Updated July 26, 2023

Residual Income Formula (Table of Contents)

What is Residual Income Formula?

In Corporate finance, the term “residual income” refers to the amount of operating income generated in excess of the minimum required return or the desired income.

As such, residual income can be seen as a performance assessment tool for the company to see how efficiently it able to utilize its business assets. In fact, the residual income is the performance indicator for the companies just like return on investment for portfolio managers. The formula for residual income can be derived by deducting the product of the minimum required rate of return and average operating assets from the operating income. Mathematically, Residual Income is represented as,

Examples of Residual Income Formula (With Excel Template)

Let’s take an example to understand the calculation of Residual Income in a better manner.

Residual Income Formula – Example #1

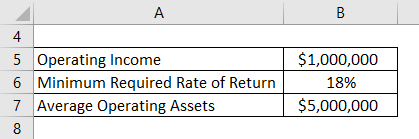

Let us take the example of an investment center that had an operating income of $1,000,000 during the year by using operating assets worth $5,000,000. Calculate the residual income of the investment center if the minimum required rate of return is 18%.

Solution:

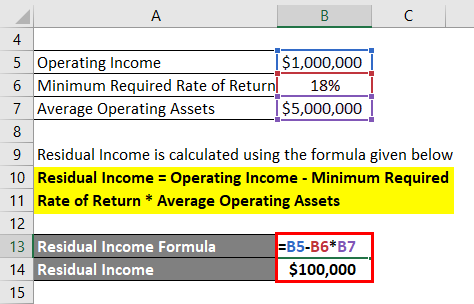

Residual Income is calculated using the formula given below

Residual Income = Operating Income – Minimum Required Rate of Return * Average Operating Assets

- Residual Income = $1,000,000 – 18% * $5,000,000

- Residual Income = $100,000

Therefore, the residual income of the investment center stood at $100,000.

Residual Income Formula – Example #2

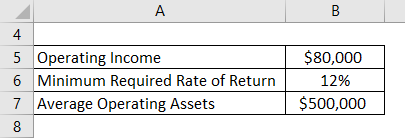

Let us take the example of a company with operating income during the current year of $80,000. The company has an operating asset base of $500,000, while the cost of capital is 12% as per the latest annual report. Calculate the residual income of the company during the year.

Solution:

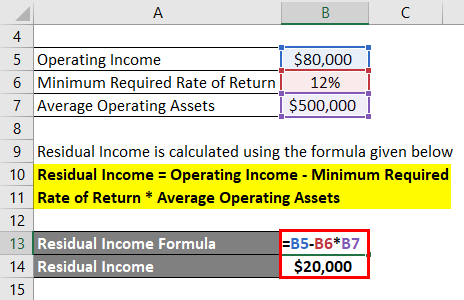

Residual Income of the company is calculated using the formula given below

Residual Income = Operating Income – Minimum Required Rate of Return * Average Operating Assets

- Residual Income = $80,000 – 12% * $500,000

- Residual Income = $20,000

Therefore, the residual income of the company during the year is $20,000.

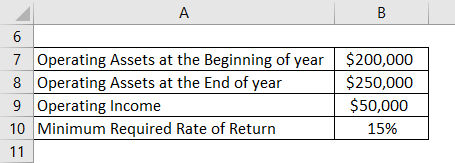

Residual Income Formula – Example #3

Let us take the example of a company which has recently acquired a new unit as a diversification of its existing operation. The value of operating assets of the unit is $200,000 at the beginning of the year and $250,000 at the end of the year. During the year, the unit generated operating income of $50,000. As per the corporate strategy, the minimum required rate of return from the unit is 15%. Calculate whether the unit is able to generate any residual income during the year.

Solution:

Average Operating Assets is calculated as

- Average Operating Assets = ($200,000 + $250,000) / 2

- Average Operating Assets = $225,000

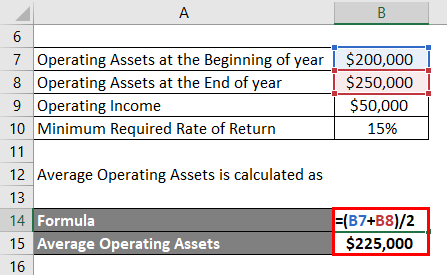

Residual Income is calculated using the formula given below

Residual Income = Operating Income – Minimum Required Rate of Return * Average Operating Assets

- Residual Income = $50,000 – 15% * $225,000

- Residual Income = $16,250

Therefore, the company is able to generate a residual income of $16,250 during the year.

Explanation

The formula for residual income can be calculated by using the following steps:

Step 1: Firstly, determine the minimum required rate of return expected by the investor based on their investment strategy, risk appetite, investment horizon, and current market return. In fact, most cases companies use the cost of capital as the minimum required rate of return.

Step 2: Next, determine the operating assets or the total capital employed by the company in the operations. In most cases, the average of the value of the operating assets at the beginning of the year and at the end of the year is used.

Step 3: Next, calculate the minimum required income based on the minimum required rate of return (step 1) and the average operating assets (step 2) as shown below.

Minimum Required Income = Minimum Required Rate of Return * Average Operating Assets

Step 4: Next, determine the operating income of the company which is an income statement item.

Step 5: Finally, the formula for residual income can be derived by deducting the minimum required income (step 3) from the operating income (step 4) as shown below.

Residual Income = Operating Income – Minimum Required Income

or

Residual Income = Operating Income – Minimum Required Rate of Return * Average Operating Assets

Relevance and Uses of Residual Income Formula

It is important to understand the concept of residual income because it is usually used in the performance assessment of capital investment, department or business unit. A positive residual incomes implies that the unit has been able to generate more return than the minimum required rate, which is desirable. As such, the higher the residual income, the better it is considered by the company. However, there can be instances when a project or business unit has failed the test for return on investment due to the low rate of return but has cleared the test for residual income on the back of nominal positive dollar value, which can be very tricky and requires management call. Another major disadvantage of residual income technique is that it favors bigger investments against smaller ones because it assesses on the basis of the absolute dollar amount.

Residual Income Formula Calculator

You can use the following Residual Income Calculator

| Operating Income | |

| Minimum Required Rate of Return | |

| Average Operating Assets | |

| Residual Income | |

| Residual Income = | Operating Income - Minimum Required Rate of Return * Average Operating Assets | |

| 0 - 0 * 0 = | 0 |

Recommended Articles

This is a guide to the Residual Income Formula. Here we discuss How to Calculate Residual Income along with practical examples. We also provide a Residual Income Calculator with a downloadable excel template. You may also look at the following articles to learn more –