Updated July 17, 2023

Definition of Interest Rate Swap

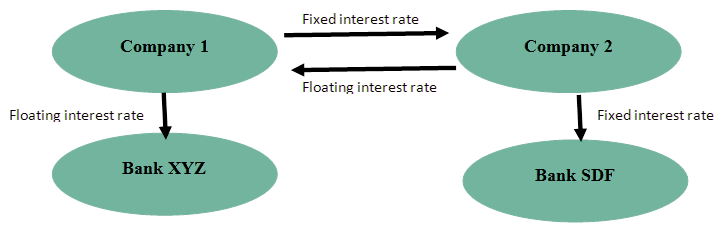

The term “interest rate swap” refers to the derivative contract between two parties agreeing to exchange one stream of interest payments for another based on a pre-determined principal amount. Interest rate swaps are typically used to exchange a fixed interest rate for a floating interest rate. These derivative instruments are traded on over-the-counter (OTC), not public exchanges.

Explanation

In an interest rate swap, two parties – one of which makes fixed rate interest payments and the other of which makes floating rate interest payments – mutually agree to interchange each other’s loan arrangement. In such contracts, the interest payments get swapped, and the parties don’t take ownership of each other’s debt. Effectively, they merely pay each other the difference in interest payments. If the fixed interest rate is higher, the party (Company 1) obligated to pay the fixed interest as per the contract will pay the difference between the fixed and floating interest to the other party (Company 2) and vice versa.

How Does Interest Rate Swap Work?

Typically, after the counterparties have decided to enter into an interest rate swap agreement, the following steps are involved:

- The counterparties actively agree on the notional principal amount, which is the basis for calculating future interest payments.

- Next, they must decide on the type and amount of interest to be exchanged. This interest payment will represent the cash flows flowing in and out of the swapping entities.

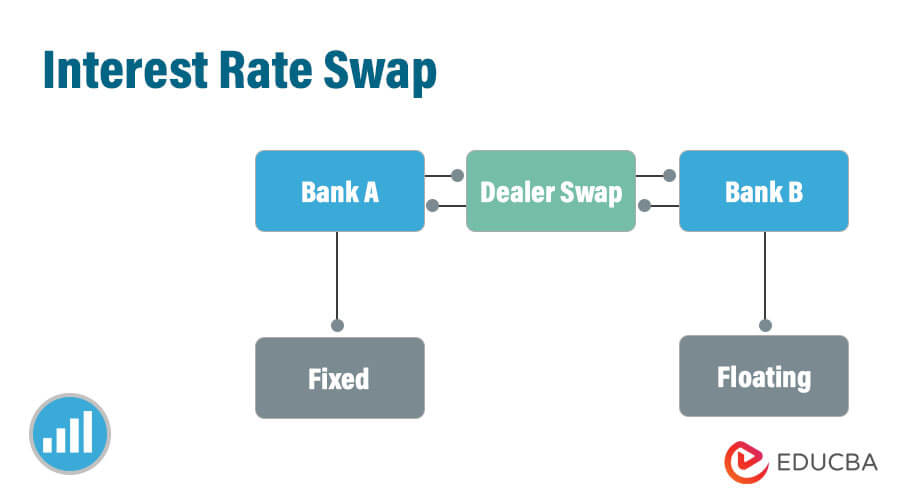

- Finally, they seal the deal by signing the financial contract. Mostly, commercial or investment banks act as intermediaries in such swap transactions.

Examples of Interest Rate Swap

Following examples are given below:

Example #1

Let us assume that PQR Inc. has to raise $10 million from the debt market to fund its new expansion project. The company offered a variable interest rate, currently at 4%. The company is concerned that the prevailing market scenario indicates a high probability of an increase in the benchmark interest rate in the near term. So, it entered into an interest rate swap agreement with TQZInc. Who currently pays a fixed interest rate of 5%. Consequently, as per the swap contract, PQR Inc. will be paid a fixed interest rate of 5% to TQZ Inc., while TQZ Inc. will pay a variable interest rate (currently 4%) to PQR Inc.

At the beginning of the swap contract, PQR Inc. has to pay 1% (= fixed 5% – variable 4%) of the notional principal to TQZ Inc. as the swap spread. However, if the benchmark interest rate increases by 2%then the variable rate will become 6%, then TQZ Inc. will have to pay PQR Inc. 1% (= variable 6% – fixed 5%) of the notional principal as the swap spread. On the other hand, if the benchmark interest rate remains stable or goes down, PQR Inc. will have to pay TQZ Inc. This is an example of a fixed-to-floating rate swap.

Example #2

Let us assume that ASD Inc. had recently raised a loan with a floating interest rate indexed to the 3-month LIBOR. However, now the company intends to move to a 3-month EURIBOR. Instead of exchanging the benchmark index, the company can opt for an interest rate swap agreement with another party whose debt is currently indexed to the 3-month EURIBOR. This is an example of a floating-to-floating rate swap wherein the exchange of one type of benchmark index for another has occurred.

Similarly, ASD Inc. can swap its benchmark index from 3-month- to 6-month LIBOR. This is another type of floating-to-floating rate swap.

Interest Rate Swap Rates

The below table provides the interest rate swap rates for monthly money swaps:

| Current | 29-Sep-20 | 1-Sep-20 | 30-Sep-19 | |

| 1 Year | 0.14% | 0.14% | 0.15% | 1.64% |

| 2 Year | 0.13% | 0.13% | 0.13% | 1.47% |

| 3 Year | 0.14% | 0.14% | 0.14% | 1.41% |

| 5 Year | 0.23% | 0.22% | 0.22% | 1.37% |

| 7 Year | 0.38% | 0.36% | 0.37% | 1.38% |

| 10 Year | 0.59% | 0.56% | 0.57% | 1.44% |

| 15 Year | 0.80% | 0.77% | 0.77% | 1.52% |

| 30 Year | 0.98% | 0.94% | 0.93% | 1.58% |

Source: Chatham Financial

Interest Rate Swap Valuation

The net present value (NPV) of the two streams of interest payments must be the same at the beginning of the transaction, which means that both counterparties pay an equal amount of money over the tenure of the underlying asset. All the future interest payments to be made during the bond’s life are estimated, which is then discounted using the expected inflation to arrive at the NPV of the transaction. It is easier to calculate the NPV for the fixed rate bond given that the periodic payment is equal, while it is very tricky in the case of the floating rate bond as it is like a benchmark (say LIBOR), which can always change.

Why Invest in Interest Rate Swap?

Investors should invest in interest rate swaps as it helps in the following:

- Gauging the interest rate perception in the bond market.

- Making decisions pertaining to taking a loan now or later.

Risks of Interest Rate Swap

There are two major risks associated with interest rate swaps. They are- interest rate risk and counterparty risk.

- Fluctuations in interest rates actively drive the interest rate risk, which can lead to significant lo

- The counterparty risk is the possibility that one or some counterparties will default on their payment.

Conclusion

Interest rate swaps may appear somewhat complicated initially. Businesses can effectively utilize interest rate swaps as a valuable tool to manage their debt efficiently once they understand the mechanics involved. To sum up, an interest rate swap contract requires two counterparties who wish to change their existing interest rate arrangement and have contrasting preferences regarding interest payments.

Recommended Articles

This is a guide to Interest Rate Swaps. Here we discuss the introduction and how does it work? Along with major risks associated with interest rate swaps. You may also have a look at the following articles to learn more –