What is Loud Budgeting?

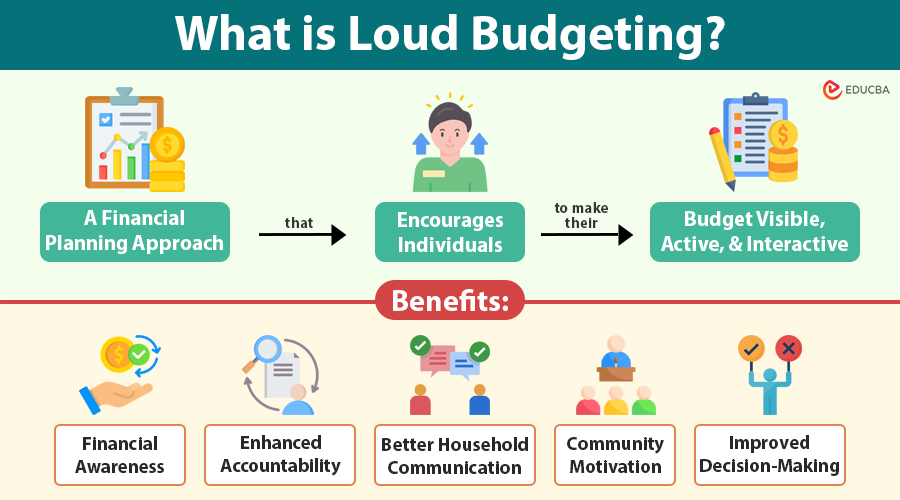

Loud Budgeting is a modern financial planning approach that encourages individuals to make their budget visible, active, and interactive. Unlike traditional methods, where financial tracking is often private, Loud Budgeting emphasizes sharing financial goals, progress, and challenges with trusted people or communities.

Loud Budgeting is not about boasting; it is about making finances visible to create accountability and informed decision-making.

The “loud” component can manifest in several ways:

- Sharing monthly budget progress with a partner or family member.

- Using apps that send notifications about spending or savings milestones.

- Engaging in online communities to discuss financial goals and learn from others.

This method fosters a mindset where money management becomes a deliberate, visible, and accountable practice, reducing financial stress and promoting healthy money habits.

Table of Contents

- Meaning

- Key Principles

- How Does it Work?

- Benefits

- Tools and Technologies

- Common Challenges

- Tips

- Loud Budgeting vs. Traditional Budgeting

Key Takeaways

- Loud Budgeting makes financial planning visible, promoting accountability and better money habits.

- It uses real-time tracking, shared goals, and transparency to improve decision-making.

- The method strengthens communication within households and trusted communities.

- You align every financial action with clear goals to support long-term success.

- Regular reviews and flexibility help the budget adapt to changing financial needs.

- Technology and social support play a major role in motivation and consistency.

Key Principles of Loud Budgeting

Several core principles guide loud budgeting:

1. Transparency

Transparency ensures that all financial activities are visible to relevant stakeholders. In households, this means couples or family members understand income, expenses, debts, and savings. Transparency prevents financial mismanagement and encourages joint decision-making.

2. Accountability

Publicly sharing or documenting your financial goals creates accountability. When others are aware of your spending or saving targets, you are more likely to follow through. This principle transforms budgeting from a passive activity into an active behavioral commitment.

3. Real-Time Tracking

Modern tools allow instant visibility into spending. Loud Budgeting relies on real-time alerts to notify users of overspending or approaching budget limits, helping prevent financial pitfalls before they happen.

4. Goal-Oriented Approach

You evaluate every transaction in the context of your pre-set goals. This helps you allocate money efficiently, whether toward debt repayment, savings, or investments.

5. Community Engagement

Sharing financial goals and achievements within trusted online forums, social media groups, or financial circles helps maintain motivation, gain insights, and learn new strategies for managing money.

6. Flexibility and Adaptability

Life is unpredictable, so budgets must be flexible. Loud Budgeting encourages periodic adjustments to goals and spending categories, ensuring the budget evolves with changes in income, expenses, or financial priorities.

How Loud Budgeting Works?

Implementing Loud Budgeting involves structured steps that make your finances visible, accountable, and actionable.

Step 1: Assess Your Financial Situation

Before creating a loud budget, you need a complete understanding of your finances:

- Track income: Write down every way you earn money, like your salary, freelance work, or passive income.

- Analyze expenses: Break spending into categories:

- Fixed expenses: Rent/mortgage, utilities, insurance

- Variable expenses: Groceries, transportation, dining out

- Discretionary spending: Entertainment, hobbies, non-essential purchases

- Evaluate debts: List all debts with balances, interest rates, and minimum monthly payments.

- Identify savings: Note current savings, investments, and emergency funds.

Why it matters: Knowing your financial baseline ensures that every budgeting decision is informed and realistic.

Step 2: Set Clear, Measurable Goals

Loud Budgeting links every spending or saving decision to a clear purpose, making your goals the priority.

- Use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound)

- Examples of goals:

- Build a $5,000 emergency fund in 12 months

- Pay off a $3,000 credit card debt in 6 months

- Save $2,000 for a vacation in one year

Why it matters: Goals provide motivation, focus, and a benchmark to measure success.

Step 3: Create a Loud Budget Plan

This step is where you allocate income to categories while integrating the “loud” element:

- Budget categories: Assign a portion of income to essentials, savings, debt, and discretionary spending.

- Tracking method: Decide how you will track spending and progress:

- Apps: YNAB, Mint, PocketGuard

- Spreadsheets: Shared Google Sheets or Excel

- Community platforms: Online forums or family chat groups

- Set alerts and notifications: Apps can alert you when you approach or exceed a category limit.

Example:

If you earn $4,000 per month, your budget may look like:

- Essentials: $2,000

- Debt: $500

- Savings: $1,000

- Discretionary: $500

Alerts notify you if discretionary spending exceeds $400.

Why it matters: It keeps your goals front and center, helping you stay disciplined and avoid unnecessary spending.

Step 4: Make It Public (Within Limits)

The “loud” part of Loud Budgeting involves sharing progress:

- Discuss monthly budgets with family or partners.

- Share achievements or challenges in a trusted online community.

- Celebrate milestones publicly to reinforce positive behavior.

Example: Announce progress: “This month, we saved an extra $100 by reducing dining out expenses toward our vacation fund!”

Why it matters: Public accountability encourages budget adherence, strengthens motivation, and fosters a supportive environment.

Step 5: Review and Adjust Regularly

Loud Budgeting is dynamic, not static:

- Weekly or biweekly check-ins: Track expenses to ensure alignment with goals.

- Monthly review: Compare planned vs. actual spending and adjust allocations as needed.

- Flexible adjustments: If unexpected expenses arise, shift money between categories without losing sight of long-term goals.

- Celebrate milestones: Reward progress to reinforce positive financial behavior.

Why it matters: Regular reviews ensure that budgeting adapts to real-life changes, keeps goals achievable, and maintains financial discipline.

Benefits of Loud Budgeting

- Financial awareness: Tracking spending in real-time increases mindfulness about money.

- Enhanced accountability: Publicly shared goals create motivation to follow the plan.

- Better household communication: Open discussions reduce conflicts about money.

- Community motivation: Engaging with others fosters a sense of accountability and shared learning.

- Improved decision-making: Real-time insights enable smarter spending, investing, and saving decisions.

- Encourages goal achievement: Visible progress reinforces positive financial behavior.

Tools and Technologies for Loud Budgeting

Using the right tools can make Loud Budgeting efficient and engaging:

- YNAB (You Need A Budget): Focuses on giving every dollar a purpose.

- Mint: Aggregates accounts, tracks expenses, and offers spending insights.

- PocketGuard: Shows how much money is safely available after bills and savings.

- Goodbudget: Envelope-based, allows family members to share budgets.

- Google Sheets/Excel: Highly customizable for those who prefer manual tracking.

Common Challenges in Loud Budgeting

- Privacy concerns: Sharing financial data requires trust; not everyone is comfortable being transparent.

- Consistency: Tracking requires regular updates and discipline.

- Comparison stress: Comparing your progress with others may create unnecessary pressure.

- Over-reliance on technology: Technical issues with apps can disrupt budgeting.

- Behavioral adjustments: Being “loud” about finances may require overcoming ingrained spending habits.

Tips for Successful Loud Budgeting

- Start small: Begin with a few key categories and gradually expand.

- Be honest: Accurate tracking is crucial for actionable insights.

- Engage selectively: Share financial details with trusted individuals.

- Celebrate milestones: Celebrate every goal you reach, even the small ones.

- Review frequently: Periodic evaluation ensures the budget evolves with your financial life.

- Educate yourself: Learn about financial management, investments, and savings strategies.

Loud Budgeting vs. Traditional Budgeting

| Feature | Traditional Budgeting | Loud Budgeting |

| Privacy | Personal & private | Shared with family/community |

| Motivation | Self-motivation | Accountability-driven |

| Tracking | Manual/periodic | Real-time & public updates |

| Flexibility | Moderate | Highly adaptable |

| Social Engagement | None | Community support & feedback |

| Goal Visibility | Internal | Shared & visible |

Loud Budgeting builds upon traditional methods by adding social engagement, accountability, and real-time tracking, which often leads to better financial outcomes.

Final Thoughts

Loud Budgeting is an innovative approach to personal finance that emphasizes transparency, accountability, and goal-oriented planning. By actively tracking finances, sharing goals with trusted individuals, and engaging with supportive communities, individuals can cultivate healthier financial habits, reduce stress, and achieve their financial objectives faster.

For anyone seeking a dynamic, disciplined, and transparent way to manage money, Loud Budgeting offers a powerful framework to make financial success more achievable and sustainable.

Frequently Asked Questions (FAQs)

Q1. Is Loud Budgeting only for people struggling with money?

Answer: No. Loud Budgeting is beneficial for anyone who wants stronger accountability, clearer goals, or better communication about finances. It works for all income levels and life stages.

Q2. What if my partner or family does not want to share financial information?

Answer: You can still apply Loud Budgeting individually. Encourage open discussions gradually and respect privacy boundaries while modeling positive financial behavior.

Q3. Is Loud Budgeting suitable for people with irregular income?

Answer: Yes. Loud Budgeting’s adaptable structure helps gig workers, freelancers, and business owners plan spending and savings with fluctuating income.

Q4. Can Loud Budgeting improve relationships?

Answer: Absolutely. Couples and families who practice financial transparency often experience greater trust, fewer conflicts, and more cooperative decision-making.

Q5. What age group benefits most from Loud Budgeting?

Answer: While adults of all ages can benefit, it is especially effective for young adults learning to build financial independence and develop long-term habits.

Q6. Can Loud Budgeting help with long-term financial planning?

Answer: Yes. It keeps big goals like retirement, homeownership, or education savings visible and consistently prioritized.

Recommended Articles

We hope this article on Loud Budgeting helped you understand how financial transparency can improve money management and accountability. Explore the articles below to learn more about budgeting strategies, smart spending habits, and effective financial planning.