The Heartbeat of Global Trading

For traders on platforms like iForex.in, few events generate as much adrenaline as the release of the NFP. Understanding this report can mean the difference between calculated profit and risking your account. This guide covers everything a trader needs to know about NFP trading.

1. What is NFP?

NFP stands for Non-Farm Payroll. It is a key economic indicator published by the U.S. Bureau of Labor Statistics (BLS). It measures the number of workers in the U.S., excluding:

- Farm workers

- Private household employees

- Non-profit organization employees

Why it matters:

The U.S. has the largest economy in the world. Consumer spending drives 70% of that economy. If people have jobs (high NFP), they spend money, the economy grows, and the USD usually strengthens.

When and How to Use NFP Trading Data?

When:

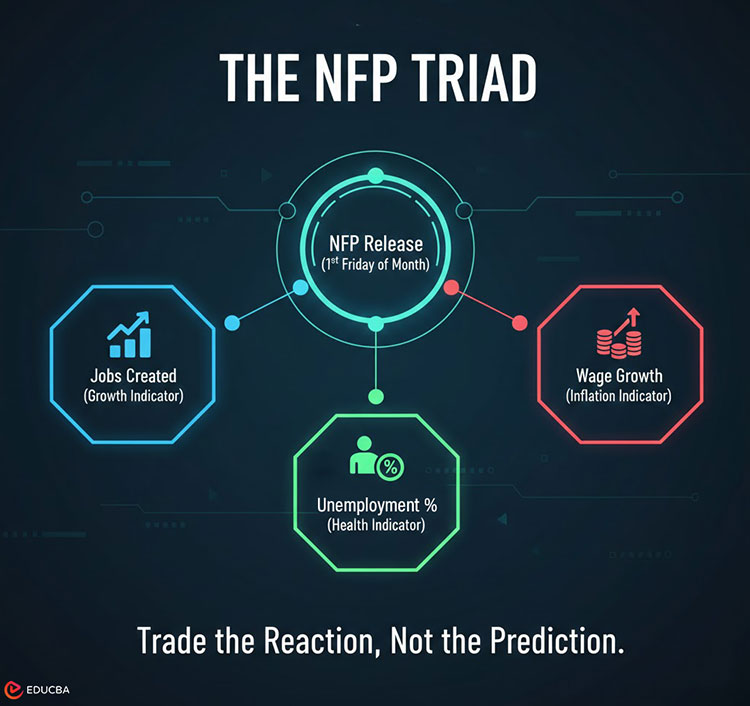

It is released on the first Friday of each month at 8:30 a.m. EST (7:00 PM IST during daylight saving time or 7:30 PM IST in winter).

How:

Traders compare the Actual figure against the Forecast (consensus).

- Actual > Forecast: Usually Bullish for USD.

- Actual < Forecast: Usually Bearish for USD.

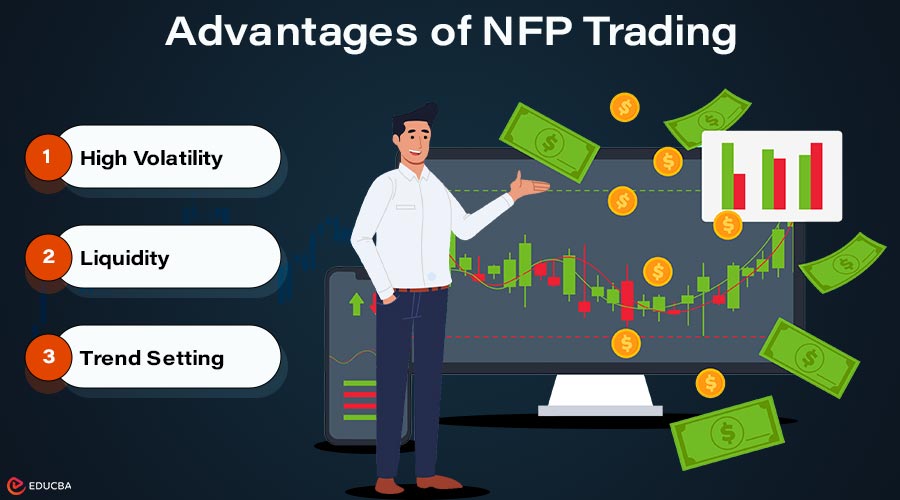

Advantages of NFP Trading

NFP trading offers several key benefits that attract both short-term and experienced Forex traders:

- High Volatility: The NFP full form can move pairs like EUR/USD by 50–100 pips in minutes, offering huge profit potential.

- Liquidity: Because the entire world participates, trading volume stays high, and orders fill quickly.

- Trend Setting: The NFP often sets the tone for the USD for the entire month.

Compliance and Risk Management

Trading NFP is high-risk. From a compliance and safety standpoint:

- Slippage: During the release, prices move so fast that your “Stop Loss” might be skipped.

- Margin Calls: High volatility can wipe out under-capitalized accounts.

- Regulatory Note: In India, ensure you trade through reputable platforms that comply with FEMA (Foreign Exchange Management Act) regulations for currency pairs.

Assets Affected by NFP Trading

NFP does not just affect the Dollar; it creates a ripple effect across:

- Major Pairs: EUR/USD, USD/JPY, GBP/USD.

- Commodities: Gold (XAU/USD) usually moves inversely to the USD.

- Indices: US30 (Dow Jones) and NAS100.

Tips for Beginner Traders in India

For a beginner in India starting on a platform like iForex.in, the NFP release happens right during the evening session.

- Avoid the “Initial Spike”: The first 5–10 minutes are often “fake-outs.” Prices may spike up and then crash.

- The 15-Minute Rule: Wait 15 minutes after the release to see which way the trend settles before entering.

- Check the “Average Hourly Earnings”: Sometimes the NFP number is good, but if wages are down, the USD might actually drop.

Key Metrics for Successful NFP Trading

To master NFP, watch these three metrics together:

- NFP Number: The raw job growth.

- Unemployment Rate: The percentage of the labor force without jobs.

- Average Hourly Earnings: This measures inflation. If wages rise, the Federal Reserve might raise interest rates, which would be very bullish for the USD.

Final Thoughts

The NFP is the “Granddaddy” of economic news. For Indian traders, it provides a perfect window of volatility during the evening. However, the most successful traders do not gamble on the number; they wait for the market to reveal its direction and then follow the momentum. Mastering NFP trading is about preparation, patience, and precise execution.

Recommended Articles

We hope this comprehensive guide to NFP trading helps you better understand market volatility and make informed trading decisions. Check out these recommended articles for more expert tips to strengthen your forex trading success.