What Financial Steps Should Parents Take in Their 30s?

The 30s bring much responsibility as well as the desire to fulfil your dreams. Major life events, such as marriage, starting a family, owning a house, or buying a dream car, typically happen in your 30s. However, not everyone can fulfill all these responsibilities or achieve their dreams smoothly.

To achieve all your financial goals, you need to plan your finances and adopt some innovative strategies. Following a well-planned financial strategy will help you achieve the desired goals even in your 30s. Here is more on financial planning for parents in 30s.

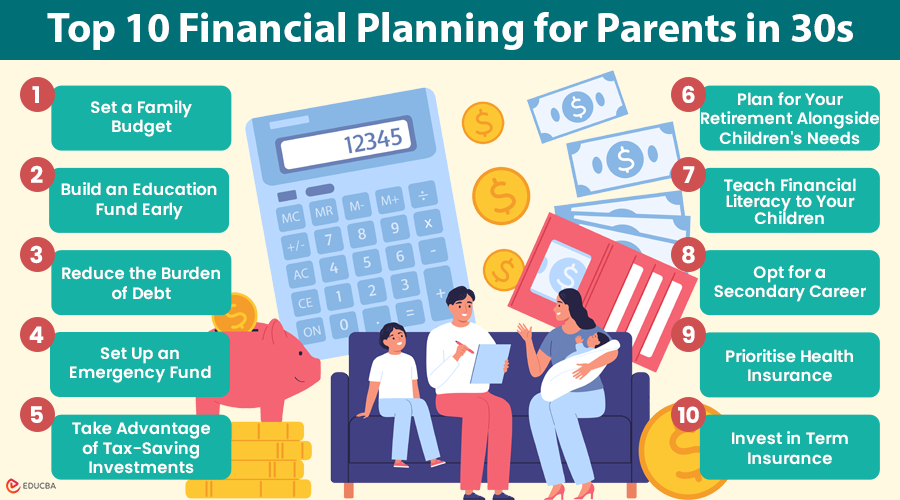

Top 10 Financial Planning for Parents in 30s

Here are some of the best ways to manage your money and strengthen your financial planning for parents in 30s:

#1. Set a Family Budget

The foundation of financial planning for parents in 30s is developing a thorough family budget. Apart from school fees, you will need to budget for childcare, healthcare, clothing, extracurricular activities, and unforeseen expenses such as medical emergencies or school trips.

As your child gets older and your family’s needs change, review and modify the budget regularly. Maintaining an emergency fund, separate from long-term savings, helps prevent unforeseen costs from disrupting your finances. You can avoid debt and manage your resources effectively with this proactive approach.

#2. Build an Education Fund Early

The cost of higher education continues to rise rapidly, and school fees are only the beginning. As early as possible, start saving for education; to take advantage of compounding, consider using mutual funds, child education plans, or systematic investment plans.

Strong financial planning for parents in 30s means building this fund early to ease future financial strain and provide high-quality learning opportunities for your child.

#3. Reduce the Burden of Debt

Many millennials accumulate various types of debt, including credit cards, personal loans, and car loans, during their 20s and early 30s. However, as you enter your late 30s and plan for a family, it is crucial to adopt strong financial habits to minimise or clear these debts.

Clearing debt is one of the most effective steps in financial planning for parents in 30s, as it improves credit scores and ensures financial flexibility.

#4. Set Up an Emergency Fund

Life is full of unpredictable events. Keep an emergency fund with six to twelve months of living expenses to handle job loss, medical issues, or family needs.

This is a cornerstone of financial planning for parents in 30s, helping you avoid stress while safeguarding your long-term investments.

#5. Take Advantage of Tax-Saving Investments

Parenting increases your financial outgoings, but tax-saving investments can help ease the burden. Utilise options like Public Provident Fund (PPF), Equity-Linked Savings Schemes (ELSS), and National Savings Certificates (NSC).

These not only reduce taxable income but also grow your wealth. Combining these with insurance policies enhances protection and savings, making your financial plan efficient.

#6. Plan for Your Retirement Alongside Children’s Needs

Securing your retirement is just as important as providing for your children. Investing in retirement funds, such as the National Pension Scheme (NPS), Employees’ Provident Fund (EPF), or private pension plans, is a top priority.

These guard against future reliance on your children by ensuring your financial stability and independence in later life.

#7. Teach Financial Literacy to Your Children

Encouraging children to understand money management early develops their financial discipline. Introduce simple concepts, such as saving, budgeting, and spending wisely, as they grow.

This enables them to become responsible adults and reduces the likelihood of future financial dependence. Consider tools like child savings accounts or allowance tracking apps to make learning interactive.

#8. Opt for a Secondary Career

Nowadays, many professionals work full-time jobs and pursue entrepreneurship, particularly as family expenses increase after having children. By your late 30s, you are likely established in your career, providing the stability and freedom to launch a side business.

In your 30s, you can create a second source of income by practising good time management. In addition to increasing your income now, this plan guarantees your financial stability once you retire, especially if your kids still require your help.

#9. Prioritise Health Insurance

Health insurance is non-negotiable for parents today. Children are prone to frequent illnesses, and medical emergencies can quickly wipe out savings. Opt for a comprehensive family floater health insurance plan that covers hospitalisation, diagnostic tests, medications, and wellness check-ups.

Some policies even include child-specific coverage for critical illnesses and preventive care. Investing in good health insurance protects your family from catastrophic health expenses and offers financial security.

#10. Invest in Term Insurance

Term insurance provides robust financial security by ensuring your family is financially protected if you pass away unexpectedly. For instance, a single premium term plan offers the advantage of paying your premium upfront in one lump sum, eliminating the hassle of regular payments.

This is ideal if you receive a bonus or inheritance and want hassle-free long-term coverage. Moreover, term insurance premiums are affordable and come with tax benefits, creating a cost-effective safety net for your loved ones.

What are the Things to Consider While Investing in Insurance Plans?

When creating a strategy for financial planning for parents in 30s, insurance plays a key role. Here are some factors to evaluate:

1. Your Financial Goals

Define your future goals, such as purchasing a home, funding education, or saving for retirement. Clear goals with timelines help you select suitable investments aligned with your needs and allow for timely adjustments as life priorities evolve.

2. Your Budget

Assess your current income and expenses. Start investing within your capacity and choose plans that allow you to increase contributions as your finances grow over time gradually.

3. Your Risk Tolerance

Know your comfort with risk. While young investors may prefer high-risk options, choose investments that suit your risk appetite, whether aggressive growth or conservative guaranteed returns, ensuring peace of mind.

4. Flexibility

Select flexible plans that allow for top-ups, partial withdrawals, or tenure changes. This adaptiveness keeps your investments relevant as you navigate career shifts or unexpected financial needs.

5. Life Coverage

Incorporate life insurance with investments to protect your family. Savings plans with insurance components safeguard loved ones financially against unforeseen events while helping your funds grow and accumulate.

6. The Tax Benefits

Invest in products offering tax deductions under Section 80C. Tax-efficient investments reduce your tax liability while growing your wealth, optimising returns during your 30s.

7. The Insurer’s Reputation

Choose investments from credible companies with strong track records and customer trust. A reputable firm assures transparency and security for your hard-earned money.

Final Thoughts

Financial readiness for parenting in your 30s requires efficient planning beyond just school fees. Prioritising insurance, budgeting, savings, and education ensures your family’s stability amid uncertainties. Equipped with these strategies for financial planning for parents in 30s, you can confidently nurture your children’s future while safeguarding your financial well-being.

Recommended Articles

We hope this guide on financial planning for parents in 30s was helpful. Explore related articles on smart budgeting tips, retirement planning strategies, and tax-saving investments.