Updated July 12, 2023

Introduction to Intercreditor Agreement

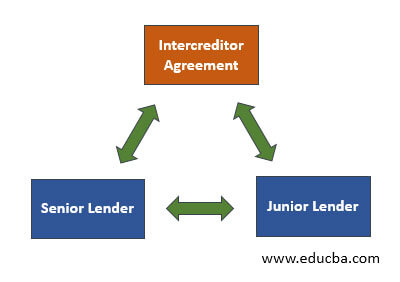

Intercreditor Agreement is a legal document accepted and signed between two or more creditors when they lend money to the same borrower. This document will state the interests and rights of the creditors. It also states who will be the first lender (Senior) and Subsequent lender (Junior).

Purpose of Intercreditor Agreement

An intercreditor agreement is a deed that regulates the interests and rights of the lenders when more than one lender funds for the same borrower. The deed will clearly state the rights to receive payments (Principal, interest, etc.) and the rights to impose security cover over the lender’s assets. In addition, it mentions the ranking of the lenders and who will be first paid. Suppose there is a situation of more than one senior lender (i.e.) a borrower with the same ranking. In that case, one more agreement could be known as a “deed of priority” between multiple senior lenders to define their priorities and rights.

Example of Intercreditor Agreement

ABC Corporation needs money for the expansion of business. Therefore, it has planned to take a bank loan for the same. It has approached Zen Bank for the major part of the financial requirement, which can directly fund the project, and it plans to take a small working capital loan from XYZ Bank. So, Zen Bank and XYZ Bank planned to enter an Intercreditor Agreement to decide on the rights and priorities. Since Zen Bank has funded a major part of the project, it will be the senior lender in the given case. It will have more rights and stay higher in rank, whereas XYZ Bank, which has funded the working capital requirement, will be the subordinate or junior lender.

Need for Intercreditor Agreement

Creditors always want to secure the money they lent; when multiple creditors have lent money to the same borrower, it becomes challenging to claim over the assets if the borrower defaults to make a payment or becomes bankrupt. The creditors enter into an Intercreditor Agreement to overcome this challenge and confusion.

Intercreditor Agreement is much needed to decide the priorities and rights among them. It states the senior lender and junior lender basis the money lent and security. The senior lender has the edge over the agreement and can limit the payments to junior lenders. The senior lenders can restrict the rights of the junior lender to act against the borrower to enforce its debt. The agreement also includes buyout rights, where one lender can buy the other lender’s claims and rights. Usually, the buyout is used in case of bankruptcy of the borrower.

Issues of Intercreditor Agreement

In Intercreditor Agreement, the junior lender must be very careful in finalizing the agreement as the senior lender always has superiority in the agreement, and improper understanding of the terms can disadvantage the junior lender. In addition, senior leaders can intentionally delay the payment to the junior lender, leading to disputes between them.

The Junior lender must have complete clarity about the agreement, and the senior lender can change the terms of the agreement without the permission of the junior lender. So junior lenders should always stay alert to avoid issues in the future that may lead to their own disadvantage. A junior lender should not agree to the terms unless evaluating the agreement completely and can negotiate with the senior lender to get better terms. If the agreement is unfavorable, junior lenders can look for other options, like refinancing the borrower or completely paying out the senior lender. If the sum lent by the senior lender is huge, it may be tough for the junior lender to repay them complete.

Challenges of Intercreditor Agreement

In the intercreditor agreement, a senior lender always enjoys more priorities and rights. So often, it can so happen that the senior lender dictates the terms and puts the junior lender at a disadvantage. A senior creditor can restrict the repayment to the junior lender by the standstill option in the agreement and make sure the senior lender can get paid first. The junior lender has to negotiate the terms clearly and strongly to hold their position and rights. Considering the strong position of the senior lender, they may unnecessarily delay the finalization of the agreement and terms. So junior lenders need to be more cautious and place in their stronghold while entering into Intercreditor Agreement.

Importance

The Intercreditor Agreement is very important as it clearly states the position and rights of the creditors. It also states the priorities, which are very much needed to incase the borrower goes bankrupt or defaults on the payments. In the absence of an Intercreditor Agreement, there won’t be a clear alignment between the creditors, and they may act on their own will, which may lead to disagreement and confusion between the parties. So, to have a fair process, it’s better to have an agreement between creditors; else, it may lead to legal issues.

Key Takeaways

The junior lender should be aware of all critical terms before agreeing. The following aspects can be evaluated once before entering into the agreement.

- Check for the payment clause and if the senior lender has imposed any limitations/blockage of payment to the junior lender.

- Amendment of terms and conditions without the consent and approval of junior lenders.

- Considering the amount lent, the senior lender enjoys more rights and priorities, so the junior lender should make sure that the agreement is fair and just to all parties.

- A junior lender can check for any collateral option specifically available for the loan/ principal lent to protect their interest and clearly state in the agreement that the standstill option is not applicable.

Conclusion

Intercreditor agreement is much needed when there are multiple lenders to the same borrower. It helps smooth transactions and can avoid confusion between creditors as their rights and priorities are clearly stated in the agreement. It often helps avoid misunderstandings and legal issues between the parties. As the senior lender controls this arrangement, the junior lender should evaluate and accept the agreement on all aspects.

Recommended Articles

This is a guide to Intercreditor Agreements. Here we also discuss the definition, purpose, example, needs, issues, and challenges of the Intercreditor Agreement and its importance. You may also have a look at the following articles to learn more –