Updated July 31, 2023

Difference Between Gross Salary vs Net Salary

Salary is a fixed amount the employer pays their employees for their services. It is a regular payment made by the employer at a fixed interval, generally monthly and generally denoted as an annual package. Most of the time, salaries are usually determined by comparing employees’ salaries for a similar role in the same or different Industry. Salary is also segmented into two major categories: i.e. gross and net salary.

Gross Salary

Gross Salary is a composite of several components of an individual salary package. It is the salary comprised of income tax, EPF, Medical insurance, etc., without prior deduction. The Gross Salary mentioned in the company’s offer letter in the salary section mentions all the required components on a yearly and monthly bases, like bonuses, overtime pay, holiday pay, and other differentials. If we think in terms of CTC perspective, Gross Salary does not cover EPF and gratuity. Moreover, Gross Salary involves only compensation benefits to the employee.

Moreover, the Ministry of Labour has empowered the employee to withdraw the whole accrued amount of his / her PF account at the time of retirement while attaining 55 years.

Apart from that, there are various other circumstances when an employee can withdraw from their privileged account, as specified below.

- Termination of services.

- Retirement due to incurable diseases or disabilities.

- Unexpected relocation of an employee to oversees

Components of Gross Salary

While calculating an individual’s annual package, the employer uses some basic components of gross salary.

- Basic Salary – A major component of the gross salary which you get.

- HRA(House Rent Allowance) – Consider the house rent of any employee & reduce the tax of an individual.

- Leave Travel Allowance – This component covers the travel cost of an employee & helps with tax exemption.

- Conveyance Allowance – This component is used to facilitate an employee to travel from home to work & back.

- Retirals – Also known as superannuation, which covers an employee pension plan for post-retirement.

- Bonus – Gifts or performance allowance which covers gross salary.

Others like Medical Allowance, Provident Fund(PF), etc.

Gross Salary Formula Calculation

Net Salary

Net Salary is the amount of the employee’s salary after deducting tax provident fund and other such deductions from the gross salary, generally known as Take home salary. However, the net salary is lower than the gross salary. In certain circumstances. It can be equal to the gross salary when the income tax is negligible and the employee’s salary falls below the government tax slab.

Net Salary Formula Calculation

- Net Salary(or Take Home Salary) = CTC(Cost to Company) – EPF(Employee Provident Fund) – Retirals – Deductions – Income Tax (TDS)

- Net Salary = Gross Salary – Income Tax (TDS) – Deductions

- Net Salary <= Gross Salary

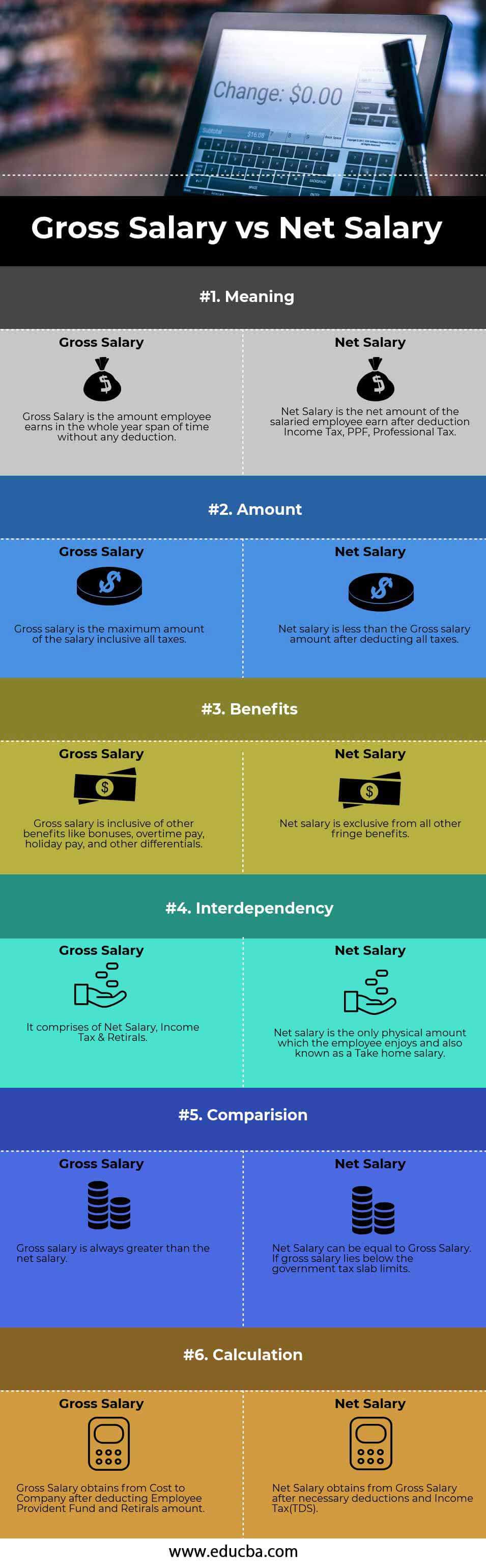

Head To Head Comparison Between Gross Salary vs Net Salary (Infographics)

Below is the top 6 difference between Gross Salary vs Net Salary

Key Differences Between Gross Salary vs Net Salary

The most significant difference between the gross salary and net salary as specified below:

- Initially, the employer decides the annual compensation, known as gross salary, without any deduction. Then, the employer reduces taxes and benefits to determine the remaining amount, known as net salary.

- Gross Salary is always higher than the Net salary.

- The best thing to perceive between gross salary vs net salary is that net salary is always dependent upon the gross salary.

- Net Salary derives from Guide to Gross Income after all adjustments and appropriations.

- Gross Salary involves all the benefits in favor of the employee, which the employer pays annually, while Net Salary is the fixed amount the employee enjoys monthly.

Gross Salary vs Net Salary Comparison Table

Look at the top 6 Comparisons between Gross Salary vs Net Salary.

| Basic Comparison |

Gross Salary |

Net Salary |

| Meaning | Gross Salary is the amount an employee earns in the whole year without any deduction. | Net Salary is the employee’s salary after deducting Income Tax, PPF, and Professional Tax. |

| Amount | Gross salary is the maximum amount of the salary inclusive of all taxes. | Net salary is less than the Gross salary amount after deducting all taxes. |

| Benefits | Gross salary includes other benefits like bonuses, overtime pay, holiday pay, and other differentials. | Net salary is excluded from all other fringe benefits. |

| Interdependency | It comprises of Net Salary, Income Tax & Retirals. | Net salary is the only physical amount the employee enjoys, also known as a Take-home salary. |

| Comparison | The gross salary is always greater than the net salary. | Net Salary can be equal to Gross Salary if the gross salary lies below the government tax slab limits. |

| Calculation | Gross Salary obtains from Cost to Company after deducting Employee Provident Fund and Retirals amount. | Net Salary obtains from Gross Salary after necessary deductions and Income Tax(TDS). |

Conclusion

Gross Salary is a composite term of benefits and taxes the employer offers annually while hiring an individual for the role that includes basic salary, HRA, Leave Travel Allowance, Bonus, and other elementary things required to continue the job. However, Net salary is a segment of the Gross salary derived after deducting income tax and other conducive deductions. Gross Salary is always higher than the net salary and sometimes equals the net salary when an employee’s salary falls below the government salary tax limit. The employer deducts the EPF amount from the employee’s monthly salary for future redemption. The employer pays a certain part of the EPF in favor of the employee.

Recommended Articles

This has guided the top difference between Gross Salary and Net Salary. Here; we discuss the Gross Salary vs Net Salary key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –