Updated July 15, 2023

What is a Product Portfolio?

The term “product portfolio” refers to the collection of all the products that a company deals in. A product portfolio may break down into product categories, lines, or individual products.

Suppose an organization offers a wide range of products to various target markets. In that case, it is very important to analyze its product portfolio to achieve the organizational goal of increased sales and profits through higher market share and enhanced brand value.

Product Portfolio Classification

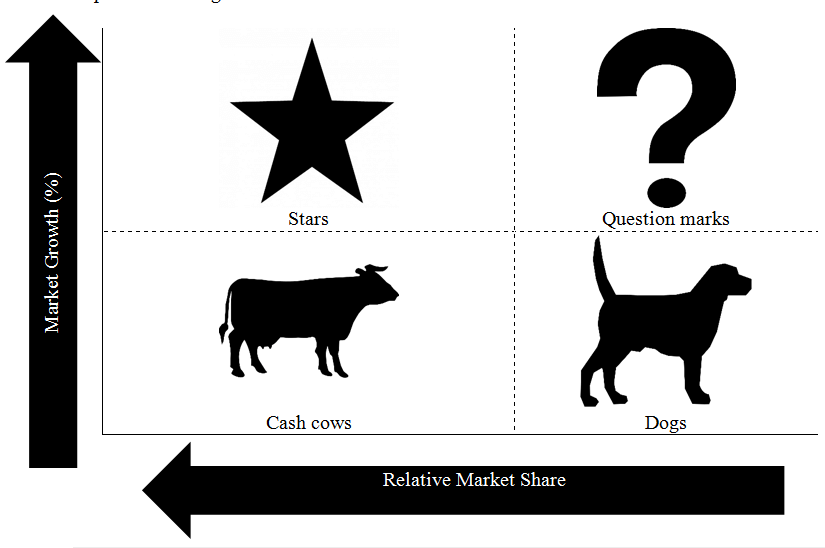

One of the most popularly used classifications of the product portfolio is the BCG growth-market share matrix developed by Boston Consulting Group’sthen CEO and Founder, Mr. Bruce Doolin Henderson, in the 1970s. The BCG matrix consists of two axes –the X-axis representing the relative market share and the Y-axis representing the expected market growth rate.

Based on the two axes, the entire matrix divide into four quadrants, where each represents a particular stage of the product in its life cycle. The four quadrants are – Cash cows, Stars, Question marks, and Dogs.

- Cash Cows: This quadrant represents those products that enjoy a high market share in a slowly growing market. The products in this category can generate maximum revenue because of their high market share in a market that is not growing. As such, the Cash cow products require the least amount of investment while it has the potential to give higher returns, which helps enhance the company’s overall profitability.

- Stars: This quadrant represents products with a low market share in a high growth rate market. As such, an organization faces steep competition for the products in this segment, and thus it can’t afford to be complacent even when it is among the top few. However, if the organization can plan properly, Star products can potentially become Cash cows in the longer term.

- Question Marks: This quadrant represents those products that may have a high market share in a market that is growing fast. However, it is not sure whether the market for the product will go up or down in the future. If the product loses customer attention, it won’t be able to gain market share, the growth rate will fall, and the product will eventually become a Dog. On the other hand, if the product can grab more customer interest to gain a higher market share, it can become a Cash cow. This uncertainty results in the dilemma of investing more money into it. An organization is unsure if the investment will give adequate returns or become a waste of money.

- Dogs: This quadrant represents products with a low market share in a slowly growing market. Hence, these products neither require higher investments nor generate high returns. Consequently, these products have an adverse impact on the overall profitability, and thus it is advisable not to invest any more in products from this segment. However, sometimes companies decide to revamp these products to make them saleable again, and in this way, they also increase their market share.

Product Portfolio Analysis

The process of product portfolio analysis help organizations to focus on products that operate in a fast moving market faster while at the same time reducing investments in failing products. An organization analyzes the entire product offering to understand how each product performs in the market. Based on the analysis, a clearly defined matrix can be constructed that provides useful insight into the current market position, which is used to build future strategies.

For instance, for Apple Inc., the iPhone is the most profitable segment and mostly drives the company’s top-line. Hence, the iPhone segment can categorize as the company’s Star product. On the other hand, the MacBook and the iPad can categorize as Cash cows.

How to Manage a Product Portfolio?

Product portfolio management is an important part of any business strategy as it helps achieve the organization’s overall objectives by planning future tactics for different product lines. Below, we discuss some of the strategy for the above-mentioned product categories:

- Cash Cows: Companies intend to retain their market share for this segment as it isn’t growing much. They introduce customer loyalty programs and similar promotions to ensure high customer retention.

- Stars: Companies undertake various sales promotion and advertising strategies for this segment to beat the high competition and increase market share. The investments are primarily focused on marketing activities.

- Question Marks: For this segment, the best strategy is to acquire new customers so that the question marks can be converted to the stars or the cash cows. Also, it is important to monitor the market to understand consumer psychology, which can be used to enhance the market share for the products in this category.

- Dogs: For this segment, the companies may need to take the hard decision of divestment. Otherwise, they can also revamp the products in this category through rebranding, innovation, etc. Nevertheless, converting the Dogs into Stars or Cash cows is difficult.

Key Takeaways

- The product portfolio is the ensemble of a company’s product offerings, which can break down into different product categories, product lines, or simply individual products.

- Based on the relative market share and the expected market growth rate, a company’s product offerings can be divided into four categories – Cash cows, Stars, Question marks, and Dogs.

- Product portfolio analysis and management help a company achieve its increased sales and profits objectives.

Recommended Articles

This is a guide to Product Portfolio. Here we also discuss the introduction and how to manage a product portfolio. Along with key takeaways. You may also have a look at the following articles to learn more –