What Is Macroprudential Policy?

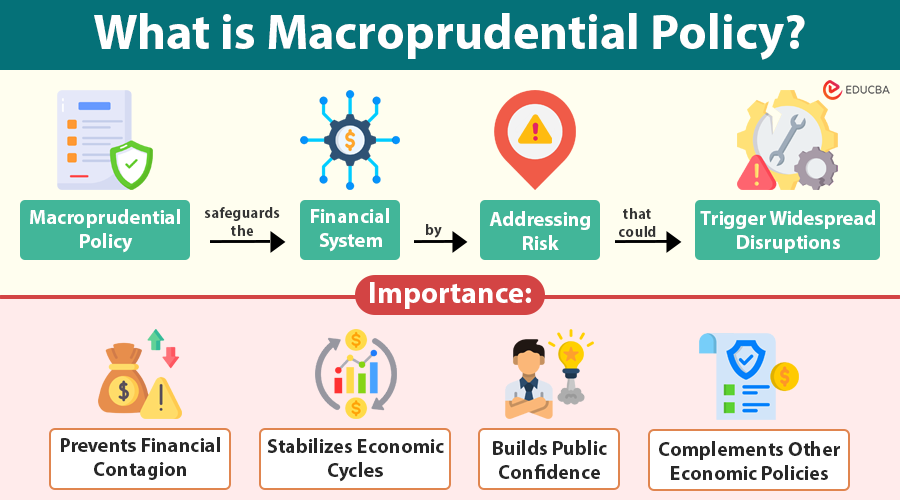

Macroprudential policy refers to a set of regulatory measures designed to safeguard the stability of the entire financial system by identifying and addressing systemic risks—the kinds of vulnerabilities that can trigger widespread economic disruptions.

Macroprudential Policy goes beyond the regulation of individual institutions (which is the domain of microprudential policy). It focuses on system-wide issues like excessive credit expansion, real estate bubbles, and the interconnectedness of banks and financial markets.

Imagine a country experiencing a housing boom, with banks aggressively lending and home prices soaring. A macroprudential policy might limit how much people can borrow to buy a house, for example, allowing loans for only 70% of the home’s value. This helps prevent buyers from taking on too much debt and reduces the chance of a housing market crash that could affect the whole financial system.

Table of Contents

- Meaning

- Characteristics

- Why is it Important?

- Objectives

- Key Tools

- Macroprudential vs. Microprudential Policy

- Implementation and Institutional Framework

- Challenges in Implementing

- Real-World Applications and Success Stories

- The Future of Macroprudential Policy

Key Takeaways

- Macroprudential policy focuses on safeguarding the entire financial system, not just individual institutions.

- It addresses systemic risks like excessive credit growth, housing bubbles, and interbank exposure.

- Key tools include capital buffers, LTV/DTI limits, and liquidity ratios, tailored to economic cycles.

- It complements monetary and fiscal policies to promote long-term financial stability.

- Successful implementation requires coordination among central banks, regulators, and international bodies.

- Challenges include timing, regulatory arbitrage, and political resistance, but its role is growing with evolving financial risks.

Characteristics of Macroprudential Policy

- Systemic focus: It looks at the big picture rather than individual components.

- Dynamic approach: Adjusts policies depending on the phase of the economic cycle.

- Preventive measures: Aims to prevent crises rather than just reacting to them.

- Inter-institutional coordination: Involves cooperation among regulators, central banks, and international bodies.

Why Is Macroprudential Policy Important?

The importance of macroprudential policy lies in its ability to prevent crises and protect economies from the domino effects of systemic failures. The 2008 financial crisis showed that the failure of a few connected financial institutions could cause the entire global financial system to crash.

1. Prevents Financial Contagion

One bank’s failure can quickly spread through the system due to complex interdependencies. Regulators minimize such vulnerabilities through stress testing and exposure limits.

2. Stabilizes Economic Cycles

Uncontrolled credit booms often lead to unsustainable growth and eventual crashes. Macroprudential policies manage leverage and credit expansion during good times to prevent painful corrections.

3. Builds Public Confidence

By actively monitoring and managing systemic risks, regulators enhance confidence in the financial system, encouraging responsible investment and lending.

4. Complements Other Economic Policies

It works alongside monetary policy (interest rate changes) and fiscal policy (government spending and taxation) to ensure overall economic stability.

Objectives of Macroprudential Policy

Macroprudential policymakers set clear and connected goals to make the financial system stronger and more stable.

1. Mitigate Systemic Risk

Systemic risk means that if one bank or part of the financial system fails, it can cause problems across the whole economy. Macroprudential tools monitor such risk clusters and implement buffers to limit their effect.

2. Reduce Procyclicality

Financial institutions often behave in procyclical ways—lending more during booms and pulling back during busts—thereby amplifying economic fluctuations. Macroprudential policies help moderate this behavior, for instance, by increasing capital requirements in good times.

3. Curb Excessive Leverage and Risk-Taking

Institutions may take on excessive leverage during economic expansions. Through tools like the leverage ratio and countercyclical capital buffer, macroprudential policy aims to contain such practices.

4. Strengthen Institutional Resilience

Macroprudential policy ensures that institutions build capital and liquidity buffers, adopt better risk governance, and prepare for adverse scenarios through simulation and stress testing.

Key Tools of Macroprudential Policy

Macroprudential regulators use a variety of instruments to limit systemic risks. Policymakers categorize these tools into structural and cyclical (time-varying) measures.

A. Structural Tools

These are permanent measures aimed at correcting long-term vulnerabilities and strengthening the core of the financial system.

1. Capital Surcharges for SIFIs

Systemically Important Financial Institutions (SIFIs) are required to hold additional capital because their failure could disrupt the entire economy. This disincentivizes risk-taking and encourages stronger governance.

2. Interbank Exposure Limits

Regulators limit how much banks can lend to or borrow from one another to avoid strong links between them that could spread problems during a financial crisis.

3. Leverage Ratio

A non-risk-based measure that caps the total amount of leverage a bank can take on, ensuring a baseline of financial stability regardless of asset risk levels.

4. Liquidity Coverage Ratio (LCR)

Banks keep a reserve of top-quality liquid assets that they can easily turn into cash during tough times.

B. Cyclical (Time-Varying) Tools

These tools are designed to be adjusted according to the economic cycle—tightened during booms and relaxed during busts.

1. Countercyclical Capital Buffer (CCyB)

Requires banks to hold extra capital during periods of excessive credit growth. This helps absorb future losses and smooths credit supply in downturns.

2. Loan-to-Value (LTV) Ratio

Caps the amount of a loan relative to the value of the collateral. For example, a 70% LTV means a borrower must contribute 30% equity. This reduces risk during property booms.

3. Debt-to-Income (DTI) Ratio

Limits borrowing to a percentage of a borrower’s income, ensuring loans remain serviceable even in times of stress.

4. Sectoral Capital Requirements

Higher capital requirements can be imposed on specific high-risk sectors (like real estate, construction, or unsecured consumer credit).

5. Dynamic Provisioning

Encourages banks to set aside reserves based on expected losses, not just actual ones. This cushions banks in downturns.

Macroprudential vs. Microprudential Policy

Both policies serve to strengthen financial stability, but they differ in scope, focus, and methodology.

| Feature | Macroprudential Policy | Microprudential Policy |

| Focus | Financial system as a whole | Individual institutions |

| Goal | Prevent systemic crises | Prevent institution-specific failures |

| Approach | Top-down, system-oriented | Bottom-up, firm-specific |

| Time Horizon | Medium to long-term | Short to medium-term |

| Tools | CCyB, LTV caps, SIFI surcharges | Capital adequacy ratios, risk weights |

| Responsibility | Central banks, financial stability boards | Financial regulatory authorities |

Implementation and Institutional Framework

Effective macroprudential policy depends on a strong institutional framework. The coordination between central banks, finance ministries, and regulatory agencies is essential.

Key Institutions

- Central banks: Often lead macroprudential policy due to their systemic oversight and control over monetary policy.

