A Guide to Open a Free Demat Account

Every year, millions of new investors join the Indian stock market, which has seen unheard-of expansion. To participate in this growing opportunity, investors must have a demat account, which acts as a digital vault for securely holding stocks, bonds, and mutual funds. For beginners, the first step toward building long-term wealth is to open a free demat account. This in-depth article covers five essential aspects of the free demat account opening process to help you make informed decisions and smoothly begin your investment journey.

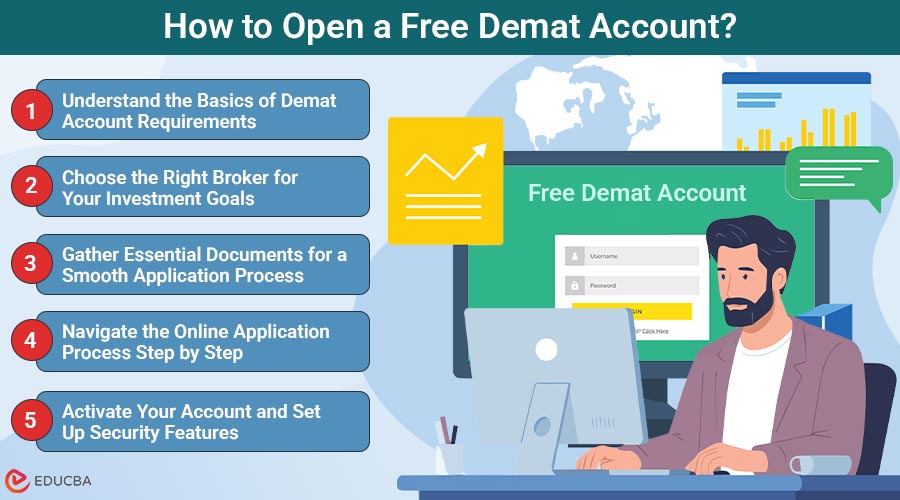

How to Open a Free Demat Account?

Opening a demat account is simple if you follow the right steps. Here is a clear breakdown of the process:

1. Understand the Basics of Demat Account Requirements

Before starting the application process, it is essential to understand what a demat account is and the documents or requirements needed to access the service. A demat account, which means a dematerialized account, is an electronic representation of your physical share certificates. Hence, trading in demat is safer and faster. They typically require basic documents, such as your PAN card, Aadhaar card, bank account details, and a recent photograph of yourself, to open an account. To comply with the rules set by SEBI, most of the brokers also require proof of income and residence.

2. Choose the Right Broker for Your Investment Goals

Due to the variety of services, features, and pricing structures among different brokers, selecting the right broker is a crucial part of your investment strategy. Compare various options by analyzing their trading features, brokerage fees, research capabilities, and customer support services. Inquire among brokers offering good teaching resources, especially when you are new. Consider factors that may increase your future profits, such as transaction costs, account maintenance fees, and other hidden expenses. Customer reviews and regulatory compliance are also factors that can help a person make an informed choice.

3. Gather Essential Documents for a Smooth Application Process

Good documentation is the foundation for establishing a procedure in a well-maintained demat account, and bringing all the required documents along will significantly facilitate your application. Ensure that your Aadhaar and PAN cards are linked, and that the latest details are present on these cards. To show proof of income, bring in recent income tax returns, wage stubs, or bank statements. Be prepared with canceled checks and passport-sized photos. Confirm the specific requirements beforehand to avoid being locked out after opening an account, as certain brokers may require additional documents to verify the address, such as utility bills.

4. Navigate the Online Application Process Step by Step

Investors can now open demat accounts from the comfort of their own homes in just a few minutes, thanks to the digital application process. To begin, visit the website of your preferred broker and select the ‘Create an Account’ section. Provide correct contact, financial, and personal information on the application form. Upload all necessary documents as crisp, high-quality scanned versions. Complete the face-to-face confirmation process, which is typically done by visiting the nearest branch or through video calls. Review all information to eliminate errors, delays, and the risk of rejection.

5. Activate Your Account and Set Up Security Features

As soon as your application is accepted, you will be able to start your investing experience by receiving account information and a login. To ensure more security, replace default passwords as soon as possible and enable two-factor authentication. Investigate the trading platform’s potential and download the broker’s mobile app. Link your bank account to enable easy money transfers and ensure all personal information is accurate.

Final Thoughts

To invest in the Indian stock market, the first step is to open a free NRI demat account. The process is quick, secure, and entirely online. By selecting the right broker, keeping your documents organized, and understanding the application process, you can start your investing journey with confidence. With patience, consistency, and informed decisions, smart investing can gradually build your wealth over time.

Recommended Articles

We hope this guide on how to open a free demat account helps you start your investment journey with ease and confidence. Explore the recommended articles to learn more about stock market basics and smart trading tips.