What is Holiday Pay?

Holiday pay refers to the wages an employee receives for public, national, or company-declared holidays, whether they work on those days or not. It is a form of paid time off that compensates employees during non-working days mandated by law or employer policy.

In simple terms, holiday pay ensures that employees are not financially penalized for taking holidays. It is both a legal and ethical recognition of employees’ right to rest and rejuvenate while maintaining a steady income.

It also promotes employee loyalty and motivation, as workers feel valued and secure knowing their pay continues during holidays. For organizations, it enhances their reputation as fair employers and ensures compliance with labor standards.

Table of Contents

- Meaning

- Introduction

- Types

- Eligibility

- How to Calculate?

- Laws and Regulations (By Country)

- Importance

- Challenges

- Best Practices for Employers

- Difference Between Holiday Pay and Vacation Pay

Understanding Holiday Pay

It varies depending on country-specific labor laws, company policy, and the type of employment contract.

Some important concepts to understand include:

- Statutory holidays: Officially declared national or state holidays (e.g., Independence Day, Republic Day, Christmas, Eid, Diwali).

- Company holidays: Additional days declared by organizations (e.g., company anniversaries, founder’s day, or year-end holidays).

- Floating holidays: Flexible holidays that employees can take for personal or cultural reasons.

In some countries, employers must pay double or triple wages to employees who work on a holiday. Others require only the regular daily wage if the employee does not work.

For example:

- In the Philippines, employees who work on a public holiday receive 200% of their daily rate.

- In India, employees covered by the Factories Act or Shops and Establishments Acts receive full pay even when they do not work on national or festival holidays.

- In the United States, there is no federal law mandating paid holidays, but many employers offer them as part of competitive compensation packages.

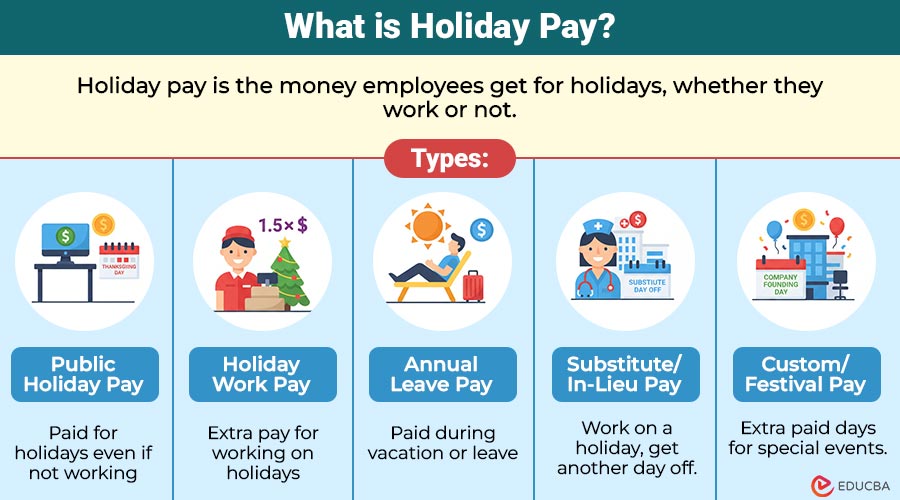

Types of Holiday Pay

The most common types include:

1. Public Holiday Pay

In the US, public holiday pay refers to wages employees receive when taking recognized national holidays off, even if they do not work. Common holidays include Independence Day, Thanksgiving, Christmas, and Memorial Day. Many companies also honor regional or state holidays.

Example: An office employee who does not work on Thanksgiving Day still receives their regular pay for that day.

2. Holiday Work Pay

When employees are required to work on a federal or company-declared holiday, they often receive premium pay, though there is no federal mandate for double pay. Many employers voluntarily offer time-and-a-half or double pay to compensate for the inconvenience.

Example: A retail employee required to work on Christmas Eve may receive 1.5× their normal hourly rate for all hours worked that day.

3. Annual Leave Pay (Paid Time Off)

Annual leave or paid time off (PTO) functions similarly to holiday pay, allowing employees to receive regular wages while on vacation or personal leave. In the US, PTO policies are typically set by individual employers, as federal law does not mandate paid leave.

Example: An employee taking a week-long vacation in July receives their normal weekly salary through their PTO balance.

4. Substitute or In-Lieu Holiday Pay

If employees work on a holiday, employers may offer a substitute holiday on another day as compensation. This is common in industries with 24/7 operations, like healthcare, retail, and hospitality.

Example: A nurse works on New Year’s Day but takes the following Monday off with pay as a compensatory day.

5. Custom or Festival Holiday Pay

Some US companies offer additional paid holidays beyond federal holidays, often tied to company culture or specific events, such as company anniversary days or end-of-year celebrations. These perks help improve morale and employee satisfaction.

Example: A tech company grants employees an extra day off for the company’s founding day, providing pay as if it were a regular holiday.

Eligibility for Holiday Pay

Eligibility depends on national labor laws and company-specific rules. Typical requirements include:

- The employee must hold a regular or contractual position.

- The employee must have worked for a minimum period (often 30–90 days) before the holiday.

- The employee must report to work or be on paid leave the day before and after the holiday.

- Employees on unpaid leave, suspension, or unexcused absence may not qualify.

Example:

Suppose a company policy states that an employee must work the day before and after a public holiday to qualify for holiday pay. In that case, an employee who takes unapproved leave on those days may lose eligibility for benefits.

Some employers also offer holiday pay to part-time and hourly employees, though this is not legally mandatory in every jurisdiction.

How is Holiday Pay Calculated?

The calculation depends on whether the employee works on the holiday or takes the day off.

1. When the Employee Does Not Work (Paid Holiday Off)

If the holiday is a paid non-working day, the employee receives their basic daily wage.

Formula:

Holiday Pay = Basic Daily Wage

Example:

If an employee’s daily wage is ₹1,200, and they do not work on Diwali (a paid holiday), they still receive their full wage.

2. When the Employee Works on a Holiday

When employees work on a declared holiday, they receive extra compensation, often double or triple pay.

Formula:

Holiday Pay = Basic Daily Wage × 2 (for double pay)

Example:

An employee with a daily wage of ₹1,200 works on a public holiday.

Holiday Pay = ₹1,200 × 2 = ₹2,400

Employers pay employees for extra hours worked at the overtime rate.

3. For Employees with Variable Earnings (Commissions, Tips, etc.)

When earnings vary, the holiday pay is calculated based on the average daily wage (ADW) over a set reference period (e.g., 3 or 12 months).

Formula:

ADW = Total Earnings for Reference Period ÷ Number of Days Worked

This approach ensures fairness and accuracy for sales or incentive-based employees.

Holiday Pay Laws and Regulations (By Country)

India

- Governed by the Factories Act, 1948, and the Shops and Establishments Acts.

- Employees are entitled to paid national holidays (Republic Day, Independence Day, Gandhi Jayanti).

- Most states also declare festival holidays with full pay.

- Employees working on holidays earn double pay or compensatory leave.

United States

- No federal law mandates paid holidays.

- Common paid holidays include Christmas, Thanksgiving, Independence Day, and New Year’s Day.

- Employers often negotiate holiday pay in employment contracts or union agreements.

United Kingdom

- Employers must provide employees with 5.6 weeks of paid annual leave, including public holidays.

- Employers can include or exclude bank holidays from this entitlement.

- Rules are governed under the Working Time Regulations 1998.

Canada

- Each province determines statutory holidays (e.g., Canada Day, Labour Day).

- Employees who work on holidays receive regular pay plus premium pay or a substitute day off.

Philippines

- The Labor Code mandates that employees receive 100% pay for regular holidays not worked and 200% pay if they work on those days.

- There are also special non-working days where pay conditions differ.

Importance of Holiday Pay

It serves multiple purposes for both employees and employers:

For Employees

- Financial stability: Ensures continuous income even during non-working days.

- Work-life balance: Allows rest without worrying about lost wages.

- Motivation and morale: Acts as a reward for dedication and hard work.

- Health and well-being: Regular breaks reduce burnout and enhance mental health.

For Employers

- Improves employee retention: Workers stay longer with employers offering fair benefits.

- Boosts productivity: Rested employees perform better after holidays.

- Strengthens employer branding: Shows compliance and care for staff welfare.

- Ensures legal compliance: Prevents penalties or disputes over unpaid wages.

Overall, it promotes a positive and productive workplace culture.

Challenges in Managing Holiday Pay

Even with clear laws, managing holiday pay can be complex for HR and payroll teams. Common challenges include:

- Tracking different employee types: (full-time, part-time, contract).

- Handling shift-based or variable schedules where holidays overlap with off-days.

- Payroll calculation errors due to manual data entry.

- There are compliance issues across different states or regions.

- Budget management for extra payroll costs during festive seasons.

Solution:

Adopting automated payroll and HR software helps employers handle holiday pay accurately. It ensures compliance, eliminates calculation errors, and provides transparent records.

Best Practices for Employers

- Establish a clear holiday policy: Define eligibility, payment rates, and applicable holidays.

- Communicate transparently: Share policy details with employees during onboarding and through HR portals.

- Stay legally updated: Monitor local labor law updates regularly.

- Use automated payroll systems: Streamline calculations and minimize disputes.

- Offer flexibility: Provide floating holidays to respect cultural and personal diversity.

- Document everything: Maintain proper records for audit and compliance purposes.

Difference Between Holiday Pay and Vacation Pay

| Basis | Holiday Pay | Vacation Pay |

| Definition | Pay for government-declared or employer-declared holidays | Pay for scheduled annual leave or personal time off |

| Purpose | To compensate for mandatory non-working days | To reward accumulated time off for rest or recreation |

| Frequency | Based on fixed public holidays | Based on earned or accrued leave |

| Legal Requirement | Often mandated by law | Usually part of the company benefit policy |

| Example | Pay for Diwali or Christmas | Pay for a week-long vacation |

Both types contribute to employee satisfaction and retention, ensuring a balance between productivity and well-being.

Final Thoughts

Holiday pay is a cornerstone of fair labor practices and employee welfare. It guarantees that workers are compensated for public holidays, whether they work or rest, while employers maintain legal compliance and goodwill.

By implementing clear policies, transparent communication, and accurate payroll systems, organizations can ensure fairness, efficiency, and higher employee satisfaction. Ultimately, it reflects a company’s commitment to respecting employee rights and fostering a healthy workplace culture.

Frequently Asked Questions (FAQs)

Q1. Is holiday pay different for full-time and part-time employees?

Answer: Yes. Full-time employees typically receive holiday pay as a standard benefit. In contrast, part-time or hourly employees may receive pro-rated holiday pay depending on their scheduled hours and employer policy. Some jurisdictions mandate it for part-time employees, so it is important to check local labor laws.

Q2. Are overtime hours on a holiday calculated differently?

Answer: Yes. Employers typically calculate overtime on holidays at higher premium rates than regular overtime. For example, an employee might earn double pay for working the holiday plus 1.5 times their regular pay for overtime hours beyond their normal schedule.

Q3. Can holiday pay be replaced with additional leave instead of cash?

Answer: In many regions, employers can offer a compensatory day off (substitute holiday) instead of extra pay, provided it is mutually agreed upon and clearly documented in company policy.

Q4. How does holiday pay affect taxes?

Answer: Most countries treat holiday pay as regular income, so employers apply standard income tax, social security, and payroll deductions. Employees may see slightly higher deductions in months with holiday pay due to increased gross income.

Q5. Can holiday pay affect bonuses or annual incentives?

Answer: Yes. Some companies include holiday pay as part of total annual earnings when calculating bonuses, while others exclude it. This depends on internal HR policies and employment contracts.

Recommended Articles

We hope this guide on Holiday Pay helped you understand how paid holidays, eligibility, and calculations work to benefit both employees and employers. Explore our related articles on: