Works in Practice?

Practical enforcement of securities regulations ensures fair trading and investor protection.

- Registration of New Securities: Companies issuing stocks or bonds must register with the regulator and provide detailed disclosures before selling to the public.

- Oversight of Stock Exchanges: Regulators monitor exchanges to ensure fair trading practices, prevent manipulation, and maintain orderly market operations.

- Monitoring Brokers and Investment Advisers: Brokers, dealers, and advisers are supervised to ensure they act in clients’ best interests and comply with ethical standards.

- Continuous Reporting by Companies: Public companies regularly submit financial statements, shareholding updates, and disclosures of material events to maintain transparency.

- Enforcement and Penalties: Regulators investigate violations, such as insider trading or fraud, and can impose fines, sanctions, or legal action to uphold market integrity.

- Investor Education and Awareness: Regulators provide guidance and resources to help investors make informed decisions and understand market risks.

Challenges in Modern Securities Regulation

Regulators face new and evolving challenges in keeping financial markets safe and transparent.

- Rise of Digital Assets and Cryptocurrencies: Rapid growth of cryptocurrencies and digital tokens creates uncertainty, as traditional rules may not fully apply.

- Globalization and Cross-Border Trading: International trading makes monitoring and enforcing regulations more complex due to differing laws across countries.

- High-Frequency and Algorithmic Trading: Advanced trading technologies can create market volatility and make it harder to detect manipulative practices.

- Corporate Governance Failures: Weak internal controls and unethical practices in companies can lead to financial scandals affecting investors.

- Balancing Innovation and Investor Protection: Regulators must encourage financial innovation while ensuring that new products and services do not compromise market integrity.

- Rapid Technological Changes: Constant advancements require regulators to adapt quickly, update frameworks, and implement advanced monitoring tools.

Future of Securities Regulation

The future of securities regulation is shaped by technology, global collaboration, and evolving market needs.

- AI and Machine Learning in Oversight: Regulators are using AI to detect fraud, analyze large datasets, and monitor trading patterns more efficiently.

- Blockchain-Based Compliance Systems: Blockchain can enhance transparency, simplify record-keeping, and reduce errors in reporting and auditing processes.

- Global Regulatory Collaboration: Countries are working together to harmonize rules, making cross-border trading safer and more consistent.

- Enhanced Retail Investor Protection: Focus is increasing on educating investors, providing easy access to information, and safeguarding against scams.

- Adapting to Digital Assets: New frameworks are being developed to effectively regulate cryptocurrencies, NFTs, and other digital financial instruments.

- Emphasis on Market Resilience: Regulators aim to strengthen systems to handle crises, prevent manipulation, and maintain confidence in financial markets.

Conclusion

Securities regulation plays a vital role in protecting investors, ensuring market transparency, and promoting fair trading. By enforcing disclosure, monitoring activities, and adapting to new challenges, regulators create a stable environment for businesses and investors alike. As markets evolve with technology and globalization, effective regulation will remain essential to maintaining trust, integrity, and sustainable growth.

Frequently Asked Questions

Q1: What is the difference between a security and a stock?

Answer:- A security is a broad financial instrument, while a stock represents ownership in a company.

Q2: Can foreign companies issue securities in another country?

Answer:- Yes, but they must comply with the host country’s regulatory requirements.

Q3: Are all investments in the stock market regulated?

Answer:- Most are, but some private or alternative investments may have limited oversight.

Q4: How often do regulators update securities rules?

Answer:- Regulations are updated regularly to address market changes and emerging risks.

Recommended Articles

We hope this guide on Securities Regulation helped you understand investor protection and market transparency. For more finance insights, explore these related articles below: