What is Digital Asset Custody?

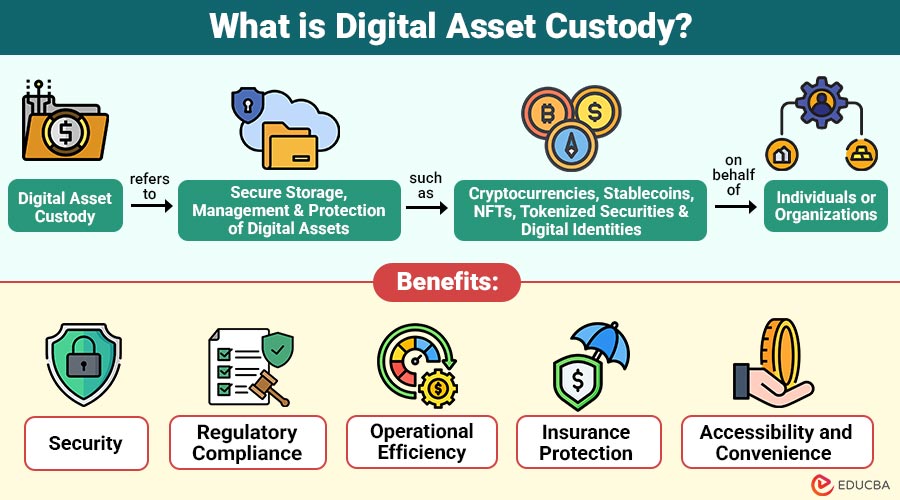

Digital asset custody refers to secure storage, management, and protection of digital assets—such as cryptocurrencies, stablecoins, NFTs, tokenized securities, and digital identities—on behalf of individuals or organizations.

Custody solutions focus on:

- Protecting private cryptographic keys

- Preventing unauthorized access and theft

- Ensuring regulatory compliance

- Enabling controlled access and transaction execution

Custodians may be individuals managing their own assets or third-party service providers offering institutional-grade security, governance, and insurance.

Table of Contents:

Key Takeaways:

- Digital asset custody services secure cryptocurrencies, NFTs, and tokens by protecting private keys and preventing unauthorized access.

- Self-custody offers full control but demands technical knowledge, while third-party custody ensures professional security and insurance.

- Multi-signature approvals, cold storage, and regulatory compliance enhance safety, accountability, and trust in digital asset management.

- Choosing reputable custodians and regular monitoring minimizes risks, ensures liquidity, and maintains operational and legal compliance.

Types of Digital Asset Custody

Here are the two primary types of digital asset custody, along with their pros, cons, and examples

1. Self-Custody

Self-custody allows individuals or organizations to retain full control over their digital assets. This typically involves storing private keys in hardware wallets, software wallets, or offline cold storage.

Pros:

- Complete control over assets.

- No reliance on third-party providers.

- Greater privacy and autonomy.

Cons:

- High security responsibility; loss of keys results in loss of assets.

- Requires technical knowledge to manage securely.

- Vulnerable to personal error or cyberattacks if not properly secured.

2. Third-Party Custody

Third-party custody involves entrusting assets to a professional service provider. These custodians offer secure storage, insurance coverage, and compliance management. This model is popular among institutional investors and businesses managing large volumes of digital assets.

Pros:

- Professional security measures.

- Reduced operational burden.

- Often insured against theft or loss.

Cons:

- Reliance on third-party security.

- Potential exposure to hacks or mismanagement.

- Possible fees for storage and transaction services.

Key Features of Digital Asset Custody

Digital asset custodianship has evolved significantly with technology. Some of the key features include:

1. Private Key Management

Digital asset custodians securely store cryptographic keys using advanced encryption, hardware wallets, and multi-signature solutions to prevent unauthorized access or theft.

2. Multi-Signature Authorization

Transactions require multiple approvals from authorized parties, enhancing security, reducing fraud risk, and ensuring assets cannot be moved without proper consent.

3. Insurance Coverage

Custodians provide insurance protection for digital assets, covering losses from cyberattacks, theft, operational failures, or other unforeseen security breaches.

4. Regulatory Compliance

Digital asset custody ensures strict adherence to financial regulations, including KYC, AML, and reporting requirements, maintaining legal and operational compliance.

5. Audit Trails and Reporting

Custodians maintain transparent records and detailed logs of all asset movements, ensuring accountability, traceability, and accurate audit reporting.

Benefits of Digital Asset Custody

Secure custody of digital assets offers several benefits for both individuals and institutions:

1. Security

Custody solutions safeguard digital assets against cyberattacks, fraud, and key loss, ensuring long-term protection and investor confidence.

2. Regulatory Compliance

Third-party custodians ensure compliance with AML, KYC, and financial regulations, thereby minimizing legal risks and maintaining operational legitimacy.

3. Operational Efficiency

Custodians streamline digital asset management, allowing investors and businesses to focus on trading, strategy, and growth opportunities.

4. Insurance Protection

Many custodians offer insurance policies for digital assets, providing financial protection against theft, cyberattacks, or operational failures.

5. Accessibility and Convenience

Custodians provide user-friendly platforms that enable users to monitor, manage, and access digital holdings efficiently, anytime, anywhere.

Challenges in Digital Asset Custody

Despite its benefits, digital asset custody also faces challenges:

1. Cybersecurity Risks

Hackers constantly develop new methods to exploit custodians, threatening digital assets and requiring advanced, evolving security measures.

2. Regulatory Uncertainty

Digital asset regulations differ across jurisdictions, frequently changing, and creating compliance challenges for custodians and asset owners globally.

3. Technical Complexity

Managing private keys, wallets, and multi-signature protocols is technically challenging, especially for individuals lacking specialized knowledge or experience.

4. Liquidity Limitations

Cold storage and certain custodial solutions may restrict immediate access to assets, delaying transactions and reducing liquidity efficiency.

Real-World Examples of Digital Asset Custody

Several institutions and platforms demonstrate effective digital asset custody in practice:

1. Coinbase Custody

Coinbase Custody provides insured storage for institutional investors, ensuring compliance, security, and 24/7 monitoring of assets.

2. BitGo

BitGo offers multi-signature wallets, insurance, and regulatory compliance services, catering to institutional clients and large-scale traders.

3. Anchorage Digital

Anchorage Digital offers a combination of secure custody, staking, and asset management solutions for enterprises and financial institutions.

Best Practices for Digital Asset Custody

Here are some key best practices for digital asset custody to ensure security, compliance, and asset protection.

1. Use Multi-Signature Wallets

Require multiple authorized approvals for every transaction to enhance security, prevent unauthorized access, and reduce fraud risks effectively.

2. Leverage Cold Storage

Store long-term digital asset holdings offline in secure cold storage to protect against cyberattacks and online threats.

3. Maintain Redundant Backups

Keep multiple, secure backups of private keys in different locations to ensure recovery in case of loss.

4. Choose Reputable Custodians

Select custodians with proven security protocols, insurance coverage, and strict regulatory compliance for maximum asset protection.

5. Regularly Monitor Assets

Perform periodic audits, security checks, and monitoring to detect anomalies and maintain the integrity of digital holdings.

Final Thoughts

Digital asset custody is essential for anyone holding digital assets, from individual investors to large financial institutions. The right custody solution ensures security, regulatory compliance, and peace of mind. As technology and regulations evolve, custody will be crucial for the safe, sustainable growth of the digital economy, enabling investors and organizations to participate efficiently and securely in this expanding market.

Frequently Asked Questions (FAQs)

Q1. Are digital asset custodians insured?

Answer: Many custodians offer insurance against cyber theft or loss, but coverage varies by provider and asset type.

Q2. Can I access my assets anytime with custody solutions?

Answer: Hot wallet solutions provide instant access, while cold storage may have a delay due to offline protocols.

Q3. Why is digital asset custody important for institutions?

Answer: It ensures security, compliance, insurance protection, and operational efficiency, which are critical for large-scale holdings.

Q4. How do custodians ensure regulatory compliance?

Answer: They implement KYC/AML procedures, audit reporting, and adhere to jurisdiction-specific legal frameworks.

Recommended Articles

We hope that this EDUCBA information on “Digital Asset Custody” was beneficial to you. You can view EDUCBA’s recommended articles for more information.