Updated July 21, 2023

Deferred Annuity Formula (Table of Contents)

What is the Deferred Annuity Formula?

The term “deferred annuity” refers to the present value of the string of periodic payments to be received in the form of lump-sum payments or installments, but after a certain period of time and not immediately.

In other words, the deferred annuity formula helps in determining the present value of the future annuity payments on the basis of the applicable rate of interest and period of delay.

Formula

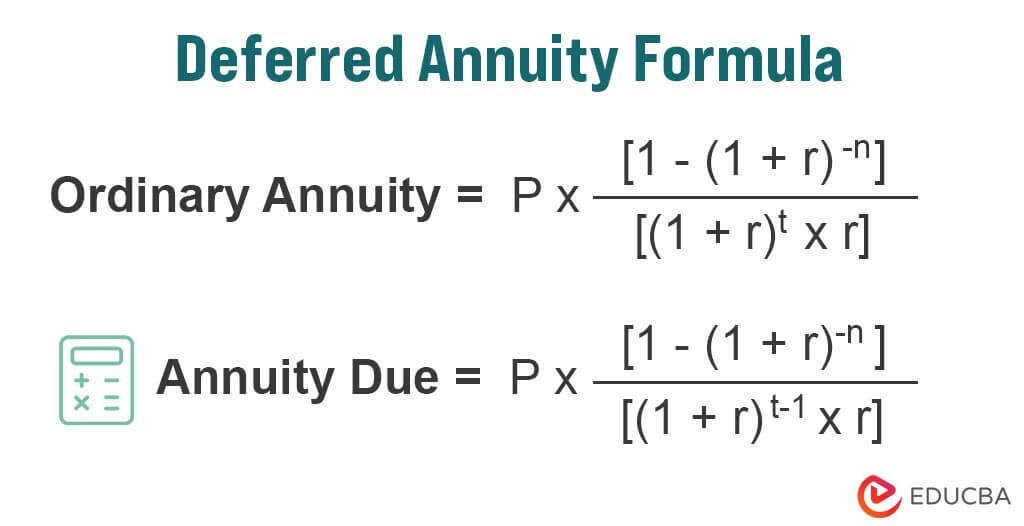

If the annuity payment is to be made at the end of each period, then it is known as ordinary annuity and its formula is expressed using annuity payment, rate of interest, number of periodic payments and period of delay. Mathematically, it is represented as,

Where,

- P = Annuity Payment

- r = Rate of Interest

- n = Number of Periodic Payments

- t = Period of Delay

If the annuity payment is to be made at the beginning of each period, then it is known as an annuity due and its formula is also expressed using annuity payment, rate of interest, number of periodic payments and period of delay. Mathematically, it is represented as,

Example of Deferred Annuity Formula (With Excel Template)

Let’s take an example to understand the calculation of Deferred Annuity in a better manner.

Deferred Annuity Formula – Example #1

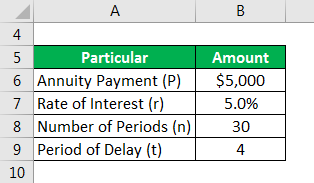

Let us take the example of David who deposited a certain amount of money today and is supposed to receive 30 annual payments of $5,000 each. However, the annuity will start 4 years from today and the applicable rate of interest is 5%. Calculate the amount of money deposited if the annuity payment is supposed to be made at the end of each year.

Solution:

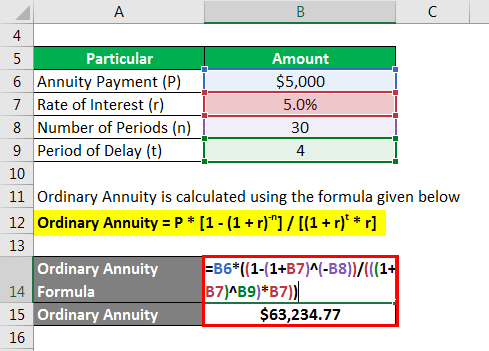

Ordinary Annuity is calculated using the formula given below

Ordinary Annuity = P × [1 – (1 + r)-n] / [(1 + r)t× r]

- Ordinary Annuity = $5,000 × [1 – (1 + 5%)-30] / [(1 + 5%)4 × 5%]

- Ordinary Annuity = $63,234.77

Therefore, David must have deposited $63,235 today for the deferred annuity payments.

