Updated July 11, 2023

What is Residual Risk?

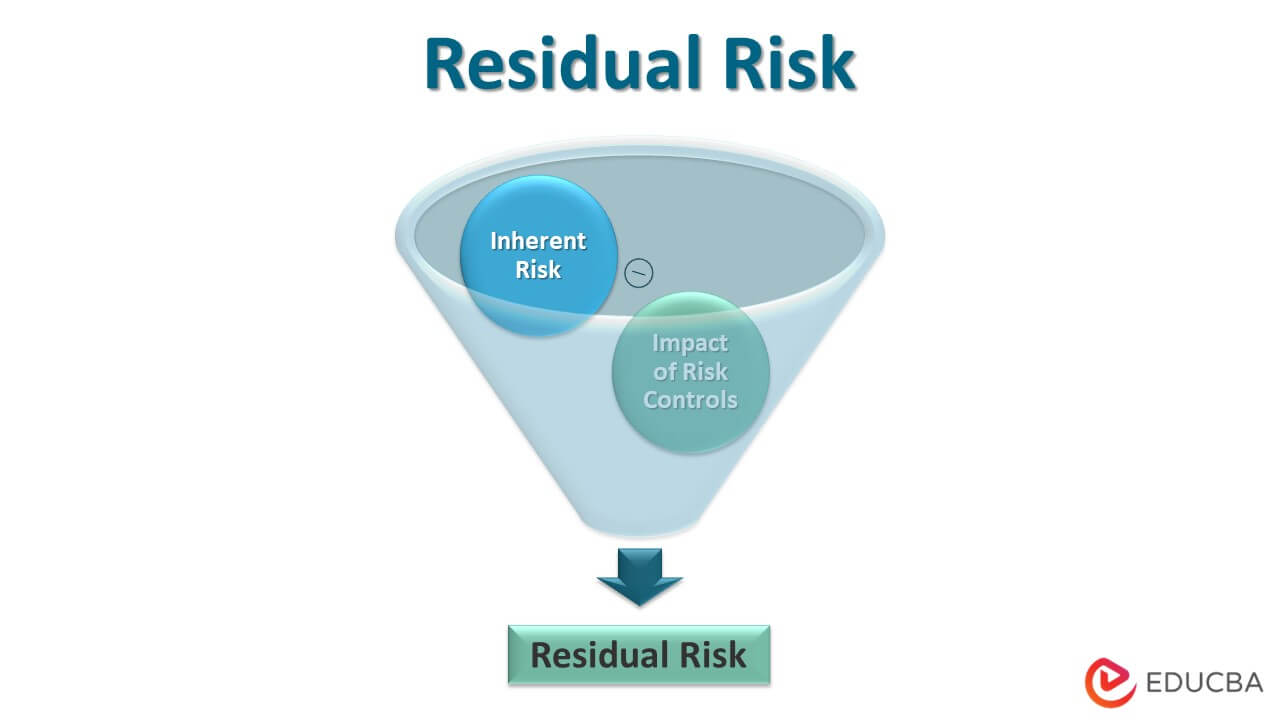

The term “residual risk” (RR) refers to the amount of risk that remains in an event after hedging, mitigating, or avoiding the inherent risks associated with an event or action. Eliminating all the associated risks is impossible; hence, some RR will be left.

However, the residual risk level must be as low as reasonably possible. Mathematically, the formula for RR represent as,

where,

Inherent risk = The level of risk naturally associated with the event or action, which exists before the risk controls or mitigations. It is also popular as gross risk.

Impact of risk controls = The amount of risk that has been mitigated, eliminated, or hedged via internal and external controls.

Explanation of Residual Risk

The explanation of RR is straightforward. First, identify the associated risks and then try to reduce or eliminate the risks as much as possible. However, it is impossible to eliminate all the risks, and hence there are some risks left, known as RR. The idea behind the computation of residual risk is that an organization should know what portion of the overall risk they should bear, irrespective of all their efforts.

How to Calculate Residual Risk

It usually calculates similarly to other risk assessments – similar methodology, similar assessment scales, etc. The difference is that in the case of RR, one needs to take cognizance of the impact of the risk controls. Now, let us look at the step-by-step approach to calculating residual risk:

- Step 1: Firstly, determine the inherent risk of an event by assessing the probability of a risk event and evaluating the level of potential business impact associated with it.

- Step 2:Next, the management team determines its level of risk tolerance based on the inherent risk level and decides what percentage it is willing to accept.

- Step 3:Next, the management will need to implement mitigating controls based on the type of risks and assess their impact. The impact of risk controls is the aggregate impact of all the mitigating controls.

- Step 4: Next, calculate the RR by subtracting the impact of risk controls (step 3) from the inherent risk (step 1).

Residual risk = Inherent Risk – Impact of Risk Controls

- Step 5: Finally, the RR should be compared with the management’s risk tolerance. If the residual risk is equal to or lower than the management’s risk tolerance, then the risk mitigation plan is right on the mark. On the other hand, if the RR is higher than the management’s risk tolerance, then it means that the risk mitigation plan is insufficient and needs further refining.

