Updated October 31, 2023

Difference Between Monetary Policy vs Fiscal Policy

The monetary authority announces monetary policies. The Ministry of Finance announces fiscal policies. In Monetary Policy, central banks try to control the money supply and credit availability through various tools. On the other hand, Fiscal Policy guidance is provided on govt. Revenue and expenditure (revenue and capital expenditure). On the other hand, the Fiscal Policy provides several incentives to increase disposable income. It may also reduce spending to contain growth.

Let us study more about the differences in detail:

In this article, we will understand both policies in detail and determine how to compute them. The cost of credit is relatively cheaper/costlier depending on the economic situation for Monetary Policy, on the one hand. We will also examine the comparative analysis between Monetary Policy and Fiscal Policy.

Without any ado, let’s get started with the head-to-head difference between monetary policy vs Fiscal Policy first. Then, we will talk about each of the policies separately.

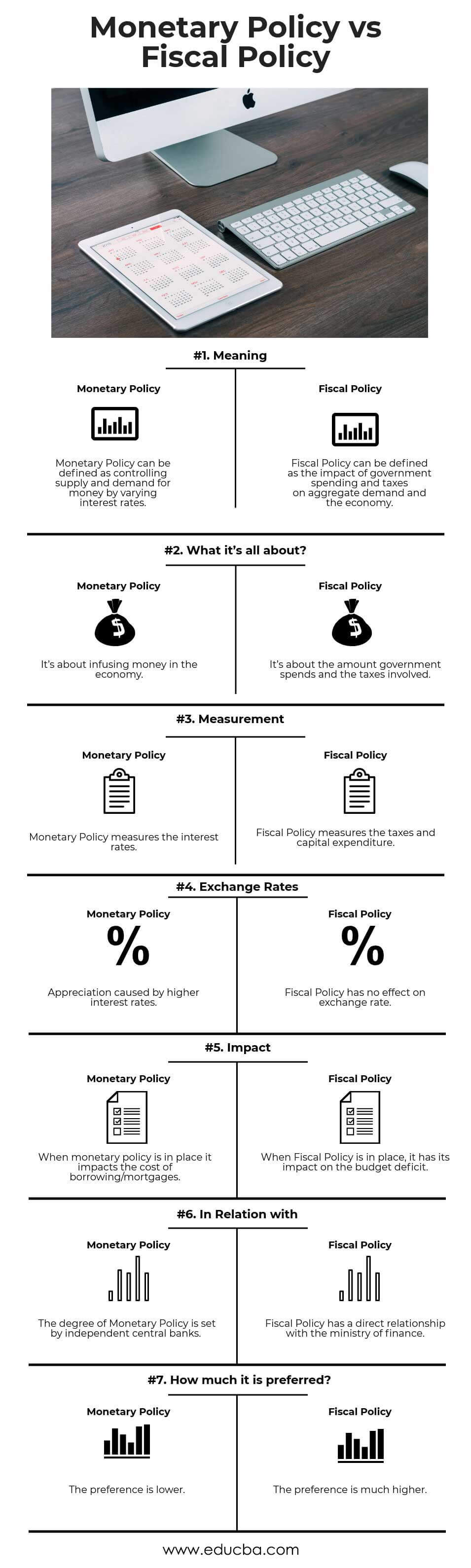

Monetary Policy vs Fiscal Policy Infographics

Below are the top 7 differences:

Key Difference Between Monetary Policy vs Fiscal Policy

Both are popular choices in the market; let us discuss some of the major differences :

- Monetary Policy is mainly changing interest rates; for example, if central banks like the US Federal Reserve feel that inflation is increasing and the economy is growing quickly, they will increase interest rates to reduce demand. Fiscal Policy, on the other hand, is the ability of the government to control demands by expenditure and taxes; for instance, if there is an increase in the fiscal deficit, it requires a government to borrow more.

- Monetary Policy is with context to the interest rates. Fiscal Policy is related to the revenue and capital expenditure of the government.

- Monetary Policy is also a credit policy where interest rate changes and monetary measures are communicated through central banks. Fiscal policy provides several incentives to increase disposable income.

- Fiscal policies are of two types: expansionary and contractionary; the former is where the government reduces taxes and increases public spending, while the latter is to increase taxes and reduce public expenditure.

- Similarly, if the money supply is increased along with decreasing the interest rates is known as expansionary monetary policy. In contrast, with a decrease in money supply and a rise in interest rates, the policy is regarded as a contractionary monetary policy.

- Monetary Policy is not given as much preference. Fiscal Policy is given much more preference by countries during recessions.

Monetary Policy vs Fiscal Policy Comparison Table

As you can see, there are many differences. Let’s look at the top difference between both –

| The Basis of Comparison | Monetary Policy | Fiscal Policy |

| Meaning | Monetary Policy can be defined as controlling supply and demand for money by varying interest rates. | Fiscal Policy can be defined as the impact of government spending and taxes on aggregate demand and the economy. |

| What it’s all about? | It’s about infusing money into the economy. | It’s about the amount the government spends and the taxes involved. |

| Measurement | Monetary Policy measures the interest rates. | Fiscal Policy measures taxes and capital expenditure. |

| Exchange Rates | Higher interest rates cause appreciation. | Fiscal Policy has no effect on an exchange rate. |

| Impact | When monetary policy is in place, it impacts the cost of borrowing/mortgages. | When Fiscal Policy is in place, it impacts the budget deficit. |

| In relation with | Independent central banks set the degree of Monetary Policy. | Fiscal Policy has a direct relationship with the Ministry of Finance. |

| How much of it is preferred? | The preference is lower. | The preference is much higher. |

Conclusion

Monetary Policy vs Fiscal Policy are both important on their terms. And with low inflation and positive economic growth, they both help create a more stable economy. Thus, the question remains: can an economy use both these policies? The answer is yes.

If an economy requires controlling the money flow, it implements the Monetary Policy. And at the same time, they can use Fiscal Policy to attain the objectives of the economy. If central banks successfully reduce interest rates, inflation and demand may increase. If Govt. successfully reduces the fiscal deficit, it works well for the economy.

Hence, using Monetary Policy vs Fiscal Policy is a great way to improve the economic condition of a country by reducing economic fluctuation and smoothening the economic cycle.

Recommended Articles

This has been a guide to Monetary Policy vs Fiscal Policy. However, here we take the difference between Monetary Policy vs Fiscal Policy with examples, infographics, and a comparison table. You may also have a look at the following articles to learn more –