- Financial Stability Committees (FSCs): Inter-agency bodies that coordinate policy decisions and risk assessments.

- International bodies: Institutions like the IMF, FSB, and Basel Committee guide international standards and best practices.

Country Examples

- United States: The Financial Stability Oversight Council (FSOC) monitors systemic risk.

- United Kingdom: The Financial Policy Committee (FPC) within the Bank of England sets macroprudential policy.

- India: The Financial Stability and Development Council (FSDC) is the apex body.

Challenges in Implementing Macroprudential Policy

Despite its benefits, macroprudential policy faces several practical and political challenges.

1. Complex Risk Identification

Systemic risks often hide beneath the surface or develop gradually over time. Shadow banking, fintech, and international exposure create blind spots.

2. Timing and Calibration

Implementing tools too late or too early may either overburden the economy or fail to prevent crises. Properly timing measures like capital buffers is a constant challenge.

3. Regulatory Arbitrage

Financial firms may find ways around regulations, shifting risky activities to less-regulated sectors (e.g., shadow banking, offshore markets).

4. Coordination Gaps

When multiple agencies share responsibility, differences in objectives or mandates may lead to policy delays or inefficiencies.

5. Public and Political Resistance

Measures like LTV caps or CCyBs may be unpopular during economic booms, especially among real estate developers or borrowers.

Real-World Applications and Success Stories

- South Korea: Successfully used LTV and DTI limits to cool down overheating housing markets.

- Switzerland: Implemented one of the first countercyclical capital buffers to stabilize housing credit.

- India: Uses risk weights, provisioning norms, and exposure limits to control lending in high-risk sectors like commercial real estate and NBFCs.

- European Union: The European Systemic Risk Board (ESRB) provides macroprudential guidelines across member states, tailored to their specific risks.

The Future of Macroprudential Policy

As financial markets evolve, macroprudential policy must also adapt.

Emerging Focus Areas:

- Climate-related financial risk: Integrating environmental risk into systemic risk assessments.

- Cybersecurity: Managing systemic threats posed by digital infrastructure failures or attacks.

- Big tech & fintech: Oversight of tech-driven financial platforms and digital currencies.

- Cross-border regulation: Enhancing coordination to manage risks from global institutions and markets.

Final Thoughts

Macroprudential policy plays a vital role in maintaining financial stability, promoting long-term economic health, and preventing the kind of widespread disruptions seen in past financial crises. As economies and financial systems become more complex and interconnected, the importance of a robust macroprudential framework will only grow.

By balancing flexibility with foresight and ensuring strong institutional coordination, macroprudential regulation can help build a financial system that is both resilient and adaptive.

Frequently Asked Questions (FAQs)

Q1. Can macroprudential policy prevent all financial crises?

Answer: Not entirely. While macroprudential policy helps reduce the chances and severity of financial crises, it cannot eliminate all risks. Some shocks—like geopolitical events or pandemics—may still trigger financial instability beyond the scope of regulation.

Q2. What role does data play in macroprudential regulation?

Answer: Data is crucial. Regulators rely on macro-financial indicators, banking sector data, and market analytics to detect emerging risks. Regulators are increasingly using advanced tools like big data analytics and AI-based monitoring systems to support real-time decision-making.

Q3. How do regulators test if macroprudential tools are effective?

Answer: Regulators use stress testing, scenario analysis, and backtesting to evaluate tool performance. They also monitor financial indicators (e.g., credit-to-GDP gaps, loan default rates) before and after policy implementation to assess impact.

Q4. Are macroprudential policies always restrictive?

Answer: Not necessarily. While many macroprudential tools are restrictive during booms, they can also be relaxed during downturns to support credit flow and economic recovery. For example, reducing capital buffer requirements or easing lending standards temporarily can boost lending in recessions.

Recommended Articles

We hope this comprehensive guide to macroprudential policy has helped you understand its importance in maintaining financial stability. Explore these recommended articles for deeper insights into financial regulations, risk management strategies, and systemic stability tools.