What Is a Performance Bond?

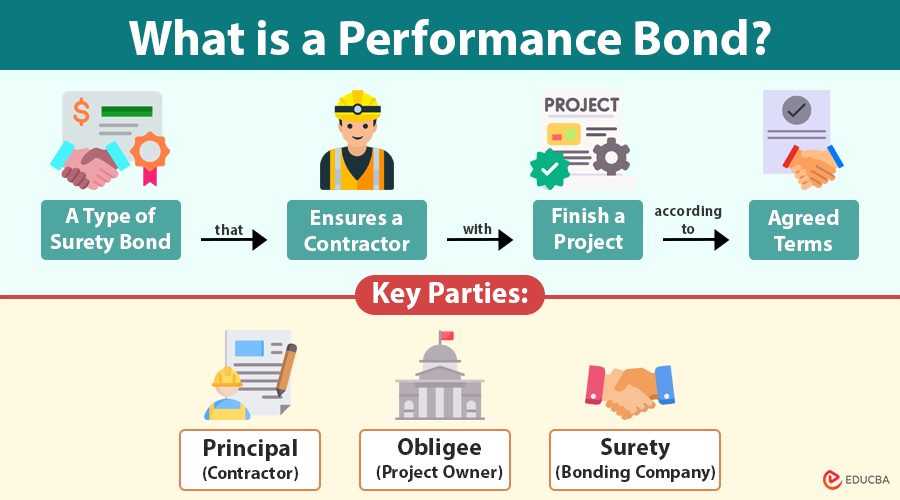

A performance bond is a type of surety bond that ensures a contractor will finish a project according to the agreed terms. If the contractor defaults, due to delay, insolvency, or poor workmanship, the surety company pays the project owner or arranges for the project to be completed at no extra cost.

For example, a contractor wins a $10 million road construction contract with a performance bond. Midway, the contractor goes bankrupt. The surety either hires a new contractor or pays up to $10 million to complete the project.

The global surety bond market, including performance bonds, was worth about $16 billion in 2021 and is expected to grow to $27 billion by 2030, with an average yearly growth rate of 5.8%.

Table of Contents

- Meaning

- Key Parties

- Importance

- How Does it Work?

- Types

- Performance Bond vs. Other Bonds

- Cost

- Public vs. Private Projects

- Benefits

- Challenges and Considerations

Key Parties in a Performance Bond

Understanding the roles of each party helps clarify how performance bonds function:

1. Principal (Contractor)

This is the entity or individual responsible for executing the contract. They are the ones who purchase the bond to assure the client of their performance. If they default, they must reimburse the surety.

2. Obligee (Project Owner)

The obligee is the beneficiary of the bond. A private company, public sector organization, or individual client may require assurance that the contractor will complete the work satisfactorily.

3. Surety (Bonding Company)

The surety is usually a bank or an insurance company that underwrites the bond. It performs a thorough review of the principal’s financial strength, history, and capability before issuing the bond. If the principal fails, the surety must step in to resolve the issue, financially or operationally.

These three-party agreements are different from traditional insurance policies, which typically involve only two parties (insurer and insured).

Why Are Performance Bonds Important?

Performance bonds offer multi-dimensional protection:

- Risk mitigation: They protect project owners from financial losses due to non-performance or delay.

- Trust and credibility: They signal that the contractor is financially stable and competent.

- Compliance assurance: Government and public sector contracts often mandate bonds to ensure transparency and prevent fraud.

- Project continuity: In the event of default, the surety may bring in another contractor or provide financial compensation to avoid halting the project.

Without performance bonds, obligees could face expensive legal battles or prolonged downtime in case of default. For the contractor, being bondable is often essential to bid on high-value or government-funded projects.

How Performance Bonds Work?

The bond process follows these steps:

1. Bond Requirement Stated in Contract

Before a project begins, the obligee typically includes a performance bond clause in the contract documents, often requiring it as a condition for project initiation.

2. Bond Application and Underwriting

The contractor applies for the bond through a surety provider. The surety conducts rigorous due diligence, including:

- Credit score and financial statement review

- Evaluation of past project performance

- Analysis of project risks and technical complexity

3. Bond Issuance

If the contractor qualifies, the surety issues the bond, usually for 100% of the contract value.

4. Project Execution

The contractor proceeds with the project. If the contractor fulfills all contract terms, the surety company voids the bond at project completion.

5. Breach or Default

If the contractor fails due to abandonment, insolvency, or substandard work, the obligee files a claim.

6. Surety’s Intervention

The surety investigates and may:

- Pay damages up to the bond amount.

- Hire another contractor to complete the work.

- Work with the principal to correct deficiencies.

This structured process ensures that the obligee is not left stranded in case of contractor failure.

