Updated April 13, 2023

Part – 17

In our last tutorial, we understood equity value and sensitivity analysis. Now we will proceed to understand DCF Excel summary.

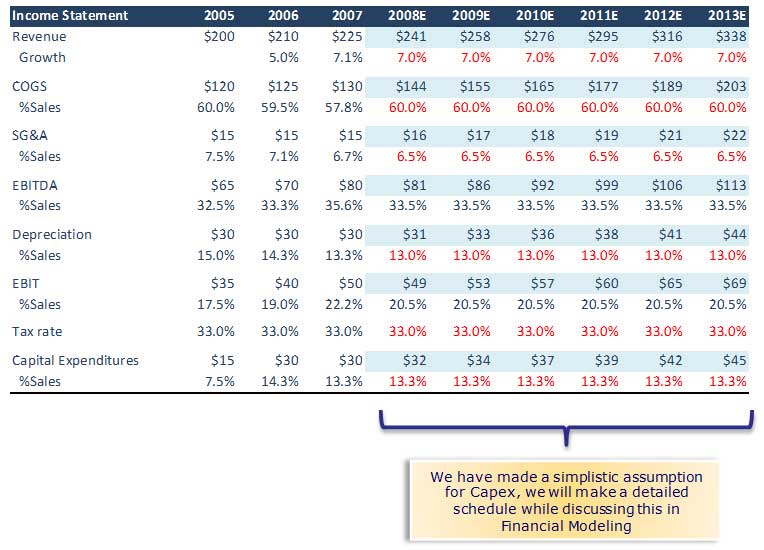

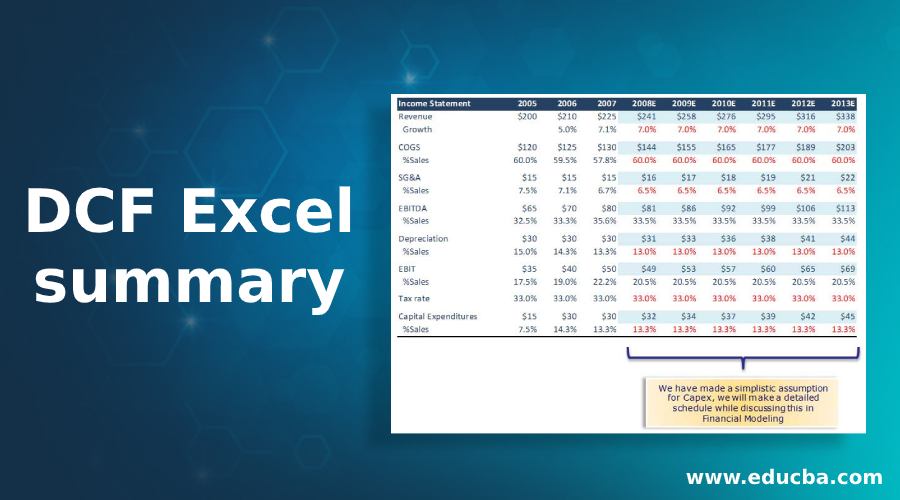

Step 1 – Forecast the Income Statement and other FCFF drivers for the Explicit Period

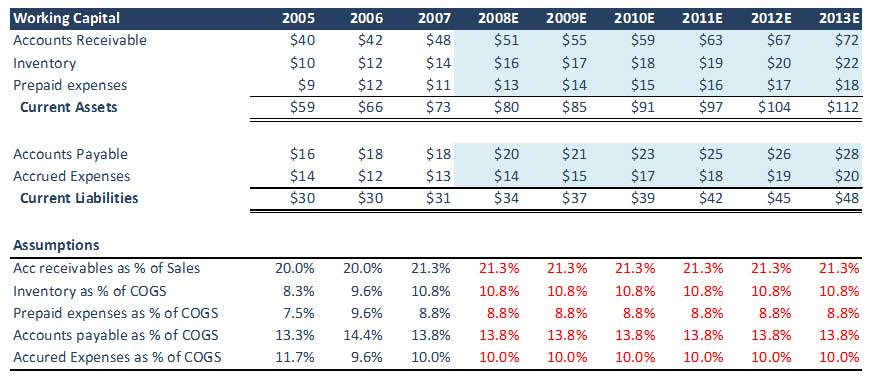

Step 2 – Forecast Working Capital

Here is the table:

