What is Risk Parity?

The term “risk parity” refers to the portfolio allocation strategy in which the risk contribution of each asset class to the overall portfolio is used to determine the allocation of funds across the asset classes of an investment portfolio.

The risk parity strategy manifests the modern portfolio theory approach, which seeks to optimize portfolio returns through portfolio diversification among various asset classes based on the risk and returns of the entire portfolio.

Explanation

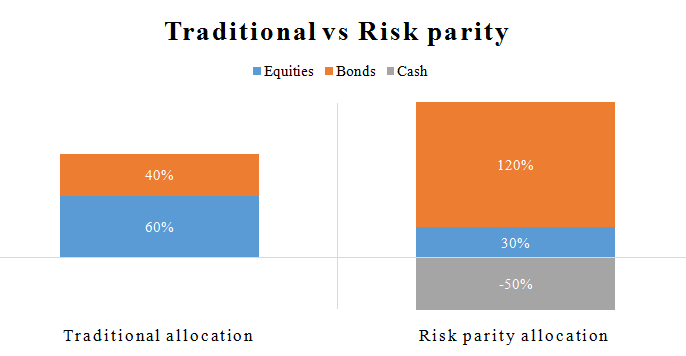

Risk parity is another advanced portfolio management strategy used by hedge fund managers. Typically, it employs quantitative methods for fund allocation to different asset classes to earn the optimized return at the targeted level of risk. A risk parity strategy of investment also includes a mix of stocks and bonds. Still, unlike the traditional predetermined asset allocation mix of 60% in equities and 40% in bonds, the asset class proportions in a risk parity strategy determine depending on the target risk and return level.

How Does Risk Parity Work?

The risk parity strategy uses leverage to diversify and reduce the equity risk of an investment portfolio while maintaining the returns at the long-term target level. Using leverage allows investment in lower-risk assets such that the overall portfolio’s return is similar to equity-like returns. The portfolio leverage (by borrowing) with a higher allocation to lower-risk assets delivers a higher return than a direct investment in higher-risk assets with a similar risk level. So, higher allocation goes into bonds compared to equities, as stocks are typically riskier than bonds.

In this way, it ensures that risk contribution from both asset classes is equal. Next, it is essential to ensure that the cost of borrowing is sufficiently low such that the net return of the leveraged portfolio (= portfolio return -borrowing cost) exceeds the expected return of the traditional allocation. It is a compelling strategy for investors with easy access to borrowed funds.

Examples of Risk Parity

The following are examples of some of the best risk parity funds available in the world:

- AQR Risk Parity II HV Fund (QRHIX): The fund was started on 5th November 2012, and as of 13th November 2020, its total assets under management (AuM) stand at ~$23 million. The fund allocation is such that ~37% of the AuM is invested in equities, ~26% in nominal interest rate bonds, and ~37% in inflation-linked bonds, which results in an equity and bond mix of 1:1.7. During the last three years/ 5 years/ since inception, the fund has generated return of 4.79%/ 6.70%/ 4.34%, which indicates that its performance has been slightly fluctuating with realized volatility of 12.5% since inception. The fund’s management fee and adjusted expenses ratio are 0.80% and 1.03%, respectively.

Source: Funds AQR

- Horizons Resolve Adaptive Asset Allocation ETF (HRAA): The fund was started on 21st July 2016 as Horizons Global Risk Parity ETF (HRA), Canada’s first Global risk parity fund. On 30th July 2020, the fund was reorganized into Horizons Resolve Adaptive Asset Allocation ETF, and as of 20th September 2020, its total assets under management (AuM) stand at ~$70 million. The fund allocation is such that ~6% of the AuM is invested in equities and ~53% in bonds. Before reorganization, the fund generated returns of 1.35% in the last three years with a volatility of 5.75%. The fund’s management fee is 0.85% plus 15% of the amount by which the fund outperforms the high water mark.

Source: Horizon ETFs, Yahoo Finance

Who Invented Risk Parity?

It was Bridgewater Associates that first launched a risk parity fund by the name All Weather asset allocation strategy in the year 1996. Although the risk parity fund was introduced to the market by Bridgewater Associates, the term was not coined until 2005, when Edward Qian of PanAgora Asset Management first used this term in his authored white paper. In 2008, Andrew Zaytsevof Alan Biller and Associates named Risk Parity one of his investment categories. Soon, the entire asset management industry adopted the term.

Diagram

Typically, any risky asset generates higher returns than plain cash. So, it makes sense to borrow and purchase risky assets (a.k.a. financial leverage) to earn higher portfolio returns. This strategy results in negative allocation to cash while the allocation to risky assets (mix of bonds and stocks) exceeds 100%. In the above chart, it can be seen that as compared to the traditional portfolio allocation of 60% to equities and 40% to bonds in the 3-asset risk parity portfolio, the portfolio allocation to equities has been halved and that of bonds has been increased three-fold resulting in negative allocation to cash (indicating borrowed fund). In this way, the portfolio risk contribution of equities is brought down while increasing that of bonds to ensure equal risk contribution of both the asset classes (considering zero risk for cash).

Criticisms

One of the basic assumptions is that all assets have exhibited a similar Sharpe ratio, which is the ratio of expected return to the volatility of returns. However, it is not always accurate; hence, leveraging up assets without reducing portfolio efficiency (Sharpe ratio) is impossible. Further, leveraging the portfolio to achieve the desired returns sometimes leads to excessive cash components.

Conclusion

So, it can be seen that the risk parity approach is an essential portfolio management strategy wherein the capital allocation is done in such a way that the risk contribution of each asset class is equal. The risk parity approach is believed to result in a higher Sharpe ratio, i.e., higher risk-adjusted return.

Recommended Articles

This is a guide to Risk Parity. Here we also discuss the introduction and how does it work? Along with examples. You may also have a look at the following articles to learn more –