Updated July 26, 2023

Definition of Elasticity of Demand Example

The elasticity of demand refers to the sensitivity of demand for goods to changes in other economic variables. These economic variables can be the price of goods, prices of other goods or income.

Here, one economic variable changes while the other variables are kept constant. Price elasticity of demand refers to the sensitivity in demand for goods to a change in their price.

When quantity demanded changes at a higher pace than change in price, demand is known to be relatively elastic. Demand is relatively inelastic when a change in quantity demanded is lesser in response to the change in price.

Examples of Elasticity of Demand (With Excel Template)

Let’s take an example to understand the calculation of the Elasticity of Demand in a better manner.

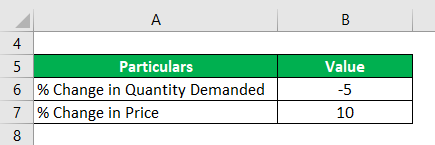

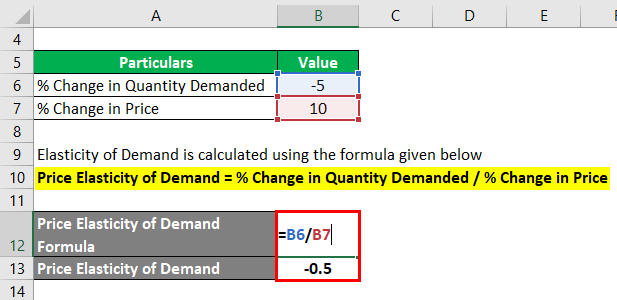

Elasticity of Demand – Example #1

The Petroleum Minister of a country is concerned about the fall in demand for petrol when the price of petrol rises. He finds that when petrol prices rise by 10%, the demand for petrol falls by 5%. Calculate the price elasticity of demand for petrol. Also, Calculate whether the demand for petrol is relatively inelastic or relatively elastic.

Solution:

The elasticity of Demand is calculated using the formula given below

Price Elasticity of Demand = % Change in Quantity Demanded / % Change in Price

- Price Elasticity of Demand = -5 /10

- Price Elasticity of Demand = -0.5

The Price Elasticity of Demand for petrol is -0.5.

Since the % change in quantity demanded is less than the % change in price, the demand for petrol is relatively inelastic.

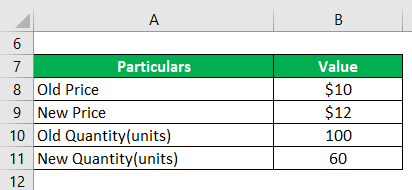

The Elasticity of Demand – Example #2

A Finance Manager in an organization wants to calculate the elasticity of demand for a product sold by the organization. He digs deep into the records and finds some fascinating data. When the price of the product was $10, the quantity demanded was 100 units. Then they increased the price to $12. The quantity demanded showed a huge fall. It fell to 60 units. Calculate the price elasticity of demand for the Finance Manager. Also, determine whether the demand is relatively prices elastic or relatively price inelastic.

Solution:

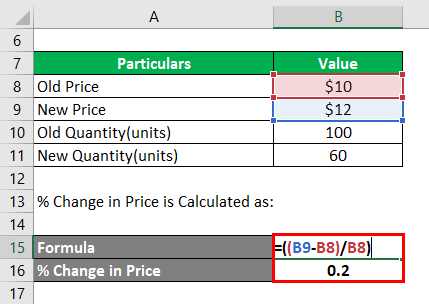

% Change in Price is Calculated as:

- % Change in Price = $12 – $10/$10 *100

- % Change in Price = $2/$10 *100

- % Change in Price = 0.2 *100

- % Change in Price = 20%

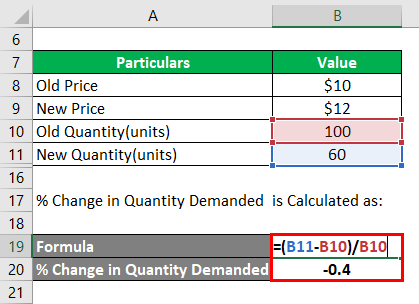

% Change in Quantity Demanded is Calculated as:

- % Change in Quantity Demanded =60 units – 100 units/100 units * 100

- % Change in Quantity Demanded = -40 units/100 units * 100

- % Change in Quantity Demanded = -0.4 * 100

- % Change in Quantity Demanded = -40%

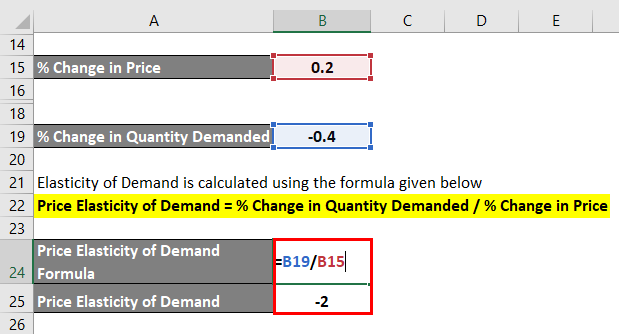

The elasticity of Demand is calculated using the formula given below

Price Elasticity of Demand = % Change in Quantity Demanded / % Change in Price

- Price Elasticity of Demand = -40/20

- Price Elasticity of Demand = -2

The price elasticity of demand is -2.

Since the % change in the quantity demanded is greater than the % change in price, the demand for the product is relatively elastic.

The elasticity of Demand – Example #3

Mrs Agatha Smith is the owner of a jewellery store in New York. The storehouse’s rare diamonds. Mrs. Smith has rich and celebrities as her clients. When the price of a particular grade of diamond was $1 million, the quantity sold was 10 units. When the price rose to $1.2 million, the quantity sold increased to 20 units. Calculate the price elasticity of demand for diamonds. Also, state what is peculiar about this demand situation.

Solution:

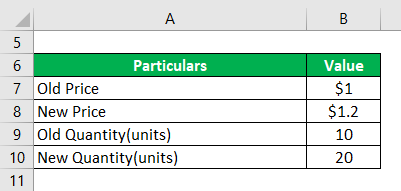

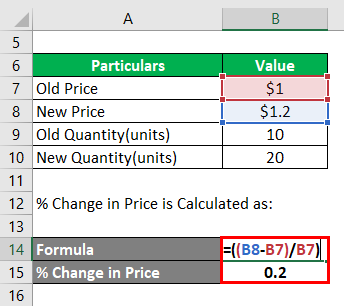

% Change in Price is Calculated as:

- % Change in Price = $1.2 million – $1 million / $1 million * 100

- % Change in Price =$0.2 million / $1 million * 100

- % Change in Price = 20%

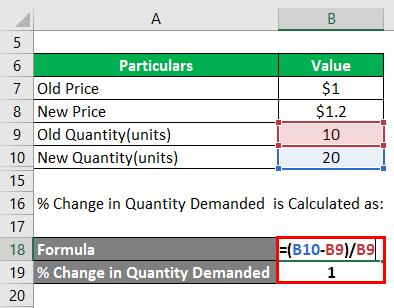

% Change in Quantity is Calculated as:

- % Change in Quantity Demanded = 20 units – 10 units / 10 units * 100

- % Change in Quantity Demanded =10 units / 10 units * 100

- % Change in Quantity Demanded = 1*100

- % Change in Quantity Demanded = 100%

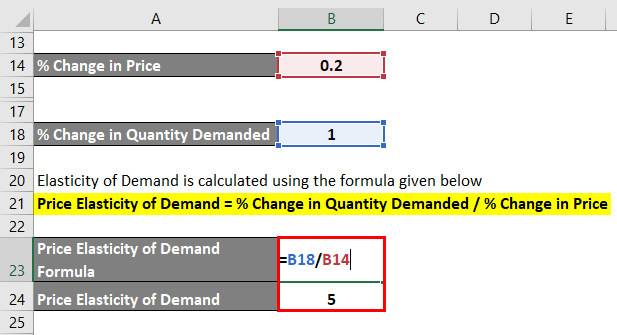

The elasticity of Demand is calculated using the formula given below

Price Elasticity of Demand = % Change in Quantity Demanded / % Change in Price

- Price Elasticity of Demand = 100 / 20

- Price Elasticity of Demand = 5

The price elasticity of demand is 5.

Peculiarity: Diamonds are an article on Snob Appeal. Articles of Snob Appeal are those commodities that are used to enhance the image of the person using these goods. Articles of Snob Appeal are an exception to the law of demand. The law of demand states that when the price of goods increases, the quantity demanded falls. However, in the case of diamonds, when the price increases, the quantity demanded goes up.

In the above case, the price elasticity of demand is positive as opposed to negative, which is generally the case.

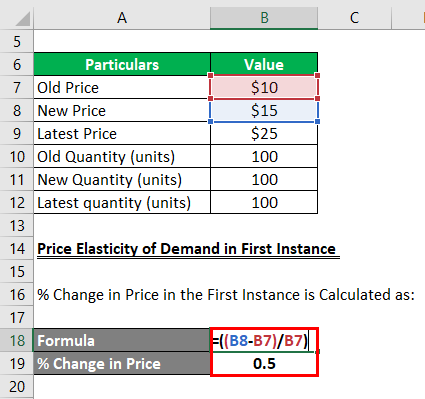

The elasticity of Demand – Example #4

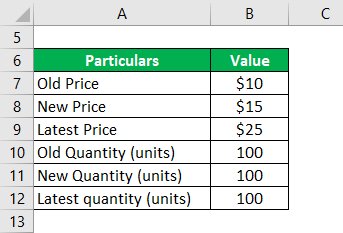

Robert Smith is an Economist at a prestigious university. While doing his research work, he came across a peculiar situation. He found out that when the price of a product was $10, the quantity demanded was 100 units. When the price rose to $15, the quantity demanded remained at 100 units. When the price rose to $25, the quantity demanded was again the same at 100 units. Calculate the price elasticity of demand. What is this particular demand situation called?

Solution:

% Change in Price in the First Instance is Calculated as:

- % Change in Price in the First Instance = $15 -$10 / $10 * 100

- % Change in Price in the First Instance = 50%

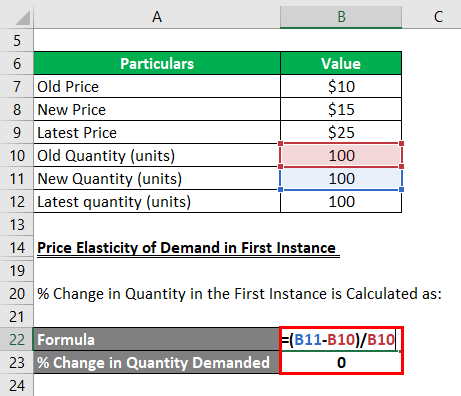

% Change in Quantity in the First Instance is Calculated as:

- % Change in Quantity in the First Instance = 100 units – 100 units / 100 units * 100

- % Change in Quantity in the First Instance = 0

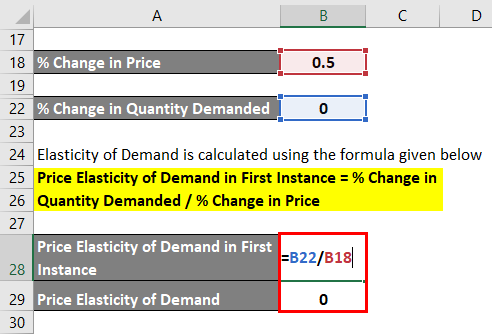

The Elasticity of Demand is calculated using the formula given below

Price Elasticity of Demand in the First Instance = % Change in Quantity Demanded / % Change in Price

- Price Elasticity of Demand = 0 / 50

- Price Elasticity of Demand = 0

Thus, the price elasticity of demand is 0. Even in the second instance, the price elasticity of demand is 0 as the quantity demanded remains the same irrespective of the change in price.

The situation is referred to as perfectly inelastic demand. Perfectly inelastic demand is a situation where the quantity demanded remains the same irrespective of the price.

Cross Elasticity

This is the other concept of elasticity of demand which explains the sensitivity of quantity demanded of any commodity when the price of the other substitute products changes.

The cross elasticity of demand is always positive as the demand for one commodity will definitely be increased when the price of substitute products increases.

For example, if the price of the coffee increases, the demand for tea in the market will increase.

Cross Elasticity of demand can be calculated as % changes in the demanded quantity of product A divided by % change in the price of product B,

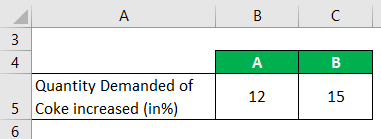

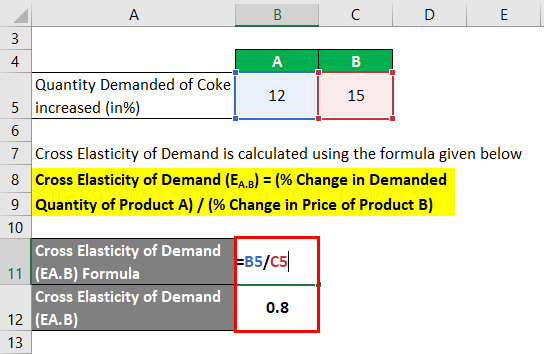

Cross Elasticity – Example #5

Let’s understand this by the example of two coke brands A and B. Suppose in a quarter, the quantity demanded of Coke A is increased by 12% due to the price of Coke B has been increased by 15%.

Solution:

Cross Elasticity of Demand is calculated using the formula given below

Cross Elasticity of Demand (EA.B) = (% Change in Demanded Quantity of Product A) / (% Change in Price of Product B)

- Cross Elasticity of Demand (EA.B) = (12%) / (15%)

- Cross Elasticity of Demand (EA.B) = 0.8

So when we see that the cross elasticity of demand is positive for Coke A and Coke B, it means these 2 are substitute products, and the changes in the price of one product would affect the demanded quantity of another product.

Income Elasticity

Income is another variable that affects the demand for any commodity. Income Elasticity of demand refers to the sensitivity of the quantity demanded to a change in the income of the consumer for a commodity.

It is measured as a % change in the demanded quantity divided by the % change in the income of consumers for a particular commodity.

Or

The income elasticity of demand could be seen with luxurious commodities. When the income of one’s increases, the person would be spending more on branded and luxurious commodities. The higher the income elasticity for any commodity means the higher sales for the commodity at the time income raises of the consumer.

The following are the best examples of positive income elasticity,

- Luxurious commodities, such as wines, high-quality chocolates, branded clothes.

- Expensive smartphones.

- Clubs and Gym membership.

- Sports cars.

- Private taxis instead of buses or any other public transport.

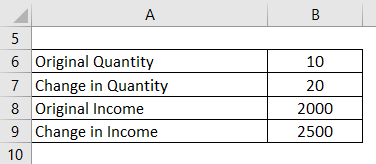

Income Elasticity – Example #6

Let’s take one example of consumer A whose income was $2000, and he was using public transport most of the time and using private cab only 10 times in a month. His salary increases to $2500, due to that he started spending more on private cab 20 times instead of public transport in a month. We will calculate income elasticity for this commodity from the above-mentioned formula,

Solution:

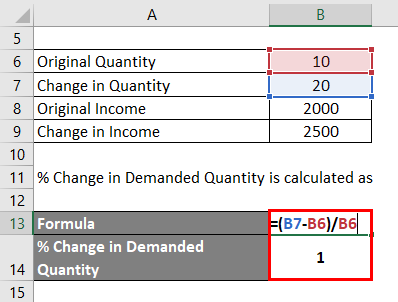

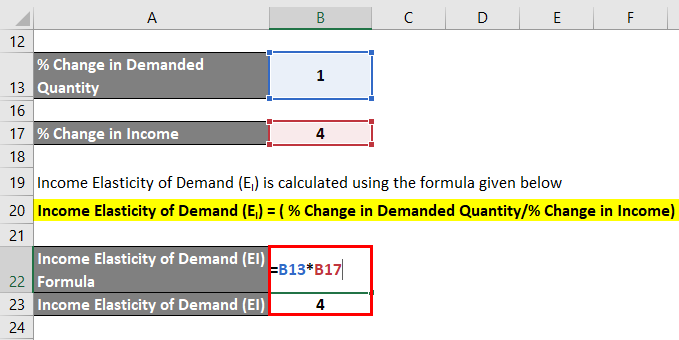

% Change in Demanded Quantity is calculated as

- % Change in Demanded Quantity = (20 – 10) / 10

- % Change in Demanded Quantity = 1

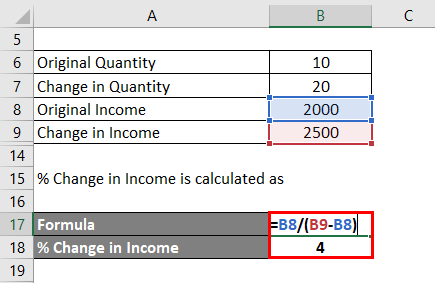

% Change in Income is calculated as

- % Change in Income = 2000 / (2500 – 2000)

- % Change in Income = 4

Income Elasticity of Demand (EI) is calculated using the formula given below.

Income Elasticity of Demand (EI) = ( % Change in Demanded Quantity / % Change in Income)

- Income Elasticity of Demand (EI) = 1 * 4

- Income Elasticity of Demand (EI) = 4

So in the above example, we can see that income elasticity for private taxi services is 4, which is highly elastic. The consumer tends to spend more on private taxis when they earn more income.

Conclusion

The elasticity of demand is a useful concept in taking pricing decisions and determination of output levels. It helps in fixing the prices of products for businesses and specifically for monopolists. We can come to know the proportion by which demand will fall in response to the rise in prices if we know the elasticity of demand. If the demand for a product is relatively inelastic, the seller of a product can charge a high price for it. If the demand is relatively elastic, he can charge a low price.

The elasticity of demand also helps in framing government policies while imposing statutory price control on a product and levying taxes. The government can levy more taxes on products that have relatively inelastic demand. Knowledge of income elasticity of demand is useful for forecasting the future demand for a product. For instance, since the general income levels of people in India are expected to rise, the demand for goods purchased with disposable income will rise by leaps and bounds. The concept of elasticity of demand is also useful in international trade. There is said to be gained from international trade for a country if it exports goods that have less elasticity of demand and imports goods that have more demand elasticity.

Recommended Articles

This has been a guide to the Elasticity of Demand Example. Here we discuss the definition and various examples of Demand Elasticity such as Price Elasticity, Income Elasticity, and Cross Elasticity with a downloadable Excel template. You can also go through our other suggested articles to learn more –