Types of Performance Bonds

Performance bonds differ based on the type of project or contract:

1. Construction Performance Bond

Contractors most commonly use this type in building projects. It ensures the general contractor delivers the project as per specifications, within time, scope, and budget.

Used by:

- Federal and municipal governments

- Real estate developers

- Infrastructure agencies

2. Supply Performance Bond

Applicable when the contract involves the timely delivery of goods or materials (e.g., machinery, steel, medical supplies). It ensures the supplier meets the delivery timelines and quality requirements.

3. Service Performance Bond

Used in contracts for services like security, IT, janitorial, landscaping, or consulting. It ensures the service provider performs duties as promised and to agreed standards.

4. Subcontractor Performance Bond

Obtained by general contractors to protect against subcontractor failure. Especially useful when the subcontractor’s role is crucial to the project’s timeline or structural integrity.

Each type addresses specific risks and obligations, tailored to different industries and use cases.

Performance Bond vs. Other Bonds

Surety companies often issue performance bonds alongside other related surety instruments. Here is a comparison:

| Bond Type | Function |

| Performance Bond | Ensures the contractor completes the project as per terms |

| Bid Bond | Guarantees the contractor will accept the contract if awarded |

| Payment Bond | Ensures subcontractors, laborers, and suppliers are paid |

| Maintenance Bond | Covers repairs for defects that arise post-completion |

| Advance Payment Bond | Protects the client if the contractor misuses upfront payments |

Most large contracts require a bundle of bonds to safeguard project interests fully.

Cost of a Performance Bond

Bond providers typically calculate the cost, or premium, for a performance bond as a percentage of the total contract value:

- Range: 0.5% to 3% (common range)

- Factors Influencing Cost:

- Contractor’s credit score and financial health

- Nature and size of the project

- Project duration and location

- Bonding capacity and past claims record

For example:

- A $1 million project with a 1% bond rate will have a $10,000 bond premium.

- The surety company may charge higher rates or deny bonding altogether if it evaluates the contractor as financially weak or the project as high-risk.

The contractor usually pays this cost upfront or includes it in their bid.

Performance Bonds in Public vs. Private Projects

Public Projects

Governments often mandate performance bonds to protect taxpayer money and ensure the responsible use of funds.

- S. Example: The Miller Act requires performance bonds for federal construction contracts exceeding $150,000.

- State Laws: Most U.S. states have “Little Miller Acts” with similar provisions.

Private Projects

Though the law does not always require them, private project owners increasingly use performance bonds to:

- Protect investors and lenders

- Increase project transparency

- Attract reliable contractors.

In real estate, large commercial developments often insist on performance bonds to safeguard timelines and budgets.

Benefits of Performance Bonds

For Project Owners (Obligees)

- Peace of mind: Knowing there is a financial safety net

- Assured completion: Prevents project abandonment

- Professionalism filter: Only credible, vetted contractors qualify for bonding

For Contractors (Principals)

- Competitive edge: Bonding capacity makes you eligible for larger contracts

- Credibility signal: Shows financial stability and proven capability

- Relationship building: Builds long-term trust with clients and sureties

Bonds create a win-win dynamic that aligns interests and elevates standards.

Challenges and Considerations

While beneficial, it comes with practical considerations:

- Underwriting hurdles: Contractors with poor credit or a lack of experience may not qualify.

- Claims disputes: Determining fault in performance failures can involve legal battles.

- Bond limits: Contractors can only be bonded up to a certain value (aggregate limit), restricting the number of projects they can handle simultaneously.

- Documentation: Bond applications require detailed financials, tax returns, and corporate disclosures.

Contractors should manage cash flow and maintain a strong financial profile to secure bonding consistently.

Final Thoughts

Performance bonds are powerful instruments that uphold trust, accountability, and reliability in contractual relationships. They reduce financial risk, ensure project completion, and serve as a benchmark of professional credibility. Whether in construction, supply, or services, performance bonds are increasingly indispensable in both public and private projects.

By understanding how these bonds work, stakeholders can better protect their interests and foster successful project outcomes.

Frequently Asked Questions (FAQs)

Q1: Is a performance bond refundable?

Answer: No. The surety company issues the bond, receives the premium, and keeps the cost, even if no one files a claim.

Q2: Can a contractor get multiple performance bonds?

Answer: Yes, but they can do so only up to their bonding capacity, which the surety determines based on the contractor’s financial strength and project history.

Q3: What happens if the surety fails to fulfill the bond?

Answer: Surety companies are regulated and typically well-capitalized. However, obligees should choose contractors who work with reputable, licensed sureties.

Recommended Articles

We hope this guide on performance bonds was helpful. Explore related articles on contract risk management, surety bonds, and securing government projects.