Definition of Indirect Tax

An indirect tax, such as a sales tax or a value-added tax, is a tax imposed by the intermediaries on the consumers after being passed by the manufacturer of the products or services consumed by these intermediaries.

Explanation

An indirect tax is imposed by the government and collected through intermediaries. While the population is subject to direct and indirect taxes, the collection methods differ. The government collects direct taxes directly from the consumer without intermediaries, imposing them directly on the consumer.

Features of Indirect Tax

- Indirect taxes require payment at the point of incidence, thus making it closer to the consumer of the goods and services.

- Indirect taxes are termed regressive in nature as subsistence goods may attract the same taxes from the rich and the poor.

- Indirect tax is paid to the government through the intermediaries

- Indirect taxes have greater coverage in society as compared to the direct taxes

Examples of Indirect Tax

Suppose Mr. Harry wants to buy an interesting collection of books to read, priced at $400. Mr. Harry sees the break-up, which includes a sales tax of $30. The tax roughly amounts to 8% of the book’s final cost before selling. Harry understands that this cost has already been handled by the seller and passed on to Harry, the end user.

Remember that the tax may be imposed on different value chain points but is passed on to the end-user, Mr. Harry.

Types of Indirect Tax

The major types of indirect taxes are as follows:

- Sales Tax: The tax is levied on the products consumed through retail or wholesale sellers. Upon sales tax collection, the seller will pay the tax amount to the government(s)

- Customs Duty: When imported into a country’s mainland, goods and services must go through the customs duty tax. Such taxes are also applicable on exports as excise.

- Securities Transaction Tax or STT: When buying or selling securities in the form of equities, investors incur a tax known as a securities transaction tax.

- Value Added Tax or VAT: More commonly in India, a VAT signifies the tax on the incremental value addition of the product as it passes through the value chain.

- Entertainment Tax: Entertainment providers, such as theaters, recreation parks, sports event organizers, etc., impose entertainment taxes.

How to Collect Indirect Taxes?

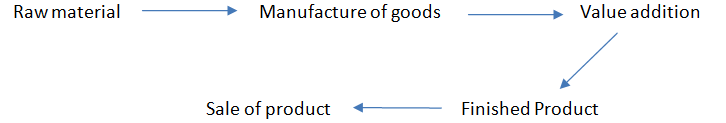

Indirect taxes are collected on the sale of goods and services. Hence, indirect taxes are levied on the purchase of goods and services. The value chain involved in manufacturing, distributing, and selling goods is important as it has different points of tax incidence. Suppose a good is manufactured and sold, passing through the following value chain:

The indirect taxes are collected at the sale of the product. The value of indirect taxes on a product depends on its value through the value chain. The total taxes will then be collected and forwarded to the government.

Advantages

Some of the advantages are given below:

- Collecting indirect taxes is made easier for governments since they are already incorporated into the product price and directly levied on the end consumer.

- Indirect taxes impose a broad-based approach, meaning they levy taxes on a wide range of products and services. This ensures an even spread of tax imposition on the end consumer.

- The different tax slabs based on what products to encourage and what to discourage are advantages for the government and society.

- Indirect taxes are not mandatory in the sense that only the purchase or renting of products or goods, or services will attract a levy of associated indirect taxes. This gives the consumers a convenient choice of whether to consume a certain good.

- An important advantage that comes into the picture while dealing with indirect taxes is that it is equitable. Say that the taxes on costlier or luxurious products are categorized under the luxury tax and are higher-taxed items.

Disadvantages

Some of the disadvantages are given below:

- Indirect taxes sometimes generate the concept of double tax or tax on tax. For example, a salaried person who buys an air-conditioner must pay sales tax on the product. This is after he has already paid direct income tax deducted from his income (TDS), giving rise to double tax.

- If not managed and laid out properly, any tax system can burden the general populace leading to tax evasion or violations. Regarding indirect taxes, the burden on taxpayers can come through overlapping or numerous taxes, leading to higher prices of goods and services.

- Some experts believe that some forms of the indirect tax system make it regressive. Indirect taxes levied on essential goods and services make it a concern. Take an example of a $5 milk packet that attracts $0.50 in indirect tax. Every buyer, irrespective of him being rich or poor, must pay $0.50 for the product.

- Indirect taxes levied on raw materials or primary goods make the final or finished products expensive, thus creating a barrier to entry in manufacturing businesses and sometimes curtailing existing manufacturer’s incentive to produce

Conclusion

Indirect taxes form a significant part of any taxation system. For example, in the United States, indirect taxes are imposed by the state governments based on different factors but are subject to certain federal restrictions. For the sake of understanding, a common difference between direct and indirect taxes is that direct taxes are deducted from an individual’s income. In contrast, indirect taxes are levied on goods purchased.

From the collector’s perspective, i.e., the government, indirect taxes reach out to the poorer sections of society, meaning that taxation evenly covers all strata. This sharply contrasts with direct taxes, where low-income groups are exempted from taxes, and the government has to deal with a lower tax ambit.

Recommended Articles

This is a guide to Indirect Tax. Here we also discuss the definition and how to collect indirect taxes. Along with advantages and disadvantages. You may also have a look at the following articles to learn more –