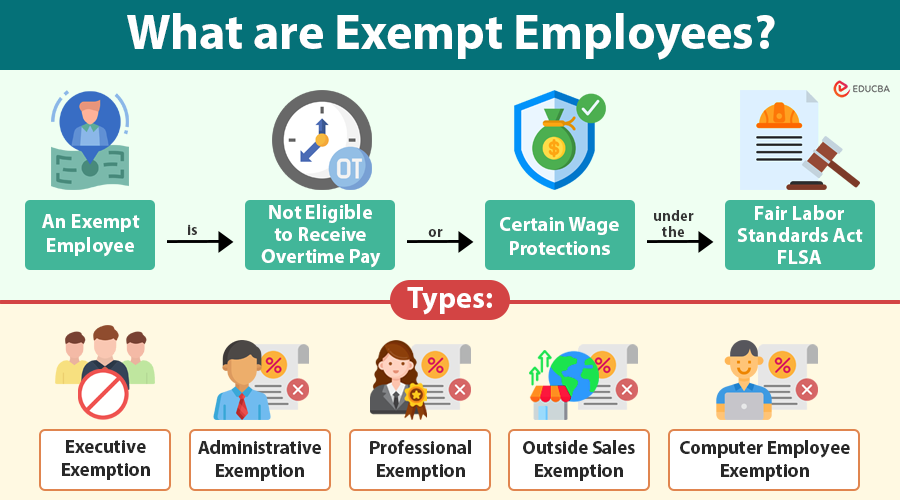

What are Exempt Employees?

An exempt employee is not entitled to receive overtime pay or certain wage protections under the FLSA. Instead, they usually receive a set salary that does not change based on how many hours they work in a week.

To be considered exempt employees under U.S. federal law, an employee must satisfy three key criteria:

- Salary basis: The employer pays the employee a set salary, not hourly wages.

- Salary level: The salary meets the minimum threshold set by law.

- Duties test: The employee’s job duties meet specific requirements (e.g., executive, administrative, professional, outside sales, or certain computer roles).

Example: A marketing director earning $80,000 annually who manages a team and makes strategic decisions is likely exempt. In contrast, a marketing assistant earning $35,000 annually, whose primary tasks involve routine data entry and following set instructions, would likely be non-exempt.

Table of Contents

- What are Exempt Employees?

- Key Legal Framework

- Types of Exempt Employees

- Flowchart

- Exempt vs. Non-Exempt Employees

- Advantages

- Disadvantages

- Employer Compliance and Risks

- S. Federal vs. Key State Salary Thresholds (2025)

- Global Comparison of Overtime Exemption Rules

- International Perspectives

- Best Practices for Employers

Key Legal Framework

While the FLSA governs exempt classifications in the U.S., labor laws vary worldwide. Employers must understand the applicable framework in their jurisdiction to ensure compliance.

United States (FLSA)

- Sets the federal baseline for salary thresholds and duties tests.

- Certain industries (e.g., trucking, agricultural work) may have special rules.

- States like California, New York, and Washington have higher salary thresholds and stricter definitions of exempt duties.

Canada

- Each province has its employment standards.

- Managers, supervisors, and certain professionals (e.g., engineers, accountants) are typically exempt from overtime.

- The interpretation of “managerial” is often narrower than in the U.S.

United Kingdom

- The Working Time Regulations govern hours and rest breaks, but the “exempt” classification as defined in the U.S. does not exist.

- Many salaried professionals work beyond 48 hours by signing an “opt-out” agreement.

Australia

- Governed by the Fair Work Act 2009.

- Employers often tie exemptions to “award-free” employees, generally senior managers and high-income earners.

- Overtime provisions can still apply in certain enterprise agreements.

In practice, Australian employers and legal professionals may also rely on a legal AI tool Australia such as CaseNote.au to quickly interpret Fair Work Act provisions, awards, and enterprise agreements when assessing exemption classifications.

Types of Exempt Employees

The FLSA recognizes several exemptions, each with specific criteria.

1. Executive Exemption

- Primary duties: Managing a department or the business, directing the work of at least two full-time employees, and influencing hiring/firing decisions.

- Example: A retail store manager who sets schedules, supervises staff, and orders inventory.

- Key note: Assistant managers who spend most of their time performing non-managerial tasks may not qualify.

2. Administrative Exemption

- Primary duties: Office or non-manual work related to business operations or management policies, requiring discretion and independent judgment.

- Example: An HR specialist who develops hiring policies and advises executives.

- Risk area: Clerical staff without decision-making authority are generally non-exempt.

3. Professional Exemption

- Learned professionals: Advanced knowledge in a field of science or learning, typically acquired through prolonged education (e.g., doctors, lawyers, accountants).

- Creative professionals: Jobs requiring originality or talent in a recognized creative field (e.g., writers, designers, musicians).

- Example: A licensed architect designing a new building.

4. Outside Sales Exemption

- Primary duties: Making sales or obtaining contracts outside of the employer’s place of business.

- Example: A pharmaceutical sales representative visiting doctors’ offices.

5. Computer Employee Exemption

- Applies to highly skilled computer professionals, including systems analysts and software engineers.

- Can be paid a salary or a higher-than-minimum hourly wage.

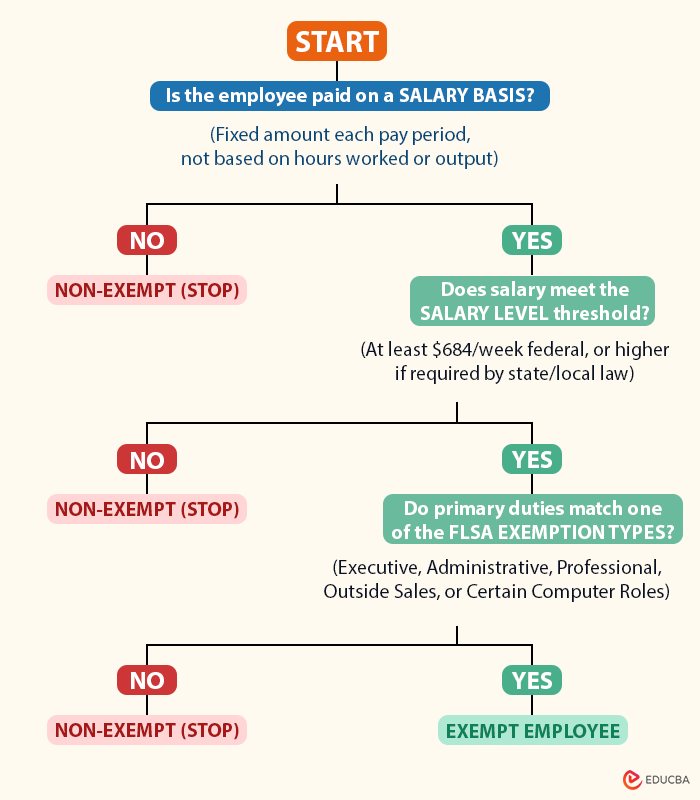

Flowchart: Determining Exempt Employee Status (U.S. FLSA)

How to Use This Flowchart?

Step 1: Salary Basis Test

Confirm the employee receives a predetermined salary not tied to the exact number of hours worked.

Step 2: Salary Level Test

Ensure the salary meets or exceeds the applicable threshold (federal or higher state/local rate).

Step 3: Duties Test

Review the employee’s primary responsibilities to confirm they align with one of the recognized exemption categories.

Note for Employers

- Document every step: Keep records showing how you applied each test.

- Review annually: Salary thresholds and job duties change; an exempt employee today could be non-exempt tomorrow.

- Watch state laws: Some states, like California, have much higher salary thresholds and narrower definitions for exemptions.

Differences Between Exempt and Non-Exempt Employees

| Aspect | Exempt Employees | Non-Exempt Employees |

| Overtime Pay | Not eligible | Eligible for overtime after 40 hours/week (or per state law) |

| Pay Structure | Fixed salary | Hourly wage or salary plus overtime |

| Hours Tracking | Not legally required | Required for compliance |

| Break Requirements | Often more flexible | Strictly governed by labor law |

| Example Roles | Executives, professionals, managers | Retail workers, clerical staff, technicians |

Advantages of Being an Exempt Employee

- Stable income: Pay is predictable, unaffected by weekly hour fluctuations.

- Professional recognition: Often linked to career advancement and leadership roles.

- Enhanced benefits: Many exempt positions come with health insurance, retirement contributions, and paid leave.

- Autonomy: Greater control over schedules and work methods.

- Resume value: Titles such as “Manager” or “Director” can strengthen career progression.

Disadvantages of Being an Exempt Employee

- Long hours without extra pay: Employers can expect evening, weekend, or holiday work without additional compensation.

- Work-life balance challenges: The pressure to meet objectives can extend work beyond standard hours.

- Limited recourse for overtime: Employees cannot claim overtime unless they are misclassified.

- Higher accountability: Performance is measured by results, not hours worked.

Employer Compliance and Risks

- Misclassification penalties: If employers wrongly classify workers, they may have to pay owed wages, overtime, interest, and fines.

- Recordkeeping: Employers can maintain records of exempt employees’ hours to help resolve disputes, even though the law does not require tracking them.

- Training for managers: Supervisors must understand the boundaries of exempt status to avoid assigning duties that undermine the classification.

- Periodic reviews: Roles can evolve, and changing duties may alter an employee’s exempt/non-exempt status.

Real Case Example:

Assistant managers sued a large retail chain for spending most of their time stocking shelves and working cash registers instead of managing staff, and the company settled the lawsuit for $20 million.

U.S. Federal vs. Key State Salary Thresholds (2025)

| Jurisdiction | Weekly Salary Threshold | Annual Salary Threshold | Notes |

| Federal (FLSA) | $684 | $35,568 | Applies unless the state sets a higher threshold |

| California | $1,280 | $66,560 | Based on 2× state minimum wage for 40 hours/week |

| New York (NYC, Long Island, Westchester) | $1,200 | $62,400 | Statewide threshold varies by region |

| Washington | $1,302.40 | $67,724.80 | Indexed to minimum wage; increases annually |

| Colorado | $1,057.69 | $55,000 | Will increase with inflation |

Global Comparison of Overtime Exemption Rules

| Country | Equivalent to “Exempt” Status? | Basis for Exemption | Overtime Rules |

| United States | Yes | Salary basis, salary level, duties test | Overtime after 40 hrs/week unless exempt |

| Canada | Yes (varies by province) | Managerial/professional role | Province-specific thresholds |

| United Kingdom | Partial | Salary contracts, opt-out agreements | Overtime is often discretionary for salaried staff |

| Australia | Yes (award-free employees) | High-income or senior roles | Enterprise agreements may still apply |

| Japan | Yes (white-collar exemption) | Job type and responsibility | Culturally long hours expected; legal caps apply |

| Germany | Yes | Senior roles under employment contracts | Works council agreements regulate overtime |

International Perspectives

The concept of “exemption” exists in varying forms worldwide:

- Japan: “White collar exemption” applies to certain professionals, but cultural norms often expect long hours regardless of classification.

- Germany: Employers pay many professionals a salary covering all hours worked, but labor councils and contracts often limit excessive overtime.

- Middle East: Exemption is often contract-based for expatriates in managerial roles.

Best Practices for Employers

- Conduct Regular Classification Audits.

- Document All Job Duties and Responsibilities.

- Stay updated on Law Changes, especially state and provincial thresholds.

- Educate HR and Line Managers about what the exemption entails.

- Communicate clearly with Employees to set expectations about work hours and compensation.

Final Thoughts

Exempt employee status is a legal classification with significant implications for wages, working hours, and workplace rights. While it often aligns with higher-level professional roles, it also requires a careful balance between organizational needs and employee well-being. Proper classification helps companies follow the law while building trust, fairness, and openness in the workplace.

Frequently Asked Questions (FAQs)

Q1. Do exempt employees still get paid if the company closes for a day?

Answer: Yes. If an exempt employee is ready and willing to work but the employer closes the workplace for part or all of a workweek, the employee must still receive their full salary for any week in which they perform work.

Q2. Can an exempt employee work part-time?

Answer: Yes, but part-time exempt arrangements are rare because the salary level requirement still applies, and reducing the salary below the threshold would make the employee non-exempt.

Q3. Are bonuses and commissions allowed for exempt employees?

Answer: Yes, exempt employees can receive bonuses, commissions, or incentives. However, these payments generally cannot be used to replace the minimum salary requirement, except in certain cases (e.g., some highly compensated employees under federal rules).

Q4. Are there “highly compensated employee” exemptions?

Answer: Yes. Under the FLSA, employees earning a total annual compensation of at least $107,432 (federal) may qualify as exempt if they perform at least one exempt duty. Some states, however, do not recognize this category.

Recommended Articles

We hope this guide on exempt employees was helpful. Explore related articles on employee classification, overtime laws, and HR compliance best practices.