Deferred Annuity Formula – Example #2

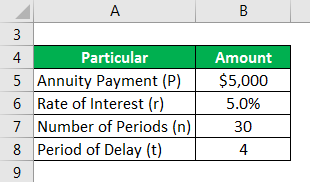

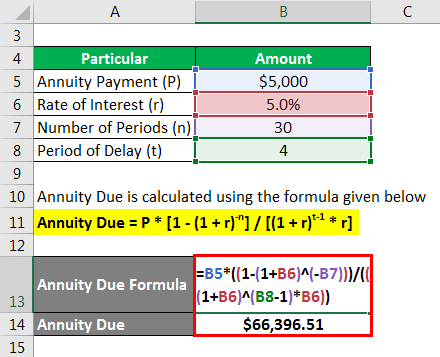

Let us now assume that all the conditions remain the same as in Example 1 except that in this case the annuity payment is supposed to be made at the beginning of each year. Calculate the amount of money deposited today by David.

Solution:

Annuity Due is calculated using the formula given below

Annuity Due = P × [1 – (1 + r)-n] / [(1 + r)t-1 × r]

- Annuity Due = $5,000 × [1 – (1 + 5%)-30] / [(1 + 5%)4-1 × 5%]

- Annuity Due = $66,396.51

Therefore, in this case, David must have deposited $66,307 today for the deferred annuity payments.

Explanation

The formula for Deferred Annuity can be calculated by using the following steps:

The major difference between a deferred annuity and most other annuity is how and when the withdrawals are started. As any other annuity plan, the deferred annuity is also funded over a period of time through a lump-sum payment or monthly contributions. However, the withdrawals, in this case, do not start immediately after the funding and as such the name – a deferred annuity.

The ordinary annuity formula can be explained as follows:

Step 1: Firstly, ensure that the annuity payment is to be made at the end of every period, which is denoted by P.

Step 2: Next, ascertain the period of delay for the payment, which is denoted by t.

Step 3: Next, determine the total no. of periodic payments to be made and it is denoted by n.

Step 4: Next, determine the rate of interest applicable for the period and it is denoted by r.

Step 5: Finally, the ordinary annuity formula can be expressed on the basis of the annuity payment (step 1), no. of periodic payments (step 2), a period of delay (step 3), and rate of interest (step 4) as shown below.

The annuity due formula can be explained as follows:

Step 1: Firstly, ensure that the annuity payment is to be made at the beginning of every period, which is denoted by P.

Step 2: Next, ascertain the period of delay for the payment, which is denoted by t.

Step 3: Next, determine the total no. of periodic payments to be made and it is denoted by n.

Step 4: Next, determine the rate of interest applicable for the period and it is denoted by r.

Step 5: Finally, the annuity due formula can be expressed on the basis of the annuity payment (step 1), no. of periodic payments (step 2), the period of delay (step 3), and rate of interest (step 4) as shown below.

Relevance and Use of Deferred Annuity Formula

Some of the major uses of deferred annuity formula are as follows:

- It is used by insurance companies to assess the quantum of money to be paid either as a regular income or a lump sum.

- It is used by investors to add to their existing retirement income, such as Social Security.

- It is used to defer the tax on earnings.

Deferred Annuity Formula Calculator

You can use the following Deferred Annuity Formula Calculator

| P | |

| r | |

| n | |

| t | |

| Annuity Due | |

| Annuity Due = | P x [1-(1+r)-n ]/[(1+r)t-1xr] | |

| 0 x [1-(1+ 0)-0)]/[(1+0)0-1x0] = | 0 |

Conclusion

So, it can be seen that deferred annuity is a very important financial concept for investors who intend to build a smooth cash inflow in the future years, especially after retirement.

Recommended Articles

This is a guide to Deferred Annuity Formula. Here we discuss how to calculate the Deferred Annuity along with practical examples. We also provide a Deferred Annuity calculator with a downloadable excel template. You may also look at the following articles to learn more –