Difference Between Pension vs Annuity

Pension and Annuity are funding schemes or plans after retirement. There are many pension schemes available in the market, and they all aim to help you save money and provide you with an income when you are older. Let’s discuss Pension vs Annuity in detail.

Pension

A pension is the amount of money paid regularly to a person who has retired because of having reached a certain age. A pension fund generally maintains and created by an employer for employees. When an employee works employer contributes to the pension fund, and because of this, the employee need not worry about saving while working. There is no need to create an agreement contract with the employer. If an employee has a pension employer will pay that at retirement. So it is a long-term saving plan in which a person receives tax relief on the money paid into the pension account.

Annuity

An annuity is nothing but an insurance product. You will get it by signing a contract with the insurance company. In an Annuity, a customer must purchase a contract for a certain amount of money that customers will fund through either a lump sum or periodic payments. The insurance company invests this money in a mutual fund, stock, or bond to earn income. The customer will get a regular payment from the annuity as per the agreement. It is a simple investing and income vehicle in which insurance companies invest annuity in the stock market.

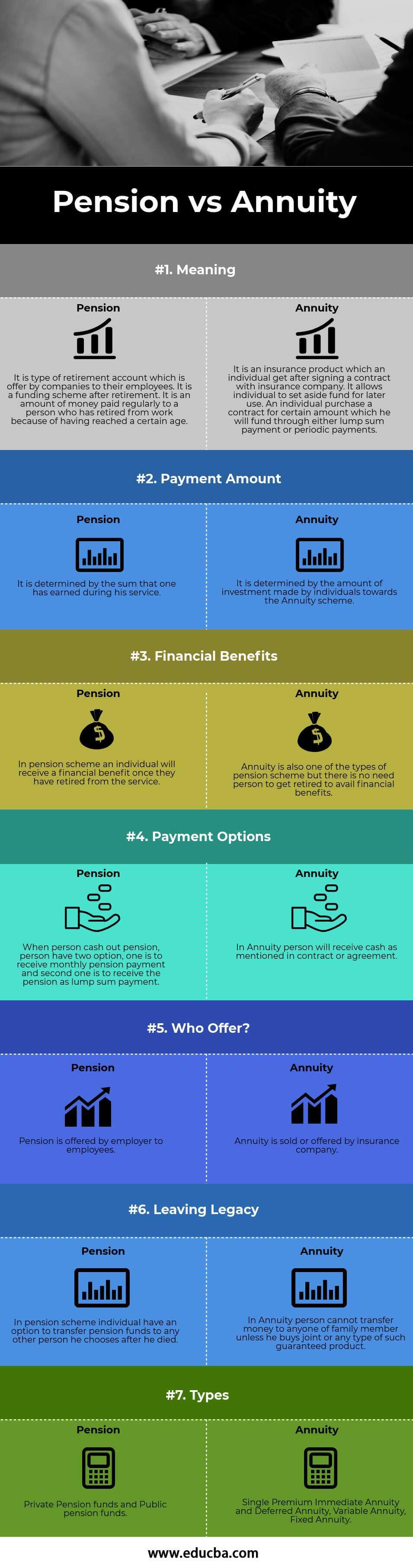

Head To Head Comparison Between Pension vs Annuity (Infographics)

Below is the top 7 difference between Pension vs Annuity

Key Differences Between Pension vs Annuity

Both Pension vs Annuity are popular choices in the market; let us discuss some of the major Difference Between Pension vs Annuity.

- An annuity is a financial scheme that will pay a set amount of cash over a defined period of time, whereas a pension is a retirement account that will pay cash after retirement from service.

- The pension amount is receivable only after retirement, whereas a person does not have to wait until retirement to get the annuity amount.

- One of the key differences is that the pension amount will depend on the total amount that a person has earned during his career. In contrast, the annuity amount depends on the amount of money invested by a person over a year.

- Any person can purchase an annuity scheme from an insurance company. In contrast, a person cannot live by a pension; an employer offers it to employees as a part of an employee’s benefits.

- The person who avails pension is generally converted into a family pension after his demise, whereas an annuity is paid to single life and joint account holder as per agreement.

- An annuity is commonly used in the financial market, whereas a pension fund is not commonly used in financial markets.

- The big advantage of an annuity is that person is the one who opens the annuity. In contrast, the pension account is opened by an employer rather than an employee or person.

- In the pension account, less transparency as compared to the annuity scheme because a person does not handle the day-to-day maintenance of the pension.

Pension vs Annuity Comparison Table

Let’s look at the top 7 Comparisons between Pension vs Annuity.

| The Basis of Comparison | Pension | Annuity |

| Meaning | Pension refers to a type of retirement account offered by companies to their employees. It is a funding scheme after retirement. It is an amount of money paid regularly to a person who has retired from work because of having reached a certain age. | An annuity is an insurance product that an individual gets after signing a contract with an insurance company. It allows individuals to set aside a fund for later use. An individual purchases a contract for a certain amount which he will fund through either lump-sum payments or periodic payments. |

| Payment Amount | It is determined by the sum that one has earned during his service. | It is determined by the amount of investment individuals make towards the Annuity scheme. |

| Financial Benefits | In a pension scheme, an individual will receive a financial benefit once they have retired from the service. | An annuity is also one of the types of pension schemes, but there is no need for compulsory retirement to avail of financial benefits. |

| Payment options | When a person cashes out a pension, a person has two options, one is to receive a monthly pension payment, and the second one is to receive the pension as a lump sum payment. | In Annuity, a person will receive cash as mentioned in the contract or agreement. |

| Who offers? | An employer offers a pension to employees. | An annuity is sold or offered by the insurance company. |

| Leaving Legacy | In a pension scheme, an individual can transfer pension funds to any other person he chooses after he dies. | In an Annuity, a person cannot transfer money to any one of the family members unless he buys a joint or any such guaranteed product. |

| Types | Private Pension Funds and Public pension funds. | Single-Premium Immediate Annuity and Deferred Annuity, Variable Annuity, Fixed Annuities. |

Conclusion

So from the analysis, it is clear that both pension vs annuity is a common source of income, and both are beneficial to the person; however, there are several differences between annuity vs pension. A pension is a retirement account that the employer offers to an employee for the employer’s benefits, and an annuity is an insurance product that a person gets by purchasing a contract. An annuity is a financial asset that pays a set amount of cash over a period of time, and a pension is a benefit that a person avails after they have retired (after completing the age limit) from work.

The pension amount is the total money one has earned during his work career, and an employer invests that money. The annuity amount is the money a person puts in the annuity account or scheme. The insurance company invests annuity money in mutual funds, stocks, and bonds. The annuity has one potential disadvantage: it incurs additional fees and commissions because the insurance company invests money in the stock market. Hence, they charge some fees for the maintenance of money.

Recommended Articles

This has been a guide to the top difference between Pension vs Annuity. Here, we also discuss the Pension vs Annuity key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.