Example

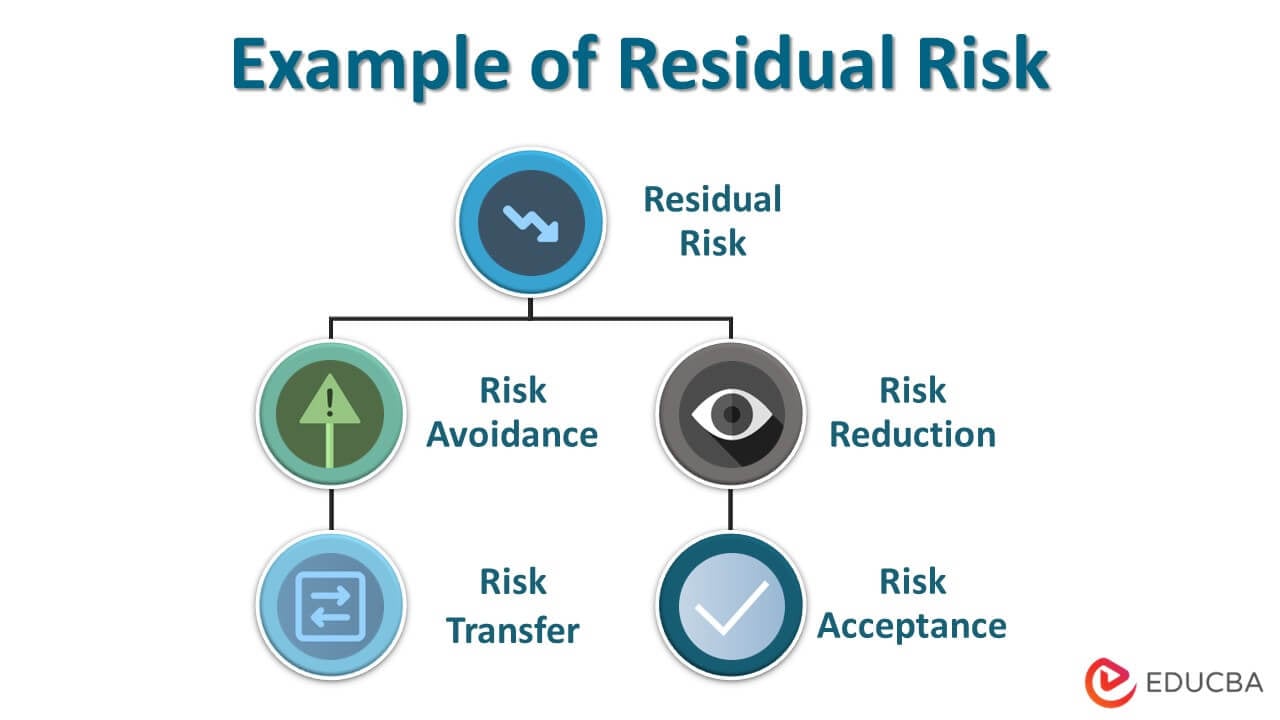

Now, let us look at some of the examples of RR under various scenarios.

- Risk Avoidance: A firm may give up on developing new technology to avoid the risks associated with the project. However, the residual risk remains that one or some competitors may develop the technology, and the firm will eventually become less competitive.

- Risk Reduction: Airline companies usually implement strict maintenance procedures to reduce the risk of an accident. However, in this case, the residual risk may be the probable human error of skipping some of the essential steps during maintenance.

- Risk Transfer: One may transfer the risk of earthquake damages to their property by getting earthquake insurance. However, there is still the risk that the insurance company will go bankrupt due to the earthquake and thus be unable to cover the losses.

- Risk Acceptance: As investors, we often accept that stock investments are subject to market risk. Accepting any risk means that the entire risk has become the RR.

Residual Risk Management

The residual risk of any business or event can manage by using either of the following three options:

- When the amount of RR is equal to or lower than the acceptable amount of risk, then the management can accept the remaining risks and do nothing about it.

- If the amount of RR is higher than the acceptable amount of risk, then the management needs to find ways to mitigate these risks.

- If the amount of RR is higher than the acceptable risk amount while the mitigant’s cost is higher than its benefit, then it is better to accept these risks.

Why is Residual Risk Important?

Understanding and monitoring residual and inherent risks are essential as it helps the organization identify the potential threat to the business and plan the mitigations accordingly. The organization will remain vulnerable to unfavorable situations without understanding the overall risk level. Additionally, monitoring residual risk is a mandatory regulatory requirement as it ensures an organization’s safety and security.

Conclusion

So, it can be seen that RR is the leftover risk after all the possible risk control measures have been put in place. To put it simply, these risks are the ones that are left after the planned risk framework has been implemented.

Recommended Articles

This is a guide to Residual Risk. Here we also discuss the introduction, how to calculate residual risk, and an example and importance. You may also have a look at the following articles to learn more –