Updated July 14, 2023

Introduction of Owner’s Equity

Owner’s equity is the amount of investment made by the owner into the business together with the net profit or loss earned till date and withdrawal of capital, if any, made during the year.

The net amount represents the owner’s stake in the business’s total capital, which the business has to pay back to the owner after the closure of the same.

Explanation

- “Owner’s Equity” is a commonly used terminology for sole proprietors. However, nowadays, corporates also utilize this term.

- Owner’s equity is the set of account balances that have cumulative account balances of contributions to date, withdrawals till date, and earnings till date.

- Contributions are the amounts of investments made till date & it is a positive figure appearing in the list of ledgers. Withdrawals mean a reduction of the stake in the owner’s equity & it is a negative figure.

- Earnings represent the profit or loss earned till date.

- It is calculated on a specific date since it is a part of the balance sheet.

The Formula of Owner Equity

- Owner’s equity is a representation of several components within it. There are two ways to calculate the same. But we will specify the most famous method of calculating the owner’s equity.

- All assets include property values, plant & equipment, inventory, trade receivables, bank balances, cash balances, etc. All outside liabilities include trade payables, outstanding expenses (salary, electricity, or other recurring expenses), non-current liabilities, etc.

Example of Owner Equity

Let’s take an example of how owner’s equity is calculated:

| Particulars | Amount ($) |

| Property Plant & Equipment | 450,000 |

| Intangible Assets | 65,000 |

| Trade Receivables | 250,000 |

| Bank Balance | 70,000 |

| Loan liability taken | 50,000 |

| Inventory | 120,000 |

| Loans & Advances to others | 45,000 |

| Other current assets | 15,000 |

| Trade payables | 46,000 |

| Deferred Tax Liability | 15,000 |

| Provisions | 35,000 |

| Tax liabilities | 15,000 |

Solution:

| Particulars | Amount ($) |

| Assets: | |

| Property Plant & Equipment | 350,000 |

| Intangible Assets | 65,000 |

| Trade Receivables | 60,000 |

| Bank Balance | 70,000 |

| Inventory | 120,000 |

| Loans & Advances to others | 45,000 |

| Other current assets | 15,000 |

| Subtotal (A) | 725,000 |

| Liabilities: | |

| Trade payables | 146,000 |

| Deferred Tax Liability | 15,000 |

| Provisions | 35,000 |

| Tax liabilities | 15,000 |

| Loan liability taken | 150,000 |

| Subtotal (B) | 361,000 |

| Owner’s Equity (A-B) | 364,000 |

Explanation: We can ask for the breakup of the owner’s equity. Because the amount is nothing balancing figure, it can be derived by investigating the information. We can say that the amount of $ 364,000 includes the following:

| Equity Capital (10,000 * $ 10) | 100,000 |

| Securities Premium (10,000 * $ 5) | 50,000 |

| Retained Earnings | 219,000 |

| Treasury Stock (500*10) | -5,000 |

| Total | 364,000 |

Components of Owner Equity

Components of Owner Equity are given below:

- Share Capital: This account represents the face value or par value of shares issued to the shareholders/owners of the business. It may happen that the 10,000 shares are issued for $ 50 per share, but the face value is $ 10 per share. In this case, $ 100,000 is the share capital. This account balance excludes the shares repurchased by the company since the same is accounted for separately.

- Additional Paid-In Capital: This represents the additional amount of issued capital. As per the above example, we issue 10,000 shares for $ 50. The additional paid-in capital, in this case, is $ 50 – $ 10 = $ 40 per share. The amount will be $ 400,000.

- Treasury Stock: This represents the amount of share capital bought back or repurchased by the company from the existing shareholders. It is shown as a negative figure in the ledger balances of the Owner’s equity.

- Retained Earnings: This represents the amount earned by the company to date but not distributed as a dividend. Thus, retained earnings mean those that have not been distributed but have been retained for the business. The amount is usually distributed to the owners only when a company does not foresee any big opportunity to use the money & increase the value of the money.

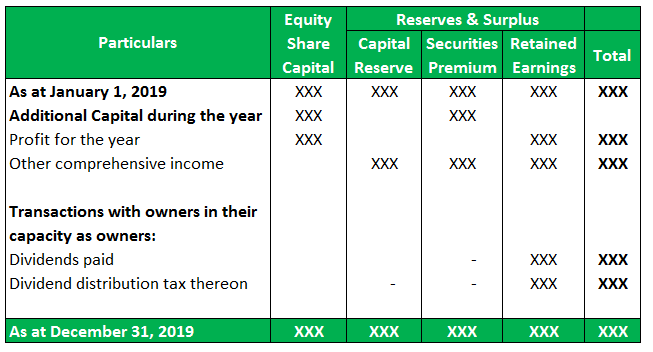

Let’s have a look over the statement of owner’s equity:

The above format may also be called a statement of changes in equity (SOCE). It is prepared at the end of the year & reflected in the balance sheet.

Owner’s Equity in Balance Sheet

- The balance in the owner’s equity is presented in the company’s balance sheet at the end of the reporting period.

- As mentioned in the above format, owner’s equity is the accumulated balance of equity share capital, capital reserve, securities premium & retained earnings.

- It can be cross-checked with total assets less total liabilities as of the said date.

- In the case of sole proprietorship businesses, the owner’s equity is nothing but the amount invested till date plus profits earned till date, and fewer withdrawals made, if any. In the case of the partnership business, the said account is maintained for each partner. In either case, the capital is represented on the left side of the balance sheet.

Advantages of Owner’s Equity

Some of the advantages of owners equity are given below:

- Infusion of new capital: The welcoming thing about owner’s equity is that it is subdivided between the owners or partners in the business. The stake can sell to new owners or add new partners to the business. There are no big restrictions on the new infusion of capital until it becomes a corporate entity. New partners mean more expansion of the expertise of the firm.

- Ownership is not a liability: Since owner’s equity is not a liability, you do not have to pay interest on the same as we do for debt capital. There is no financing cost which may become a liability for the business. However, you may pay a fixed dividend for preference capital; optionally, you may pay a dividend to equity shareholders.

- Lower risk: If a business depends on equity than the external parties like debt, it is called a self-reliant business. In case of liquidation of the business, the creditors may file a case for bankruptcy, but owners will never do the same. Thus, finance providers perceive larger equity with a lower risk of default.

Disadvantages of Owner’s Equity

Usually, there cannot be any disadvantage to having owner’s equity in the balance sheet. However, from different angles, we can specify the following points as disadvantages:

- Dilution of Ownership: We like the infusion of new capital. But this usually happens in the case of corporate entities wherein the share or stake of the main owner (who started the business) reduces as and when new investors come into the business. This reduction of own share percentage refers to dilution of ownership. Equity capital is associated with voting rights. More dilution of stake means the control is divided into many hands. In such a situation, every proposal needs the approval of a majority of the owners. This delays the decision of the management. Thus, an increase in owners equity means a reduction in percentage holding & thus, a proportionate reduction in the control.

- Cost of Equity: Equity capital does not require any interest payment, but since the owners are taking a substantial risk, they expect an overall return from the business. This expectation cost is way higher than the interest cost of debt capital.

- Rate of Change in Capital: Finance providers compare how the total capital has moved in the past years. The increasing trend represents the company’s profitable business & reflects the strategies used by the owners. However, the decreasing trend represents losses. Finance providers may perceive this as a bad signal and avoid providing the credit line.

On a concluding thought, we can say that owner’s equity is the owners’ money, which grows only if the business flourishes. So, the owners have to only focus on increasing the business & controlling the costs. Easier said than done & this is the toughest thing in the economy. Because owners are exposed to ample risks like industry, product, finance, etc., they have to deal with all to flourish the venture.

Recommended Articles

This is a guide to Owner’s Equity. Here we also discuss the introduction and components of owner equity, advantages, and disadvantages. You may also have a look at the following articles to learn more –