What is Debt Management?

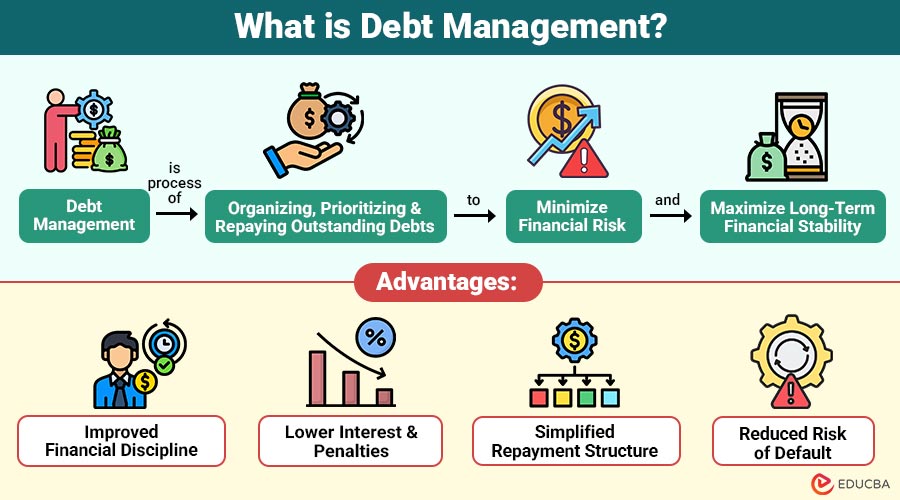

Debt Management is the process of organizing, prioritizing, and repaying outstanding debts to minimize financial risk and maximize long-term financial stability. It involves budgeting, negotiating with creditors, consolidating loans, and adopting disciplined repayment strategies.

The primary goals of debt management are:

- To reduce the overall debt burden

- To avoid missed payments and penalties

- To improve creditworthiness

- To regain financial control

Debt management can be applied at both personal and organizational levels.

Table of Contents:

- Meaning

- Importance

- Types of Debt

- Strategies

- Difference

- Tools

- Advantages

- Disdvantages

- Real-World Examples

Key Takeaways:

- Debt management organizes repayments, reduces interest costs, improves credit health, and restores long-term financial stability.

- Understanding debt types enables smarter strategies, better prioritization, and informed decisions for sustainable financial control.

- Consistent budgeting, disciplined payments, and proactive negotiations are essential to managing personal or business debt.

- Early, structured debt management helps prevent defaults, cash flow crises, and bankruptcy.

Why is Debt Management Important?

Debt management is important for the following key reasons that support financial stability, control, and long-term growth:

1. Prevents Financial Stress

Structured debt repayment creates clarity, control, and predictability, reducing anxiety, uncertainty, and emotional pressure caused by unmanaged financial obligations.

2. Improves Credit Score

Making timely and consistent debt payments builds a positive credit history, increasing creditworthiness and access to better loan terms.

3. Reduces Interest Costs

Strategic debt repayment prioritizes high-interest liabilities, minimizing accumulated interest expenses and reducing the overall cost of borrowing.

4. Ensures Cash Flow Stability

Effective debt planning aligns repayments with income cycles, preventing cash shortages and ensuring sufficient liquidity for daily operations.

5. Supports Long-Term Goals

Managing debt responsibly frees resources for savings, investments, and asset creation, supporting long-term financial security and growth.

Types of Debt

Understanding the types of debt is the first step toward effective debt management.

1. Secured Debt

Collateralized debt typically has lower interest rates and better terms for borrowers, enabling lenders to seize assets if payments are not made.

2. Unsecured Debt

Debt not backed by collateral, approved based on creditworthiness, often carries higher interest rates and stricter terms, and poses a higher risk to both lender and borrower.

3. Revolving Debt

Debt with a flexible credit limit, allowing borrowers to reuse funds after repayment and with interest applied to carried balances, is useful for ongoing expenses.

4. Installment Debt

Debt is repaid in fixed, scheduled payments over a set period, providing predictable obligations and helping borrowers plan finances efficiently over time.

5. Short-Term Debt

Debt that must be repaid within one year, often used for immediate cash needs, usually carries higher interest rates because of its shorter repayment period.

6. Long-Term Debt

Debt with extended repayment timelines, often spanning several years, is used for significant investments, growth projects, or major assets, offering more manageable long-term payments.

Common Debt Management Strategies

The following strategies help individuals and organizations manage debt efficiently, reduce financial pressure, and regain control over repayments:

1. Budgeting and Expense Tracking

Creating a realistic budget identifies unnecessary spending, reallocates funds toward debt repayment, and ensures better financial control and planning.

2. Debt Snowball Method

Regardless of interest, paying off debts in order from smallest to largest balance increases incentive through rapid repayment accomplishments.

3. Debt Avalanche Method

The process of paying off all debts is accelerated, and the total interest paid is reduced by giving priority to the debts with the highest interest rates.

4. Debt Consolidation

Combining several loans into one loan makes repayment easier, often results in lower interest rates, and increases consumers’ affordability.

5. Negotiation with Creditors

Borrowers can request lower interest rates, extended repayment periods, or partial settlements to reduce debt burdens.

6. Debt Management Plans

Structured repayment plans, managed by credit counselors, consolidate debts, negotiate better terms, and support consistent, manageable monthly payments.

Difference Between Debt Management and Debt Consolidation

The differences between debt management and debt consolidation are outlined below for clear comparison and better understanding:

| Aspect | Debt Management | Debt Consolidation |

| Purpose | Control and reduce debt | Combine multiple debts |

| Interest Rates | May be decreased via negotiation | Often lower than existing rates |

| Credit Impact | Neutral to positive if managed well | May temporarily affect the score |

| Professional Help | Often involves credit counselors | May or may not require advisors |

| Flexibility | High | Moderate |

Tools for Debt Management

Modern debt management is increasingly supported by digital tools and platforms.

1. Budgeting Apps

Digital apps help track income and expenses, categorize spending, and identify areas to save for faster debt repayment.

2. Debt Calculators

Online calculators estimate debt payoff timelines, monthly payments, and interest savings, helping plan repayment strategies effectively.

3. Personal Finance Software

Software centralizes financial accounts, monitors spending, budgets, and tracks debts, providing a comprehensive view of overall finances.

4. Automated Payment Systems

Automated payments prevent missed deadlines, ensure timely debt repayment, and protect credit scores from late payment penalties.

5. Credit Monitoring Services

Services track credit score changes, alert users to credit activity, and help maintain a strong credit profile consistently.

Advantages of Debt Management

The following advantages highlight how effective debt management improves financial stability, control, and long-term financial health:

1. Improved Financial Discipline

Effective debt management encourages consistent budgeting, prioritizing repayments, and maintaining financial control, fostering long-term disciplined money habits.

2. Lower Interest and Penalties

Timely and strategic debt repayments reduce accumulated interest and avoid late payment penalties, saving money over time.

3. Simplified Repayment Structure

Consolidating debts or following structured plans makes repayments easier to track and manage, and to stay on schedule consistently.

4. Reduced Risk of Default

Managing debt responsibly lowers the likelihood of missed payments, defaults, and negative impacts on creditworthiness or financial stability.

Disadvantages of Debt Management

Here are the disadvantages associated with implementing a debt management approach:

1. Requires Consistent Discipline

Effective debt management demands ongoing commitment to budgeting, timely payments, and financial planning, which can be challenging for those with inconsistent habits.

2. May Involve Service Fees

Some debt management programs or consolidation services charge fees, increasing overall costs and slightly reducing the financial benefits of repayment strategies.

3. Limited Access to New Credit During Repayment

While managing existing debt, borrowing new credit may be restricted, limiting financial flexibility and the ability to respond to emergencies.

4. Long-Term Commitment

Debt management often requires years of consistent repayment, demanding patience, dedication, and sustained effort to achieve complete financial freedom.

Real-World Examples

The following examples illustrate how effective debt management strategies are applied in practical, real-life scenarios:

1. Personal Debt

An individual with multiple credit cards uses the debt avalanche method to pay off high-interest balances first, reducing total interest and improving their credit score within two years.

2. Small Business

A small business consolidates vendor loans into a single structured repayment plan, improving cash flow and stabilizing operations.

Final Thoughts

Debt management is about creating a sustainable financial future, not just paying off what you owe. Individuals and businesses can restore control over their finances by comprehending the many sorts of debt, implementing the appropriate techniques, utilizing contemporary resources, and upholding financial discipline. A well-organized debt management strategy is crucial for long-term financial stability and expansion, whether you are handling personal credit card debt or business obligations.

Frequently Asked Questions (FAQs)

Q1. Does debt management affect credit score?

Answer: Proper debt management generally improves credit scores over time through consistent payments.

Q2. Who should consider a debt management plan?

Answer: Individuals or businesses struggling with multiple debts, high interest rates, or missed payments can benefit from a DMP.

Q3. How long does debt management take?

Answer: The duration depends on the amount of debt, interest rates, and repayment strategy, typically ranging from 2 to 5 years.

Q4. Can debt management prevent bankruptcy?

Answer: Yes, effective debt management often helps avoid bankruptcy by restoring financial control early.

Recommended Articles

We hope that this EDUCBA information on “Debt Management” was beneficial to you. You can view EDUCBA’s recommended articles for more information.