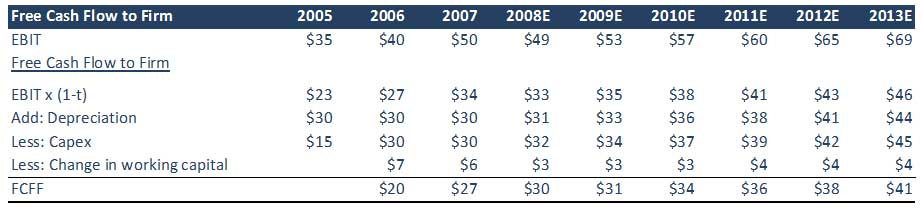

Step 3: Calculate FCFF using EBIT formula

Step 4: Calculate Terminal Value

Method 1 – Perpetuity Growth Method

When WACC = 10% & Growth rate = 4.5%,

Method 2 – Exit Multiple Method

When the EBITDA transaction multiple is 7x,

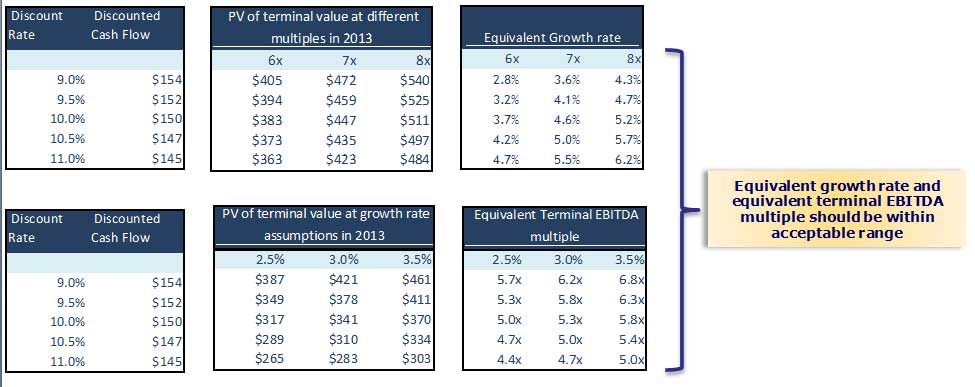

Step 5: Terminal Value Reality Check of Assumptions

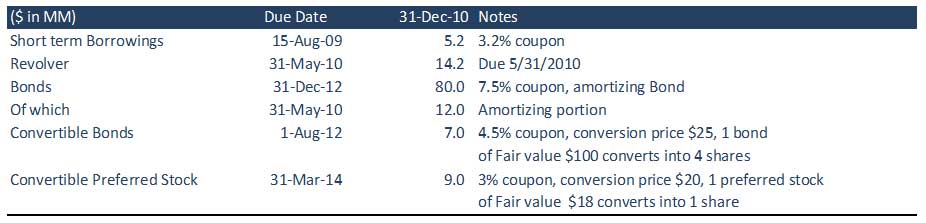

Step 6: Extract the Capital Structure

Please refer to the below image:

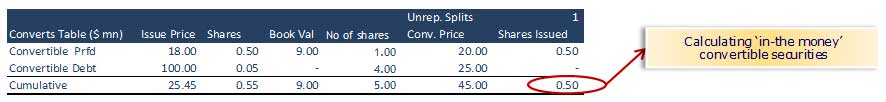

Step 7 – Understanding the Convertible Features: Calculate ‘in the money’ convertible securities

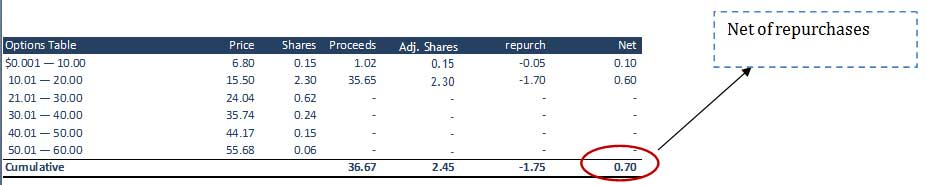

Step 8: Calculate ‘in the money’ stock options

Please refer to the below table:

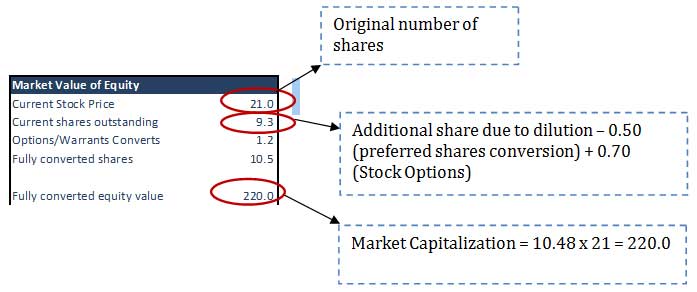

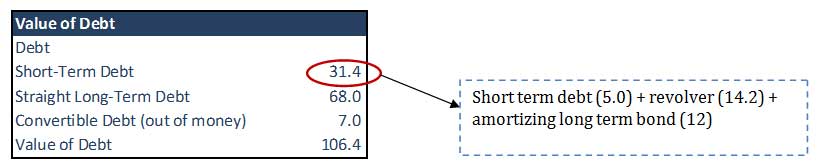

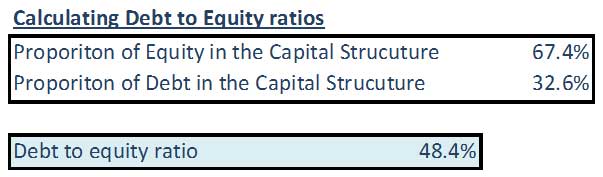

Step 9: Calculate the Value of Debt / Proportion of Equity & Debt in the Capital Structure

Debt

Total Capital = Debt + Equity

Total Capital = 220.0 + 106.4 = 326.4

The above proportions will be used to calculate the Weighted Average Cost of Capital (WACC).

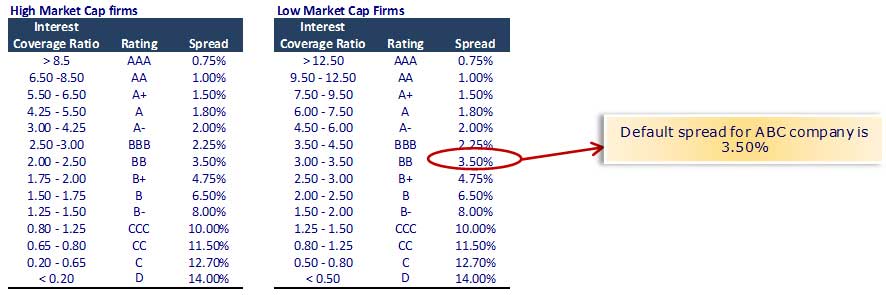

Step 10 – WACC: Cost Of Debt

Using the synthetic rating method, we have Interest coverage ratio = EBIT / Interest Expense

Interest Expense for ABC company (small cap $257million) is 15; Interest coverage ratio = 50/15 = 3.33

Pre-tax Cost of Debt = Risk-free rate + default spread = 5.0% + 3.50% = 8.50%

Post-tax cost of debt = 8.50% × (1-33%) = 5.70%

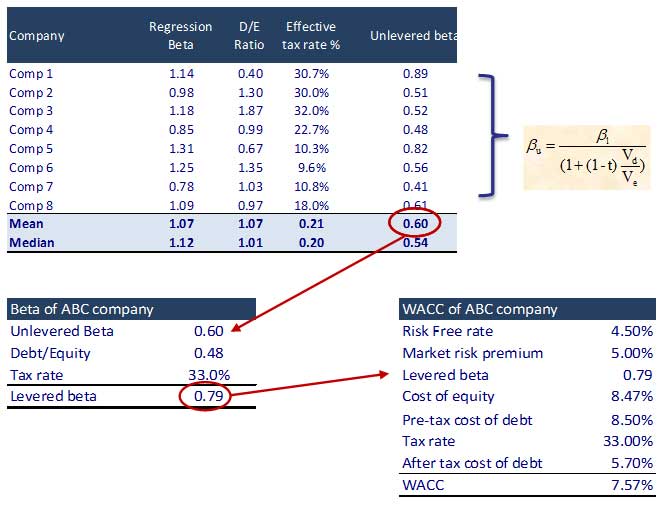

Step 11 – Calculate Cost of Equity & WACC

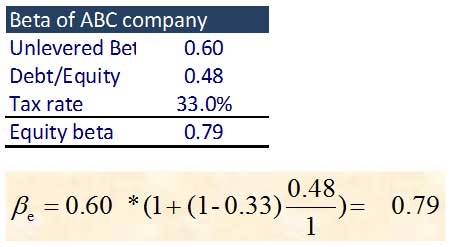

Identify the listed comparables and their Beta. Also, find the Unlevered Beta for comparables

