What is Hedge Accounting?

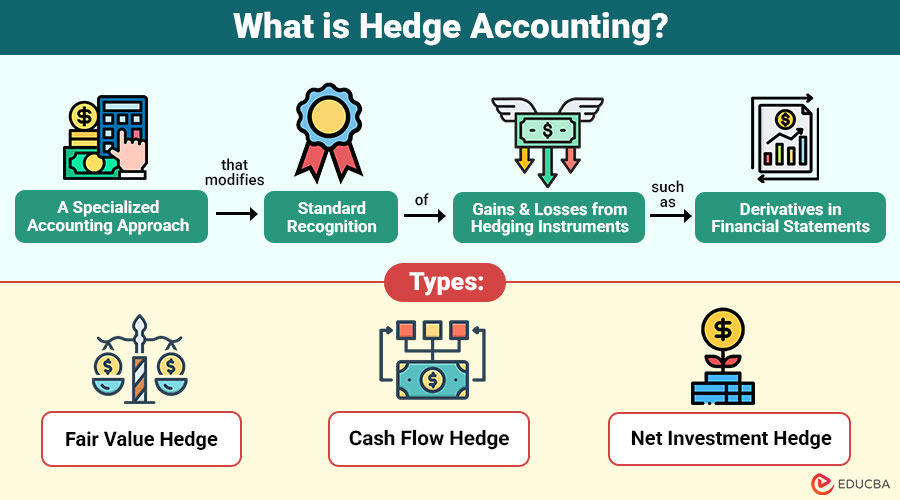

Hedge accounting is a specialized accounting approach that modifies the standard recognition of gains and losses from hedging instruments, such as derivatives in financial statements. Its primary goal is to match the timing of these gains or losses with the impact of the hedged risk on the associated assets, liabilities, or forecasted transactions.

For example, a company expects to receive USD 1 million in three months and is worried that the exchange rate may change. To reduce this risk, it enters into a forward contract to lock in today’s exchange rate.

- Without Hedge Accounting: Changes in the forward contract’s value are recorded immediately in profit or loss, causing fluctuations

- With Hedge Accounting: The gains or losses on the forward contract are recognized at the same time as the USD receipt affects profit, reducing volatility in financial statements.

Table of Contents:

- Meaning

- Importance

- Types

- Key Components

- Advantages

- Disadvantages

- When Should Companies Use Hedge Accounting?

Key Takeaways:

- Hedge accounting aligns the gains and losses of hedging instruments with the hedged items to maintain financial stability.

- It reduces earnings volatility, providing smoother financial performance and improved transparency for investors and stakeholders.

- Proper implementation requires documentation, continuous monitoring, skilled personnel, and clearly defined risk management policies.

- Hedges for net investment, cash flow, and fair value aid in the efficient and strategic management of various financial risks.

Why is Hedge Accounting Important?

Hedge accounting plays a crucial role in financial reporting for risk-aware organizations. Its importance lies in the following areas:

1. Reduces Earnings Volatility

Matches gains and losses, preventing sudden fluctuations, and stabilizes reported profits for smoother financial performance over time.

2. Reflects Risk Management Strategy

It aligns accounting results with management’s intentions and clearly demonstrates how financial risks are effectively identified and mitigated.

3. Improves Financial Statement Transparency

Investors and stakeholders obtain better insight into the organization’s risk management practices and financial decision-making processes.

4. Enhances Comparability

Ensures financial results remain consistent across reporting periods, making performance easier to compare for users.

Types of Hedge Accounting

There are three main types, each designed to manage different kinds of risks.

1. Fair Value Hedge

Exposure to the changes in fair value of recognized asset or obligation or an unrecognized firm commitment is reduced by a fair value hedge.

Examples:

- Hedging fixed-rate debt against interest rate changes

- Hedging inventory price risk

Accounting Treatment:

- The profit or loss of the business includes changes in fair value of hedged item and the hedging instrument.

- The entity adjusts the carrying amount of the hedged item.

2. Cash Flow Hedge

A cash flow hedge mitigates exposure to future cash flow unpredictability that may impact profit or loss.

Examples:

- Hedging variable interest payments

- Hedging forecast foreign currency sales

Accounting Treatment:

- The company documents the hedge’s effective part in Other Comprehensive Income (OCI).

- The company immediately recognizes the ineffective component in profit or loss.

- Amounts in OCI are reclassified to profit or loss when the hedged transaction affects earnings

3. Net Investment Hedge

Companies use a net investment hedge to hedge foreign currency risk arising from investments in foreign operations.

Examples:

- Hedging equity investment in a foreign subsidiary

- Hedging long-term loans denominated in foreign currency related to overseas operations

Accounting Treatment:

- The company recognizes the effective portion in other comprehensive income (OCI).

- After disposing of the overseas operation, the company reclassifies the gain or loss to profit or loss.

Key Components of Hedge Accounting

To apply hedge accounting, several critical elements must be present:

1. Hedged Item

The hedged item is an asset, liability, firm commitment, forecast transaction, or net investment exposed to risk.

2. Hedging Instrument

A derivative, such as a forward, swap, or option, is used; sometimes non-derivative instruments are also allowed.

3. Hedged Risk

This refers to the specific risk being mitigated, like interest rate, currency, or commodity price fluctuations.

4. Hedge Effectiveness

The extent to which variations in the hedging instrument offset changes in the hedged item’s value is known as hedge effectiveness.

Advantages of Hedge Accounting

It offers several advantages to organizations:

1. Better Earnings Stability

Reduces artificial profit fluctuations caused by changes in derivative fair values, providing consistent earnings over time.

2. Improved Financial Reporting Quality

It creates a clear connection between risk management activities and accounting results, enhancing overall financial reporting accuracy.

3. Enhanced Investor Confidence

Stakeholders and investors learn more about the strategic identification, management, and mitigation of financial risks.

4. Alignment with Business Strategy

Accounting outcomes reflect management’s actual risk-mitigation objectives, ensuring that financial reporting accurately aligns with strategic business goals.

Disadvantages of Hedge Accounting

Despite its benefits, it also presents disadvantages:

1. Complex Documentation

Requires detailed, formal documentation at inception that clearly and comprehensively outlines risk management objectives, strategies, and relationships.

2. Ongoing Monitoring

The effectiveness of the hedge must be assessed continuously to ensure that hedging relationships remain valid throughout the reporting period.

3. Strict Compliance Requirements

Failure to meet hedge accounting criteria can result in immediate discontinuation, affecting financial statements and the stability of reported earnings.

4. System and Resource Intensive

Requires advanced accounting systems and skilled professionals, increasing operational costs and resource allocation for accurate reporting.

When Should Companies Use Hedge Accounting?

Hedge accounting is most suitable when:

1. Use of Derivatives

Companies should apply hedge accounting when derivatives are actively employed to manage financial risks effectively.

2. Financial Statement Volatility

Hedge accounting is suitable if fluctuations in financial statements significantly influence stakeholder decisions and perceptions.

3. Systems and Expertise

Firms must have robust systems and skilled personnel to implement and maintain hedge accounting processes accurately.

4. Risk Management Policies

Companies should have well-defined, documented risk management policies to support consistent application of hedge accounting practices.

Final Thoughts

Hedge accounting allows organizations to accurately reflect risk management strategies in financial statements by aligning gains and losses on hedging instruments with hedged items. It reduces volatility, enhances transparency, and strengthens reporting credibility. Despite the need for documentation, monitoring, and expertise, effective hedge accounting supports strategic decisions, improves stakeholder confidence, and delivers significant benefits for organizations facing substantial financial risks.

Frequently Asked Questions (FAQs)

Q1. Is hedge accounting mandatory?

Answer: No, hedge accounting is optional, but strict criteria must be met to apply it.

Q2. Can all derivatives qualify for hedge accounting?

Answer: Only derivatives that meet documentation and effectiveness requirements qualify.

Q3. What happens if a hedge becomes ineffective?

Answer: The ineffective portion is recognized immediately in profit or loss.

Q4. Which industries commonly use hedge accounting?

Answer: Banking, manufacturing, energy, aviation, and multinational corporations frequently use hedge accounting.

Recommended Articles

We hope that this EDUCBA information on “Hedge Accounting” was beneficial to you. You can view EDUCBA’s recommended articles for more information.