Introduction to Pump and Dump

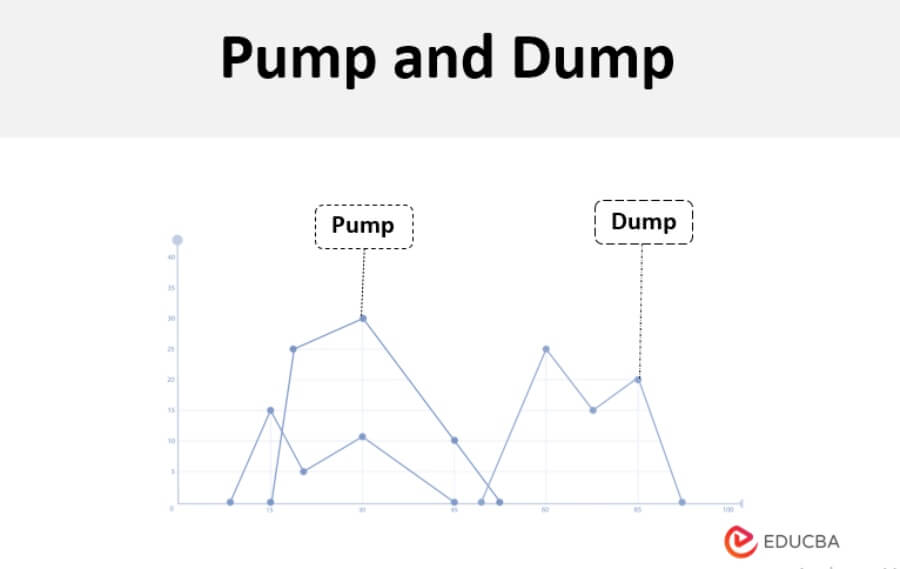

The term ‘Pump and Dump’ is a method using which the price of shares in the open market will be inflated to the benefit of management holding effective control over the company; in other words, the share price will rise to such levels by spreading some positive news about the company and take the advantage by selling holdings at such raised prices.

Explanation

The explanation of Pump and Dump is as follows:

- The shares of the company must be registered on the trading platform.

- The individual or group of people are insignificant control positions, meaning they have a significant role to play in any company decision.

- They must own a large enough percentage of the company’s shares to prevent a decline in share prices from their sell-off.

- Then such a group of a person spreads some positive news such as good results or acquisition of the company by some major group; significant investments are going to be made by govt, etc., which positively impact the prices of shares in the open market.

- Then sell off their holdings and earn good returns from such holdings.

How do Pump and Dump work?

The pump and dump scheme could mostly be done with penny stocks which means such stocks whose market share is limited and significantly less, and most of the holdings of such stocks are held with management itself. These shares are generally traded at such low prices, attracting new entrants who did not know of investment but found such shares because of the price of the share. Such companies also do not take care of listing guidelines because they are only listed to accept such benefits by manipulating the price.

Because of such a small company, its management can easily manipulate the information or rumors. Due to the small company, such companies also did not provide much information in the public domain, which limits the investor with limited information. Then the management started spreading major positive news about the company, which instantly impacted the share price and rose sharply.

Examples of Pump and Dump

The Company XYZ Inc. has a share capital of 500,000, currently traded at $500 per share in the open market. The management of the company holds 45% of the holdings with them. The financial results of quarter 3 of the year are yet to be declared by the company in the coming week after being adopted in the company’s general meeting. Now, to take advantage of such a situation, management personnel has started spreading rumors that the company has earned 150% more profits than last quarter and could consider declaring a dividend also in the company results.

After this news reaches the open market, the other familiar trading member starts buying the share from the open market to take advantage of such results as good results will surely raise the price of a share in the open market, and the buying pressure created will increase the price of the share in the open market say to $750. Now, after the share attains a level, the management starts selling their holding, i.e., 45,000 shares, at such raised prices, i.e., $750, which increases the supply of the shares resulting in the downfall of the price of share and loss for the new entrants who have purchased the share at such high prices.

Types of Pump and Dump

The types are as follows:

- The first type of such a pump and sump technique is to flow information about the company, which is wrong but will positively impact share prices.

- The following practice is creating bogus demand for the shares of the company, i.e., some brokering house will be appointed who will create bogus demand for the shares and not offer any share of the company for sale, which results in the price of the share.

How to spot Pump and Dump Scams?

The scams could be easily spotted by performing some due diligence before investing hard-earned money in such bogus situations, which are as follows:

- The share has been trading at a meager price for an extended period.

- The company’s financials represent not such good profits which could raise the price of a share.

- The management started increasing their holding by purchasing shares from the open market.

- The sudden positive news about the company starts blowing.

- The sudden rise in the number of buyers will be seen.

- The situation of shortage of supply of shares in the open market for sale will be created.

- The financial and performance charts of the company will show a sudden rise in the prices of shares.

Reasons for Pump and Dump

The reasons are as follows:

- The technique of pump and dump is only used with the intention of the rise in the price of the share of the company to such high levels and then selling off the holdings held for earnings high inflated profits and selling off thereby resulting in decreasing the price of the share at which they could also repurchase the shares sold suppose for instance a company ABC Inc. has a share capital of 100,000 shares and Mr. A holds 45,000 shares of company ABC Inc. which is currently trading in the open market for $100 per share then by spreading such rumors the price of shares got rises to $150 per share then Mr. A has sold all his 45,000 shares. Due to a heavy sell-off, the price again comes to $80 per share. Mr. A has repurchased his holding of 45,000 shares, resulting in a net profit of $70 per share.

- Through this technique, the person could earn riskless profits, which some internal person generates to take advantage of the position held.

Conclusion

To conclude, the term ‘Pump and Dump’ is a technique used by those who have significant influence over the performance of the company and has a considerable market share as well; in other words, it can only be executed by those persons who influence the company which could either be in the form of having more than 20% market stake of shares or having 20% or more voting powers which after that be used to manipulate the general public by spreading some positive rumors about the company for taking advantage of price rise.

Recommended Articles

This is a guide to Pump and Dump. Here we discuss an introduction to Pump and Dump with examples, working, types, and reasons. You can also go through our other related articles to learn more –