Step 12: Present Value of the FCFF for the projected years

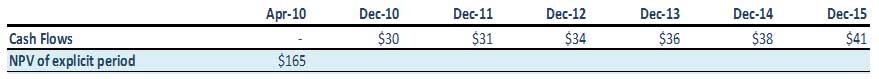

Calculate the Present Value of the Explicit Cash Flows using WACC derived above

Step 13: Calculate the Present Value of the Terminal Value using WACC

(A) Terminal Value using Perpetuity Growth Method

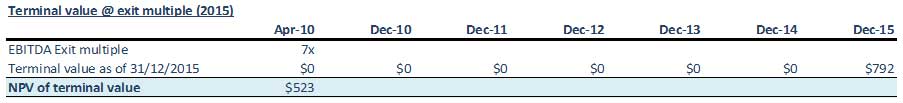

(B) Terminal Value using Exit Multiple Method

Please note that the Terminal Values from both approaches are not in sync. We may have to double-check our assumptions on EBITDA Exit Multiples or the WACC/growth rate assumptions applied. Both approaches should ideally give similar answers.

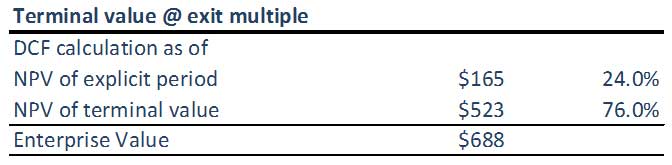

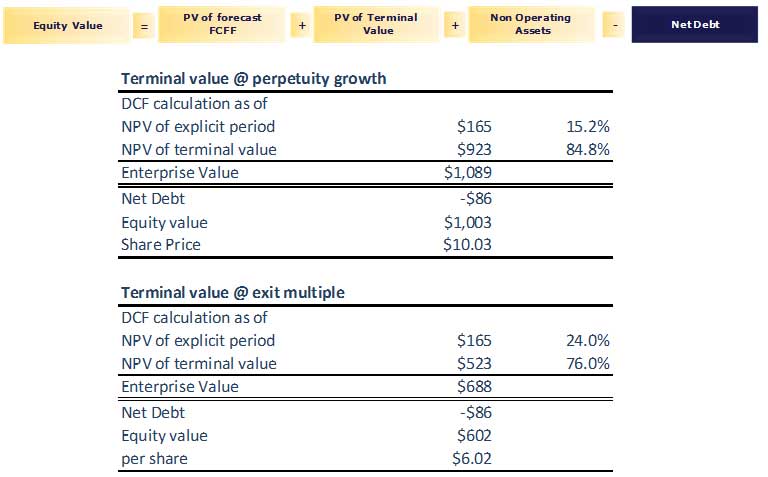

Step 14: Calculate the Enterprise value of the firm

By summing the (adjusted) present value of the projected free cash flows and the (adjusted) present value of the terminal value (whether calculated using the perpetuity method or multiple method), the result is the Enterprise Value of the modeled business.

Step 15 – Arrive at the Equity Value of the firm post Adjustments

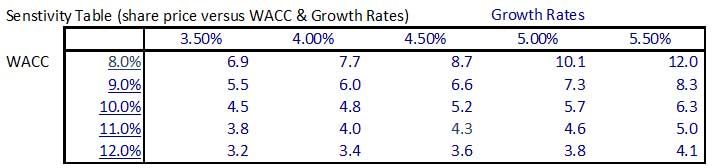

Step 16: Sensitivity Analysis of Key Inputs

The data table function is especially useful for conducting Share Price Sensitivity Analysis

Recommended Articles

Here are some articles that will help you to get more details about the DCF Excel summary: