What is an Independent Contractor?

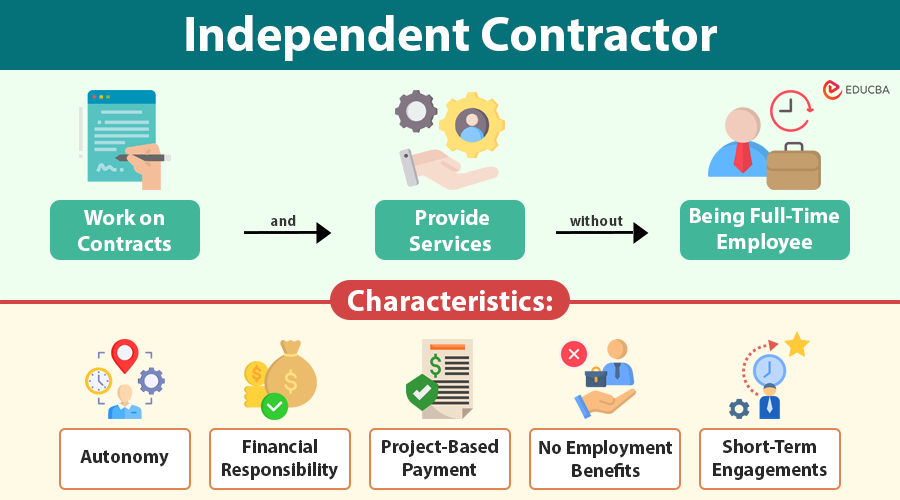

Independent contractors, also called freelancers or consultants, work on contracts and provide services without being full-time employees.

Unlike permanent employees, independent contractors control their work methods, schedules, and business operations. They offer companies cost-effective expertise and flexibility while enjoying autonomy and the ability to work with multiple clients.

Table of Contents

- Meaning

- Characteristics

- Independent Contractor vs Employee

- Roles and Responsibilities

- Advantages

- Legal and Tax Considerations

- How to Become an Independent Contractor?

- Challenges Faced

Characteristics of Independent Contractors

- Autonomy: They decide how, when, and where to complete their work.

- Financial responsibility: Contractors are responsible for managing their own taxes, insurance, and business expenses.

- Project-based payment: Typically compensated per project, milestone, or retainer rather than a fixed salary.

- No employment benefits: They do not receive health insurance, paid leave, or retirement contributions from clients.

- Short-term engagements: Contracts are usually limited to specific projects or periods.

Independent Contractor vs Employee

It is essential to understand the distinction between an independent contractor and an employee, as misclassification can result in fines, back taxes, and other financial issues.

| Feature | Independent Contractor | Employee |

| Control | Manages own work methods and schedule | Employer dictates work hours and processes |

| Benefits | No paid leave, insurance, or retirement | Eligible for company-provided benefits |

| Taxation | Responsible for self-employment tax | Employer withholds income and payroll taxes |

| Contract Type | Project- or service-based | Permanent or fixed-term employment contract |

| Equipment | Often provides own tools | Employer provides the necessary tools and equipment |

Roles and Responsibilities of Independent Contractors

Businesses typically hire independent contractors for their specialized expertise. Their roles vary depending on the industry and project scope.

Common Roles

- Consultants: Advise in IT, finance, management, or marketing.

- Freelancers: Handle creative projects like content writing, graphic design, or web development.

- Specialized contractors: Perform tasks requiring certifications, e.g., engineers, electricians, and legal advisors.

Core Responsibilities

- Deliver work per contract specifications.

- Communicate progress and report challenges to clients promptly.

- Manage taxes, accounting, and other administrative duties.

- Maintain high-quality standards and compliance with regulations.

- Protect intellectual property and client confidentiality.

Advantages of Being an Independent Contractor

Independent contracting offers flexibility, autonomy, and potential for higher earnings.

Benefits for Contractors

- Flexibility: Work on preferred schedules and locations.

- Income potential: Set competitive rates and take on multiple projects.

- Skill growth: Gain exposure across industries.

- Autonomy: Control work methods and project choices.

Benefits for Businesses

- Cost savings: No long-term employment costs, such as benefits.

- Access to expertise: Hire specialists for specific projects.

- Scalable workforce: Engage contractors as needed without the need for permanent hiring.

- Fast project execution: Contractors bring expertise for quicker results.

Legal and Tax Considerations

Independent contractors and hiring businesses must follow legal and tax regulations to avoid disputes and penalties.

Legal Considerations

- Contracts: Include scope, payment terms, deadlines, intellectual property rights, and confidentiality clauses.

- Licensing: Certain industries require licenses or professional certifications.

- Compliance: Contractors must comply with applicable labor laws, health regulations, and safety standards.

Tax Considerations

- Self-employment taxes: Contractors must pay their own Social Security, Medicare, and income taxes.

- Estimated payments: Quarterly tax payments may be necessary to avoid penalties.

- Business expenses: Deductible costs include equipment, office supplies, and professional subscriptions.

How to Become an Independent Contractor?

Becoming an independent contractor involves planning, legal setup, and marketing:

- Identify your niche: Offer services that match your expertise and market demand.

- Register your business: Choose a legal entity such as a sole proprietorship, LLC, or corporation.

- Develop a portfolio: Showcase past projects and achievements.

- Set rates: Determine pricing based on hourly, project-based, or retainer models.

- Draft contracts: Set clear deliverables, deadlines, and payment terms to avoid confusion.

- Market yourself: Leverage social media, online platforms, and networking to attract clients.

- Insurance: Consider liability insurance to protect against disputes.

Challenges Faced by Independent Contractors

While independent contracting offers freedom, it comes with unique challenges:

- Income variability: Work may fluctuate, requiring financial planning.

- No employee benefits: Contractors are responsible for self-managing their health insurance, retirement, and paid leave.

- Administrative duties: Accounting, contracts, and tax filings require meticulous attention to detail and time management.

- Legal risks: Misclassification or poorly drafted contracts can lead to disputes and litigation.

- Market competition: Contractors must differentiate their skills to stay competitive.

Final Thoughts

Independent contractors are important in the workforce because they provide flexibility, skills, and affordable solutions. Both professionals and businesses benefit from understanding the roles, responsibilities, legal requirements, and challenges associated with contracting. By planning strategically, setting clear contracts, and complying with tax laws, independent contractors can achieve successful and sustainable careers, while businesses gain access to top-tier expertise.

Frequently Asked Questions (FAQs)

Q1. Can an independent contractor work for multiple clients at the same time?

Answer: Yes, independent contractors can work with multiple clients simultaneously, as long as there are no conflicts of interest and contractual obligations allow it.

Q2. Do independent contractors need a business license?

Answer: Depending on the country, state, or city, independent contractors may need to register their business or obtain a local business license to operate legally.

Q3. How can independent contractors protect their intellectual property?

Answer: Contractors should include IP clauses in contracts, retain rights to their original work when appropriate, and use confidentiality agreements to protect sensitive information.

Q4. What tools can independent contractors use to manage their business?

Answer: Contractors often use project management software (e.g., Trello, Asana), accounting tools (e.g., QuickBooks, FreshBooks), and communication platforms (e.g., Slack, Zoom) to stay organized and efficient.

Q5. Are independent contractors eligible for unemployment benefits?

Answer: Generally, independent contractors are not eligible for standard unemployment benefits because they are self-employed and not covered under traditional employer-based unemployment programs.

Recommended Articles

We hope this guide on independent contractors helped you understand their roles, responsibilities, and benefits. Explore our related articles on: